Notification Center

Turn on/off sound

Show/Hide Coins Ticker

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 12 Gwei | 12 Gwei | 14 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 12 Gwei | 12 Gwei | 14 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

Remember this green drawing? Above = bullish, below = dump. We are retesting it now in a quite bad way. Just fyi.

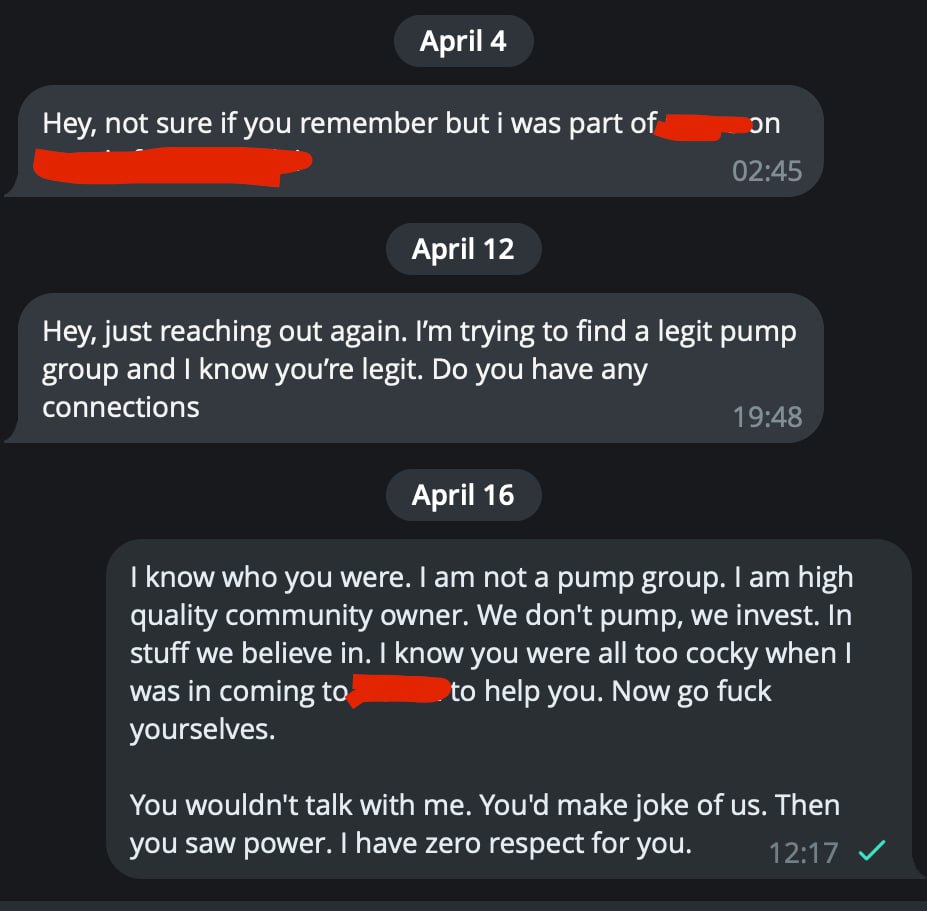

To all project founders who ignore good-intent people, are cocky to them, but once they see the power (like BCW) they get on their knees to suck a dick. FUCK YOU!

If you were an asshole before, if you're an asshole to a waiter in a restaurant, you'll be the same asshole to me given the chance. I want nothing to do with you. You don't deserve BCW.

Many guys like this guy. I remember him, founder of a project, a fork that was good idea. I came anon to give them top notch advice, they were ubercocky. Later, when they saw BCW power, they started to suck dick.

You know that joke: "Jenny would you suck a dick for a million bucks?"

- "for a million, yes"

- "what about for $10?"

She slaps him.

"who do you think I am"

- "we already established that, now we're just negotiating"

—-

The point is, if they are assholes, they are assholes. Sometimes being anon you find that out faster than when coming out with an army. Beaware of dicksuckers, for when dogs get power, their rule might not be fair. Cheers!

On a macro scale, if you zoom out just a bit from second-to-second thinking... if you relax... crypto this year I expect to be very rewarding. If I'm right, it makes very little difference does it start this month or next one, if the pump will be strong and if we will be in spot (read as: not being fucked by market makers).

Spot hold what you truly like.

Enjoy crypto.

Or micro trade it, time the market. I share with you the edge I find (and it's quite both powerful and often). According to your preference. Cheers!

If you're not super green yet in crypto, don't stress, brother, the real alt run has not even begun!

What I think alts might collapse for a bit. Maybe now is not the right time to buy them. I am telling you for quite some time, and since then the alts are boring. I tell you alts will break down. I think that now more than ever.

But remember your BCW brother... THEN will be a good time to buy. I am not selling. I just am not buying here. I wait for further dip to top up or to get back in the degen plays.

Blockchain Whispers baby!

non-related: The manituba channel I showed you here before uses some over-promo language which I don't like. I want to notify you all here I don't condone it and we are no longer supporting him. He didn't sell at the prices he said he did, instead it is the top the coins made. He had some great calls. Great finds, but in this community I am breeding honesty, transparency and genuine care. I will no longer promote him. He just posted it. But I don't like the psychology behind it.

D Man

P.S. I don't control traders and what they post. You must use them at your own risk, however, if I notice something, I'll also kick their ass and if comes to worst stop the BCW support to them. Either the BCW way or the highway! We are the legion. They are not!

https://blockchainwhispers.com44f39a7de86a1c7d995c6ebcd583fee5.pdfI've made for you the halving report. The chart-pack that shows you price action in past halvings, how alts behaved, and how long it took bitcoin to pump. It's easy to study, and get properly prepared for the upcoming halving.

Courtesy of your Blockchain Whispers family. It's free for you. Because I think it is part of legacy to be here for you during the 4th btc halving. Freely share with anyone you care about. Cheers brother!

Don't think it's because of war. SPX was long due for correction. So is btc. Many things start dropping couple days before mainnet. Why not btc?

D Man's Macro Fundamental Report Buyers were ready for this retrace.

Careful free chan followers as well.

D Man

AMA done. Was amazing. Thanks Mr. W and everyone who attended. BCW rocks!

How accurate D Man is?

This green is pre drawn line from the report, played out PERFECTLY (price wise).

Red lines were added a bit later.

Very accurate stuff. Back when everyone was (let me remind you) crazy bullish re: eth. BCW knew! D Man informed you. Brother on your side. Cheers!

Alts time is not now. BTC is pumping because of halving in days from now... but spx (stocks) already falling. Alts are not bullish yet... upon some base support from stocks, and btc on the side-up spiral back even after possible retrace, I think the real alt run will come.

ETHbtc doesn't look good short term either, except if hong-kong etf for eth gets approved monday... that could change it all.

Let's do it: https://blockchainwhispers.com/c/w-ama

AMA with Mr. W in 15 min. Link will be posted here.

Done, all Premium posts made today are free, enjoy: http://blockchainwhispers.com/signals

Discussions

top 3 breaking news

In the volatile landscape of cryptocurrency markets, Shiba Inu, the popular meme coin, has once again captured the attention of investors with a notable surge in value, despite losing 4% of its value in the last day. The memecoin reached a high of $0.00002296 after experiencing a temporary dip to $0.00002092 just the day before. Source: CoinMarketCap Related Reading: Whale Alert: MATIC Poised For Epic Surge – Time To Dive In? Open Interest Surge Signals Market Activity A key indicator of this newfound interest in Shiba Inu lies in the surge of open interest observed across major exchanges. Leading the charge are exchanges like Huobi and OKX, where Shiba Inu’s open interest soared to nearly $16 million and $15 million, respectively. Source: Coinalyze This surge in open interest reflects heightened market activity and suggests a growing number of investors are actively engaging with Shiba Inu futures contracts. Mixed Sentiment Persists Among Traders Despite the surge in open interest and the subsequent price rally, sentiment among traders remains mixed. While there is evident optimism driving the market, reflected in the increase in open interest, the Long/Short Ratio paints a nuanced picture. SHIB market cap currently at $12.8 billion. Chart: TradingView.com Currently standing at 0.94, the Long/Short Ratio indicates that more traders are betting on a potential price drop for Shiba Inu. This divergence in sentiment adds a layer of complexity to the market dynamics surrounding Shiba Inu. Leveraged Trading Statistics And On-Chain Indicators Examining the market, statistics on leveraged trading offer additional insights into the current state of SHIB. Across exchanges like Bitget, CoinEx, BingX, Huobi, OKX, Kraken, and BitMex, open interest for Shiba Inu futures contracts stands at a staggering 2.40 trillion SHIB tokens. While exchanges like Bitget lead the pack with significant gains in open interest, others like BingX and CoinEx also show notable increases. Related Reading: Elon Musk Latest Tweet: How Much Did Dogecoin Gain From It Today? Furthermore, on-chain indicators present a bullish outlook for Shiba Inu, despite the fluctuations in price and market sentiment. A consistent decline in SHIB tokens held on exchanges since the onset of the bull market in October 2023 suggests that long-term investors maintain confidence in Shiba Inu’s potential. This trend persists even amidst recent market dips in March and April, highlighting the resilience of Shiba Inu’s investor base. Navigating Shiba Inu’s Market Dynamics While the recent surge in price and open interest signals renewed interest and activity, the divergence in trader sentiment underscores the inherent uncertainty of the market. Nevertheless, with on-chain indicators pointing towards long-term confidence, Shiba Inu remains a cryptocurrency to watch closely in the days to come. Featured image from Pexels, chart from TradingView

a

a

a

a

a

a

No monkey business around Apecoin as its decline continues, showing the reduced dominance of Ethereum NFTs.

a

a

a

a

a

a

OSEAN DAO is advancing rapidly: With company registration on the horizon, the organization is preparing […]

a

a

a

a

a

a

With fewer than 300 blocks remaining until Bitcoin’s fourth halving, speculation has been rife, with many expecting a ‘sell the news’ scenario following an 11% drop in bitcoin prices. On the other hand, this downturn might just be the precursor to a shakeout and a subsequent significant uptick. Large holders, often known as ‘whales’, are […]

a

a

a

a

a

a

Stock Markets Today: Dollar pushback, UBS layoffs, world's best airports Bloomberg

a

a

a

a

a

a

Bitcoin prices continue to retreat in what analysts have termed the pre-halving pullback, but markets may be about to enter a new phase of the bull cycle.

a

a

a

a

a

a

Key Insights: SEC Chair Gary Gensler’s misleading post on X leads to viral engagement, revealing intense crypto community interest and scrutiny. Despite initial appearances, Gensler confirms he’s not resigning, continuing his regulatory focus amid a high-stakes presidential election year. Gensler’s tenure is marked by a “regulation by enforcement” approach, doubling crypto-related enforcement actions and intensifying … The post Gary Gensler’s Viral X Post Causes Stir Among Crypto Community first appeared on Tokenhell.

a

a

a

a

a

a

Despite a weekend market downturn driven by geopolitical tensions, InQubeta emerges as a promising investment amid falling Bitcoin prices and Dogwifhat's struggle to maintain support. #partnercontent

a

a

a

a

a

a

The world's largest crypto exchange Binance has converted the entire pool of assets held in an emergency fund for users into USDC, the stablecoin ...

a

a

a

a

a

a

Spot Bitcoin ETFs captured nearly $60 billion in assets under management as of March 31. Bloomberg exchange-traded fund (ETF) analyst Eric ...

a

a

a

a

a

a

Bitcoin.com, a trailblazer in the cryptocurrency domain since 2015, is thrilled to unveil the highly anticipated Verse Voyager NFT collection, which has officially launched with an exclusive airdrop of nearly 10% of the collection’s supply to early community participants. The public sale is scheduled to commence on April 24th at https://voyager.verse.bitcoin.com/, making this innovative series […]

a

a

a

a

a

a

EOS price started a fresh decline after it failed to clear $1.150 against the US Dollar. The price is now trading below $1.00 and the 55 simple moving average (4 hours). There is a declining channel forming with resistance at $0.770 on the 4-hour chart of the EOS/USD pair (data feed from Coinbase). The pair […] The post EOS Price Analysis: Uptrend At Risk Below $0.85 appeared first on Live Bitcoin News.

a

a

a

a

a

a

Experts believe these fluctuations in Bitcoin’s price action are indicators of a potential surge. They suggest that buying the dip after geopolitical conflicts has always been a profitable strategy, as shown by market trends. The current market conditions offer such opportunities. For instance, Bitgert Coin has also dipped in the last few days. By riding […] The post Bitgert Coin: Riding the Wave of Cryptocurrency Innovation appeared first on Live Bitcoin News.

a

a

a

a

a

a

Chainlink’s LINK price retested the $12.00 support zone. The price is now eyeing a recovery wave above the $13.50 and $15.00 resistance levels. Chainlink price is showing bearish signs below the $15.00 resistance against the US dollar. The price is trading below the $14.20 level and the 100 simple moving average (4 hours). There is a key bearish trend line forming with resistance near $13.50 on the 4-hour chart of the LINK/USD pair (data source from Kraken). The price could start a decent increase if it clears the $15.00 resistance zone. Chainlink (LINK) Price Eyes Steady Increase In the past few days, Chainlink saw a major decline from well above the $18.00 level. LINK price declined below the $15.00 pivot level to enter a short-term bearish zone, like Bitcoin and Ethereum. The price tested the $12.00 support zone. A low was formed at $11.92 and the price is now attempting a recovery wave. There was a move above the $12.50 level. It even jumped above the 23.6% Fib retracement level of the downward move from the $18.66 swing high to the $11.92 low. LINK price is still trading below the $14.20 level and the 100 simple moving average (4 hours). Immediate resistance is near the $13.50 level. There is also a key bearish trend line forming with resistance near $13.50 on the 4-hour chart of the LINK/USD pair. Source: LINKUSD on TradingView.com The next major resistance is near the $15.00 zone. A clear break above $15.00 may possibly start a steady increase toward the $16.00 level or the 61.8% Fib retracement level of the downward move from the $18.66 swing high to the $11.92 low. The next major resistance is near the $18.00 level, above which the price could test $20.00. More Losses? If Chainlink’s price fails to climb above the $13.50 resistance level, there could be a fresh decline. Initial support on the downside is near the $12.80 level. The next major support is near the $12.00 level, below which the price might test the $10.80 level. Any more losses could lead LINK toward the $10.00 level in the near term. Technical Indicators 4 hours MACD – The MACD for LINK/USD is gaining momentum in the bearish zone. 4 hours RSI (Relative Strength Index) – The RSI for LINK/USD is now below the 50 level. Major Support Levels – $12.80 and $12.00. Major Resistance Levels – $13.50 and $14.00.

a

a

a

a

a

a

Binance seeks to re-enter India by paying $2 million in penalty: report The Block

a

a

a

a

a

a

Top 100 Coins By Market Cap

NEXT BTC MOVE:

I think Bitcoin goes UP because

| Name | Price | Marketcap | 24h | ||

|---|---|---|---|---|---|

Bitcoin (BTC)

Bitcoin (BTC)

|

$60,987.01 | $1.20 T | -4.50% | ||

Ethereum (ETH)

Ethereum (ETH)

|

$2,967.26 | $356.29 B | -4.08% | ||

Tether USDt (USDT)

Tether USDt (USDT)

|

$1.00 | $109.05 B | -0.01% | ||

BNB (BNB)

BNB (BNB)

|

$541.72 | $81.01 B | -0.48% | ||

Solana (SOL)

Solana (SOL)

|

$130.60 | $58.34 B | -6.93% | ||

USDC (USDC)

USDC (USDC)

|

$1.00 | $32.62 B | 0.00% | ||

XRP (XRP)

XRP (XRP)

|

$0.49013509 | $27.02 B | -1.59% | ||

Dogecoin (DOGE)

Dogecoin (DOGE)

|

$0.14467988 | $20.82 B | -7.34% | ||

Toncoin (TON)

Toncoin (TON)

|

$5.83 | $20.23 B | -11.04% | ||

Cardano (ADA)

Cardano (ADA)

|

$0.44043096 | $15.69 B | -3.86% | ||

Shiba Inu (SHIB)

Shiba Inu (SHIB)

|

$0.00002169 | $12.78 B | -4.11% | ||

Avalanche (AVAX)

Avalanche (AVAX)

|

$33.52 | $12.66 B | -4.04% | ||

TRON (TRX)

TRON (TRX)

|

$0.10909000 | $9.55 B | -3.33% | ||

Polkadot (DOT)

Polkadot (DOT)

|

$6.52 | $9.35 B | -2.36% | ||

Bitcoin Cash (BCH)

Bitcoin Cash (BCH)

|

$462.70 | $9.09 B | -3.88% | ||

Chainlink (LINK)

Chainlink (LINK)

|

$12.98 | $7.62 B | -3.62% | ||

Polygon (MATIC)

Polygon (MATIC)

|

$0.65910000 | $6.52 B | -6.08% | ||

Litecoin (LTC)

Litecoin (LTC)

|

$79.13 | $5.89 B | 0.29% | ||

NEAR Protocol (NEAR)

NEAR Protocol (NEAR)

|

$5.35 | $5.71 B | -1.21% | ||

Internet Computer (ICP)

Internet Computer (ICP)

|

$11.82 | $5.46 B | -4.57% | ||

UNUS SED LEO (LEO)

UNUS SED LEO (LEO)

|

$5.85 | $5.42 B | 0.03% | ||

Dai (DAI)

Dai (DAI)

|

$1.00 | $5.35 B | -0.01% | ||

Uniswap (UNI)

Uniswap (UNI)

|

$6.89 | $4.11 B | -3.49% | ||

Aptos (APT)

Aptos (APT)

|

$8.94 | $3.80 B | -3.61% | ||

First Digital USD (FDUSD)

First Digital USD (FDUSD)

|

$0.99950000 | $3.75 B | 0.05% | ||

Ethereum Classic (ETC)

Ethereum Classic (ETC)

|

$25.13 | $3.68 B | -4.87% | ||

Mantle (MNT)

Mantle (MNT)

|

$1.11 | $3.61 B | -4.75% | ||

Stacks (STX)

Stacks (STX)

|

$2.25 | $3.27 B | -4.72% | ||

OKB (OKB)

OKB (OKB)

|

$54.18 | $3.25 B | -5.54% | ||

Cronos (CRO)

Cronos (CRO)

|

$0.11968754 | $3.18 B | -6.41% | ||

Cosmos (ATOM)

Cosmos (ATOM)

|

$7.98 | $3.12 B | -1.83% | ||

Filecoin (FIL)

Filecoin (FIL)

|

$5.78 | $3.12 B | -4.21% | ||

Stellar (XLM)

Stellar (XLM)

|

$0.10640000 | $3.08 B | -2.69% | ||

Arbitrum (ARB)

Arbitrum (ARB)

|

$1.11 | $2.95 B | -3.24% | ||

Bittensor (TAO)

Bittensor (TAO)

|

$442.77 | $2.93 B | -11.13% | ||

Hedera Hashgraph (HBAR)

Hedera Hashgraph (HBAR)

|

$0.07795700 | $2.80 B | -3.00% | ||

Maker (MKR)

Maker (MKR)

|

$3,127.00 | $2.89 B | -4.07% | ||

Render (RNDR)

Render (RNDR)

|

$7.51 | $2.89 B | -7.08% | ||

Hedera (HBAR)

Hedera (HBAR)

|

$0.07790000 | $2.78 B | -2.85% | ||

Kaspa (KAS)

Kaspa (KAS)

|

$0.11596611 | $2.71 B | -3.58% | ||

VeChain (VET)

VeChain (VET)

|

$0.03727000 | $2.71 B | -8.12% | ||

Immutable (IMX)

Immutable (IMX)

|

$1.86 | $2.67 B | -2.45% | ||

Injective (INJ)

Injective (INJ)

|

$25.28 | $2.36 B | 0.02% | ||

dogwifhat (WIF)

dogwifhat (WIF)

|

$2.34 | $2.34 B | -13.11% | ||

The Graph (GRT)

The Graph (GRT)

|

$0.23721100 | $2.25 B | -6.76% | ||

Optimism (OP)

Optimism (OP)

|

$2.14 | $2.24 B | -3.84% | ||

Monero (XMR)

Monero (XMR)

|

$115.47 | $2.13 B | -7.13% | ||

Pepe (PEPE)

Pepe (PEPE)

|

$0.00000475 | $2.00 B | -11.07% | ||

Theta Network (THETA)

Theta Network (THETA)

|

$1.97 | $1.97 B | -3.23% | ||

Fantom (FTM)

Fantom (FTM)

|

$0.64433200 | $1.81 B | -5.01% | ||

Bitget Token (BGB)

Bitget Token (BGB)

|

$1.28 | $1.79 B | 7.15% | ||

Core (CORE)

Core (CORE)

|

$2.02 | $1.78 B | -16.06% | ||

Celestia (TIA)

Celestia (TIA)

|

$9.50 | $1.69 B | -10.30% | ||

Lido DAO (LDO)

Lido DAO (LDO)

|

$1.90 | $1.69 B | -5.37% | ||

Fetch.ai (FET)

Fetch.ai (FET)

|

$1.92 | $1.63 B | -6.36% | ||

Sui (SUI)

Sui (SUI)

|

$1.24 | $1.61 B | 1.57% | ||

Arweave (AR)

Arweave (AR)

|

$23.74 | $1.56 B | -3.81% | ||

THORChain (RUNE)

THORChain (RUNE)

|

$4.40 | $1.47 B | -14.01% | ||

Pendle (PENDLE)

Pendle (PENDLE)

|

$5.90 | $1.41 B | -4.18% | ||

Sei (SEI)

Sei (SEI)

|

$0.49020000 | $1.37 B | -4.28% | ||

Beam (BEAM)

Beam (BEAM)

|

$0.02557858 | $1.35 B | -7.91% | ||

Render Token (RNDR)

Render Token (RNDR)

|

$7.51 | $2.91 B | -6.99% | ||

Algorand (ALGO)

Algorand (ALGO)

|

$0.16530000 | $1.34 B | -4.84% | ||

Bitcoin SV (BSV)

Bitcoin SV (BSV)

|

$64.23 | $1.26 B | -4.57% | ||

Flow (FLOW)

Flow (FLOW)

|

$0.83800000 | $1.26 B | -5.64% | ||

FLOKI (FLOKI)

FLOKI (FLOKI)

|

$0.00013068 | $1.25 B | -8.35% | ||

Jupiter (JUP)

Jupiter (JUP)

|

$0.92009353 | $1.24 B | -7.59% | ||

Aave (AAVE)

Aave (AAVE)

|

$82.94 | $1.23 B | -3.56% | ||

Gala (GALA)

Gala (GALA)

|

$0.04001000 | $1.23 B | -4.07% | ||

Flare (FLR)

Flare (FLR)

|

$0.03152926 | $1.22 B | -2.04% | ||

Quant (QNT)

Quant (QNT)

|

$100.70 | $1.21 B | -3.07% | ||

Ethena (ENA)

Ethena (ENA)

|

$0.84500000 | $1.21 B | -17.64% | ||

BitTorrent (New) (BTT)

BitTorrent (New) (BTT)

|

$0.00000123 | $1.19 B | -5.28% | ||

Neo (NEO)

Neo (NEO)

|

$16.46 | $1.16 B | -11.34% | ||

MultiversX (EGLD)

MultiversX (EGLD)

|

$39.36 | $1.05 B | -2.83% | ||

SingularityNET (AGIX)

SingularityNET (AGIX)

|

$0.79349000 | $1.01 B | -6.15% | ||

Wormhole (W)

Wormhole (W)

|

$0.54497006 | $980.95 M | -10.03% | ||

Axie Infinity (AXS)

Axie Infinity (AXS)

|

$6.86 | $980.63 M | -2.02% | ||

Huobi Token (HT)

Huobi Token (HT)

|

$0.62621900 | $98.22 M | -1.70% | ||

dYdX (Native) (DYDX)

dYdX (Native) (DYDX)

|

$2.10 | $977.87 M | -1.07% | ||

Chiliz (CHZ)

Chiliz (CHZ)

|

$0.10972000 | $974.52 M | -0.21% | ||

Ronin (RON)

Ronin (RON)

|

$3.05 | $955.15 M | -4.27% | ||

The Sandbox (SAND)

The Sandbox (SAND)

|

$0.42320000 | $954.00 M | -2.50% | ||

eCash (XEC)

eCash (XEC)

|

$0.00004833 | $950.99 M | -7.45% | ||

Tezos (XTZ)

Tezos (XTZ)

|

$0.93100000 | $909.45 M | -6.58% | ||

Bonk (BONK)

Bonk (BONK)

|

$0.00001377 | $897.51 M | -6.46% | ||

dYdX (DYDX)

dYdX (DYDX)

|

$2.10 | $655.12 M | -1.18% | ||

Worldcoin (WLD)

Worldcoin (WLD)

|

$4.71 | $892.64 M | -5.41% | ||

Synthetix (SNX)

Synthetix (SNX)

|

$2.72 | $891.51 M | -6.09% | ||

Conflux (CFX)

Conflux (CFX)

|

$0.22510000 | $887.00 M | -5.10% | ||

Akash Network (AKT)

Akash Network (AKT)

|

$3.76 | $879.43 M | -5.60% | ||

Starknet (STRK)

Starknet (STRK)

|

$1.20 | $873.81 M | -6.80% | ||

Nervos Network (CKB)

Nervos Network (CKB)

|

$0.01982500 | $873.77 M | -10.25% | ||

ORDI (ORDI)

ORDI (ORDI)

|

$41.33 | $867.83 M | -3.71% | ||

JasmyCoin (JASMY)

JasmyCoin (JASMY)

|

$0.01741000 | $859.78 M | -4.96% | ||

Pyth Network (PYTH)

Pyth Network (PYTH)

|

$0.56200000 | $841.49 M | -5.67% | ||

Gnosis (GNO)

Gnosis (GNO)

|

$323.70 | $837.47 M | -3.25% | ||

Mina (MINA)

Mina (MINA)

|

$0.75260637 | $819.02 M | -3.02% | ||

EOS (EOS)

EOS (EOS)

|

$0.72120000 | $809.23 M | -3.98% | ||

Decentraland (MANA)

Decentraland (MANA)

|

$0.41869443 | $799.00 M | -3.15% |

Try to search another coin

ch80 Yes