Notification Center

Turn on/off sound

Show/Hide Coins Ticker

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 16 Gwei | 16 Gwei | 19 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 16 Gwei | 16 Gwei | 19 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

Mr. S just published a curious report about TIME.

Every chart consists of price and TIME. This one found an ancient method by stocks trader from seventies, adjusted by Mr. S for Bitcoin shows you when this bull cycle will reach bottom and when top according to this theory.

Very valuable report for strategising, I hope you find it useful. Unlock it here: https://blockchainwhispers.com/signals?signal_anchor=8364

I made this post (spot positions update) from Mr. M free for all now: https://blockchainwhispers.com/signals?signal_anchor=8359 Enjoy

Here's banana.

I know you're hungry. I know you want something different in life. Better. However, impatience is enemy of achievement.

How did it work for you before?

It's easy for me to write "1000x". But you know I'm ethics, trust and loyalty above and before anything. I try to write as conservative and as close to real as I can predict.

Maybe this banana will not satisfy your everpresent hunger, but 3x in slow times, might be better than 0x. Maybe that 3x will be foundation to next 10x becoming 30x. Maybe you'll skip it but will give you ideas of good ways to approach token-selection for your portfolio. Maybe it doesn't make even 3x... and only after I said all this I can say, but maybe, it also pleasantly surprises us!

While I'm waiting on the team, your BCW analysts are now checking projects with similar market category, similar development level where we have close confidence this will get and their marketcaps vs the expected marketcap at launch of this (implemented hard caps with the team in place)...

To understand, look, I don't want noobs, idiots etc. I know in most bullish days I'm not noob's favorite person as I'm telling them about caution education etc. However, I'm the only one followed in bear and bull markets, because I tell as transparently as educated as I am able.

My friend, the truth is at the end of the crypto bull run, there will not be all winners.

Yes, at some point many people might be in green, but due to their lack of proper perspective, they will fail. They will not book, chase the top, be stubborn at chart, having ego, having too much greed, whatever.

This particular opportunity, I know you'd like to see "gazillion X" — but really, of those screaming gazillion X on twitter, how many actually in this period achieved that gazillion X.

This find, at marketcap I assume, vs what the industry average on this developed project without much marketing, so basically taking every bit of figure conservatively, presents an easy and natural 3x opportunity vs the market.

If the market will fly, this will fly with it. Not as some AI coins, etc... but risk vs reward... is in our favor because we have one non-public advantage and that is we know the narrative change while most ignored that news. And plus now we have a slippage free entry.

So, let's say in this bull run avg of this category at this stage will be +10x, this one will be 3x first to category and 10x with the category it's 30x.

If the category or alts will not move, it is still 3x.

If it will drop the entire market 50% instead of pumping 10x, this thing is still +1.5x with some time delay as bear markets make.

Of course, no guarantees, but THIS is why I like such opportunity. Eventually, chart gaps are filled, liquidity voids cleared, and price-to-category equalized.

I know, I know, too advanced shit for avg noob. Wen Lambo? Wen moon?

For that, you have other channels. I'm very happy about this find, and I will invite you to check it when the time comes. I'll invite you not to put all your eggs in this basket, I'll structure it so that you must read and inform yourself before entering... so that at the end of the day, only the real holders get true BCW opportunity.

And even with this, yup, completely non-noob-friendly - we might still fail, project might end up being shit.

But we the real BCW know, given many such opportunities, edge by edge, where we are vs where the rest of the market is.

Remember all those dumps and pumps we predicted. Not all, but more than Twitter did, more than many if not most gurus did, many than sometimes even HUGE trading desks did (remember when I told you Microstrategy bought at the wrong timing, and it proved correct) - and they have a team of top pros...

Brother, we are united into something really powerful. Crypto awarded us with real people having almost the same opportunity as top pros. And we are staying sharp on top of it. This is why I didn't abandon crypto in bear times. Why I traded... so for this next bull run, I am more capable, more educated, more experienced to guide you with maximum edge.

Again, noobs I am sorry but, NO GUARANTEES!

Can you live with that?

Good, then join me and fellow BCW elite-hand brothers on the amazing crypto journey ahead!

D Man

Good news is yes, this year, I do expect to finally us, we all here in crypto to have a 2017-like alt run. Probably the last of its kind. This year, not this day or week. If you can live with it, you might get finally rewarded for years of being in crypto while others abandoned it after long and exhausting red periods. Cheers my loyal bro!

Imagine a guy developing something for years and the village already starts talking "he is nuts, never gonna deliver it" and one day he does, long after everyone stopped checking on him...

Similar find we have here. Not as strong though. They didn't invent anything breakthrough, but they reached that community-dulling moment because they were chasing something else for 2 years, now changed the direction and practically nobody noticed! They are very close to achieving it. And we, BCW, are among the very first to cash-in on the info.

Making a zero-slippage deal with the team, helped them restructure to buy out all previous investors since they got too small, and make even better, healthier (supertight) tokenomics that the market will appreciate.

Stay tuned, will tell more when I can/know.

My biggest concern, slippage at low marketcap is now solved (thanks to BCW reputation that makes teams listen). And tokenomics got even better (no airdrops, team got less, no coins for exchanges,... instead huge percentage for public and liquidity).

Will tell you more, this is just a small teaser why I'm happy about it. Not a gem of the year, but if it works out, it is easy and simple coin due to undervalue to market and category average due to info we know and others don't. It's not a privileged info, it's just something that most, professional market scanners, hobbyists etc overlooked because they assumed the team continued in the old direction, the news of the new direction didn't reach the community.

Sharing more in the following days.

Again, not a gem, but a really good, simple-to-understand opportunity imo.

Think of it this way: it's not a Lamborghini. It's a Prius, but a Prius offered at $1 starting auction and other people not knowing it's a real car, they think it's a toy. You know it's real. That's why I'm hot for this.

You might not reach valuation of Lambo, but if you reach even half the valuation of Prius and you paid $100, or $1000 for the $10,000 car, you did a great job, no?

Stay tuned.. (days, not hours, be relaxed)

Cheers!

I am very excited about this find. It is an undergem. It is not a gem only because it misses some technological breakthrough. Everything else: under the radar; price-to-opportunity; narrative... heck even chain is on the massive-gains train so to speak. I'll tell you about it soon. I made a nice progress with the team to do the crazy thing, to buy out the old investors so you have slippage--free entry. All this, thanks to BCW stellar reputation. Stay tuned. Likely early next week.

Cheers!

D Man

P.S. They asked me when. I said now. I want us actually to do this in red times. It will remain under the radar, and you'll be the lowest buyer possible. No one will be able to dump on you in profit. This is the strong position I like for BCW.

I might have something good to really good for you soon (days)... It is good for small wallets, a bit trouble for medium, a skip for whales this time due to liquidity.

It's a narrative change caught by so few. I love the opportunity and I think you'll be excited we discovered this timely as well. Cheers!

Halved. Weekend volume. Don't trust it. Have a nice weekend instead. Cheers!

P.S. The report is free. I think halving event is crypto public service.

So far it is predictable as we are heading into halving the price shows some green. It's a hook more than likely. S&P500 is continuing in its correction, and this gap is basically retail money expecting immediate post-halving results. Check the report, and then you'll know whether to expect immediate 100x long or not. Cheers my friend!

Halving is here. Miners rewards cut in half. You have the report here https://t.me/blockchainwhispersbaby/11349 about what to expect in price if history is to be asked. Cheers my friend!

Remember this green drawing? Above = bullish, below = dump. We are retesting it now in a quite bad way. Just fyi.

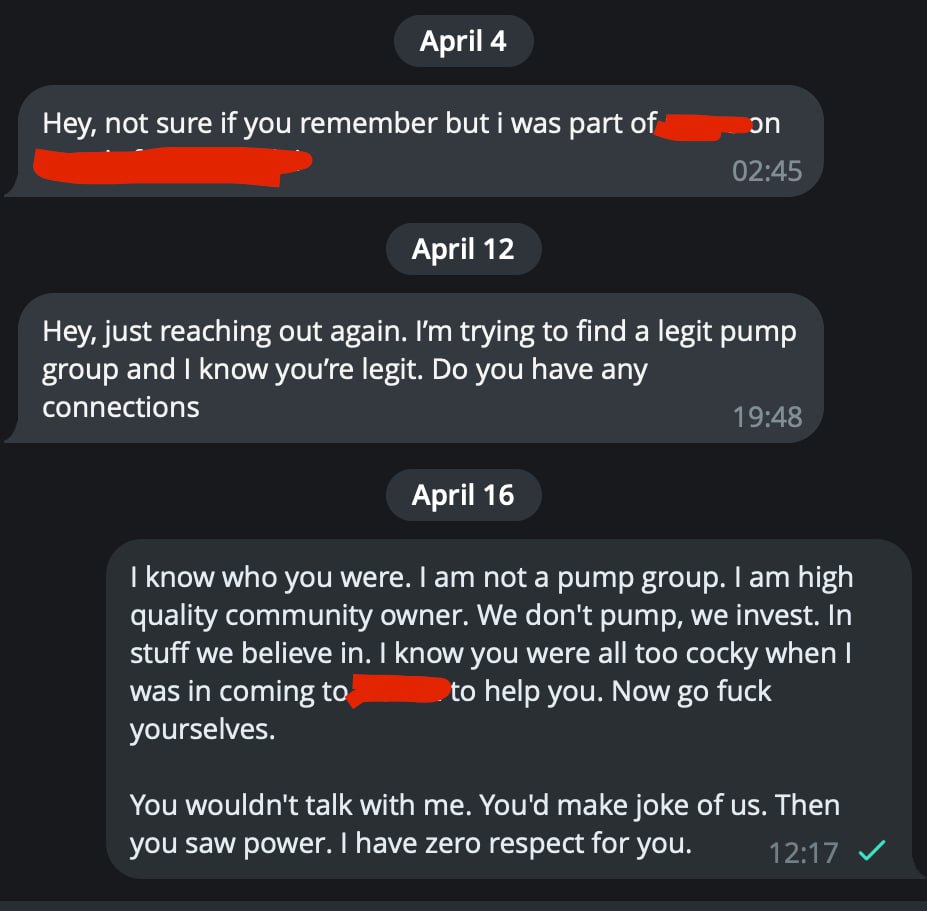

To all project founders who ignore good-intent people, are cocky to them, but once they see the power (like BCW) they get on their knees to suck a dick. FUCK YOU!

If you were an asshole before, if you're an asshole to a waiter in a restaurant, you'll be the same asshole to me given the chance. I want nothing to do with you. You don't deserve BCW.

Many guys like this guy. I remember him, founder of a project, a fork that was good idea. I came anon to give them top notch advice, they were ubercocky. Later, when they saw BCW power, they started to suck dick.

You know that joke: "Jenny would you suck a dick for a million bucks?"

- "for a million, yes"

- "what about for $10?"

She slaps him.

"who do you think I am"

- "we already established that, now we're just negotiating"

—-

The point is, if they are assholes, they are assholes. Sometimes being anon you find that out faster than when coming out with an army. Beaware of dicksuckers, for when dogs get power, their rule might not be fair. Cheers!

On a macro scale, if you zoom out just a bit from second-to-second thinking... if you relax... crypto this year I expect to be very rewarding. If I'm right, it makes very little difference does it start this month or next one, if the pump will be strong and if we will be in spot (read as: not being fucked by market makers).

Spot hold what you truly like.

Enjoy crypto.

Or micro trade it, time the market. I share with you the edge I find (and it's quite both powerful and often). According to your preference. Cheers!

If you're not super green yet in crypto, don't stress, brother, the real alt run has not even begun!

What I think alts might collapse for a bit. Maybe now is not the right time to buy them. I am telling you for quite some time, and since then the alts are boring. I tell you alts will break down. I think that now more than ever.

But remember your BCW brother... THEN will be a good time to buy. I am not selling. I just am not buying here. I wait for further dip to top up or to get back in the degen plays.

Blockchain Whispers baby!

Discussions

top 3 breaking news

Strike, a payments app focused on the Bitcoin blockchain, is now available in Europe. The platform recently expanded to Africa and its app is also accessible in Latin America. Strike raised $80 million in 2022 as it sought to expand its services globally. Strike, the digital payments app built on Bitcoin’s Lightning Network, announced the […] The post Bitcoin payments app Strike is now available in Europe appeared first on CoinJournal.

a

a

a

a

a

a

Quick Take. Bloomberg Senior ETF Analyst Eric Balchunas said BlackRock is “gaga” when it comes to its highly-successful spot bitcoin ETF. BlackRock's ...

a

a

a

a

a

a

Citi (C) CEO Jane Fraser Sees Risks Poised by Insurers in Private Credit Bloomberg

a

a

a

a

a

a

European Integration of Kosovo: Macron Urges Progress on Serb Minority Bloomberg

a

a

a

a

a

a

Analysts cite a classic trading pattern and growth in the altcoin total market capitalization index as proof of an upcoming altcoin season.

a

a

a

a

a

a

As the Dogeverse presale hits $6 million, stirring considerable buzz for its returns, and Healix Protocol grabs eyes with its high-profile HLX Token launch in the health-tech sector, BlockDAG is rapidly advancing as the superior contender. By securing a whopping $20.1 million in its ongoing presale, BlockDAG is not just leading but redefining what success [...] The post Best Crypto Presale 2024: BlockDAG Leads with $20.1M Success & 30,000x ROI, Surpassing Dogeverse & HLX Token Presale appeared first on Blockonomi.

a

a

a

a

a

a

On-chain data shows the new whale entrants in the Bitcoin market now hold almost twice as much as the veterans. Here’s what could be behind this shift. Bitcoin Newbie Whale Holdings Have Been Rapidly Growing Recently In a new post on X, CryptoQuant founder and CEO Ki Young Ju has discussed about how the holdings of the new whales compares against the old ones in the market right now. Related Reading: Is The Bitcoin Top Already Here? This Historical Pattern Says So The on-chain indicator of interest here is the “Realized Cap,” which, in short, keeps track of the total amount of capital that the investors have used to purchase their Bitcoin. This capitalization model is in contrast to the usual market cap, which simply measures the total value that the holders as a whole are carrying based on the current spot price. In the context of the current topic, the Realized Cap of the entire market isn’t of interest, but rather specifically that of two segments: the short-term holder whales and long-term holder whales. Whales are defined as entities on the network who are holding at least 1,000 BTC in their balance. At the current exchange rate, this amount is worth $66.6 million, so the whales are clearly quite massive holders. Because of these large holdings, these investors can hold some influence in the market. Based on holding time, the whales can be subdivided into two categories. The short-term holder (STH) whales are those who acquired their coins within the past 155 days, while the long-term holder (LTH) whales have been holding since longer than this timespan. Now, here is the chart shared by Ju that reveals the Realized Cap breakdown between these two Bitcoin whale cohorts: Looks like the metric has shot up for the STH whales recently | Source: @ki_young_ju on X As is visible in the above graph, the Realized Cap of the STH whales has historically not been too different from that of the LTH whales, but that appears to have changed recently. The metric has pulled away for these new whales this year with some very sharp growth, as its value has now reached the $110.6 billion mark. This means that the STH whales have collectively bought their coins at an initial investment of a whopping $110.6 billion. The Realized Cap of the LTH whales, on the other hand, has continued its usual trajectory, floating around $66.9 billion currently. This means that there is now a massive gap between the indicator for these two cohorts. But what’s the reason behind the sudden emergence of this brand-new trend? As mentioned before, the STH cutoff stands at 155 days, which means that the Realized Cap of the STH whales would signify the total value of the purchases made by the whales over the last five months. In the past five months, there has been one event in particular that has stood out, which has also never been present in any of the prior cycles: the approval of the spot exchange-traded funds (ETFs). The spot ETFs provide an alternative mode of investment into the asset through a means that’s familiar to traditional investors. These funds have been bringing in some unprecedented demand into BTC and as their holdings also fall under the 155 days mark, they would count as STH whales. Related Reading: Ethereum To See Fresh Move Soon? What Futures Data Says Bitcoin has also been rallying this year, so all this new investment would have had to purchase at relatively high prices, thus causing the Realized Cap, which correlates to direct capital flows, to inflate even further. BTC Price Bitcoin is now trading at $66,400 after witnessing a surge of more than 6% over the past week. The price of the asset seems to have been overall consolidating sideways recently | Source: BTCUSD on TradingView Featured image from Todd Cravens on Unsplash.com, CryptoQuant.com, chart from TradingView.com

a

a

a

a

a

a

Bitcoin has been trying to reclaim the $70,000 price range for a while, but whale addresses have other ideas.

a

a

a

a

a

a

April 24, 2024 (Investorideas.com Newswire) Investorideas.com, a go-to platform for big investing ideas, reports on trading for Mullen Automotive, Inc. (NASDAQ: MULN), an emerging electric vehicle ("EV") manufacturer, is one of the top gainers on NASDAQ, trading at $3.6689, up 0.9389 for a gain of 34.3919%.

a

a

a

a

a

a

The Open Source Justice Foundation is a non-profit charity focused on open source protocols that can alleviate the need for a traditional justice system. Learn more about OSJF's work at opensourcejustice.org.

a

a

a

a

a

a

Ripple has fired back against the U.S. Securities and Exchange Commission’s (SEC) request for it to pay nearly $2 billion in penalties. In March, the SEC asked the court to order Ripple to pay $876,308,712 in disgorgement, $198,150,940 in prejudgment interest, and a $876,308,712 civil penalty, which totals around $1.95 billion. Ripple filed an opposition […] The post Ripple Rejects SEC’s $2,000,000,000 Request for Penalties, Says Firm Will Pay No More Than $10,000,000 appeared first on The Daily Hodl.

a

a

a

a

a

a

... cryptocurrency exchange's collapse https://t.co/aLrqw1oMtZ. ... @crypto. A group of FTX investors and customers ... From bloomberg.com · 2:30 PM · Apr 24, ...

a

a

a

a

a

a

B. Riley (RILY) Stock Rises on Release of Annual Report; Skeptics Still Critical Bloomberg

a

a

a

a

a

a

The spot exchange-traded funds will be denominated in the United States dollar, Hong Kong dollar, and Chinese yuan.

a

a

a

a

a

a

One of the issuers waived management fees for the first six months, undercutting rival offerings.

a

a

a

a

a

a

The next era of Web3 will be defined by the ability of projects to attract and retain users, says Kelly Ye of Decentral Park Capital. Coinbase’s Ethereum Layer 2 is showing the way forward.

a

a

a

a

a

a

On-chain real-world assets and the integration of wallet infrastructure will replace intermediaries and become standard in the modern asset management lifecycle, says Mehdi Brahimi, head of institutional business at L1.

a

a

a

a

a

a

The new regulations could offer banks a competitive edge by limiting institutions without a banking license to a maximum stablecoin issuance of $10 billion, the report said.

a

a

a

a

a

a

REPO Act: Russian-Asset Seizure Law Spurs Debate Over Impact on Dollar Bloomberg

a

a

a

a

a

a

Explore the story of a PEPE specialist who accrued millions during the last price spike and is now extremely optimistic about a new token currently valued at $0.065. Learn about the potential investment implications and the future projections of this new crypto token.

a

a

a

a

a

a

Reports suggested that the latest individual to be charged in connection to the crypto scheme was associated with Gilbert Armenta, the boyfriend of OneCoin founder Ruja Ignatova.

a

a

a

a

a

a

April 24, 2024 (Investorideas.com Newswire) The May FOMC meeting comes at a delicate time for the FOMC

a

a

a

a

a

a

Morgan Stanley is exploring expanding sales of Bitcoin exchange-traded funds by allowing its roughly 15,000 brokers to solicit customer purchases, ...

a

a

a

a

a

a

OP_CAT, which could enable advanced functionality on Bitcoin, was introduced as BIP-420 by Taproot Wizards co-founder Udi Wertheimer.

a

a

a

a

a

a

Strike's “Send Globally” feature enables users to make local currency remittances using Bitcoin's Lightning Network as a global payment rail.

a

a

a

a

a

a

Yves Bennaïm, founder and chair of 2B4CH, a Swiss pro-Bitcoin think tank, has initiated a public campaign to amend the country's constitution.

a

a

a

a

a

a

Strike, a Bitcoin-only app, has expanded support to European customers following massive regional demand and rising cryptocurrency prices.

a

a

a

a

a

a

Since the beginning of 2024, large Bitcoin holders have accumulated an additional 266,000 BTC.

a

a

a

a

a

a

According to Eric Balchunas, a senior Bloomberg ETF analyst, these ETFs are set to commence trading on April 30, marking a significant milestone for ...

a

a

a

a

a

a

Bloomberg said that these companies are already in the final stages of preparation to commence trading for the crypto investment vehicles by the end ...

a

a

a

a

a

a

Top 100 Coins By Market Cap

NEXT BTC MOVE:

I think Bitcoin goes UP because

| Name | Price | Marketcap | 24h | ||

|---|---|---|---|---|---|

Bitcoin (BTC)

Bitcoin (BTC)

|

$64,889.47 | $1.28 T | -2.67% | ||

Ethereum (ETH)

Ethereum (ETH)

|

$3,179.39 | $388.04 B | -1.48% | ||

Tether USDt (USDT)

Tether USDt (USDT)

|

$0.99960209 | $110.42 B | -0.08% | ||

BNB (BNB)

BNB (BNB)

|

$601.93 | $88.84 B | -1.31% | ||

Solana (SOL)

Solana (SOL)

|

$152.00 | $67.95 B | -3.68% | ||

USDC (USDC)

USDC (USDC)

|

$1.00 | $33.54 B | 0.00% | ||

XRP (XRP)

XRP (XRP)

|

$0.53284038 | $29.38 B | -3.52% | ||

Dogecoin (DOGE)

Dogecoin (DOGE)

|

$0.15432081 | $22.23 B | -4.17% | ||

Toncoin (TON)

Toncoin (TON)

|

$5.58 | $19.39 B | -2.00% | ||

Cardano (ADA)

Cardano (ADA)

|

$0.47632305 | $16.97 B | -5.78% | ||

Shiba Inu (SHIB)

Shiba Inu (SHIB)

|

$0.00002620 | $15.44 B | -3.42% | ||

Avalanche (AVAX)

Avalanche (AVAX)

|

$37.13 | $14.01 B | -4.72% | ||

Polkadot (DOT)

Polkadot (DOT)

|

$7.07 | $10.14 B | -4.50% | ||

TRON (TRX)

TRON (TRX)

|

$0.11369000 | $9.94 B | 0.47% | ||

Bitcoin Cash (BCH)

Bitcoin Cash (BCH)

|

$485.20 | $9.53 B | -5.13% | ||

Chainlink (LINK)

Chainlink (LINK)

|

$14.86 | $8.71 B | -2.51% | ||

NEAR Protocol (NEAR)

NEAR Protocol (NEAR)

|

$7.14 | $7.59 B | 1.54% | ||

Polygon (MATIC)

Polygon (MATIC)

|

$0.71810000 | $7.09 B | -2.38% | ||

Internet Computer (ICP)

Internet Computer (ICP)

|

$14.03 | $6.48 B | -4.24% | ||

Litecoin (LTC)

Litecoin (LTC)

|

$84.80 | $6.30 B | -0.49% | ||

Dai (DAI)

Dai (DAI)

|

$0.99989655 | $5.35 B | -0.03% | ||

UNUS SED LEO (LEO)

UNUS SED LEO (LEO)

|

$5.77 | $5.34 B | 0.10% | ||

Uniswap (UNI)

Uniswap (UNI)

|

$7.80 | $4.66 B | -3.12% | ||

First Digital USD (FDUSD)

First Digital USD (FDUSD)

|

$1.00 | $4.41 B | -0.29% | ||

Hedera (HBAR)

Hedera (HBAR)

|

$0.12030516 | $4.30 B | 5.60% | ||

Aptos (APT)

Aptos (APT)

|

$9.35 | $3.98 B | -4.87% | ||

Stacks (STX)

Stacks (STX)

|

$2.72 | $3.96 B | -7.79% | ||

Ethereum Classic (ETC)

Ethereum Classic (ETC)

|

$27.00 | $3.95 B | -4.25% | ||

Mantle (MNT)

Mantle (MNT)

|

$1.12 | $3.65 B | -5.85% | ||

Stellar (XLM)

Stellar (XLM)

|

$0.11650000 | $3.37 B | 0.27% | ||

Render (RNDR)

Render (RNDR)

|

$8.75 | $3.37 B | -3.76% | ||

Cronos (CRO)

Cronos (CRO)

|

$0.12617630 | $3.35 B | -3.75% | ||

Filecoin (FIL)

Filecoin (FIL)

|

$6.18 | $3.35 B | -4.84% | ||

Cosmos (ATOM)

Cosmos (ATOM)

|

$8.52 | $3.33 B | -2.36% | ||

Immutable (IMX)

Immutable (IMX)

|

$2.27 | $3.31 B | -4.52% | ||

Hedera Hashgraph (HBAR)

Hedera Hashgraph (HBAR)

|

$0.12110000 | $4.29 B | 7.01% | ||

OKB (OKB)

OKB (OKB)

|

$54.61 | $3.28 B | -1.53% | ||

dogwifhat (WIF)

dogwifhat (WIF)

|

$3.23 | $3.24 B | 7.04% | ||

Pepe (PEPE)

Pepe (PEPE)

|

$0.00000742 | $3.12 B | -3.17% | ||

Bittensor (TAO)

Bittensor (TAO)

|

$464.89 | $3.09 B | -8.07% | ||

Arbitrum (ARB)

Arbitrum (ARB)

|

$1.14 | $3.02 B | -4.27% | ||

Kaspa (KAS)

Kaspa (KAS)

|

$0.12699515 | $2.98 B | -1.98% | ||

VeChain (VET)

VeChain (VET)

|

$0.04071000 | $2.95 B | -3.76% | ||

Maker (MKR)

Maker (MKR)

|

$2,925.00 | $2.70 B | 0.80% | ||

The Graph (GRT)

The Graph (GRT)

|

$0.27718150 | $2.63 B | -6.95% | ||

Optimism (OP)

Optimism (OP)

|

$2.46 | $2.57 B | -2.36% | ||

Injective (INJ)

Injective (INJ)

|

$27.41 | $2.56 B | -2.97% | ||

Theta Network (THETA)

Theta Network (THETA)

|

$2.36 | $2.36 B | -2.04% | ||

Monero (XMR)

Monero (XMR)

|

$120.45 | $2.22 B | -2.01% | ||

Core (CORE)

Core (CORE)

|

$2.49 | $2.20 B | -0.59% | ||

Arweave (AR)

Arweave (AR)

|

$33.12 | $2.16 B | -1.28% | ||

Fetch.ai (FET)

Fetch.ai (FET)

|

$2.47 | $2.09 B | 0.63% | ||

Fantom (FTM)

Fantom (FTM)

|

$0.74023108 | $2.08 B | -0.07% | ||

Celestia (TIA)

Celestia (TIA)

|

$11.22 | $2.01 B | -2.40% | ||

THORChain (RUNE)

THORChain (RUNE)

|

$5.58 | $1.87 B | -1.90% | ||

Lido DAO (LDO)

Lido DAO (LDO)

|

$2.05 | $1.82 B | -3.24% | ||

FLOKI (FLOKI)

FLOKI (FLOKI)

|

$0.00018857 | $1.80 B | -5.93% | ||

Algorand (ALGO)

Algorand (ALGO)

|

$0.21700000 | $1.75 B | 11.88% | ||

Bitget Token (BGB)

Bitget Token (BGB)

|

$1.23 | $1.72 B | -1.87% | ||

Sei (SEI)

Sei (SEI)

|

$0.60430000 | $1.69 B | -7.23% | ||

Sui (SUI)

Sui (SUI)

|

$1.27 | $1.65 B | -5.63% | ||

Render Token (RNDR)

Render Token (RNDR)

|

$8.77 | $3.35 B | -3.72% | ||

Bonk (BONK)

Bonk (BONK)

|

$0.00002515 | $1.64 B | 12.00% | ||

Jupiter (JUP)

Jupiter (JUP)

|

$1.11 | $1.50 B | -6.06% | ||

Pendle (PENDLE)

Pendle (PENDLE)

|

$6.21 | $1.48 B | -5.53% | ||

Beam (BEAM)

Beam (BEAM)

|

$0.02786574 | $1.48 B | -9.36% | ||

Gala (GALA)

Gala (GALA)

|

$0.04855000 | $1.47 B | -3.53% | ||

Flow (FLOW)

Flow (FLOW)

|

$0.96100000 | $1.44 B | 0.43% | ||

Aave (AAVE)

Aave (AAVE)

|

$92.88 | $1.37 B | -2.96% | ||

Bitcoin SV (BSV)

Bitcoin SV (BSV)

|

$69.34 | $1.37 B | -3.59% | ||

Quant (QNT)

Quant (QNT)

|

$109.40 | $1.32 B | 0.78% | ||

SingularityNET (AGIX)

SingularityNET (AGIX)

|

$1.00 | $1.28 B | -0.09% | ||

Neo (NEO)

Neo (NEO)

|

$18.12 | $1.28 B | -6.11% | ||

Ethena (ENA)

Ethena (ENA)

|

$0.90000000 | $1.28 B | -7.82% | ||

BitTorrent (New) (BTT)

BitTorrent (New) (BTT)

|

$0.00000128 | $1.24 B | -3.48% | ||

Flare (FLR)

Flare (FLR)

|

$0.03127636 | $1.21 B | -4.36% | ||

Akash Network (AKT)

Akash Network (AKT)

|

$4.94 | $1.16 B | -5.57% | ||

MultiversX (EGLD)

MultiversX (EGLD)

|

$42.59 | $1.14 B | -3.93% | ||

Huobi Token (HT)

Huobi Token (HT)

|

$0.58096400 | $92.45 M | 15.11% | ||

Axie Infinity (AXS)

Axie Infinity (AXS)

|

$7.73 | $1.11 B | 0.41% | ||

Chiliz (CHZ)

Chiliz (CHZ)

|

$0.12148000 | $1.08 B | 3.72% | ||

dYdX (Native) (DYDX)

dYdX (Native) (DYDX)

|

$2.29 | $1.06 B | -3.25% | ||

The Sandbox (SAND)

The Sandbox (SAND)

|

$0.47310000 | $1.06 B | -3.41% | ||

Ronin (RON)

Ronin (RON)

|

$3.30 | $1.04 B | -2.99% | ||

eCash (XEC)

eCash (XEC)

|

$0.00005262 | $1.03 B | -4.60% | ||

Wormhole (W)

Wormhole (W)

|

$0.55651956 | $1.00 B | -8.27% | ||

Tezos (XTZ)

Tezos (XTZ)

|

$1.02 | $999.49 M | -3.60% | ||

dYdX (DYDX)

dYdX (DYDX)

|

$2.29 | $708.71 M | -3.25% | ||

Worldcoin (WLD)

Worldcoin (WLD)

|

$5.10 | $989.04 M | -7.51% | ||

Conflux (CFX)

Conflux (CFX)

|

$0.24720000 | $971.37 M | -2.64% | ||

Mina (MINA)

Mina (MINA)

|

$0.88704855 | $968.70 M | -1.55% | ||

JasmyCoin (JASMY)

JasmyCoin (JASMY)

|

$0.01953200 | $960.63 M | -5.72% | ||

KuCoin Token (KCS)

KuCoin Token (KCS)

|

$9.96 | $957.32 M | 1.30% | ||

Synthetix (SNX)

Synthetix (SNX)

|

$2.92 | $956.55 M | -3.45% | ||

Pyth Network (PYTH)

Pyth Network (PYTH)

|

$0.63690000 | $947.02 M | -6.53% | ||

ORDI (ORDI)

ORDI (ORDI)

|

$44.86 | $942.05 M | -7.16% | ||

EOS (EOS)

EOS (EOS)

|

$0.83840000 | $938.32 M | -0.46% | ||

Starknet (STRK)

Starknet (STRK)

|

$1.26 | $914.77 M | -5.29% | ||

Decentraland (MANA)

Decentraland (MANA)

|

$0.47297480 | $902.59 M | -0.89% | ||

Gnosis (GNO)

Gnosis (GNO)

|

$346.80 | $901.88 M | -12.99% |

Try to search another coin

clc7 Bitcoin