Notification Center

Turn on/off sound

Show/Hide Coins Ticker

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 6 Gwei | 6 Gwei | 8 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 6 Gwei | 6 Gwei | 8 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

Brother, our patience can be tested. It was and is tested. However, if we are determined, we can remain patient. And then, when our time does come, it will be like: "oh, already!" :)

I fully expect alt run this year. Relax now... because when the time comes, you will have plenty of excitement to look forward to.

I informed you of this top. Of bear phase, D Man's Macro fundamental report readers went into further details.. the point is, you my friend are once again at the right side of trade and expectation. There is currently not much to be made for regular spot traders, so patience is the right move.

Cheers my friend!

D Man

Mr. S just published a curious report about TIME.

Every chart consists of price and TIME. This one found an ancient method by stocks trader from seventies, adjusted by Mr. S for Bitcoin shows you when this bull cycle will reach bottom and when top according to this theory.

Very valuable report for strategising, I hope you find it useful. Unlock it here: https://blockchainwhispers.com/signals?signal_anchor=8364

I made this post (spot positions update) from Mr. M free for all now: https://blockchainwhispers.com/signals?signal_anchor=8359 Enjoy

Here's banana.

I know you're hungry. I know you want something different in life. Better. However, impatience is enemy of achievement.

How did it work for you before?

It's easy for me to write "1000x". But you know I'm ethics, trust and loyalty above and before anything. I try to write as conservative and as close to real as I can predict.

Maybe this banana will not satisfy your everpresent hunger, but 3x in slow times, might be better than 0x. Maybe that 3x will be foundation to next 10x becoming 30x. Maybe you'll skip it but will give you ideas of good ways to approach token-selection for your portfolio. Maybe it doesn't make even 3x... and only after I said all this I can say, but maybe, it also pleasantly surprises us!

While I'm waiting on the team, your BCW analysts are now checking projects with similar market category, similar development level where we have close confidence this will get and their marketcaps vs the expected marketcap at launch of this (implemented hard caps with the team in place)...

To understand, look, I don't want noobs, idiots etc. I know in most bullish days I'm not noob's favorite person as I'm telling them about caution education etc. However, I'm the only one followed in bear and bull markets, because I tell as transparently as educated as I am able.

My friend, the truth is at the end of the crypto bull run, there will not be all winners.

Yes, at some point many people might be in green, but due to their lack of proper perspective, they will fail. They will not book, chase the top, be stubborn at chart, having ego, having too much greed, whatever.

This particular opportunity, I know you'd like to see "gazillion X" — but really, of those screaming gazillion X on twitter, how many actually in this period achieved that gazillion X.

This find, at marketcap I assume, vs what the industry average on this developed project without much marketing, so basically taking every bit of figure conservatively, presents an easy and natural 3x opportunity vs the market.

If the market will fly, this will fly with it. Not as some AI coins, etc... but risk vs reward... is in our favor because we have one non-public advantage and that is we know the narrative change while most ignored that news. And plus now we have a slippage free entry.

So, let's say in this bull run avg of this category at this stage will be +10x, this one will be 3x first to category and 10x with the category it's 30x.

If the category or alts will not move, it is still 3x.

If it will drop the entire market 50% instead of pumping 10x, this thing is still +1.5x with some time delay as bear markets make.

Of course, no guarantees, but THIS is why I like such opportunity. Eventually, chart gaps are filled, liquidity voids cleared, and price-to-category equalized.

I know, I know, too advanced shit for avg noob. Wen Lambo? Wen moon?

For that, you have other channels. I'm very happy about this find, and I will invite you to check it when the time comes. I'll invite you not to put all your eggs in this basket, I'll structure it so that you must read and inform yourself before entering... so that at the end of the day, only the real holders get true BCW opportunity.

And even with this, yup, completely non-noob-friendly - we might still fail, project might end up being shit.

But we the real BCW know, given many such opportunities, edge by edge, where we are vs where the rest of the market is.

Remember all those dumps and pumps we predicted. Not all, but more than Twitter did, more than many if not most gurus did, many than sometimes even HUGE trading desks did (remember when I told you Microstrategy bought at the wrong timing, and it proved correct) - and they have a team of top pros...

Brother, we are united into something really powerful. Crypto awarded us with real people having almost the same opportunity as top pros. And we are staying sharp on top of it. This is why I didn't abandon crypto in bear times. Why I traded... so for this next bull run, I am more capable, more educated, more experienced to guide you with maximum edge.

Again, noobs I am sorry but, NO GUARANTEES!

Can you live with that?

Good, then join me and fellow BCW elite-hand brothers on the amazing crypto journey ahead!

D Man

Good news is yes, this year, I do expect to finally us, we all here in crypto to have a 2017-like alt run. Probably the last of its kind. This year, not this day or week. If you can live with it, you might get finally rewarded for years of being in crypto while others abandoned it after long and exhausting red periods. Cheers my loyal bro!

Imagine a guy developing something for years and the village already starts talking "he is nuts, never gonna deliver it" and one day he does, long after everyone stopped checking on him...

Similar find we have here. Not as strong though. They didn't invent anything breakthrough, but they reached that community-dulling moment because they were chasing something else for 2 years, now changed the direction and practically nobody noticed! They are very close to achieving it. And we, BCW, are among the very first to cash-in on the info.

Making a zero-slippage deal with the team, helped them restructure to buy out all previous investors since they got too small, and make even better, healthier (supertight) tokenomics that the market will appreciate.

Stay tuned, will tell more when I can/know.

My biggest concern, slippage at low marketcap is now solved (thanks to BCW reputation that makes teams listen). And tokenomics got even better (no airdrops, team got less, no coins for exchanges,... instead huge percentage for public and liquidity).

Will tell you more, this is just a small teaser why I'm happy about it. Not a gem of the year, but if it works out, it is easy and simple coin due to undervalue to market and category average due to info we know and others don't. It's not a privileged info, it's just something that most, professional market scanners, hobbyists etc overlooked because they assumed the team continued in the old direction, the news of the new direction didn't reach the community.

Sharing more in the following days.

Again, not a gem, but a really good, simple-to-understand opportunity imo.

Think of it this way: it's not a Lamborghini. It's a Prius, but a Prius offered at $1 starting auction and other people not knowing it's a real car, they think it's a toy. You know it's real. That's why I'm hot for this.

You might not reach valuation of Lambo, but if you reach even half the valuation of Prius and you paid $100, or $1000 for the $10,000 car, you did a great job, no?

Stay tuned.. (days, not hours, be relaxed)

Cheers!

I am very excited about this find. It is an undergem. It is not a gem only because it misses some technological breakthrough. Everything else: under the radar; price-to-opportunity; narrative... heck even chain is on the massive-gains train so to speak. I'll tell you about it soon. I made a nice progress with the team to do the crazy thing, to buy out the old investors so you have slippage--free entry. All this, thanks to BCW stellar reputation. Stay tuned. Likely early next week.

Cheers!

D Man

P.S. They asked me when. I said now. I want us actually to do this in red times. It will remain under the radar, and you'll be the lowest buyer possible. No one will be able to dump on you in profit. This is the strong position I like for BCW.

I might have something good to really good for you soon (days)... It is good for small wallets, a bit trouble for medium, a skip for whales this time due to liquidity.

It's a narrative change caught by so few. I love the opportunity and I think you'll be excited we discovered this timely as well. Cheers!

Halved. Weekend volume. Don't trust it. Have a nice weekend instead. Cheers!

P.S. The report is free. I think halving event is crypto public service.

So far it is predictable as we are heading into halving the price shows some green. It's a hook more than likely. S&P500 is continuing in its correction, and this gap is basically retail money expecting immediate post-halving results. Check the report, and then you'll know whether to expect immediate 100x long or not. Cheers my friend!

Halving is here. Miners rewards cut in half. You have the report here https://t.me/blockchainwhispersbaby/11349 about what to expect in price if history is to be asked. Cheers my friend!

Remember this green drawing? Above = bullish, below = dump. We are retesting it now in a quite bad way. Just fyi.

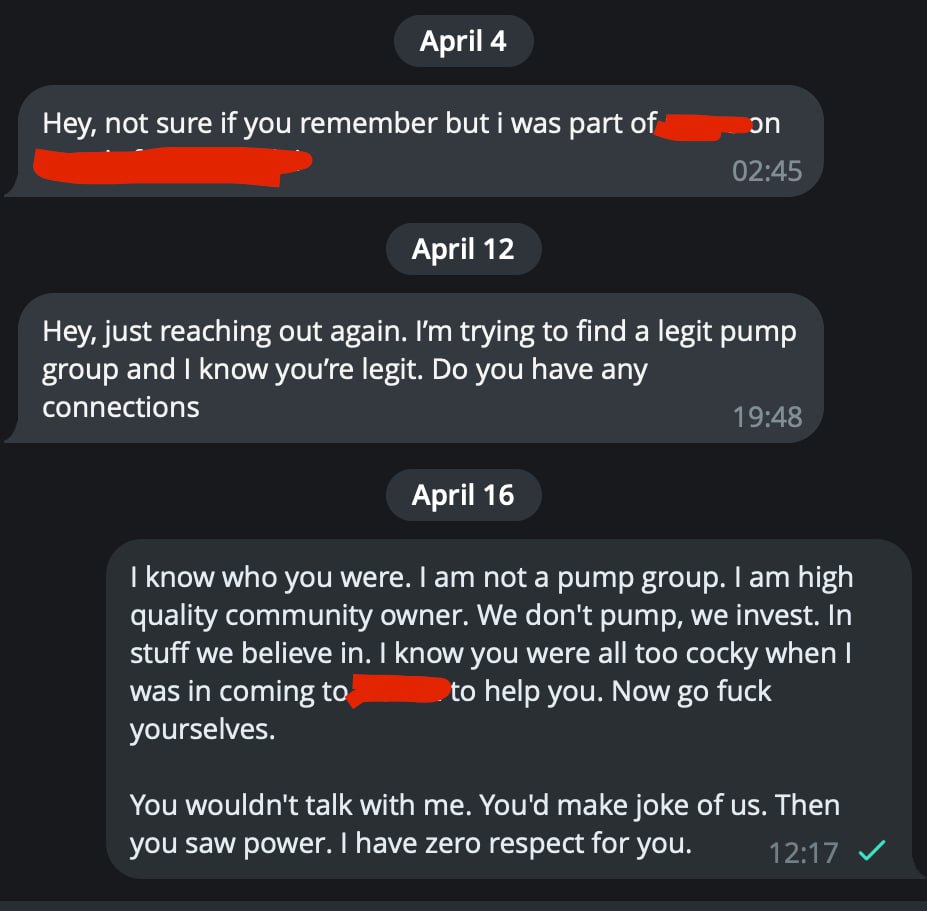

To all project founders who ignore good-intent people, are cocky to them, but once they see the power (like BCW) they get on their knees to suck a dick. FUCK YOU!

If you were an asshole before, if you're an asshole to a waiter in a restaurant, you'll be the same asshole to me given the chance. I want nothing to do with you. You don't deserve BCW.

Many guys like this guy. I remember him, founder of a project, a fork that was good idea. I came anon to give them top notch advice, they were ubercocky. Later, when they saw BCW power, they started to suck dick.

You know that joke: "Jenny would you suck a dick for a million bucks?"

- "for a million, yes"

- "what about for $10?"

She slaps him.

"who do you think I am"

- "we already established that, now we're just negotiating"

—-

The point is, if they are assholes, they are assholes. Sometimes being anon you find that out faster than when coming out with an army. Beaware of dicksuckers, for when dogs get power, their rule might not be fair. Cheers!

On a macro scale, if you zoom out just a bit from second-to-second thinking... if you relax... crypto this year I expect to be very rewarding. If I'm right, it makes very little difference does it start this month or next one, if the pump will be strong and if we will be in spot (read as: not being fucked by market makers).

Spot hold what you truly like.

Enjoy crypto.

Or micro trade it, time the market. I share with you the edge I find (and it's quite both powerful and often). According to your preference. Cheers!

Discussions

top 3 breaking news

Crypto analysts believe the large transfers could have a “big impact” depending on where the capital is getting deployed.

a

a

a

a

a

a

Blockchain News, Opinion, TV and Jobs – New York, New York, April 25th, 2024, ChainwireKadena, the only scalable Layer-1 Proof-of-Work blockchain, ...

a

a

a

a

a

a

Runes and Ordinals 'Artist' Creator, Casey Rodarmor has just invented two of the most dramatically impactful protocols in the blockchain ...

a

a

a

a

a

a

Atlassian Co-CEO Scott Farquhar Resigns, Leaving Mike Cannon-Brookes as Sole Chief Bloomberg

a

a

a

a

a

a

The on-chain analytics firm Santiment has revealed that over 85% of all altcoins in the sector are currently in the historical “opportunity zone.” MVRV Would Suggest Most Altcoins Are Ready For A Bounce In a new post on X, Santiment discussed how the altcoin market looks based on their MVRV ratio model. The “Market Value to Realized Value (MVRV) ratio” is a popular on-chain indicator that compares the market cap of Bitcoin against its realized cap. The market cap here is the usual total valuation of the asset’s circulating supply based on the current spot price. At the same time, the latter is an on-chain capitalization model that calculates the asset’s value by assuming the “true” value of any coin in circulation is the last price at which it is transferred on the blockchain. Related Reading: Bitcoin Forms Death Cross & TD-9 Sell Signal: Brace For Impact? Given that the last transaction of any coin would have likely been the last time it changed hands, the price at its time would act as its current cost basis. As such, the realized cap essentially sums up the cost basis of every token in the circulating supply. Therefore, one way to view the model is as a measure of the total amount of capital the investors have put into the asset. In contrast, the market cap measures the value holders are carrying. Since the MVRV ratio compares these two models, its value can tell whether Bitcoin investors hold more or less than their total initial investment. Historically, when investors have been in high profits, tops have become probable to form, as the risk of profit-taking can spike in such periods. On the other hand, a dominance of losses could lead to bottom formations as selling pressure runs out in the market. Based on these facts, Santiment has defined an “opportunity” and “danger” zone model for altcoins. The chart below shows how the market currently looks from the perspective of this MVRV model. The data for the MVRV divergence for the various altcoins | Source: Santiment on X Under this model, when the MVRV divergence for any asset on some timeframe is higher than 1, the coin is considered to be inside the bullish opportunity zone. Similarly, if it is less than -1, it suggests it’s in the bearish danger zone. Related Reading: Bitcoin Whales Continue Buying, Now Hold 25.16% Of All Supply The chart shows that MVRV divergence for a large part of the market is in the opportunity zone right now. As the analytics firm explains, Over 85% of assets we track are in a historic opportunity zone when calculating the market value to realized value (MVRV) of wallets’ collective returns over 1-month, 3-month, and 6-month cycles. Thus, if the model is to go by, now may be the time to go around altcoin shopping. ETH Price Ethereum, the largest among the altcoins, has observed a 3% surge over the past week, which has taken its price to $3,150. Looks like the price of the asset has gone up over the last few days | Source: ETHUSD on TradingView Featured image from Shutterstock.com, Santiment.net, chart from TradingView.com

a

a

a

a

a

a

US Economic Growth Isn't Helping Biden Reelection Campaign Due to Inflation Bloomberg

a

a

a

a

a

a

Ethereum price is attempting a recovery wave above the $3,125 zone. ETH must clear the $3,200 resistance to continue higher in the near term. Ethereum extended losses and tested the $3,075 support zone. The price is trading below $3,180 and the 100-hourly Simple Moving Average. There is a key rising channel forming with support at $3,140 on the hourly chart of ETH/USD (data feed via Kraken). The pair could continue to move down if it trades below the $3,125 support. Ethereum Price Faces Resistance Ethereum price struggled to recover and extended losses below the $3,100 level. ETH traded as low as $3,074 and is currently attempting another recovery wave, like Bitcoin. There was a minor increase above the $3,125 resistance. The price climbed above the 23.6% Fib retracement level of the recent drop from the $3,292 swing high to the $3,074 low. However, the bears are active near the $3,200 resistance zone. Ethereum is now trading below $3,180 and the 100-hourly Simple Moving Average. There is also a key rising channel forming with support at $3,140 on the hourly chart of ETH/USD. Immediate resistance is near the $3,180 level and the 100-hourly Simple Moving Average. The first major resistance is near the $3,200 level or the 61.8% Fib retracement level of the recent drop from the $3,292 swing high to the $3,074 low. Source: ETHUSD on TradingView.com The next key resistance sits at $3,240, above which the price might gain traction and rise toward the $3,280 level. A close above the $3,280 resistance could send the price toward the $3,350 resistance. If there is a move above the $3,350 resistance, Ethereum could even test the $3,500 resistance. Any more gains could send Ether toward the $3,550 resistance zone. More Downsides In ETH? If Ethereum fails to clear the $3,180 resistance, it could continue to move down. Initial support on the downside is near the $3,125 level. The first major support is near the $3,075 zone. The main support is near the $3,030 level. A clear move below the $3,030 support might set the pace for more losses and send the price toward $2,880. Any more losses might send the price toward the $2,750 level in the near term. Technical Indicators Hourly MACD – The MACD for ETH/USD is losing momentum in the bearish zone. Hourly RSI – The RSI for ETH/USD is now below the 50 level. Major Support Level – $3,125 Major Resistance Level – $3,200

a

a

a

a

a

a

State Secretary Blinken: US and China Need to 'Avoid Miscalculations' Bloomberg

a

a

a

a

a

a

Bitcoin cash price started a fresh decline below the $550 zone against the US Dollar. The price is now trading below the $540 zone and the 55 simple moving average (4 hours). There is a key bearish trend line forming with resistance near $507 on the 4-hour chart of the BCH/USD pair (data feed from […] The post Bitcoin Cash Analysis: BCH Turns Red Below $525 appeared first on Live Bitcoin News.

a

a

a

a

a

a

CoinShares found a significant increase in hedge funds and wealth managers survey respondents who have allocated to Solana compared to earlier this year.

a

a

a

a

a

a

Cryptocurrency investment remains one of the most dynamic and rapidly evolving sectors. The top 5 established giants like Bitcoin, Binance Coin, Ripple, and Solana have solidified their presence in the market. However, a new player, BlockDAG, is captivating investors with its novel approach to blockchain technology. BlockDAG’s state-of-the-art DAG architecture, advanced algorithms, and user-centric low […] The post Top 5 Cryptos in 2024: BlockDAG’s $20.5M Presale Shines Among Bitcoin, Binance Coin, Ripple (XRP) & Solana appeared first on Live Bitcoin News.

a

a

a

a

a

a

BlockDAG is setting ambitious goals, targeting a $10 valuation for its BDAG token by 2025 amidst significant excitement generated by a moon-shot keynote announcement. This visionary move has not only captured the attention of Chainlink investors but has also positioned BlockDAG ahead of current MATIC price predictions. Leveraging the innovative combination of Directed Acyclic Graph […] The post Analysts Eyes $10 Pricing for BDAG by 2025 Amid Moon-Shot Keynote, Draws Chainlink Investors & Surpasses MATIC Predictions appeared first on Live Bitcoin News.

a

a

a

a

a

a

A recent FBI announcement urging Americans not to use unlicensed money-transmitting services misses “a great deal of nuance” about how crypto services operate, says Piper Alderman Partner Michael Bacina.

a

a

a

a

a

a

Hybe Shares Tumble Amid Internal Struggle With Min Hee-jin, CEO of Ador Bloomberg

a

a

a

a

a

a

The metrics of the BNB network demonstrated immense growth over the last quarter.

a

a

a

a

a

a

After a massive rise in Ethereum’s outflow last week, investors have started to sell ETH as its price dropped.

a

a

a

a

a

a

BNB Chain, one of the largest smart contracts-enabled ecosystems in the crypto environment, has announced the inclusion of native liquid staking in its BSC blockchain. The new feature aims to allow validators to secure the network and maintain the liquidity of its assets while the ecosystem abandons the Beacon chain. BNB Chain Evolves Into a […]

a

a

a

a

a

a

On-chain analytics firm Spot On Chain’s team of analysts, using Google Cloud’s Vertex artificial intelligence (AI), has conducted an in-depth analysis to forecast the future price of Bitcoin (BTC). Their latest report provides valuable insights into the leading cryptocurrency’s short-, medium-, and long-term outlook. Bitcoin Price Forecasts According to Spot On Chain’s report, Bitcoin prices are expected to fluctuate between $56,000 and $70,000 during May, June, and July 2024. This projected range indicates the potential for market volatility, with a 48% probability assigned to the scenario where BTC prices may dip below $60,000. Moreover, the report advises a cautious approach, acknowledging the possibility of short-term fluctuations or corrections in the price. Related Reading: SEC Anticipated To Reject Spot Ethereum ETFs In Upcoming Decision, ETH Price Takes 5% Hit Spot On Chain’s analysis reveals a significant movement in the latter half of 2024, with a compelling 63% probability of Bitcoin reaching $100,000. This mid-term projection reflects a prevailing bullish sentiment in the market, further fueled by anticipated rate cuts after the Federal Open Market Committee’s (FOMC) December 2023 meeting. These rate cuts aim to bring the federal funds rate down to 4.6% and are expected to boost demand for risk-on assets such as stocks and Bitcoin. Looking ahead to the first half of 2025, Spot On Chain’s modeling indicates a strong probability that Bitcoin will cross the $150,000 threshold. Specifically, a 42% probability is assigned to this scenario, indicating a bullish outlook for Bitcoin’s price trajectory. What’s more, looking at the entire year of 2025, the probability of Bitcoin exceeding $150,000 rises to an eye-popping 70%. Based on historical data and patterns in previous cycles, Bitcoin reached a new all-time high approximately 6 to 12 months after the Halving event. Price Consolidation On The Horizon? Crypto analyst Retk Capital has also provided insights into the current Bitcoin price action, shedding light on key resistance levels and the potential for a consolidation phase before an anticipated parabolic upside. According to Retk Capital’s analysis, Bitcoin has consistently been rejected from the $65,600 resistance level, failing to regain it as a support level. This resistance zone has significantly impeded Bitcoin’s upward movement in recent days, as seen on the cryptocurrency’s daily BTC/USD chart below. Related Reading: HBAR Prices Crashes 35% As BlackRock Denies Any Ties To Hedera Retk Capital further highlights that Bitcoin has been witnessing downside wicks into a pool of liquidity at approximately $60,600. This occurrence has been observed over multiple weeks, indicating the presence of buyers in that price range. If Bitcoin experiences further downward movement, the analyst believes that there is a possibility that it may approach this area once again. The analyst further notes: Price dropping without context can be emotionally challenging. However, understanding that this downside is part of the consolation within a technical range-bound structure that will precede Parabolic Upside makes this experience much more comforting. As of this writing, BTC is trading at $63,900, down nearly 8% over the past two weeks and the same percentage over the past 30 days. Featured image from Shutterstock, chart from TradingView.com

a

a

a

a

a

a

China Vanke Crisis May Continue to Spell Trouble for Chinese Lenders Bloomberg

a

a

a

a

a

a

BlackRock's Bitcoin exchange-traded fund has abruptly ended its streak of consecutive inflows at 71 days. Advertisement.

a

a

a

a

a

a

Bitcoin price failed to recover above the $65,500 resistance. BTC is again moving lower and there is a risk of more downsides below $63,000. Bitcoin started another decline after it failed to surpass the $65,500 resistance zone. The price is trading below $64,500 and the 100 hourly Simple moving average. There is a connecting bearish trend line forming with resistance at $64,500 on the hourly chart of the BTC/USD pair (data feed from Kraken). The pair could accelerate lower if there is a daily close below the $63,000 support zone. Bitcoin Price Faces Hurdles Bitcoin price started a recovery wave from the $62,750 support zone. BTC was able to climb above the $64,000 and $64,500 resistance levels. However, the price failed to clear the $65,500 resistance zone. A high was formed at $65,300 and the price started another decline. There was a move below the $64,500 level. The price tested the 50% Fib retracement level of the recovery wave from the $62,743 swing low to the $65,300 high. Bitcoin is now trading below $64,500 and the 100 hourly Simple moving average. There is also a connecting bearish trend line forming with resistance at $64,500 on the hourly chart of the BTC/USD pair. Immediate resistance is near the $64,500 level or the trend line. The first major resistance could be $65,350 or $65,500. A clear move above the $65,500 resistance might send the price higher. The next resistance now sits at $66,200. Source: BTCUSD on TradingView.com If there is a clear move above the $66,200 resistance zone, the price could continue to move up. In the stated case, the price could rise toward $67,000. The next major resistance is near the $67,400 zone. Any more gains might send Bitcoin toward the $68,800 resistance zone in the near term. More Losses In BTC? If Bitcoin fails to rise above the $64,500 resistance zone, it could continue to move down. Immediate support on the downside is near the $64,000 level. The first major support is $63,750 or the 61.8% Fib retracement level of the recovery wave from the $62,743 swing low to the $65,300 high. If there is a close below $63,750, the price could start to drop toward $62,750. Any more losses might send the price toward the $61,200 support zone in the near term. Technical indicators: Hourly MACD – The MACD is now gaining pace in the bearish zone. Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level. Major Support Levels – $64,000, followed by $63,750. Major Resistance Levels – $64,500, $65,350, and $66,200.

a

a

a

a

a

a

Top 100 Coins By Market Cap

NEXT BTC MOVE:

I think Bitcoin goes UP because

| Name | Price | Marketcap | 24h | ||

|---|---|---|---|---|---|

Bitcoin (BTC)

Bitcoin (BTC)

|

$64,353.99 | $1.27 T | 0.03% | ||

Ethereum (ETH)

Ethereum (ETH)

|

$3,139.20 | $383.14 B | -0.21% | ||

Tether USDt (USDT)

Tether USDt (USDT)

|

$1.00 | $110.47 B | 0.01% | ||

BNB (BNB)

BNB (BNB)

|

$610.15 | $90.03 B | 0.79% | ||

Solana (SOL)

Solana (SOL)

|

$143.28 | $64.07 B | -1.84% | ||

USDC (USDC)

USDC (USDC)

|

$1.00 | $33.36 B | -0.01% | ||

XRP (XRP)

XRP (XRP)

|

$0.52764399 | $29.09 B | 0.31% | ||

Dogecoin (DOGE)

Dogecoin (DOGE)

|

$0.15055703 | $21.69 B | -0.04% | ||

Toncoin (TON)

Toncoin (TON)

|

$5.36 | $18.60 B | -3.02% | ||

Cardano (ADA)

Cardano (ADA)

|

$0.47312220 | $16.86 B | -0.11% | ||

Shiba Inu (SHIB)

Shiba Inu (SHIB)

|

$0.00002562 | $15.10 B | 0.81% | ||

Avalanche (AVAX)

Avalanche (AVAX)

|

$35.48 | $13.43 B | -0.99% | ||

TRON (TRX)

TRON (TRX)

|

$0.11774000 | $10.31 B | 3.18% | ||

Polkadot (DOT)

Polkadot (DOT)

|

$6.84 | $9.84 B | -1.26% | ||

Bitcoin Cash (BCH)

Bitcoin Cash (BCH)

|

$475.70 | $9.38 B | -0.37% | ||

Chainlink (LINK)

Chainlink (LINK)

|

$14.62 | $8.59 B | 0.65% | ||

NEAR Protocol (NEAR)

NEAR Protocol (NEAR)

|

$7.36 | $7.83 B | 8.42% | ||

Polygon (MATIC)

Polygon (MATIC)

|

$0.72230000 | $7.16 B | 2.05% | ||

Litecoin (LTC)

Litecoin (LTC)

|

$84.66 | $6.32 B | 1.52% | ||

Internet Computer (ICP)

Internet Computer (ICP)

|

$13.59 | $6.30 B | -0.77% | ||

Dai (DAI)

Dai (DAI)

|

$1.00 | $5.35 B | 0.01% | ||

UNUS SED LEO (LEO)

UNUS SED LEO (LEO)

|

$5.77 | $5.34 B | 0.00% | ||

Uniswap (UNI)

Uniswap (UNI)

|

$7.80 | $4.68 B | 1.62% | ||

First Digital USD (FDUSD)

First Digital USD (FDUSD)

|

$1.00 | $4.42 B | -0.12% | ||

Hedera (HBAR)

Hedera (HBAR)

|

$0.11775574 | $4.21 B | 3.90% | ||

Ethereum Classic (ETC)

Ethereum Classic (ETC)

|

$26.57 | $3.90 B | 1.81% | ||

Stacks (STX)

Stacks (STX)

|

$2.63 | $3.83 B | -3.90% | ||

Aptos (APT)

Aptos (APT)

|

$8.95 | $3.82 B | -0.20% | ||

Mantle (MNT)

Mantle (MNT)

|

$1.11 | $3.61 B | 0.19% | ||

Cronos (CRO)

Cronos (CRO)

|

$0.12713796 | $3.38 B | 1.41% | ||

Render (RNDR)

Render (RNDR)

|

$8.55 | $3.31 B | 2.11% | ||

Stellar (XLM)

Stellar (XLM)

|

$0.11350000 | $3.29 B | 0.27% | ||

Cosmos (ATOM)

Cosmos (ATOM)

|

$8.31 | $3.25 B | -1.23% | ||

Filecoin (FIL)

Filecoin (FIL)

|

$5.92 | $3.22 B | -1.15% | ||

OKB (OKB)

OKB (OKB)

|

$52.57 | $3.15 B | -2.91% | ||

Pepe (PEPE)

Pepe (PEPE)

|

$0.00000739 | $3.11 B | 4.08% | ||

Hedera Hashgraph (HBAR)

Hedera Hashgraph (HBAR)

|

$0.11740000 | $4.23 B | 4.72% | ||

Immutable (IMX)

Immutable (IMX)

|

$2.08 | $3.04 B | -4.45% | ||

dogwifhat (WIF)

dogwifhat (WIF)

|

$3.00 | $3.01 B | 4.19% | ||

Bittensor (TAO)

Bittensor (TAO)

|

$451.08 | $3.00 B | 0.63% | ||

VeChain (VET)

VeChain (VET)

|

$0.03942000 | $2.87 B | -0.01% | ||

Arbitrum (ARB)

Arbitrum (ARB)

|

$1.08 | $2.86 B | -1.78% | ||

Kaspa (KAS)

Kaspa (KAS)

|

$0.11845393 | $2.78 B | 0.85% | ||

Maker (MKR)

Maker (MKR)

|

$2,844.00 | $2.63 B | 0.29% | ||

The Graph (GRT)

The Graph (GRT)

|

$0.26666142 | $2.53 B | -0.06% | ||

Optimism (OP)

Optimism (OP)

|

$2.42 | $2.53 B | 0.83% | ||

Injective (INJ)

Injective (INJ)

|

$26.31 | $2.46 B | 0.10% | ||

Theta Network (THETA)

Theta Network (THETA)

|

$2.42 | $2.41 B | 5.07% | ||

Monero (XMR)

Monero (XMR)

|

$120.78 | $2.23 B | 2.01% | ||

Arweave (AR)

Arweave (AR)

|

$33.47 | $2.20 B | 3.87% | ||

Fantom (FTM)

Fantom (FTM)

|

$0.75916171 | $2.13 B | 4.94% | ||

Core (CORE)

Core (CORE)

|

$2.27 | $2.01 B | -3.43% | ||

Fetch.ai (FET)

Fetch.ai (FET)

|

$2.25 | $1.90 B | -0.42% | ||

Celestia (TIA)

Celestia (TIA)

|

$10.53 | $1.89 B | -2.29% | ||

THORChain (RUNE)

THORChain (RUNE)

|

$5.45 | $1.83 B | 1.99% | ||

Lido DAO (LDO)

Lido DAO (LDO)

|

$2.00 | $1.79 B | 0.97% | ||

FLOKI (FLOKI)

FLOKI (FLOKI)

|

$0.00018190 | $1.74 B | -0.82% | ||

Sei (SEI)

Sei (SEI)

|

$0.61510000 | $1.72 B | 4.19% | ||

Bitget Token (BGB)

Bitget Token (BGB)

|

$1.19 | $1.67 B | -0.49% | ||

Bonk (BONK)

Bonk (BONK)

|

$0.00002518 | $1.64 B | 8.04% | ||

Algorand (ALGO)

Algorand (ALGO)

|

$0.20220000 | $1.64 B | -0.38% | ||

Render Token (RNDR)

Render Token (RNDR)

|

$8.53 | $3.33 B | 2.61% | ||

Sui (SUI)

Sui (SUI)

|

$1.19 | $1.54 B | -3.22% | ||

Gala (GALA)

Gala (GALA)

|

$0.04719000 | $1.43 B | 2.49% | ||

Beam (BEAM)

Beam (BEAM)

|

$0.02694817 | $1.43 B | 0.60% | ||

Pendle (PENDLE)

Pendle (PENDLE)

|

$5.74 | $1.38 B | -4.73% | ||

Flow (FLOW)

Flow (FLOW)

|

$0.91600000 | $1.38 B | -1.02% | ||

Jupiter (JUP)

Jupiter (JUP)

|

$1.02 | $1.38 B | -3.14% | ||

Quant (QNT)

Quant (QNT)

|

$110.30 | $1.33 B | 3.46% | ||

Aave (AAVE)

Aave (AAVE)

|

$89.73 | $1.33 B | 0.36% | ||

Bitcoin SV (BSV)

Bitcoin SV (BSV)

|

$65.60 | $1.29 B | -2.79% | ||

BitTorrent (New) (BTT)

BitTorrent (New) (BTT)

|

$0.00000132 | $1.28 B | 5.65% | ||

Neo (NEO)

Neo (NEO)

|

$17.45 | $1.23 B | -1.96% | ||

Ethena (ENA)

Ethena (ENA)

|

$0.85100000 | $1.21 B | -0.98% | ||

Flare (FLR)

Flare (FLR)

|

$0.03085531 | $1.19 B | 1.36% | ||

SingularityNET (AGIX)

SingularityNET (AGIX)

|

$0.91742000 | $1.18 B | -1.07% | ||

MultiversX (EGLD)

MultiversX (EGLD)

|

$42.52 | $1.15 B | 3.40% | ||

Akash Network (AKT)

Akash Network (AKT)

|

$4.78 | $1.12 B | -4.56% | ||

Huobi Token (HT)

Huobi Token (HT)

|

$0.59491700 | $93.61 M | 2.36% | ||

Wormhole (W)

Wormhole (W)

|

$0.61511891 | $1.11 B | 13.88% | ||

Chiliz (CHZ)

Chiliz (CHZ)

|

$0.11788000 | $1.05 B | 0.29% | ||

Axie Infinity (AXS)

Axie Infinity (AXS)

|

$7.29 | $1.05 B | -1.55% | ||

The Sandbox (SAND)

The Sandbox (SAND)

|

$0.46130000 | $1.04 B | 0.35% | ||

eCash (XEC)

eCash (XEC)

|

$0.00005229 | $1.03 B | 3.12% | ||

dYdX (Native) (DYDX)

dYdX (Native) (DYDX)

|

$2.18 | $1.01 B | 0.26% | ||

Conflux (CFX)

Conflux (CFX)

|

$0.25310000 | $998.81 M | 4.52% | ||

dYdX (DYDX)

dYdX (DYDX)

|

$2.17 | $678.17 M | 0.20% | ||

Tezos (XTZ)

Tezos (XTZ)

|

$1.00 | $982.09 M | -0.06% | ||

KuCoin Token (KCS)

KuCoin Token (KCS)

|

$10.19 | $980.01 M | 2.81% | ||

Synthetix (SNX)

Synthetix (SNX)

|

$2.94 | $962.06 M | 4.35% | ||

Ronin (RON)

Ronin (RON)

|

$2.98 | $941.95 M | -6.95% | ||

Worldcoin (WLD)

Worldcoin (WLD)

|

$4.77 | $933.09 M | -0.83% | ||

Mina (MINA)

Mina (MINA)

|

$0.84818791 | $926.76 M | -0.92% | ||

JasmyCoin (JASMY)

JasmyCoin (JASMY)

|

$0.01863600 | $918.36 M | -0.84% | ||

EOS (EOS)

EOS (EOS)

|

$0.81510000 | $916.61 M | -11.35% | ||

Pyth Network (PYTH)

Pyth Network (PYTH)

|

$0.60370000 | $904.84 M | -0.10% | ||

Decentraland (MANA)

Decentraland (MANA)

|

$0.45937932 | $876.64 M | 0.76% | ||

ORDI (ORDI)

ORDI (ORDI)

|

$41.72 | $876.17 M | -4.26% | ||

Gnosis (GNO)

Gnosis (GNO)

|

$330.00 | $859.32 M | -1.48% | ||

Starknet (STRK)

Starknet (STRK)

|

$1.17 | $854.35 M | -0.49% |

Try to search another coin

clc7 Bitcoin