Notification Center

Turn on/off sound

Show/Hide Coins Ticker

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 10 Gwei | 10 Gwei | 13 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 10 Gwei | 10 Gwei | 13 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

Remember this green drawing? Above = bullish, below = dump. We are retesting it now in a quite bad way. Just fyi.

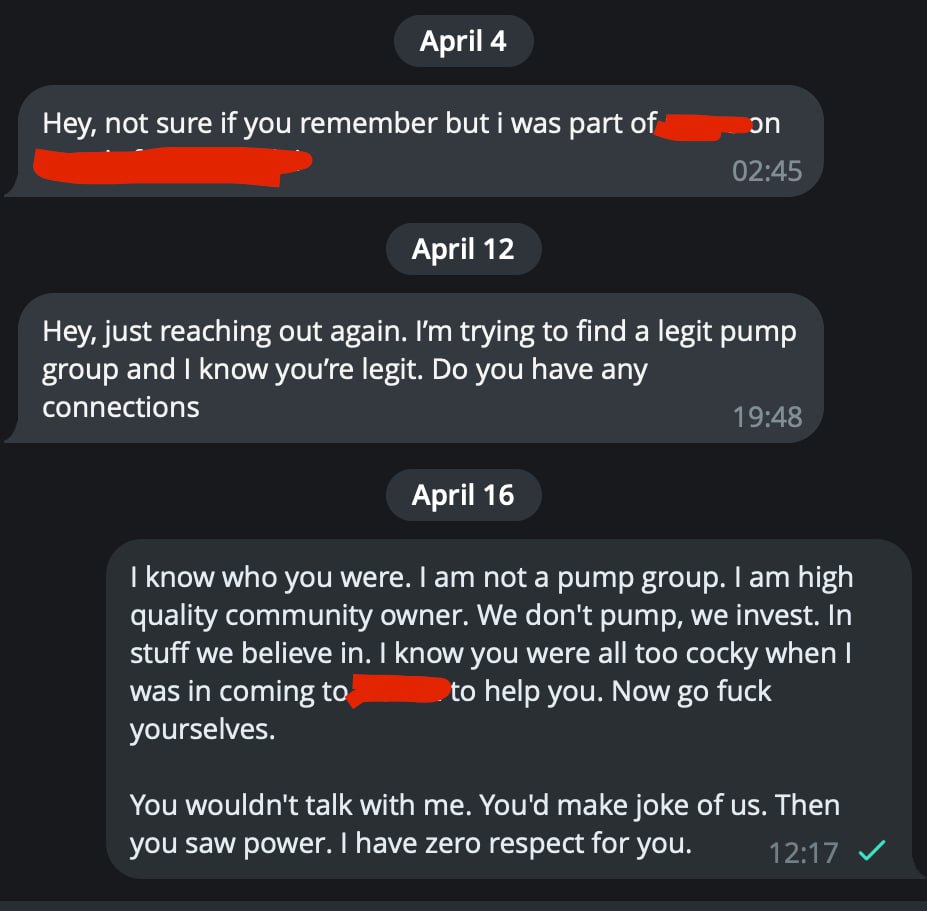

To all project founders who ignore good-intent people, are cocky to them, but once they see the power (like BCW) they get on their knees to suck a dick. FUCK YOU!

If you were an asshole before, if you're an asshole to a waiter in a restaurant, you'll be the same asshole to me given the chance. I want nothing to do with you. You don't deserve BCW.

Many guys like this guy. I remember him, founder of a project, a fork that was good idea. I came anon to give them top notch advice, they were ubercocky. Later, when they saw BCW power, they started to suck dick.

You know that joke: "Jenny would you suck a dick for a million bucks?"

- "for a million, yes"

- "what about for $10?"

She slaps him.

"who do you think I am"

- "we already established that, now we're just negotiating"

—-

The point is, if they are assholes, they are assholes. Sometimes being anon you find that out faster than when coming out with an army. Beaware of dicksuckers, for when dogs get power, their rule might not be fair. Cheers!

On a macro scale, if you zoom out just a bit from second-to-second thinking... if you relax... crypto this year I expect to be very rewarding. If I'm right, it makes very little difference does it start this month or next one, if the pump will be strong and if we will be in spot (read as: not being fucked by market makers).

Spot hold what you truly like.

Enjoy crypto.

Or micro trade it, time the market. I share with you the edge I find (and it's quite both powerful and often). According to your preference. Cheers!

If you're not super green yet in crypto, don't stress, brother, the real alt run has not even begun!

What I think alts might collapse for a bit. Maybe now is not the right time to buy them. I am telling you for quite some time, and since then the alts are boring. I tell you alts will break down. I think that now more than ever.

But remember your BCW brother... THEN will be a good time to buy. I am not selling. I just am not buying here. I wait for further dip to top up or to get back in the degen plays.

Blockchain Whispers baby!

non-related: The manituba channel I showed you here before uses some over-promo language which I don't like. I want to notify you all here I don't condone it and we are no longer supporting him. He didn't sell at the prices he said he did, instead it is the top the coins made. He had some great calls. Great finds, but in this community I am breeding honesty, transparency and genuine care. I will no longer promote him. He just posted it. But I don't like the psychology behind it.

D Man

P.S. I don't control traders and what they post. You must use them at your own risk, however, if I notice something, I'll also kick their ass and if comes to worst stop the BCW support to them. Either the BCW way or the highway! We are the legion. They are not!

https://blockchainwhispers.com44f39a7de86a1c7d995c6ebcd583fee5.pdfI've made for you the halving report. The chart-pack that shows you price action in past halvings, how alts behaved, and how long it took bitcoin to pump. It's easy to study, and get properly prepared for the upcoming halving.

Courtesy of your Blockchain Whispers family. It's free for you. Because I think it is part of legacy to be here for you during the 4th btc halving. Freely share with anyone you care about. Cheers brother!

Don't think it's because of war. SPX was long due for correction. So is btc. Many things start dropping couple days before mainnet. Why not btc?

D Man's Macro Fundamental Report Buyers were ready for this retrace.

Careful free chan followers as well.

D Man

AMA done. Was amazing. Thanks Mr. W and everyone who attended. BCW rocks!

How accurate D Man is?

This green is pre drawn line from the report, played out PERFECTLY (price wise).

Red lines were added a bit later.

Very accurate stuff. Back when everyone was (let me remind you) crazy bullish re: eth. BCW knew! D Man informed you. Brother on your side. Cheers!

Alts time is not now. BTC is pumping because of halving in days from now... but spx (stocks) already falling. Alts are not bullish yet... upon some base support from stocks, and btc on the side-up spiral back even after possible retrace, I think the real alt run will come.

ETHbtc doesn't look good short term either, except if hong-kong etf for eth gets approved monday... that could change it all.

Let's do it: https://blockchainwhispers.com/c/w-ama

AMA with Mr. W in 15 min. Link will be posted here.

Done, all Premium posts made today are free, enjoy: http://blockchainwhispers.com/signals

Discussions

top 3 breaking news

In the throes of an inflationary tide, the Federal Reserve faces an enduring challenge, grappling with inflation rates that stubbornly refuse to bow to conventional monetary controls. As the latest data from the Bureau of Labor Statistics reveals, price surges across key sectors — most notably, motor vehicle insurance, repairs, and healthcare services — signal a relentless inflationary pressure. This persistence underscores a sobering reality: the Fed’s toolkit, primarily the adjustment of interest rates, appears insufficient in the current economic milieu to rein in the rising costs that affect everyday Americans.The year 2024, an election year, adds a complex layer to the already tumultuous economic narrative. Traditionally, such years see a stimulation of the economy, often through fiscal injections that aim to invigorate consumer spending and bolster short-term growth. In an almost ritualistic fashion, this stimulus often manifests as direct financial support to the populace — a strategy that, while providing immediate relief, can inadvertently channel excess liquidity into investment assets, inflating their value.As we approach the threshold of 2025, it’s becoming increasingly clear that one asset, in particular, is poised to capture a significant portion of this redirected capital: Bitcoin. The cryptocurrency, often lauded for its deflationary design and finite supply, stands in stark contrast to the US Dollar, which, as evidenced by the ongoing inflation across various sectors, seems to be depreciating in purchasing power with each passing year. This is especially poignant considering that wages have not kept pace with inflation, intensifying the struggle for the average person to afford basic commodities.Amid this financial landscape, Bitcoin emerges not only as a speculative investment but also as a saving technology, a digital haven where value can be preserved and shielded from the erosive effects of inflation. It is this distinctive attribute that has garnered the attention and favor of a growing number of global investors. Bitcoin, a global asset recognized and respected across borders, is rapidly becoming the preferred vehicle for safeguarding wealth. Its intrinsic qualities — decentralization, scarcity, and portability — make it an alluring alternative to traditional assets tied to the performance of national economies.The inflation figures glaringly indicate that the cost of living is on an upswing, with expenditures like rent and healthcare carving larger portions from household budgets. As the dollar’s purchasing power dwindles, the investment lens turns towards assets that can potentially offset this decline. Bitcoin, with its capped supply of 21 million coins, offers a narrative of scarcity that traditional fiat currencies — subject to policy-driven expansion — cannot match.As we find ourselves navigating through a time of economic uncertainty, Bitcoin’s ascent reflects a paradigm shift in asset valuation. It epitomizes a burgeoning recognition of digital assets’ potential in a world where traditional monetary policies are meeting their limits. As the economy treads into 2025, Bitcoin’s role is not just as a disruptor, but as a herald of a new financial era where asset preservation becomes accessible beyond the fluctuating fortunes of any single nation’s currency.Where Are Prices Still Rising chart below shows the 12-month percentage change from March 2023 to March 2024. Here is the data:Motor vehicle insurance: +22.2%Motor vehicle repair: +11.6%Hospital services: +7.5%Rent: +5.7%Electricity: +5.0%Housing: +4.7%Food away from home: +4.2%Transportation: +4.0%All items: +3.5%Education: +2.4%Food and beverages: +2.2%Energy: +2.1%Gasoline (all types): +1.3%Food at home: +1.2%New vehicles: -0.1%Used cars and trucks: -2.2%College textbooks: -4.8%Televisions: -6.9%Airline fares: -7.1%Toys: -8.2%Car and truck rental: -8.8%Smartphones: -9.0%Inflation Persists: The Fed’s Rate Dilemma and Bitcoin’s Emerging Dominance was originally published in The Dark Side on Medium, where people are continuing the conversation by highlighting and responding to this story.

a

a

a

a

a

a

The internet is covered in blood this weekend as the crypto charts turn red, everyone is talking about the war in Israel, Alex Pereira…Continue reading on The Dark Side »

a

a

a

a

a

a

Exploring Ethereum’s Layer 2 Solutions: How Layer 2 solutions are slashing Gas Fees and Fueling EfficiencyLayer 2 Scaling Solutions (Definition + 4 Examples) — WhiteboardCryptoAre you sick and tired of paying exorbitant gas fees when using Ethereum? Well, these L2 scaling solutions may be the key to circumventing these issues. Creating a scalable, cost-efficient, and decentralized means of using Ethereum.The Backbone of Ethereum’s Layer 2 SolutionsThe congestion and high costs associated with Ethereum’s network have led to the development of layer 2 solutions, each designed to tackle these challenges head-on. These include rollups, state channels, plasma, sidechains, and validium, each with its unique approach to improving Ethereum’s network performance.Rollups: A Game-Changer in Transaction EfficiencyRollups have emerged as a pivotal layer 2 solution, processing transactions outside the main Ethereum chain and posting transaction data back to it. They come in two flavors:Optimistic Rollups: Operating on the principle of assumed validity, these rollups only verify transactions when challenged. Notable examples include Optimism and Arbitrum.Zero-Knowledge Rollups (ZK-Rollups): These rollups take hundreds of transactions off-chain, produce a cryptographic proof (zero-knowledge proof), and post this proof alongside the transaction data to the main chain, exemplified by zkSync and Loopring.Please note that Zk Rollups consist of Zk-Snark and ZK-Stark, however, for simplicity purposes, I will only be discussing Zk-rollups as a whole.Simple Explanation: RollupsRollup: multiple transactions ROLLED into one transaction.Example:Imagine Ethereum is a busy motorway with a toll booth, the cars on the motorway are the transactions. During peak hours, the motorway becomes congested, leading to delays and higher toll fees (gas fees). To alleviate congestion, two new lanes are introduced: zk-rollups and optimistic rollups. These two new lanes allow cars to group into buses (bundled transactions), which means instead of having individual toll fees for each car, you now just have one toll fee for the whole bus (which consists of individual cars).The toll booth only needs to process fewer transactions (buses) instead of individual cars. The rollups increase the scalability of the highway and reduce the costs (transaction fees).Simple Explanation: Zk-RollupsZk rollups: combine a bunch of things into one rolled-up thing, HOWEVER, they do not use smart contracts.Layer 2 Scaling Solutions (Definition + 4 Examples) — WhiteboardCryptoZk-Rollups (zero knowledge rollups): take all transactions off-chain combine them into a single transaction, and then generate a cryptographic proof known as zero-knowledge proof. The cryptographic proof + data about transactions is submitted to the Ethereum blockchain. The zero-knowledge proof attests that all transactions in the bundle are valid without revealing specific details about them.Essentially, you are bundling transactions into one single transaction and then generating a cryptographic proof called a ZKP which is submitted to the Ethereum blockchain and attests all bundled transactions are valid without actually revealing details about the transaction.Example:- Send secret message to a friend in a locked box- You send the key to open the box via a secure courier- Your friend receives the box and the key but doesn’t know the courier’s identity or how the key was sentSimilarly, zk-Rollups ensure transaction validity without revealing transaction contents through zero-knowledge proofsOptimistic RollupsOptimistic rollups: optimistic rollups have their own optimistic virtual machine, which allows them to do stuff with smart contracts HOWEVER they are slower and less efficient.Layer 2 Scaling Solutions (Definition + 4 Examples) — WhiteboardCryptoOptimistic rollups assume all transactions bundled together and submitted to the Ethereum blockchain are valid by default, however, there is a challenge period during which these transactions can be disputed if someone believes a transaction is fraudulent. If a transaction is fraudulent, it is rolled back (transaction reversed/unsent). i.e. optimistic rollups are OPTIMISTIC about all transactions being valid.Here’s a step-by-step process of how optimistic rollups occur:1) Submission: transactions bundled together and submitted to the Ethereum blockchain as a single batch via the optimistic roll-up system. The optimistic rollup system assumes these transactions are valid, without performing validation checks.2) Challenge period: after submission, there is a designated waiting period (challenge period) where anyone can challenge and question the validity of the transactions in the batch. If someone detects a fraudulent or incorrect transaction, they can submit a challenge against it3) Challenge process: if the challenge is valid, and proves that a transaction within the batch was invalid, the specific transaction is targeted for reversal4) Rollback: reverse specific transactions, not all the bundled transactions. The blockchain ledger is updated to reflect the state before the invalid transaction was executed. For example: if the transaction involved transferring 10ETH from Alice to Bob, rolling back the transaction would restore the 10 ETH to Alice’s account as if the transfer to Bob never happened5) Impact on the Batch: the rest of the transactions in the batch, if they are not challenged would remain valid and processed.Zk-Rollups vs Optimistic RollupsSimilaritiesBoth layer 2 scaling solutions aim to improve transaction throughput and reduce transaction feesBoth bundle multiple transactions into a batchBoth maintain the security and integrity of transactions while operating outside the main layer 1 blockchain.DifferencesComputational complexity:Zk-Rollups: require significant computational power to generate zero-knowledge proofs which are complex and resource-intensive. Example: completing a highly detailed and complex jigsaw puzzle that requires specific techniques and tools. The process is intricate and requires time and resources, akin to generating zero-knowledge proofs.Optimistic Rollups: less computationally demanding as they don’t require the generation of complex proofs. Example: write a book draft and ask for feedback later.Use CasesZk-Rollups: ideal for high-throughput applications like payments and simple contract executions, where speed and privacy are crucial. Example: high-speed train system (zk-Rollups) efficiently move a large number of passengers (transactions) quickly and on schedule, ideal for daily commutesOptimistic rollups: better suited for complex smart contracts due to their compatibility with Ethereum’s EVM, allowing for more flexible application development. Example: a cargo ship (optimistic rollup) can carry various types of goods (complex smart contracts) and adapt to different cargo needs, but it may not be as fast as the high-speed train.Validation MechanismZk-Rollups: validate transactions within the batch using cryptographic proofs (zero-knowledge proofs) before posting to the blockchain. This means the validity of each transaction is proven without revealing its contents. Example: a game where you prove you solved a puzzle without showing the solution. You provide a seal (the zero-knowledge proof) that only someone who solved the puzzle could create. Others accept you’ve solved the puzzle based on the seal’s authenticity, without needing to see the solved puzzle.Optimistic rollups: assume transactions are valid by default and post them without comprehensive validation. A challenge period allows users to dispute transactions if they believe they are invalid/fraudulent. Example: leaving a suggestion box in the community center. Everyone’s welcome to drop in their suggestions (transactions) without checking them first, however, there’s a weekly review where anyone can challenge the suggestions. If the challenged suggestion is found to be against the rules, it’s removed.State Channels: Direct, Efficient, and PrivateLayer 2 Scaling Solutions (Definition + 4 Examples) — WhiteboardCryptoState channels enable participants to conduct transactions in a private channel, significantly reducing the load on the main Ethereum blockchain. This is especially useful for scenarios requiring numerous transactions between a fixed set of participants, with Raiden Network and Connext leading the charge.Simplified Explanation: State ChannelsState channels allow participants to interact in a private channel, allowing participants to conduct numerous transactions amongst themselves within this private channel, without posting all of these transactions to the blockchain immediately. This speeds up transactions and reduces costs, as transactions do not occur on the main blockchain. Once participants are done transacting, the final state is settled on the blockchain.They are essentially private channels for participants to send and receive transactions that do not occur on the main blockchain. Once transactions have finished, the final state of transactions is settled on the blockchain.How it works:1) Open channel: participants deposit a certain amount of crypto e.g. ETH into a smart contract on the blockchain, opening a state channel. This initial deposit establishes the rules for the interaction within the channel2) Transacting off-chain: after the channel is open, participants can freely and instantly exchange numerous transactions amongst themselves, these transactions are not recorded on the blockchain but are signed by the parties involved, ensuring they are secure and verifiable3) Closing the channel: when participants decide to conclude their business, the final state of their transactions, who owns what after all exchanges is submitted to the blockchain. The smart contract then distributes these funds according to this final state.4) Dispute resolution: if there is disagreement about the final state of transactions when trying to close the channel, the smart contract as an arbitrator (judge), and uses the history of the signed transactions to determine the correct distribution of fundsExample: Pay-per-minute streaming serviceA pay-per-minute video streaming service, where you pay for each minute of video content you watch.You and the streaming service open a state channel by depositing ETH into a smart contract on the blockchain. The deposit is the maximum amount you are willing to pay to watchInstead of sending a transaction to the blockchain for every minute watched, you and the streaming service provider keep track of the minutes off-chain.After your binge-watching session, the final tally of minutes watched is agreed upon e.g. watched 90 minutes, you owe 0.1ETH. The final state is submitted to the blockchain, and the smart contract redistributes the deposited funds accordingly- paying the service for the content watched, and returning the remaining amount of the deposit to you.If there is a disagreement on the final number of minutes watched, the smart contract can use off-chain transaction history (Signed messages) to determine the correct amount.Plasma: Creating a Lattice of Child BlockchainsPlasma’s approach involves creating child blockchains anchored to the main Ethereum blockchain, facilitating independent transactions that only interact with the main chain for security purposes, a technique employed by Polygon.Plasma: Simplified ExplanationPlasma creates child chains that are anchored to the main Ethereum blockchain, allowing for off-chain transaction processing in a way that can dramatically reduce the burden on the main chain.By child chains, we mean secondary blockchains anchored to the main layer 1 blockchain.How it works:Create child chains (secondary chains) that operate off the main Ethereum blockchain, these child chains have their own rules and operate independentlyTransactions occur on these child chains, and periodically the child chains’ transactions and recordings are posted to the main Ethereum chainUsers can withdraw their assets from the child chain to the main Ethereum chain by submitting a withdrawal request. If there are disputes or fraud detected on the child chain, users can submit fraud proofs to the main chain to challenge the dishonesty, ensuring assets are protected by the security mechanisms of the main Ethereum blockchainExample: The Arcade Token SystemAn arcade where each game machine accepts special arcade tokens. The arcade is popular, and to manage the demand, the owner decides to issue sub-tokens for different sections of the arcade, with each section representing a child chain.Each section of the arcade (e.g. racing games, shooting games, classic games) has its sub-tokens, similar to creating child chains off the main Ethereum blockchain. Players can exchange the main arcade tokens for these specific sub-tokens for each section.The game plays are quick and efficient because there handled within the section as individuals do not need to go to the main token desk every time, to exchange their tokens for subtokens. Instead, they already have subtokens available in each section. The subtokens being issued at individual sections reducing the amount of load on the main desk issuing tokens, is akin to plasma child chains handling transactions, off the main chain.At the end of the day, the arcade owner counts the sub-tokens from each section and records this in the main ledger, similar to how the state of the child chain is periodically committed to the Ethereum main chain. This ensures all sub-token transactions are ultimately accounted for under the main arcade token system.If a player wants to leave the arcade, they exchange their sub tokens back to the main arcade tokens (withdrawal back to the main Ethereum chain). If there is a dispute (a machine not awarding the correct amount of sub-tokens), players can bring it up with the management (submitting a fraud-proof), to ensure fairness, secured by the overarching governance of the arcade (the Ethereum main chain).Sidechains: Independence with a BridgeRunning parallel to Ethereum, sidechains have their consensus mechanisms and are connected to the Ethereum mainnet via two-way bridges. This allows for asset transfers between the mainnet and the sidechain, a functionality embraced by Polygon’s PoS chain and xDai (Gnosis Chain).Sidechains: Simplified ExplanationEthereum mainnet (main blockchain) is a central library, where people come to borrow books (conduct transactions). Due to its popularity, the library is often crowded, making the process of borrowing books slow and expensive due to the high demand for the librarian’s time (high gas fees on the Ethereum blockchain).To alleviate this, the library opens several reading rooms (sidechains) dedicated to specific genres; one for fiction, one for non-fiction, and another for academic texts. Each reading room operates independently, with its checkout system (consensus mechanism) and buyers can take books (assets) from the main library into one of these rooms to read in a quieter, more focused environment.How it works:1) Depositing books (Asset locking and minting)Locking: choose a book in the main library to read in a quiet reading room. The library marks this book as “checked out” in its system, making it unavailable to other patronsMinting: simultaneously, a duplicate of the book is created for you in the reading room, allowing you to read it there without affecting its availability in the main library.2) Reading in the reading room (transactions on the sidechain)You enjoy reading the book in the calm environment of the reading room, where it is easier and quicker to read because of fewer distractions,3) Returning books (asset unlocking and burning)Burning: when you finish, you return the duplicate book to the reading room’s desk, where it is removed from their records.Unlocking: concurrently, the main library updates its system to show the original book as checked in, making it available again for others to borrow.Real World Example: The Polygon NetworkA practical example of a sidechain in the cryptocurrency world is the Polygon Network, designed to scale Ethereum transactions. Polygon acts as a sidechain that allows for faster and cheaper transactions than directly on the Ethereum mainnet. Users can transfer assets (such as ETH or ERC-20 tokens) from Ethereum to Polygon, perform transactions within the Polygon network, and then transfer assets back to the Ethereum mainnet. This process involves locking assets on Ethereum, minting them on Polygon, and then, when transferring back, burning them on Polygon and unlocking the original assets on Ethereum.The sidechain concept, exemplified by Polygon, showcases how sidechains can offer a scalable, efficient solution for blockchain transactions, addressing the limitations of the main blockchain without sacrificing its foundational security and trust.Sidechains vs State Channels vs Plasma: A comparisonSimilaritiesOff-chain Scaling: All three solutions aim to scale blockchain capabilities by handling transactions off the main chain.Reduced Burden on Main Chain: By moving transactions off-chain, they significantly reduce the computational load and associated costs on the main blockchain.DifferencesOperational Mechanics: While sidechains operate as independent blockchains and require asset transfers, state channels, and Plasma operate more closely tied to the main chain. State channels keep the interaction off-chain and only settle on-chain, while Plasma uses a hierarchical chain structure to manage its operations.Security Model: Sidechains may have varying security protocols independent of the main chain, whereas state channels and Plasma benefit from the underlying security of the main blockchain.Use Cases: Sidechains are versatile and can be customized for a variety of applications. State channels are ideal for applications requiring frequent and rapid microtransactions, such as gaming or payment services. Plasma is well-suited for high-throughput use cases where participants don’t need to interact frequently with the main chain.Validium: A Fusion of Efficiency and SecurityValidium blends the best of ZK-rollups and Plasma, processing transactions off-chain, storing data off-chain, and using zero-knowledge proofs for main-chain verification.How Validium Works:Transaction Processing Off-Chain: Similar to ZK-rollups, Validium processes transactions outside of the main Ethereum chain (off-chain). This helps in reducing the load on the main chain, thereby increasing transaction throughput.Data Storage Off-Chain: Unlike ZK-rollups, which store data on-chain, Validium stores transaction data off-chain. This further decreases the data burden on the main blockchain but requires strong data availability guarantees to ensure that data can be retrieved when needed.Zero-Knowledge Proofs: Validium uses zero-knowledge proofs to validate transactions. These proofs are cryptographic methods that allow one party to prove to another party that a statement is true without revealing any information beyond the validity of the statement itself.Security: The main blockchain still provides security through these zero-knowledge proofs, even though the data is stored off-chain. The proofs ensure that all transactions are valid, and because they are submitted to the main chain, they benefit from its security properties.Example to Understand Validium:Imagine a large stadium hosting a concert with thousands of attendees entering through a single gate. This gate represents the main Ethereum blockchain where each transaction (entry) needs to be processed, causing delays and high costs (high gas fees).Now, consider the introduction of a new system — Validium:Off-Chain Ticket Checks: Instead of checking each ticket at the main gate, there are multiple smaller gates (off-chain processing) around the stadium where tickets are scanned quickly and efficiently.Storing Information Off-Site: The results of these ticket checks (transaction data) are not stored at the main gate but in a secure off-site location (off-chain data storage). This reduces the congestion at the main gate.Validation at the Main Gate: At the end of the concert, a trusted official (using zero-knowledge proofs) visits the main gate and confirms that all tickets checked at the smaller gates are valid without having to bring all the individual ticket data to the main gate. This validation uses cryptographic proofs that confirm the legitimacy of all tickets checked without revealing the ticket details themselves.Validium vs Zk-RollupsValidium and Zero-Knowledge (ZK) Rollups are both Layer 2 scaling solutions for blockchains such as Ethereum. They aim to enhance transaction throughput and reduce the load on the main blockchain. Here’s a comparison that details their similarities and differences:SimilaritiesZero-Knowledge Proofs:Both use zero-knowledge proofs to verify the correctness of transactions off-chain before submitting this proof to the main blockchain. This ensures that the transactions are valid without revealing the actual transaction data.Off-Chain Computation:Both Validium and ZK Rollups perform transaction computations off-chain, which helps reduce the load on the main blockchain and speeds up processing times.Enhanced Scalability:By processing transactions off-chain, both technologies significantly increase the scalability of the network, allowing it to handle much higher transaction volumes than would be possible on the main chain alone.Security Reliance on Main Chain:They both leverage the security of the main blockchain by submitting proofs to it, ensuring that even though the computation is done off-chain, the integrity and security of transactions are not compromised.DifferencesData Availability:ZK Rollups: Store transaction data on-chain. This means all the data needed to reconstruct the state of the rollup is available on the Ethereum blockchain, which enhances security and trustworthiness because data can always be accessed and verified by anyone.Validium: Stores transaction data off-chain. While this approach further reduces the data burden on the Ethereum mainnet, it introduces potential risks related to data availability. If the off-chain data is lost or inaccessible, it might be impossible to reconstruct the state or prove the validity of transactions.Custody and Trust Model:ZK Rollups: Because they store data on-chain, they generally require less trust in external parties to maintain and manage the system.Validium: Requires more trust in the operators who manage the off-chain data storage, as users must rely on these operators to maintain data integrity and availability.Use Cases:ZK Rollups: These are suitable for applications where on-chain data availability and decentralization are critical, such as in financial applications and DeFi platforms where users must be able to independently verify all aspects of the system.Validium: This may be more appropriate for use cases where privacy is more critical, and the application can tolerate some level of trust in third parties for managing data.Cost and Efficiency:ZK Rollups: While they reduce computation loads on the main chain, they still require storing data on-chain, which incurs gas costs associated with data storage.Validium: Potentially offers even lower transaction costs than ZK Rollups because it does not incur on-chain data storage fees, making it more cost-effective for applications with massive data throughput needs.Validium vs PlasmaSimilaritiesOff-Chain Transaction Processing:Both Validium and Plasma process transactions off the main blockchain (off-chain), reducing the load and increasing the scalability of the main chain.Security Anchoring:They rely on the main blockchain for security. Both solutions periodically submit proofs or data to the main blockchain to ensure that the off-chain operations are secure and can be verified.Scalability Focus:The primary goal of both technologies is to enable higher transaction throughput than what the main blockchain can handle natively.DifferencesData Availability:Validium: Stores transaction data off-chain and relies on zero-knowledge proofs to validate transactions. This method can introduce concerns regarding data availability, as the necessary data to prove the state or challenge transactions is not stored on the main blockchain.Plasma: Requires data to be available for users to challenge fraudulent exits and invalid state transitions. Plasma chains frequently commit state roots to the main blockchain, which helps in verifying the state maintained off-chain.Transaction Validation:Validium: Uses zero-knowledge proofs for validating transactions. These proofs are submitted to the main blockchain, verifying that all transactions are correct without revealing any specific transaction details.Plasma: Utilizes fraud proofs where users can challenge invalid transactions or exits by submitting proof of fraud to the main blockchain. This process relies on users being vigilant and actively monitoring Plasma chains.Complexity in User Interaction:Validium: Generally simpler for end-users since they do not need to participate in challenging invalid state transitions; the integrity of transactions is guaranteed by the zero-knowledge proofs.Plasma: Users must be capable of challenging fraudulent activities, requiring them to monitor the network and understand the process of submitting fraud proofs. This adds a layer of complexity and responsibility for the users.Use Cases:Validium: Well-suited for applications where privacy and scalability are paramount, and where users can trust a third party for managing off-chain data.Plasma: Better suited for applications that require decentralized security without relying heavily on a third party to manage data, as users have the tools to enforce the network’s integrity themselves.Trust Model:Validium: Requires a higher degree of trust in the entity managing the off-chain data storage, since data is not stored on the blockchain.Plasma: Offers a more trust-minimized environment as it allows anyone to challenge fraudulent states, which means users are not heavily reliant on a single third party’s honesty.Embracing Ethereum’s Layer 2 FutureEthereum’s layer 2 solutions are not just technological advancements; they are stepping stones towards a more scalable, efficient, and inclusive digital ecosystem. As these solutions continue to evolve, they promise to open new avenues for blockchain applications, making Ethereum’s network more accessible to users worldwide.By understanding and embracing these layer 2 solutions, the Ethereum community is well on its way to overcoming scalability challenges, setting a precedent for future blockchain innovations.Exploring Ethereum’s Layer 2 Solutions: How Layer 2 solutions are slashing Gas Fees and Fueling… was originally published in The Dark Side on Medium, where people are continuing the conversation by highlighting and responding to this story.

a

a

a

a

a

a

Bitcoin 3 days ago. Bitcoin and Ethereum spot ETFs may hit Hong Kong markets as early as Monday: Bloomberg. Bitcoin Apr. 14, 2024. Aark Raises $6M ...

a

a

a

a

a

a

... crypto attorney Gabriel Shapiro. During ... Eisenberg was found guilty of commodities fraud, commodities market manipulation, and wire fraud, Bloomberg ...

a

a

a

a

a

a

Hong Kong has approved introducing Exchange-Traded Funds (ETFs) for Ethereum and Bitcoin, a historic move representing a critical turning point for the cryptocurrency industry, especially in the Asian market. This action is the most recent in the city’s continuous attempts to create a thorough regulatory framework for digital assets. Hong Kong has been aggressively pursuing … The post Hong Kong Authorities Leverage Cryptocurrency ETF, Approves ETH, BTC ETFs first appeared on Tokenhell.

a

a

a

a

a

a

Iran's first strike on Israel pushed down crypto and risk assets, while leading to a spike in gold.

a

a

a

a

a

a

(Bloomberg) -- Bitcoin sank as part of a wider retreat in cryptocurrencies amid a wave of caution across global markets sparked by Middle East ...

a

a

a

a

a

a

Bitcoin sank as part of a wider retreat in cryptocurrencies amid a wave of caution across global markets sparked by Middle East tension ...

a

a

a

a

a

a

Crypto exchange Kraken has acquired TradeStation Crypto, the digital asset-focused division of online brokerage TradeStation, to support its expansion efforts in the United States, Coindesk reported.However, the closing date of the acquisition and other details remain unclear as neither company has announced anything officially. The financials of the deal have not been revealed.Kraken’s Push in the US“We can confirm Kraken has recently purchased TradeStation's crypto business,” a Kraken spokesperson wrote in an email confirming the acquisition to the crypto-focused publication. “This transaction is part of our efforts to accelerate our US presence and will support further growth and new product opportunities for Kraken in the US.”Indeed, Florida-based TradeStation Crypto holds money transmitter licenses in 47 states in the US, Washington DC, and Puerto Rico, according to the Financial Crimes Enforcement Center’s (FinCEN) database. These licenses are necessary for running crypto exchange operations and registrar businesses in compliance with federal laws in the US.A Global Expansion PlanHeadquartered in San Francisco, Kraken is focused on its expansion, both domestically and internationally. In Europe, the exchange recently obtained multiple licenses, including regulatory approval in Spain and Ireland. Furthermore, the American exchange acquired BCM, a Dutch crypto exchange, late last year to further expand its presence in continental Europe.Recently, Kraken expanded its services with the launch of a self-custodial cryptocurrency wallet. The exchange also offers a dedicated platform to its institutional clients, along with custodial solutions.Meanwhile, Kraken is facing regulatory backlash. The US securities regulator has charged the exchange with illegally operating an unregistered securities exchange, broker, dealer, and clearing agency, and with mixing customers’ money and crypto assets with its own.Interestingly, TradeStation Crypto settled with the Securities and Exchange Commission earlier this year by paying $1.5 million for offering crypto lending products, which were categorised as unregistered securities. This article was written by Arnab Shome at www.financemagnates.com.

a

a

a

a

a

a

Chainlink and Polygon were hot prospects for buyers earlier in the year, but are things the same now?

a

a

a

a

a

a

Lombard Odier's Chaar on Israel's Retaliatory Strike on Iran, Impact on Oil Bloomberg

a

a

a

a

a

a

BNB price is attempting a fresh increase from the $515 zone. The price could gain bullish momentum if it clears the $572 resistance zone. BNB price started a fresh increase after it found support near the $515 zone. The price is now trading below $555 and the 100 simple moving average (4 hours). There was a break above a key bearish trend line with resistance at $540 on the 4-hour chart of the BNB/USD pair (data source from Binance). The pair could gain bullish momentum if it clears the $572 resistance zone. BNB Price Faces Hurdles After a downside correction below $550, BNB price found support near the $515 zone. A low was formed at $513.6 and the price started a recovery wave, like Ethereum and Bitcoin. There was a move above the $525 and $530 resistance levels. The bulls pushed the price above the $540 pivot level and the 23.6% Fib retracement level of the downward move from the $630 swing high to the $513 low. There was also a break above a key bearish trend line with resistance at $540 on the 4-hour chart of the BNB/USD pair. The price is still trading below $550 and the 100 simple moving average (4 hours). Immediate resistance is near the $555 level. The next resistance sits near the $572 level or the 50% Fib retracement level of the downward move from the $630 swing high to the $513 low. Source: BNBUSD on TradingView.com A clear move above the $572 zone could send the price further higher. In the stated case, BNB price could test $600. A close above the $600 resistance might set the pace for a larger increase toward the $630 resistance. Any more gains might call for a test of the $650 level in the coming days. Another Decline? If BNB fails to clear the $572 resistance, it could start another decline. Initial support on the downside is near the $532 level. The next major support is near the $520 level. The main support sits at $515. If there is a downside break below the $515 support, the price could drop toward the $500 support. Any more losses could initiate a larger decline toward the $465 level. Technical Indicators 4-Hours MACD – The MACD for BNB/USD is losing pace in the bullish zone. 4-Hours RSI (Relative Strength Index) – The RSI for BNB/USD is currently below the 50 level. Major Support Levels – $532, $520, and $515. Major Resistance Levels – $555, $572, and $600.

a

a

a

a

a

a

Bittensor (TAO) and Stacks (STX) have been lead decliners in the crypto market crash after a dip in the U.S. stock market and Middle Eastern conflicts. Due to rapid price declines, their investors are shifting to new prominent investment avenues for potential gains and sustainable growth in the upcoming bull market after halving. Bittensor (TAO) […] The post Stacks and Bittensor investors are turning to the DTX Exchange presale, anticipating 3000% gains appeared first on Live Bitcoin News.

a

a

a

a

a

a

The highly anticipated Blockchain Life Forum 2024 is set to take place in the vibrant city of Dubai on April 15-16.

a

a

a

a

a

a

Binance is reportedly planning to operate as a registered entity in India, compliant with domestic AML and tax rules.

a

a

a

a

a

a

SPEEDY is one of the newest tokens embodying a global decentralized community. The token has officially launched on the Fantom blockchain.

a

a

a

a

a

a

It boasts secure data storage on the blockchain and integrates with other Solana and Web3 products. Following a well-received launch event ...

a

a

a

a

a

a

As blockchain technology underpins a growing number of systems, from cryptocurrencies to supply chain management, the need for advanced oversight and ...

a

a

a

a

a

a

Ethereum price is still consolidating near the $3,000 zone. ETH could start a steady increase if the bulls push the price above the $3,100 resistance. Ethereum is still struggling to recover above the $3,100 resistance zone. The price is trading below $3,100 and the 100-hourly Simple Moving Average. There is a key bearish trend line forming with resistance at $3,070 on the hourly chart of ETH/USD (data feed via Kraken). The pair could accelerate lower if there is a close below the $2,850 support zone. Ethereum Price Consolidates Ethereum price attempted another recovery wave and remained stable above the $3,000 level. However, the bears defended the $3,100 resistance zone, like Bitcoin. There was another decline below $3,000. The price even spiked below the $2,900 support. A low was formed at $2,867 and the price is now recovering losses. It climbed above the 23.6% Fib retracement level of the downward move from the $3,278 swing high to the $2,867 low. Ethereum is still trading below $3,100 and the 100-hourly Simple Moving Average. Immediate resistance is near the $3,020 level. The first major resistance is near the $3,070 level and the 100-hourly Simple Moving Average. There is also a key bearish trend line forming with resistance at $3,070 on the hourly chart of ETH/USD. The trend line is close to the 50% Fib retracement level of the downward move from the $3,278 swing high to the $2,867 low. The next key resistance sits at $3,120, above which the price might rise toward the $3,200 level. Source: ETHUSD on TradingView.com The main downtrend resistance sits at $3,280. A close above the $3,280 resistance could send the price toward the $3,350 pivot level. If there is a move above the $3,350 resistance, Ethereum could even climb toward the $3,550 resistance. More Losses In ETH? If Ethereum fails to clear the $3,100 resistance, it could start another decline. Initial support on the downside is near the $2,920 level. The first major support is near the $2,850 zone. A clear move below the $2,850 support might send the price toward $2,620. Any more losses might send the price toward the $2,550 level in the near term. Technical Indicators Hourly MACD – The MACD for ETH/USD is gaining momentum in the bearish zone. Hourly RSI – The RSI for ETH/USD is now below the 50 level. Major Support Level – $2,850 Major Resistance Level – $3,100

a

a

a

a

a

a

Top 100 Coins By Market Cap

NEXT BTC MOVE:

I think Bitcoin goes UP because

| Name | Price | Marketcap | 24h | ||

|---|---|---|---|---|---|

Bitcoin (BTC)

Bitcoin (BTC)

|

$62,003.34 | $1.22 T | 1.68% | ||

Ethereum (ETH)

Ethereum (ETH)

|

$2,999.36 | $360.14 B | 0.42% | ||

Tether USDt (USDT)

Tether USDt (USDT)

|

$1.00 | $109.52 B | 0.03% | ||

BNB (BNB)

BNB (BNB)

|

$543.89 | $81.30 B | -0.79% | ||

Solana (SOL)

Solana (SOL)

|

$138.88 | $62.05 B | 3.97% | ||

USDC (USDC)

USDC (USDC)

|

$1.00 | $33.06 B | 0.01% | ||

XRP (XRP)

XRP (XRP)

|

$0.48785278 | $26.89 B | -1.50% | ||

Toncoin (TON)

Toncoin (TON)

|

$6.68 | $23.20 B | 10.33% | ||

Dogecoin (DOGE)

Dogecoin (DOGE)

|

$0.14778610 | $21.27 B | 0.11% | ||

Cardano (ADA)

Cardano (ADA)

|

$0.44324346 | $15.79 B | -1.52% | ||

Shiba Inu (SHIB)

Shiba Inu (SHIB)

|

$0.00002197 | $12.95 B | -0.33% | ||

Avalanche (AVAX)

Avalanche (AVAX)

|

$33.69 | $12.78 B | -1.65% | ||

TRON (TRX)

TRON (TRX)

|

$0.10687000 | $9.37 B | -2.61% | ||

Polkadot (DOT)

Polkadot (DOT)

|

$6.51 | $9.37 B | -1.85% | ||

Bitcoin Cash (BCH)

Bitcoin Cash (BCH)

|

$462.70 | $9.14 B | -1.49% | ||

Chainlink (LINK)

Chainlink (LINK)

|

$13.25 | $7.81 B | 0.32% | ||

Polygon (MATIC)

Polygon (MATIC)

|

$0.64880000 | $6.44 B | -3.38% | ||

Litecoin (LTC)

Litecoin (LTC)

|

$78.85 | $5.88 B | -1.26% | ||

NEAR Protocol (NEAR)

NEAR Protocol (NEAR)

|

$5.50 | $5.87 B | 0.11% | ||

Internet Computer (ICP)

Internet Computer (ICP)

|

$12.50 | $5.80 B | 3.97% | ||

UNUS SED LEO (LEO)

UNUS SED LEO (LEO)

|

$5.82 | $5.39 B | -0.66% | ||

Dai (DAI)

Dai (DAI)

|

$1.00 | $5.35 B | 0.02% | ||

Uniswap (UNI)

Uniswap (UNI)

|

$7.17 | $4.30 B | 2.25% | ||

Aptos (APT)

Aptos (APT)

|

$9.11 | $3.87 B | -0.39% | ||

Ethereum Classic (ETC)

Ethereum Classic (ETC)

|

$25.29 | $3.72 B | -0.89% | ||

Mantle (MNT)

Mantle (MNT)

|

$1.12 | $3.64 B | -1.49% | ||

First Digital USD (FDUSD)

First Digital USD (FDUSD)

|

$0.99960000 | $3.64 B | 0.02% | ||

Stacks (STX)

Stacks (STX)

|

$2.32 | $3.37 B | 1.48% | ||

OKB (OKB)

OKB (OKB)

|

$54.72 | $3.28 B | -1.08% | ||

Cronos (CRO)

Cronos (CRO)

|

$0.11983897 | $3.18 B | -1.67% | ||

Cosmos (ATOM)

Cosmos (ATOM)

|

$8.06 | $3.15 B | -1.03% | ||

Stellar (XLM)

Stellar (XLM)

|

$0.10880000 | $3.15 B | 0.75% | ||

Filecoin (FIL)

Filecoin (FIL)

|

$5.79 | $3.14 B | -1.24% | ||

Bittensor (TAO)

Bittensor (TAO)

|

$447.25 | $2.96 B | -1.33% | ||

Arbitrum (ARB)

Arbitrum (ARB)

|

$1.11 | $2.93 B | -2.65% | ||

Render (RNDR)

Render (RNDR)

|

$7.57 | $2.91 B | -2.61% | ||

Hedera Hashgraph (HBAR)

Hedera Hashgraph (HBAR)

|

$0.08058000 | $2.88 B | 0.95% | ||

Immutable (IMX)

Immutable (IMX)

|

$1.99 | $2.90 B | 4.58% | ||

Hedera (HBAR)

Hedera (HBAR)

|

$0.08020000 | $2.87 B | 0.99% | ||

VeChain (VET)

VeChain (VET)

|

$0.03869350 | $2.81 B | 1.38% | ||

Maker (MKR)

Maker (MKR)

|

$2,932.61 | $2.71 B | -7.87% | ||

Kaspa (KAS)

Kaspa (KAS)

|

$0.11422715 | $2.67 B | -2.46% | ||

dogwifhat (WIF)

dogwifhat (WIF)

|

$2.54 | $2.55 B | 5.48% | ||

Injective (INJ)

Injective (INJ)

|

$26.70 | $2.49 B | 1.94% | ||

The Graph (GRT)

The Graph (GRT)

|

$0.24565062 | $2.33 B | 0.68% | ||

Optimism (OP)

Optimism (OP)

|

$2.14 | $2.24 B | -2.05% | ||

Monero (XMR)

Monero (XMR)

|

$114.36 | $2.11 B | -2.78% | ||

Pepe (PEPE)

Pepe (PEPE)

|

$0.00000496 | $2.09 B | 1.45% | ||

Theta Network (THETA)

Theta Network (THETA)

|

$1.98 | $1.99 B | -1.37% | ||

Fantom (FTM)

Fantom (FTM)

|

$0.66946247 | $1.88 B | 1.25% | ||

Celestia (TIA)

Celestia (TIA)

|

$10.51 | $1.87 B | 7.94% | ||

Lido DAO (LDO)

Lido DAO (LDO)

|

$1.94 | $1.74 B | 0.68% | ||

Bitget Token (BGB)

Bitget Token (BGB)

|

$1.24 | $1.74 B | -3.12% | ||

Core (CORE)

Core (CORE)

|

$1.91 | $1.69 B | -7.29% | ||

Fetch.ai (FET)

Fetch.ai (FET)

|

$1.98 | $1.68 B | 0.50% | ||

Arweave (AR)

Arweave (AR)

|

$24.40 | $1.60 B | 0.96% | ||

THORChain (RUNE)

THORChain (RUNE)

|

$4.76 | $1.59 B | 5.59% | ||

Sui (SUI)

Sui (SUI)

|

$1.22 | $1.58 B | -3.07% | ||

Sei (SEI)

Sei (SEI)

|

$0.51010000 | $1.44 B | 2.34% | ||

Pendle (PENDLE)

Pendle (PENDLE)

|

$5.77 | $1.39 B | -3.52% | ||

Algorand (ALGO)

Algorand (ALGO)

|

$0.16770000 | $1.37 B | -0.85% | ||

Beam (BEAM)

Beam (BEAM)

|

$0.02577121 | $1.36 B | -0.86% | ||

Render Token (RNDR)

Render Token (RNDR)

|

$7.55 | $2.91 B | -2.44% | ||

Jupiter (JUP)

Jupiter (JUP)

|

$0.99950930 | $1.35 B | 5.66% | ||

Gala (GALA)

Gala (GALA)

|

$0.04399000 | $1.35 B | 7.88% | ||

Neo (NEO)

Neo (NEO)

|

$18.50 | $1.31 B | 10.11% | ||

FLOKI (FLOKI)

FLOKI (FLOKI)

|

$0.00013412 | $1.28 B | -0.27% | ||

Ethena (ENA)

Ethena (ENA)

|

$0.88900000 | $1.28 B | 0.05% | ||

Flow (FLOW)

Flow (FLOW)

|

$0.84700000 | $1.28 B | -0.95% | ||

Bitcoin SV (BSV)

Bitcoin SV (BSV)

|

$64.42 | $1.27 B | -1.40% | ||

Quant (QNT)

Quant (QNT)

|

$103.80 | $1.26 B | 1.64% | ||

Aave (AAVE)

Aave (AAVE)

|

$83.60 | $1.24 B | -0.86% | ||

Flare (FLR)

Flare (FLR)

|

$0.03116377 | $1.20 B | -2.75% | ||

BitTorrent (New) (BTT)

BitTorrent (New) (BTT)

|

$0.00000122 | $1.18 B | -1.92% | ||

MultiversX (EGLD)

MultiversX (EGLD)

|

$39.49 | $1.06 B | -1.46% | ||

SingularityNET (AGIX)

SingularityNET (AGIX)

|

$0.81515000 | $1.05 B | 0.84% | ||

dYdX (Native) (DYDX)

dYdX (Native) (DYDX)

|

$2.20 | $1.02 B | 2.74% | ||

Wormhole (W)

Wormhole (W)

|

$0.56375626 | $1.01 B | -0.34% | ||

Huobi Token (HT)

Huobi Token (HT)

|

$0.60060400 | $95.74 M | -0.49% | ||

Axie Infinity (AXS)

Axie Infinity (AXS)

|

$6.79 | $977.02 M | -2.68% | ||

eCash (XEC)

eCash (XEC)

|

$0.00004858 | $960.14 M | -1.81% | ||

Ronin (RON)

Ronin (RON)

|

$3.04 | $956.78 M | -2.40% | ||

The Sandbox (SAND)

The Sandbox (SAND)

|

$0.42370000 | $956.70 M | -1.73% | ||

Bonk (BONK)

Bonk (BONK)

|

$0.00001428 | $931.21 M | 1.26% | ||

Chiliz (CHZ)

Chiliz (CHZ)

|

$0.10400000 | $927.61 M | -6.88% | ||

Tezos (XTZ)

Tezos (XTZ)

|

$0.94642320 | $926.16 M | -0.66% | ||

Synthetix (SNX)

Synthetix (SNX)

|

$2.80 | $918.36 M | 0.66% | ||

dYdX (DYDX)

dYdX (DYDX)

|

$2.19 | $687.26 M | 3.28% | ||

Worldcoin (WLD)

Worldcoin (WLD)

|

$4.74 | $906.82 M | -1.48% | ||

Pyth Network (PYTH)

Pyth Network (PYTH)

|

$0.58440000 | $881.68 M | 2.37% | ||

Starknet (STRK)

Starknet (STRK)

|

$1.21 | $880.92 M | -1.67% | ||

Conflux (CFX)

Conflux (CFX)

|

$0.22130000 | $876.14 M | -3.27% | ||

JasmyCoin (JASMY)

JasmyCoin (JASMY)

|

$0.01764100 | $872.56 M | -0.30% | ||

ORDI (ORDI)

ORDI (ORDI)

|

$41.54 | $872.37 M | -1.85% | ||

Akash Network (AKT)

Akash Network (AKT)

|

$3.72 | $870.54 M | -2.35% | ||

Gnosis (GNO)

Gnosis (GNO)

|

$332.50 | $861.09 M | 1.34% | ||

Nervos Network (CKB)

Nervos Network (CKB)

|

$0.01934200 | $853.21 M | -6.96% | ||

EOS (EOS)

EOS (EOS)

|

$0.74600000 | $839.34 M | 1.71% | ||

Mina (MINA)

Mina (MINA)

|

$0.76924886 | $837.48 M | -0.56% | ||

KuCoin Token (KCS)

KuCoin Token (KCS)

|

$8.38 | $805.89 M | 3.22% |

Try to search another coin

ch80 Yes