Notification Center

Turn on/off sound

Show/Hide Coins Ticker

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 28 Gwei | 28 Gwei | 28 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 28 Gwei | 28 Gwei | 28 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

Brother, our patience can be tested. It was and is tested. However, if we are determined, we can remain patient. And then, when our time does come, it will be like: "oh, already!" :)

I fully expect alt run this year. Relax now... because when the time comes, you will have plenty of excitement to look forward to.

I informed you of this top. Of bear phase, D Man's Macro fundamental report readers went into further details.. the point is, you my friend are once again at the right side of trade and expectation. There is currently not much to be made for regular spot traders, so patience is the right move.

Cheers my friend!

D Man

Mr. S just published a curious report about TIME.

Every chart consists of price and TIME. This one found an ancient method by stocks trader from seventies, adjusted by Mr. S for Bitcoin shows you when this bull cycle will reach bottom and when top according to this theory.

Very valuable report for strategising, I hope you find it useful. Unlock it here: https://blockchainwhispers.com/signals?signal_anchor=8364

I made this post (spot positions update) from Mr. M free for all now: https://blockchainwhispers.com/signals?signal_anchor=8359 Enjoy

Here's banana.

I know you're hungry. I know you want something different in life. Better. However, impatience is enemy of achievement.

How did it work for you before?

It's easy for me to write "1000x". But you know I'm ethics, trust and loyalty above and before anything. I try to write as conservative and as close to real as I can predict.

Maybe this banana will not satisfy your everpresent hunger, but 3x in slow times, might be better than 0x. Maybe that 3x will be foundation to next 10x becoming 30x. Maybe you'll skip it but will give you ideas of good ways to approach token-selection for your portfolio. Maybe it doesn't make even 3x... and only after I said all this I can say, but maybe, it also pleasantly surprises us!

While I'm waiting on the team, your BCW analysts are now checking projects with similar market category, similar development level where we have close confidence this will get and their marketcaps vs the expected marketcap at launch of this (implemented hard caps with the team in place)...

To understand, look, I don't want noobs, idiots etc. I know in most bullish days I'm not noob's favorite person as I'm telling them about caution education etc. However, I'm the only one followed in bear and bull markets, because I tell as transparently as educated as I am able.

My friend, the truth is at the end of the crypto bull run, there will not be all winners.

Yes, at some point many people might be in green, but due to their lack of proper perspective, they will fail. They will not book, chase the top, be stubborn at chart, having ego, having too much greed, whatever.

This particular opportunity, I know you'd like to see "gazillion X" — but really, of those screaming gazillion X on twitter, how many actually in this period achieved that gazillion X.

This find, at marketcap I assume, vs what the industry average on this developed project without much marketing, so basically taking every bit of figure conservatively, presents an easy and natural 3x opportunity vs the market.

If the market will fly, this will fly with it. Not as some AI coins, etc... but risk vs reward... is in our favor because we have one non-public advantage and that is we know the narrative change while most ignored that news. And plus now we have a slippage free entry.

So, let's say in this bull run avg of this category at this stage will be +10x, this one will be 3x first to category and 10x with the category it's 30x.

If the category or alts will not move, it is still 3x.

If it will drop the entire market 50% instead of pumping 10x, this thing is still +1.5x with some time delay as bear markets make.

Of course, no guarantees, but THIS is why I like such opportunity. Eventually, chart gaps are filled, liquidity voids cleared, and price-to-category equalized.

I know, I know, too advanced shit for avg noob. Wen Lambo? Wen moon?

For that, you have other channels. I'm very happy about this find, and I will invite you to check it when the time comes. I'll invite you not to put all your eggs in this basket, I'll structure it so that you must read and inform yourself before entering... so that at the end of the day, only the real holders get true BCW opportunity.

And even with this, yup, completely non-noob-friendly - we might still fail, project might end up being shit.

But we the real BCW know, given many such opportunities, edge by edge, where we are vs where the rest of the market is.

Remember all those dumps and pumps we predicted. Not all, but more than Twitter did, more than many if not most gurus did, many than sometimes even HUGE trading desks did (remember when I told you Microstrategy bought at the wrong timing, and it proved correct) - and they have a team of top pros...

Brother, we are united into something really powerful. Crypto awarded us with real people having almost the same opportunity as top pros. And we are staying sharp on top of it. This is why I didn't abandon crypto in bear times. Why I traded... so for this next bull run, I am more capable, more educated, more experienced to guide you with maximum edge.

Again, noobs I am sorry but, NO GUARANTEES!

Can you live with that?

Good, then join me and fellow BCW elite-hand brothers on the amazing crypto journey ahead!

D Man

Good news is yes, this year, I do expect to finally us, we all here in crypto to have a 2017-like alt run. Probably the last of its kind. This year, not this day or week. If you can live with it, you might get finally rewarded for years of being in crypto while others abandoned it after long and exhausting red periods. Cheers my loyal bro!

Imagine a guy developing something for years and the village already starts talking "he is nuts, never gonna deliver it" and one day he does, long after everyone stopped checking on him...

Similar find we have here. Not as strong though. They didn't invent anything breakthrough, but they reached that community-dulling moment because they were chasing something else for 2 years, now changed the direction and practically nobody noticed! They are very close to achieving it. And we, BCW, are among the very first to cash-in on the info.

Making a zero-slippage deal with the team, helped them restructure to buy out all previous investors since they got too small, and make even better, healthier (supertight) tokenomics that the market will appreciate.

Stay tuned, will tell more when I can/know.

My biggest concern, slippage at low marketcap is now solved (thanks to BCW reputation that makes teams listen). And tokenomics got even better (no airdrops, team got less, no coins for exchanges,... instead huge percentage for public and liquidity).

Will tell you more, this is just a small teaser why I'm happy about it. Not a gem of the year, but if it works out, it is easy and simple coin due to undervalue to market and category average due to info we know and others don't. It's not a privileged info, it's just something that most, professional market scanners, hobbyists etc overlooked because they assumed the team continued in the old direction, the news of the new direction didn't reach the community.

Sharing more in the following days.

Again, not a gem, but a really good, simple-to-understand opportunity imo.

Think of it this way: it's not a Lamborghini. It's a Prius, but a Prius offered at $1 starting auction and other people not knowing it's a real car, they think it's a toy. You know it's real. That's why I'm hot for this.

You might not reach valuation of Lambo, but if you reach even half the valuation of Prius and you paid $100, or $1000 for the $10,000 car, you did a great job, no?

Stay tuned.. (days, not hours, be relaxed)

Cheers!

I am very excited about this find. It is an undergem. It is not a gem only because it misses some technological breakthrough. Everything else: under the radar; price-to-opportunity; narrative... heck even chain is on the massive-gains train so to speak. I'll tell you about it soon. I made a nice progress with the team to do the crazy thing, to buy out the old investors so you have slippage--free entry. All this, thanks to BCW stellar reputation. Stay tuned. Likely early next week.

Cheers!

D Man

P.S. They asked me when. I said now. I want us actually to do this in red times. It will remain under the radar, and you'll be the lowest buyer possible. No one will be able to dump on you in profit. This is the strong position I like for BCW.

I might have something good to really good for you soon (days)... It is good for small wallets, a bit trouble for medium, a skip for whales this time due to liquidity.

It's a narrative change caught by so few. I love the opportunity and I think you'll be excited we discovered this timely as well. Cheers!

Halved. Weekend volume. Don't trust it. Have a nice weekend instead. Cheers!

P.S. The report is free. I think halving event is crypto public service.

So far it is predictable as we are heading into halving the price shows some green. It's a hook more than likely. S&P500 is continuing in its correction, and this gap is basically retail money expecting immediate post-halving results. Check the report, and then you'll know whether to expect immediate 100x long or not. Cheers my friend!

Halving is here. Miners rewards cut in half. You have the report here https://t.me/blockchainwhispersbaby/11349 about what to expect in price if history is to be asked. Cheers my friend!

Remember this green drawing? Above = bullish, below = dump. We are retesting it now in a quite bad way. Just fyi.

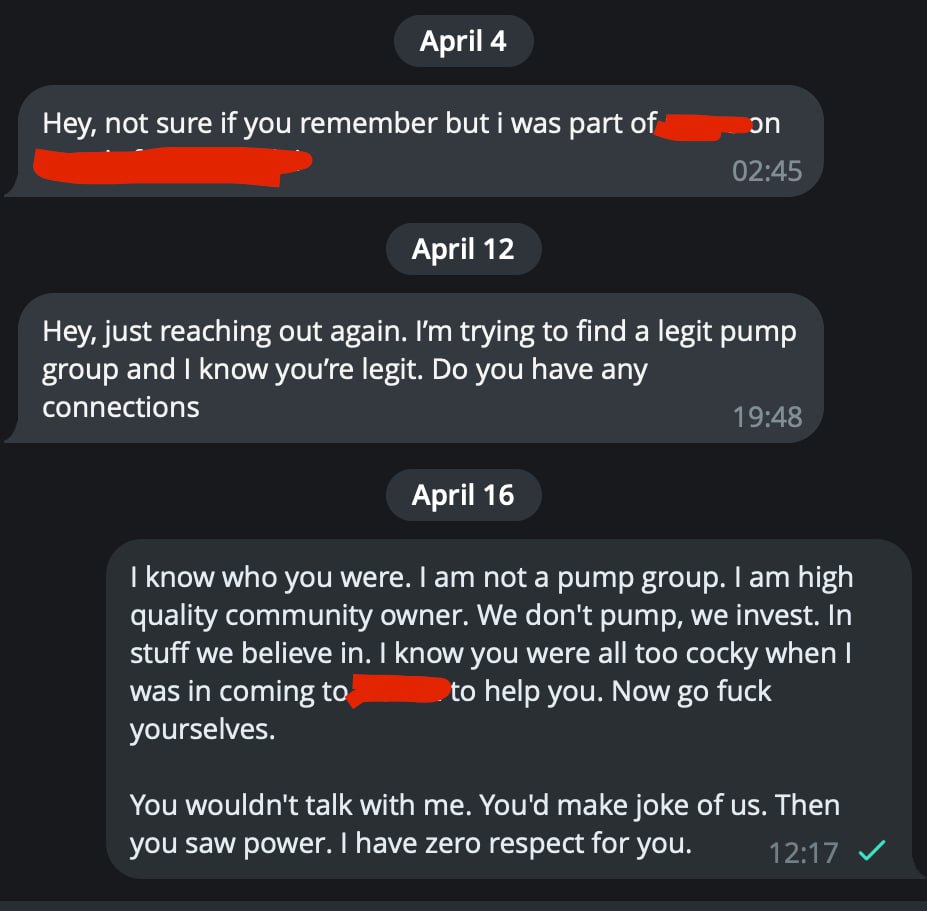

To all project founders who ignore good-intent people, are cocky to them, but once they see the power (like BCW) they get on their knees to suck a dick. FUCK YOU!

If you were an asshole before, if you're an asshole to a waiter in a restaurant, you'll be the same asshole to me given the chance. I want nothing to do with you. You don't deserve BCW.

Many guys like this guy. I remember him, founder of a project, a fork that was good idea. I came anon to give them top notch advice, they were ubercocky. Later, when they saw BCW power, they started to suck dick.

You know that joke: "Jenny would you suck a dick for a million bucks?"

- "for a million, yes"

- "what about for $10?"

She slaps him.

"who do you think I am"

- "we already established that, now we're just negotiating"

—-

The point is, if they are assholes, they are assholes. Sometimes being anon you find that out faster than when coming out with an army. Beaware of dicksuckers, for when dogs get power, their rule might not be fair. Cheers!

On a macro scale, if you zoom out just a bit from second-to-second thinking... if you relax... crypto this year I expect to be very rewarding. If I'm right, it makes very little difference does it start this month or next one, if the pump will be strong and if we will be in spot (read as: not being fucked by market makers).

Spot hold what you truly like.

Enjoy crypto.

Or micro trade it, time the market. I share with you the edge I find (and it's quite both powerful and often). According to your preference. Cheers!

Discussions

top 3 breaking news

The renowned ‘epic satoshi’ from the fourth halving block, also known as Sat # 1,968,750,000,000,000, fetched a price of 33.3 bitcoins, valued at just over $2.13 million on Thursday afternoon Eastern Standard Time. This satoshi, the smallest denomination of BTC, was sold for an astonishing 338 billion percent more than the typical value of a […]

a

a

a

a

a

a

April 25, 2024 (Investorideas.com Newswire) The Q1 US GDP report somewhat puts a 'cat among the pigeons' in terms of the US economic outlook

a

a

a

a

a

a

Retail Traders Are Turning Pessimistic on Stocks for First Time Since November Bloomberg

a

a

a

a

a

a

Stranded energy and unused electricity are magnets for bitcoin miners, as they take electricity that can't readily be used for other purposes and turn ...

a

a

a

a

a

a

As Bitcoin tumbled, the wider crypto market fell in lockstep, with the combined market cap of all cryptocurrencies dropping by 4.7% overnight.

a

a

a

a

a

a

Major bank Morgan Stanley may soon allow its 15000 brokers to recommend Bitcoin ETFs to clients. The move could boost inflows and send a ...

a

a

a

a

a

a

Proceeds will go to fund the development of Bitcoin layer-2 lightning startup Tirrel Corp.

a

a

a

a

a

a

Here are the stories that made it to ANC's "Market Edge". Join ANC PRESTIGE to get access to perks: ...

a

a

a

a

a

a

The leading UK-based bank says it is still bullish on Bitcoin, holding firm on its bold price prediction.

a

a

a

a

a

a

Bitcoin (CRYPTO: BTC) soared 140% over the past year as economic resilience drew investors back to risk assets. Other factors also contributed to ...

a

a

a

a

a

a

Bitcoin's price stood tall above $66,000 for a few days and even challenged $67,000 on a couple of occasions but to no avail.

a

a

a

a

a

a

Hougan also reaffirmed previous price predictions and said Bitcoin is still on track to hit $250,000 in the coming years.

a

a

a

a

a

a

As cryptocurrency groups work to shield mines from local regulations, U.S. President Joe Biden proposed an excise tax on bitcoin energy use.

a

a

a

a

a

a

УНН Economy ✎ Bitcoin and altcoin prices fell sharply due to low risk appetite amid a sell-off in tech stocks and expectations of higher interest ...

a

a

a

a

a

a

Recent trends in the crypto market have indicated a notable shift in trader behavior, particularly among those investing in Bitcoin. Using data from CryptoQuant, Bloomberg has revealed that the Bitcoin funding rate—the cost for traders to open long positions in Bitcoin’s perpetual futures—has turned negative for the first time since October 2023. This change suggests a “cooling interest” in leveraging bullish bets on Bitcoin, coinciding with the fading impact of major market drivers. Related Reading: Is A $72K Bitcoin Surge On The Horizon? Glassnode’s Latest Analysis Points To An Answer Bitcoin Market Dynamics Post-Halving The decline in Bitcoin’s funding rate correlates with a reduction in net inflows to US spot Bitcoin Exchange-Traded Funds (ETFs), which previously pushed the cryptocurrency to record highs. Despite the anticipation surrounding the Bitcoin Halving—an event reducing the reward for mining new blocks and theoretically lessening the supply of new coins—the price impact has been surprisingly muted. According to Bloomberg, this subdued response has compounded the effects of broader economic factors, such as geopolitical tensions and changes in monetary policy expectations, leading to increased risk aversion among investors. Following the latest Bitcoin halving, the market has not seen the bullish surge many expected. Instead, Bitcoin has only seen a correction of over 10%, from its all-time high (ATH) in March with prices stabilizing in the $63,000 region, at the time of writing. As CryptoQuant’s Head of Research Julio Moreno pointed out, the recent downturn in Bitcoin’s funding rates to below zero underscores a “decreased eagerness” among traders to take long positions. According to Bloomberg, this trend is supported by a significant drop in daily inflows to US spot Bitcoin ETFs and a reduction in open interest in Bitcoin futures at the Chicago Mercantile Exchange (CME), which indicates a broader cooling of enthusiasm for crypto investments. [1/4] Bitcoin ETF Flow – 25 April 2024 – UPDATE pic.twitter.com/ojRayOFlnu — BitMEX Research (@BitMEXResearch) April 25, 2024 In a Bloomberg report, K33 Research analyst Vetle Lunde noted that the “current streak of neutral-to-below-neutral funding rates is unusual,” suggesting that the market might be entering a price-consolidation phase. Notably, this period of reduced leverage activity could potentially lead to further price stabilization, but it also raises questions about the near-term prospects for Bitcoin’s recovery. Adjustments In Mining Difficulty And Market Implications Interestingly, alongside these market adjustments, Bitcoin’s mining difficulty has increased for the first time immediately following the fourth halving. The difficulty adjustment, which occurs every 2016 block, increased by 2%, reaching a new high of 88.1 trillion, according to Bitbo data. This adjustment contradicts past trends where the difficulty typically decreased post-halving due to reduced profitability pushing less efficient miners out of the market. This anomaly in mining difficulty suggests that despite lower rewards post-Halving, miners remain active, possibly buoyed by more efficient mining technologies or strategic shifts within mining operations. Related Reading: Samson Mow On Bitcoin Halving: Brace For Supply Shock, Omega Candle In Sight This resilience in mining activity could help sustain the network’s security and processing power. Still, it reflects the complexities of predicting Bitcoin’s market dynamics solely based on historical halving outcomes. Featured image from Unsplash, Chart from TradingView

a

a

a

a

a

a

Layer-1 blockchains are foundational networks supporting various applications directly on their protocol, while Layer-2 blockchains operate atop these foundational layers, enhancing scalability and efficiency. Comparing the usage and efficiency of EVM-compatible L1 and L2 blockchains and side chains helps us better understand the market values and where most of the DeFi activity comes from. Dune […] The post Polygon leads in EVM efficiency as DeFi users favor low transaction costs appeared first on CryptoSlate.

a

a

a

a

a

a

Dogecoin appears to be in serious predicament as crypto prices tumble due to unfavorable economic data in US

a

a

a

a

a

a

A reaction to the indictment charges against the Samourai developers yesterday, and the patently absurd distortions of reality, prior regulatory clarification, and the functionality of the software to categorize them as a money transmission business.

a

a

a

a

a

a

For $PNC, $500 Billion of Assets Isn’t Enough to Take on $JPM and $BAC Bloomberg

a

a

a

a

a

a

“The SEC argues that nearly every token should be registered under U.S. securities laws,” commented a16z crypto’s general counsel Miles Jennings.

a

a

a

a

a

a

Proof of Pitch is set to redefine the traditional pitch competition paradigm by unveiling its AI-driven competition. In essence, Proof of Pitch is poised to reshape the startup landscape with its innovative fusion of Artificial Intelligence (AI) insights and the strategic expertise of top Web3 venture capitalists. Scheduled for June 10th and 11th, 2024, at […]

a

a

a

a

a

a

As cryptocurrencies' prices rebound, Justin Bieber's substantial NFT losses prompt reflections on current crypto market

a

a

a

a

a

a

Bloomberg ETF Analyst James Seyffart previously explained on X that ETF shares are created or destroyed in units, which only happens when there is a ...

a

a

a

a

a

a

According to Bloomberg, trading of a spot bitcoin-ETF from Bosera Capital and HashKey Capital on the Hong Kong Stock Exchange will start on 30 April.

a

a

a

a

a

a

The blockchain race is about to get even more crowded: Movement Labs, a San Francisco-based software development team that's building a layer-2 ...

a

a

a

a

a

a

On the public blockchain front, Visa supports payment to web3 merchants using stablecoins (USDC) if they use Worldpay or Nuvei. Image Copyright: ...

a

a

a

a

a

a

Andres Zunino, ZirconTech cofounder and web development authority, drives innovation in Web3 for digital transformation. getty. Blockchain and ...

a

a

a

a

a

a

Top 100 Coins By Market Cap

NEXT BTC MOVE:

I think Bitcoin goes UP because

| Name | Price | Marketcap | 24h | ||

|---|---|---|---|---|---|

Bitcoin (BTC)

Bitcoin (BTC)

|

$64,003.75 | $1.26 T | -1.01% | ||

Ethereum (ETH)

Ethereum (ETH)

|

$3,152.18 | $384.72 B | -0.96% | ||

Tether USDt (USDT)

Tether USDt (USDT)

|

$0.99960010 | $110.42 B | 0.00% | ||

BNB (BNB)

BNB (BNB)

|

$611.48 | $90.25 B | 1.84% | ||

Solana (SOL)

Solana (SOL)

|

$147.63 | $66.00 B | -2.86% | ||

USDC (USDC)

USDC (USDC)

|

$1.00 | $33.24 B | 0.01% | ||

XRP (XRP)

XRP (XRP)

|

$0.52469255 | $28.93 B | -0.58% | ||

Dogecoin (DOGE)

Dogecoin (DOGE)

|

$0.15190404 | $21.88 B | -0.85% | ||

Toncoin (TON)

Toncoin (TON)

|

$5.42 | $18.83 B | -1.92% | ||

Cardano (ADA)

Cardano (ADA)

|

$0.47286057 | $16.85 B | -0.82% | ||

Shiba Inu (SHIB)

Shiba Inu (SHIB)

|

$0.00002612 | $15.40 B | 1.27% | ||

Avalanche (AVAX)

Avalanche (AVAX)

|

$35.45 | $13.45 B | -3.52% | ||

TRON (TRX)

TRON (TRX)

|

$0.11649000 | $10.23 B | 3.09% | ||

Polkadot (DOT)

Polkadot (DOT)

|

$6.88 | $9.93 B | -1.81% | ||

Bitcoin Cash (BCH)

Bitcoin Cash (BCH)

|

$476.70 | $9.42 B | -0.48% | ||

Chainlink (LINK)

Chainlink (LINK)

|

$14.69 | $8.65 B | -0.52% | ||

NEAR Protocol (NEAR)

NEAR Protocol (NEAR)

|

$7.17 | $7.64 B | 2.87% | ||

Polygon (MATIC)

Polygon (MATIC)

|

$0.71420000 | $7.10 B | 0.33% | ||

Internet Computer (ICP)

Internet Computer (ICP)

|

$13.68 | $6.36 B | -1.02% | ||

Litecoin (LTC)

Litecoin (LTC)

|

$83.42 | $6.23 B | -1.22% | ||

Dai (DAI)

Dai (DAI)

|

$1.00 | $5.35 B | 0.02% | ||

UNUS SED LEO (LEO)

UNUS SED LEO (LEO)

|

$5.75 | $5.33 B | -0.20% | ||

Uniswap (UNI)

Uniswap (UNI)

|

$8.03 | $4.82 B | 3.92% | ||

First Digital USD (FDUSD)

First Digital USD (FDUSD)

|

$1.00 | $4.41 B | -0.05% | ||

Hedera (HBAR)

Hedera (HBAR)

|

$0.12020728 | $4.30 B | -4.48% | ||

Stacks (STX)

Stacks (STX)

|

$2.72 | $3.96 B | -0.05% | ||

Aptos (APT)

Aptos (APT)

|

$9.12 | $3.89 B | -2.28% | ||

Ethereum Classic (ETC)

Ethereum Classic (ETC)

|

$26.30 | $3.87 B | -1.86% | ||

Mantle (MNT)

Mantle (MNT)

|

$1.13 | $3.68 B | 1.22% | ||

Cronos (CRO)

Cronos (CRO)

|

$0.12635477 | $3.36 B | 0.75% | ||

Pepe (PEPE)

Pepe (PEPE)

|

$0.00000796 | $3.35 B | 8.14% | ||

Render (RNDR)

Render (RNDR)

|

$8.57 | $3.30 B | -0.72% | ||

Stellar (XLM)

Stellar (XLM)

|

$0.11370000 | $3.29 B | -1.69% | ||

Cosmos (ATOM)

Cosmos (ATOM)

|

$8.37 | $3.27 B | -1.60% | ||

Filecoin (FIL)

Filecoin (FIL)

|

$6.00 | $3.27 B | -1.72% | ||

OKB (OKB)

OKB (OKB)

|

$53.16 | $3.19 B | -2.43% | ||

Hedera Hashgraph (HBAR)

Hedera Hashgraph (HBAR)

|

$0.12070000 | $4.29 B | -6.70% | ||

dogwifhat (WIF)

dogwifhat (WIF)

|

$3.13 | $3.17 B | -2.15% | ||

Bittensor (TAO)

Bittensor (TAO)

|

$462.88 | $3.08 B | 1.99% | ||

Immutable (IMX)

Immutable (IMX)

|

$2.10 | $3.08 B | -6.55% | ||

Arbitrum (ARB)

Arbitrum (ARB)

|

$1.10 | $2.92 B | -2.74% | ||

VeChain (VET)

VeChain (VET)

|

$0.03979000 | $2.91 B | -0.75% | ||

Kaspa (KAS)

Kaspa (KAS)

|

$0.11920122 | $2.79 B | -4.29% | ||

Maker (MKR)

Maker (MKR)

|

$2,862.00 | $2.65 B | -0.66% | ||

The Graph (GRT)

The Graph (GRT)

|

$0.26973645 | $2.56 B | -2.07% | ||

Optimism (OP)

Optimism (OP)

|

$2.44 | $2.55 B | -0.24% | ||

Injective (INJ)

Injective (INJ)

|

$26.54 | $2.48 B | -2.83% | ||

Theta Network (THETA)

Theta Network (THETA)

|

$2.41 | $2.42 B | 3.37% | ||

Monero (XMR)

Monero (XMR)

|

$119.06 | $2.19 B | -1.04% | ||

Fantom (FTM)

Fantom (FTM)

|

$0.75404696 | $2.11 B | 2.76% | ||

Core (CORE)

Core (CORE)

|

$2.35 | $2.08 B | -2.82% | ||

Arweave (AR)

Arweave (AR)

|

$31.42 | $2.07 B | -2.28% | ||

Fetch.ai (FET)

Fetch.ai (FET)

|

$2.30 | $1.96 B | -4.77% | ||

Celestia (TIA)

Celestia (TIA)

|

$10.85 | $1.95 B | -3.70% | ||

FLOKI (FLOKI)

FLOKI (FLOKI)

|

$0.00019603 | $1.88 B | 5.40% | ||

Bonk (BONK)

Bonk (BONK)

|

$0.00002858 | $1.86 B | 12.70% | ||

THORChain (RUNE)

THORChain (RUNE)

|

$5.52 | $1.85 B | -0.60% | ||

Lido DAO (LDO)

Lido DAO (LDO)

|

$2.04 | $1.82 B | -0.35% | ||

Sei (SEI)

Sei (SEI)

|

$0.63030000 | $1.76 B | 5.21% | ||

Algorand (ALGO)

Algorand (ALGO)

|

$0.20420000 | $1.67 B | -3.77% | ||

Bitget Token (BGB)

Bitget Token (BGB)

|

$1.19 | $1.67 B | -2.93% | ||

Render Token (RNDR)

Render Token (RNDR)

|

$8.51 | $3.31 B | -0.81% | ||

Sui (SUI)

Sui (SUI)

|

$1.23 | $1.60 B | -2.88% | ||

Beam (BEAM)

Beam (BEAM)

|

$0.02815572 | $1.49 B | 1.90% | ||

Gala (GALA)

Gala (GALA)

|

$0.04803000 | $1.47 B | 0.11% | ||

Pendle (PENDLE)

Pendle (PENDLE)

|

$5.98 | $1.44 B | -3.12% | ||

Jupiter (JUP)

Jupiter (JUP)

|

$1.06 | $1.43 B | -5.16% | ||

Flow (FLOW)

Flow (FLOW)

|

$0.92400000 | $1.40 B | -3.03% | ||

Aave (AAVE)

Aave (AAVE)

|

$90.88 | $1.35 B | -1.50% | ||

Bitcoin SV (BSV)

Bitcoin SV (BSV)

|

$66.98 | $1.32 B | -3.32% | ||

Quant (QNT)

Quant (QNT)

|

$109.00 | $1.32 B | 0.96% | ||

Ethena (ENA)

Ethena (ENA)

|

$0.88100000 | $1.26 B | -0.93% | ||

Neo (NEO)

Neo (NEO)

|

$17.81 | $1.26 B | -0.69% | ||

BitTorrent (New) (BTT)

BitTorrent (New) (BTT)

|

$0.00000127 | $1.23 B | -0.79% | ||

SingularityNET (AGIX)

SingularityNET (AGIX)

|

$0.95002000 | $1.22 B | -4.57% | ||

Flare (FLR)

Flare (FLR)

|

$0.03054174 | $1.18 B | -1.85% | ||

Wormhole (W)

Wormhole (W)

|

$0.64048458 | $1.15 B | 15.44% | ||

MultiversX (EGLD)

MultiversX (EGLD)

|

$42.16 | $1.14 B | -0.51% | ||

Huobi Token (HT)

Huobi Token (HT)

|

$0.58071800 | $93.14 M | 0.71% | ||

Akash Network (AKT)

Akash Network (AKT)

|

$4.76 | $1.12 B | -3.70% | ||

dYdX (Native) (DYDX)

dYdX (Native) (DYDX)

|

$2.29 | $1.06 B | -0.61% | ||

Axie Infinity (AXS)

Axie Infinity (AXS)

|

$7.37 | $1.06 B | -4.03% | ||

Chiliz (CHZ)

Chiliz (CHZ)

|

$0.11864000 | $1.06 B | -2.04% | ||

The Sandbox (SAND)

The Sandbox (SAND)

|

$0.46230000 | $1.05 B | -1.90% | ||

Conflux (CFX)

Conflux (CFX)

|

$0.25820000 | $1.02 B | 4.48% | ||

eCash (XEC)

eCash (XEC)

|

$0.00005149 | $1.02 B | -1.23% | ||

dYdX (DYDX)

dYdX (DYDX)

|

$2.27 | $708.99 M | -0.92% | ||

Tezos (XTZ)

Tezos (XTZ)

|

$1.02 | $998.31 M | 0.49% | ||

Ronin (RON)

Ronin (RON)

|

$3.10 | $980.49 M | -5.71% | ||

Worldcoin (WLD)

Worldcoin (WLD)

|

$4.89 | $972.89 M | -1.71% | ||

EOS (EOS)

EOS (EOS)

|

$0.85850000 | $968.37 M | 3.28% | ||

KuCoin Token (KCS)

KuCoin Token (KCS)

|

$9.99 | $960.65 M | 0.53% | ||

Synthetix (SNX)

Synthetix (SNX)

|

$2.93 | $959.29 M | 0.18% | ||

Mina (MINA)

Mina (MINA)

|

$0.86203839 | $941.71 M | -2.91% | ||

JasmyCoin (JASMY)

JasmyCoin (JASMY)

|

$0.01887200 | $934.28 M | -1.87% | ||

Pyth Network (PYTH)

Pyth Network (PYTH)

|

$0.61580000 | $927.85 M | -1.61% | ||

ORDI (ORDI)

ORDI (ORDI)

|

$43.67 | $917.10 M | -2.46% | ||

Decentraland (MANA)

Decentraland (MANA)

|

$0.46738009 | $891.91 M | -0.76% | ||

Starknet (STRK)

Starknet (STRK)

|

$1.20 | $871.26 M | -4.87% | ||

Gnosis (GNO)

Gnosis (GNO)

|

$332.50 | $863.83 M | -4.57% |

Try to search another coin

clc7 Bitcoin