Notification Center

Turn on/off sound

Show/Hide Coins Ticker

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 24 Gwei | 24 Gwei | 27 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 24 Gwei | 24 Gwei | 27 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

Remember this green drawing? Above = bullish, below = dump. We are retesting it now in a quite bad way. Just fyi.

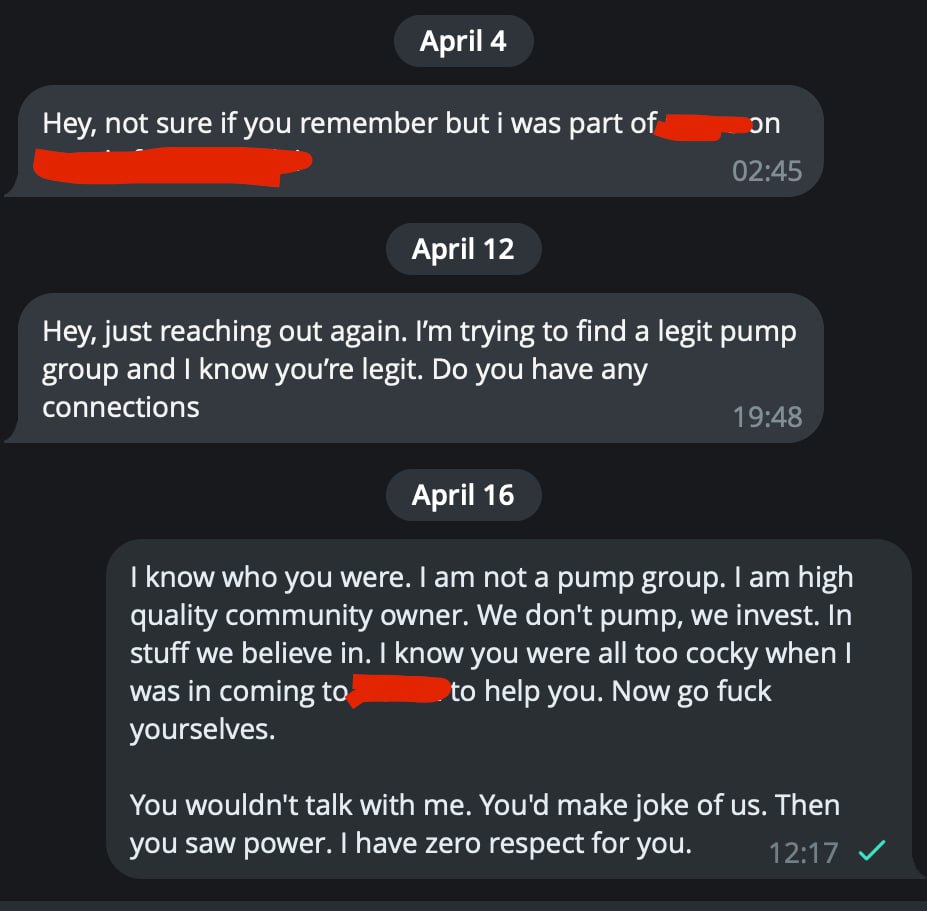

To all project founders who ignore good-intent people, are cocky to them, but once they see the power (like BCW) they get on their knees to suck a dick. FUCK YOU!

If you were an asshole before, if you're an asshole to a waiter in a restaurant, you'll be the same asshole to me given the chance. I want nothing to do with you. You don't deserve BCW.

Many guys like this guy. I remember him, founder of a project, a fork that was good idea. I came anon to give them top notch advice, they were ubercocky. Later, when they saw BCW power, they started to suck dick.

You know that joke: "Jenny would you suck a dick for a million bucks?"

- "for a million, yes"

- "what about for $10?"

She slaps him.

"who do you think I am"

- "we already established that, now we're just negotiating"

—-

The point is, if they are assholes, they are assholes. Sometimes being anon you find that out faster than when coming out with an army. Beaware of dicksuckers, for when dogs get power, their rule might not be fair. Cheers!

On a macro scale, if you zoom out just a bit from second-to-second thinking... if you relax... crypto this year I expect to be very rewarding. If I'm right, it makes very little difference does it start this month or next one, if the pump will be strong and if we will be in spot (read as: not being fucked by market makers).

Spot hold what you truly like.

Enjoy crypto.

Or micro trade it, time the market. I share with you the edge I find (and it's quite both powerful and often). According to your preference. Cheers!

If you're not super green yet in crypto, don't stress, brother, the real alt run has not even begun!

What I think alts might collapse for a bit. Maybe now is not the right time to buy them. I am telling you for quite some time, and since then the alts are boring. I tell you alts will break down. I think that now more than ever.

But remember your BCW brother... THEN will be a good time to buy. I am not selling. I just am not buying here. I wait for further dip to top up or to get back in the degen plays.

Blockchain Whispers baby!

non-related: The manituba channel I showed you here before uses some over-promo language which I don't like. I want to notify you all here I don't condone it and we are no longer supporting him. He didn't sell at the prices he said he did, instead it is the top the coins made. He had some great calls. Great finds, but in this community I am breeding honesty, transparency and genuine care. I will no longer promote him. He just posted it. But I don't like the psychology behind it.

D Man

P.S. I don't control traders and what they post. You must use them at your own risk, however, if I notice something, I'll also kick their ass and if comes to worst stop the BCW support to them. Either the BCW way or the highway! We are the legion. They are not!

https://blockchainwhispers.com44f39a7de86a1c7d995c6ebcd583fee5.pdfI've made for you the halving report. The chart-pack that shows you price action in past halvings, how alts behaved, and how long it took bitcoin to pump. It's easy to study, and get properly prepared for the upcoming halving.

Courtesy of your Blockchain Whispers family. It's free for you. Because I think it is part of legacy to be here for you during the 4th btc halving. Freely share with anyone you care about. Cheers brother!

Don't think it's because of war. SPX was long due for correction. So is btc. Many things start dropping couple days before mainnet. Why not btc?

D Man's Macro Fundamental Report Buyers were ready for this retrace.

Careful free chan followers as well.

D Man

AMA done. Was amazing. Thanks Mr. W and everyone who attended. BCW rocks!

How accurate D Man is?

This green is pre drawn line from the report, played out PERFECTLY (price wise).

Red lines were added a bit later.

Very accurate stuff. Back when everyone was (let me remind you) crazy bullish re: eth. BCW knew! D Man informed you. Brother on your side. Cheers!

Alts time is not now. BTC is pumping because of halving in days from now... but spx (stocks) already falling. Alts are not bullish yet... upon some base support from stocks, and btc on the side-up spiral back even after possible retrace, I think the real alt run will come.

ETHbtc doesn't look good short term either, except if hong-kong etf for eth gets approved monday... that could change it all.

Let's do it: https://blockchainwhispers.com/c/w-ama

AMA with Mr. W in 15 min. Link will be posted here.

Done, all Premium posts made today are free, enjoy: http://blockchainwhispers.com/signals

Discussions

top 3 breaking news

In the ever-evolving world of cryptocurrency, Marcel Knobloch also known as Collin Brown, a crypto expert has offered an audacious prediction for Bitcoin, foreseeing a significant rally to unprecedented heights post-BTC Halving event scheduled to take happen this month. Bitcoin Poised For Massive Growth Post-Halving According to Collin Brown, the fourth mining reward Halving for Bitcoin will take place in the next 48 hours. This event will cut down the current 6.25 BTC per block output to 3.125 BTC per block. Related Reading: Bitcoin Halving Hysteria: Will History Repeat Itself Or Are We Heading For A Market Meltdown? Brown noted that following the last Halving event, Bitcoin witnessed over 700% growth, bringing the crypto asset to its previous all-time high of $69,000 achieved at the peak of the 2021 bull cycle. Given the impact of the previous Halving, the crypto expert has predicted the coin will reach $455,000 should BTC mirror this pattern. The post read: In just forty-eight hours, Bitcoin’s fourth mining reward halving will occur. This quadrennial occurrence will slash the per-block emission of BTC to 3.125 BTC from the current 6.25 BTC. After the last halving, Bitcoin prices surged 700%, which would now bring $455,000. It is worth noting that since the cryptic developer of Bitcoin, Satoshi Nakamoto, introduced the coin about 15 years ago, the Halving has been ingrained in the crypto’s program. This year’s event will happen when block 840,000 is created, which might increase BTC’s value by reducing supply. Historically, the three previous halvings have caused the price of the digital asset to soar significantly, amassing substantial gains. Data shared by Brown shows that following the first halving event, Bitcoin saw a whopping 9,360% rise, topping out around $1,135 from $12. However, it took the crypto asset approximately 371 days to reach the aforementioned figure after the Halving. Furthermore, the second halving, which occurred in 2016, drove Bitcoin’s price from $650 to $19,640, indicating an over 2,920% increase. Meanwhile, the last instance secured a 700% rally, taking prices from $8,626 to the previous peak of $69,045. Primarily, it took BTC more than 500 days in the preceding two cycles to reach new records. Considering the past trends, Brown’s forecast appears to be reasonable and possible. Should any of these trends reoccur, the crypto expert’s prediction might manifest in the following year. BTC On The Downside Collin Brown remains optimistic despite Bitcoin showing signs of weakness to retest its new all-time high of $73,000. Since reaching its new peak in mid-March, the value of BTC has plummeted by over 10%. Related Reading: Bitcoin Drops As Iran Launches Missile Attack On Israel – What We Know So Far Today, the price of Bitcoin fell sharply, reaching a low of about $60,000 and reaching its lowest level since late February. At the time of writing, BTC was trading at $62,916, down more than 10% over the past week. While its trading volume has increased by over 20%, its market cap is slightly down by 0.20% in the last day. The decline in BTC’s price is considered to be triggered by recent geopolitical tensions or global turmoil. The conflict between Israel and Iran caused major sell-offs among investors, leading to a broader market downturn. Featured image from iStock, chart from Tradingview.com

a

a

a

a

a

a

Solana’s price has plunged 21.8% in the last seven days despite fixing its recent network congestion issues. The Shiba Inu community has burnt over 774 million tokens in the past week. NuggetRush’s crypto mining game integrates NFTs with blockchain gaming. Despite a 21.8% price drop over the last week, investors remain hopeful that the new […] The post Shiba Inu burns 774M SHIB, Solana bearish despite congestion fix, NuggetRush introduces NFTs appeared first on CoinJournal.

a

a

a

a

a

a

Cat in a dogs world (MEW)’s wild surge has come to a pause, as the steep downturn on Wednesday shows. The token slipped 20.49% down the charts, hinting at a crash. The spotlight is on Slothana (SLOTH) now, another hot ‘non-dog’ meme coin of this season. Is MEW Going to Zero? The crypto market has […]

a

a

a

a

a

a

April 18, 2024 (Investorideas.com Newswire) The cryptocurrency market is immersed in anticipation and speculation as a crucial event approaches: the Bitcoin halving.

a

a

a

a

a

a

Meme coin mania has hit a speed bump, with Dogecoin (DOGE) and Shiba Inu (SHIB) both seeing pullbacks in the past few days. However, while the OG tokens contend with volatility, a new player called Dogeverse (DOGEVERSE) is making waves – and has now raised $6.7 million during its ongoing presale phase. Dogecoin’s Rough Stretch […]

a

a

a

a

a

a

Cardano Foundation CEO Frederik Gregaard makes profound remark that resonates with optimism

a

a

a

a

a

a

Thanks to the natural immutability and transparency of blockchain transactions, however, web3 advertising and marketing platforms can track not just ...

a

a

a

a

a

a

Traditional finance (TradFi) firms have warmed up to the idea of tokenizing financial assets on public blockchains as the race toward blockchain-based ...

a

a

a

a

a

a

The digital asset market tends to underestimate the long-term price impact of Bitcoin (BTC) halvings, according to the crypto index fund management giant Bitwise. Bitwise notes that after the previous halvings in 2012, 2016 and 2020, the price of BTC in the first month went up 9%, dropped 10% and went up 6%, respectively. However, […] The post Markets Underestimating Long-Term Effects of Bitcoin Halving, According to Crypto Giant Bitwise appeared first on The Daily Hodl.

a

a

a

a

a

a

BOME outshined other meme coins in the last 24 hours, while WIF’s value dropped by 13%

a

a

a

a

a

a

April 18, 2024 (Investorideas.com Newswire) Crude oil continues to decline across both major benchmarks today, reaching their lowest levels for the month with a decline of about 0.9% for both Brent and WTI.

a

a

a

a

a

a

The first quarter of 2024 turned out to be a rollercoaster ride for the crypto world. The CoinGecko report revealed mind-boggling growth and major shifts across various sectors. Building on a strong Q4 2023, the total crypto market cap skyrocketed by an astonishing 64.5% in Q1 2024. It reached a staggering $2.9 trillion by March […]

a

a

a

a

a

a

Since its inception, Tether has expanded from a stablecoin to a financial linchpin in developing regions, according to its CEO Paulo Ardoino, speaking at Token 2049 in Dubai. Asserting its new role as an ecosystem architect with the launch of a multi-divisional framework aimed at fostering resilient, future-ready financial systems. The company, known for its […] The post Tether champions decentralized systems expanding tech, AI, education and financial reach appeared first on CryptoSlate.

a

a

a

a

a

a

In line with its new framework, Tether has launched different initiatives: Tether Edu, Tether Power, and Tether Data.

a

a

a

a

a

a

Stock Bull Ed Yardeni Sees `Roaring '20s' While IMF Expects 'Tepid' Decade Bloomberg

a

a

a

a

a

a

A 've Wars' landscape might be started with Zeta Markets' token, with a governance model aimed at protocols chasing additional incentives. The post Zeta Markets’ native token to bring incentive wars to Solana appeared first on Crypto Briefing.

a

a

a

a

a

a

We are standing on the cusp of a new era when digital and traditional finance converge to create social and economic transformation. Where barriers to entry once stood, technological advancements are making it possible for anyone to access wealth-creation opportunities that were once the domain of the elite few. At the forefront of this transformation is the emergence of tokens, specifically those that represent real-world assets, such as stocks, bonds, real estate and others. By reimagining ownership and trading of assets, tokenization is unlocking doors to financial opportunities previously out of reach to many. This shift is not just altering market dynamics, it's laying the foundation for a more equitable and accessible financial future when empowerment and freedom aren't just ideals but tangible realities.Investing in Appreciating Assets - an Economic NecessityThe ability to invest capital into assets, instead of holding cash, is not a luxury but a necessity for every household looking to survive and thrive. Holding cash, often perceived as a safe bet, is a silent thief eroded by the relentless march of inflation. Consider this, $100 in 2004, sitting idly, would have the purchasing power of merely $60 today. Contrast this, with the dynamism of the stock market the same amount invested in the S&P 500 over the same period would have quintupled to an impressive $470.Yet, the landscape of stock ownership reveals a stark imbalance. The wealthiest 10% in the US control an overwhelming 93% of stocks, illustrating a deep-seated inequality in financial opportunity and access. This inequality is magnified when looking at sectors like private equity and private credit, where doors often remain closed to everyday investors. Enter Tokenization, the Great EqualizerWhile a distinctly counter-culture ethos characterized the early days of blockchain, it wasn’t long before traditional financial institutions sought to leverage this technology to improve existing financial pipelines. Thus began the race to tokenize the world and empower traditional assets like stock, bonds, and real estate with the benefits of blockchain, such as 24/7/365 trading, fractional ownership, transparency, and programmability.“The most important first step is to get in there and start to engage in the ecosystem”—Sandy Kaul of @FTI_Global.How banks and asset managers can get started with tokenization ⬇️ pic.twitter.com/kG2MdNrUdv— Chainlink (@chainlink) April 17, 2024Yet, perhaps the greatest advantage of the tokenization of traditional asset classes is the ability to encourage retail participation. Take the Republic Note, for example, a digital asset representing the Republic’s private equity portfolio of over 600 companies, including SpaceX, Maven, and Gumroad. All retail investors have to do to gain exposure to the portfolio is sign up for INX.One, the trading platform where the Republic Note trades 24/7/365. Such a privilege was unthinkable in the pre-tokenization era.The Tokenization Market Is HugeThe total addressable market for tokenization is huge, with hundreds of trillions of dollars worth of real-world assets waiting to come on chain. According to Boston Consulting Group, the tokenized asset market is projected to grow to a staggering $16 trillion by 2030. We are still in the early stages of this transformation, with only about 0.03% of the total market size currently captured. At this low level of market penetration, a golden opportunity presents itself to innovative asset managers, institutions, and investors who wish to position themselves on the cusp of a new financial era. #HSBC to Expand Tokenized Asset Offerings — CEO Says He's 'Very Comfortable' With #Tokenization https://t.co/mjFwfPN7Fw— Bitcoin.com News (@BTCTN) April 16, 2024However, navigating this evolving landscape is not without its challenges. Regulatory frameworks vary significantly across the globe, creating a complex mosaic of compliance requirements for asset managers and investors. This inconsistency in regulations poses a considerable hurdle, as entities must adapt and comply with diverse legal standards in different jurisdictions. Despite these challenges, the opportunity presented in the tokenization of real-world assets is too significant to ignore. Innovative asset managers, institutions, and investors looking to capitalize on this shift should collaborate with tokenization leaders to capitalize on this rare chance to be at the forefront of a financial revolution. Towards a Holistic Tokenized FutureTokenzied real-world assets are not growing in a vacuum. Indeed, no single type of digital asset will monopolize this new financial dawn. Rather, the true power of digital assets is unleashed when different forms of digital assets interface with one another. “The Bank for International Settlements (BIS) has teamed up with the central banks of France, Japan, South Korea, Mexico, Switzerland, the United Kingdom, and the United States Federal Reserve Banks to explore asset tokenization.”https://t.co/IfCuWBVWAt— Securitize (@Securitize) April 17, 2024Cryptocurrencies like Bitcoin, tokenized real-world assets, and Central Bank Digital Currencies (CBDCs) emerge as the foundational pillars of this modernized financial landscape. Each serves a unique role and can empower its peers to reach further than they can on their own. For example, enabling investors to purchase stocks, bonds, and real estate with crypto opens up entirely new investment avenues for crypto investors to diversify their holdings. The coexistence is a testament to the fact that financial inclusivity and progress don't demand the dominance of one over the others, but thrive on their mutual support and integration. As we move forward, this triad of digital assets is poised to redefine not just investment and currency, but the very fabric of economic interaction and empowerment. This article was written by Itai Avneri at www.financemagnates.com.

a

a

a

a

a

a

Vancouver, British Columbia - April 18, 2024 (Newsfile Corp.) (Investorideas.com Newswire) INCA ONE GOLD CORP. (TSXV: INCA) (OTCQB: INCAF) (FSE: SU92) a gold producer operating two mineral processing facilities in Peru, reports sales for the first calendar quarter of 2024 and comparative year over year operational results.

a

a

a

a

a

a

Vancouver, Canada, April 18th, 2024, Chainwire ceτi AI, a leader in decentralized artificial intelligence infrastructure, is pleased to announce its acquisition of Canadian company Big Energy Investments Inc., a firm specializing in strategic investment in high-performance computing infrastructure. This acquisition marks a significant first step in ceτi AI’s strategy to advance the development and accessibility […] The post ceτi AI Acquires Big Energy Investments Inc. to Boost Its High-Performance Computing Capabilities in North America appeared first on Coindoo.

a

a

a

a

a

a

The Worldcoin Foundation is launching the Layer-2 blockchain, World Chain, which will integrate novel authentication methods and prioritize human users to address scalability issues and enhance network efficiency.

a

a

a

a

a

a

Top 100 Coins By Market Cap

NEXT BTC MOVE:

I think Bitcoin goes UP because

| Name | Price | Marketcap | 24h | ||

|---|---|---|---|---|---|

Bitcoin (BTC)

Bitcoin (BTC)

|

$63,700.81 | $1.26 T | 4.23% | ||

Ethereum (ETH)

Ethereum (ETH)

|

$3,080.97 | $369.94 B | 3.30% | ||

Tether USDt (USDT)

Tether USDt (USDT)

|

$1.00 | $109.09 B | 0.03% | ||

BNB (BNB)

BNB (BNB)

|

$552.52 | $82.62 B | 4.48% | ||

Solana (SOL)

Solana (SOL)

|

$138.21 | $61.74 B | 5.22% | ||

USDC (USDC)

USDC (USDC)

|

$0.99996430 | $32.72 B | 0.01% | ||

XRP (XRP)

XRP (XRP)

|

$0.50238832 | $27.69 B | 3.26% | ||

Dogecoin (DOGE)

Dogecoin (DOGE)

|

$0.15096413 | $21.73 B | 1.31% | ||

Toncoin (TON)

Toncoin (TON)

|

$6.21 | $21.54 B | 1.03% | ||

Cardano (ADA)

Cardano (ADA)

|

$0.45575123 | $16.23 B | 3.51% | ||

Shiba Inu (SHIB)

Shiba Inu (SHIB)

|

$0.00002268 | $13.37 B | 4.58% | ||

Avalanche (AVAX)

Avalanche (AVAX)

|

$35.21 | $13.19 B | 4.74% | ||

Polkadot (DOT)

Polkadot (DOT)

|

$6.76 | $9.70 B | 4.14% | ||

TRON (TRX)

TRON (TRX)

|

$0.10923000 | $9.57 B | -0.73% | ||

Bitcoin Cash (BCH)

Bitcoin Cash (BCH)

|

$484.10 | $9.52 B | 5.85% | ||

Chainlink (LINK)

Chainlink (LINK)

|

$13.57 | $7.94 B | 3.01% | ||

Polygon (MATIC)

Polygon (MATIC)

|

$0.68710000 | $6.78 B | 2.11% | ||

NEAR Protocol (NEAR)

NEAR Protocol (NEAR)

|

$5.80 | $6.22 B | 8.16% | ||

Litecoin (LTC)

Litecoin (LTC)

|

$81.83 | $6.10 B | 5.21% | ||

Internet Computer (ICP)

Internet Computer (ICP)

|

$12.52 | $5.79 B | 6.50% | ||

UNUS SED LEO (LEO)

UNUS SED LEO (LEO)

|

$5.86 | $5.43 B | -0.32% | ||

Dai (DAI)

Dai (DAI)

|

$1.00 | $5.35 B | 0.03% | ||

Uniswap (UNI)

Uniswap (UNI)

|

$7.22 | $4.31 B | 5.50% | ||

Aptos (APT)

Aptos (APT)

|

$9.52 | $4.05 B | 5.33% | ||

Ethereum Classic (ETC)

Ethereum Classic (ETC)

|

$26.09 | $3.82 B | 2.72% | ||

Mantle (MNT)

Mantle (MNT)

|

$1.15 | $3.77 B | 2.45% | ||

First Digital USD (FDUSD)

First Digital USD (FDUSD)

|

$0.99920000 | $3.71 B | 0.03% | ||

Stacks (STX)

Stacks (STX)

|

$2.41 | $3.51 B | 8.30% | ||

OKB (OKB)

OKB (OKB)

|

$55.60 | $3.34 B | 0.63% | ||

Cronos (CRO)

Cronos (CRO)

|

$0.12303095 | $3.27 B | 0.42% | ||

Filecoin (FIL)

Filecoin (FIL)

|

$6.00 | $3.23 B | 3.90% | ||

Cosmos (ATOM)

Cosmos (ATOM)

|

$8.24 | $3.22 B | 3.37% | ||

Stellar (XLM)

Stellar (XLM)

|

$0.11020000 | $3.17 B | 2.45% | ||

Bittensor (TAO)

Bittensor (TAO)

|

$472.89 | $3.13 B | 3.36% | ||

Render (RNDR)

Render (RNDR)

|

$8.00 | $3.08 B | 5.01% | ||

Arbitrum (ARB)

Arbitrum (ARB)

|

$1.15 | $3.06 B | 4.44% | ||

Hedera Hashgraph (HBAR)

Hedera Hashgraph (HBAR)

|

$0.08174100 | $2.92 B | 5.36% | ||

Maker (MKR)

Maker (MKR)

|

$3,168.00 | $2.94 B | 0.99% | ||

Hedera (HBAR)

Hedera (HBAR)

|

$0.08210000 | $2.93 B | 5.47% | ||

VeChain (VET)

VeChain (VET)

|

$0.03969000 | $2.89 B | 3.82% | ||

Immutable (IMX)

Immutable (IMX)

|

$2.00 | $2.86 B | 9.10% | ||

Kaspa (KAS)

Kaspa (KAS)

|

$0.12033756 | $2.81 B | 1.86% | ||

Injective (INJ)

Injective (INJ)

|

$28.27 | $2.64 B | 11.61% | ||

dogwifhat (WIF)

dogwifhat (WIF)

|

$2.56 | $2.53 B | 6.39% | ||

The Graph (GRT)

The Graph (GRT)

|

$0.25219594 | $2.39 B | 3.63% | ||

Optimism (OP)

Optimism (OP)

|

$2.24 | $2.34 B | 4.50% | ||

Pepe (PEPE)

Pepe (PEPE)

|

$0.00000514 | $2.16 B | 2.09% | ||

Monero (XMR)

Monero (XMR)

|

$116.02 | $2.14 B | -3.78% | ||

Theta Network (THETA)

Theta Network (THETA)

|

$2.08 | $2.07 B | 5.73% | ||

Fantom (FTM)

Fantom (FTM)

|

$0.68599822 | $1.92 B | 2.13% | ||

Core (CORE)

Core (CORE)

|

$2.07 | $1.83 B | -5.10% | ||

Lido DAO (LDO)

Lido DAO (LDO)

|

$1.99 | $1.78 B | 3.69% | ||

Celestia (TIA)

Celestia (TIA)

|

$9.96 | $1.77 B | -3.67% | ||

Bitget Token (BGB)

Bitget Token (BGB)

|

$1.26 | $1.76 B | 2.06% | ||

Fetch.ai (FET)

Fetch.ai (FET)

|

$2.04 | $1.73 B | 6.56% | ||

Arweave (AR)

Arweave (AR)

|

$24.91 | $1.63 B | 5.89% | ||

Sui (SUI)

Sui (SUI)

|

$1.24 | $1.61 B | -1.28% | ||

THORChain (RUNE)

THORChain (RUNE)

|

$4.75 | $1.59 B | -0.46% | ||

Pendle (PENDLE)

Pendle (PENDLE)

|

$6.18 | $1.48 B | 2.41% | ||

Sei (SEI)

Sei (SEI)

|

$0.52020000 | $1.46 B | 5.34% | ||

Beam (BEAM)

Beam (BEAM)

|

$0.02677596 | $1.42 B | 4.62% | ||

Algorand (ALGO)

Algorand (ALGO)

|

$0.17470000 | $1.42 B | 4.20% | ||

Render Token (RNDR)

Render Token (RNDR)

|

$8.02 | $3.08 B | 5.04% | ||

Jupiter (JUP)

Jupiter (JUP)

|

$0.99558744 | $1.34 B | 5.84% | ||

FLOKI (FLOKI)

FLOKI (FLOKI)

|

$0.00013938 | $1.33 B | 4.61% | ||

Ethena (ENA)

Ethena (ENA)

|

$0.93400000 | $1.32 B | -0.40% | ||

Bitcoin SV (BSV)

Bitcoin SV (BSV)

|

$66.95 | $1.32 B | 4.18% | ||

Gala (GALA)

Gala (GALA)

|

$0.04304000 | $1.32 B | 8.91% | ||

Flow (FLOW)

Flow (FLOW)

|

$0.87800000 | $1.32 B | 3.59% | ||

Neo (NEO)

Neo (NEO)

|

$18.33 | $1.29 B | 4.35% | ||

Quant (QNT)

Quant (QNT)

|

$106.50 | $1.28 B | 5.62% | ||

Aave (AAVE)

Aave (AAVE)

|

$86.14 | $1.27 B | 3.06% | ||

Flare (FLR)

Flare (FLR)

|

$0.03254723 | $1.26 B | 3.96% | ||

BitTorrent (New) (BTT)

BitTorrent (New) (BTT)

|

$0.00000125 | $1.21 B | 0.04% | ||

MultiversX (EGLD)

MultiversX (EGLD)

|

$40.94 | $1.10 B | 3.98% | ||

SingularityNET (AGIX)

SingularityNET (AGIX)

|

$0.84522000 | $1.08 B | 6.94% | ||

Wormhole (W)

Wormhole (W)

|

$0.58899823 | $1.06 B | 5.24% | ||

Huobi Token (HT)

Huobi Token (HT)

|

$0.63260900 | $101.09 M | 5.79% | ||

dYdX (Native) (DYDX)

dYdX (Native) (DYDX)

|

$2.20 | $1.02 B | 7.94% | ||

Axie Infinity (AXS)

Axie Infinity (AXS)

|

$7.08 | $1.01 B | 3.94% | ||

eCash (XEC)

eCash (XEC)

|

$0.00005102 | $1.01 B | 2.65% | ||

The Sandbox (SAND)

The Sandbox (SAND)

|

$0.44110000 | $994.28 M | 4.30% | ||

Ronin (RON)

Ronin (RON)

|

$3.12 | $978.84 M | 2.15% | ||

Chiliz (CHZ)

Chiliz (CHZ)

|

$0.10900000 | $963.78 M | 0.32% | ||

Bonk (BONK)

Bonk (BONK)

|

$0.00001464 | $954.62 M | 4.24% | ||

Tezos (XTZ)

Tezos (XTZ)

|

$0.97400000 | $950.20 M | 1.54% | ||

Synthetix (SNX)

Synthetix (SNX)

|

$2.85 | $933.86 M | 2.53% | ||

dYdX (DYDX)

dYdX (DYDX)

|

$2.21 | $685.40 M | 8.57% | ||

Conflux (CFX)

Conflux (CFX)

|

$0.23570000 | $928.60 M | 4.56% | ||

Worldcoin (WLD)

Worldcoin (WLD)

|

$4.92 | $926.99 M | 2.56% | ||

Akash Network (AKT)

Akash Network (AKT)

|

$3.95 | $923.63 M | 7.73% | ||

Starknet (STRK)

Starknet (STRK)

|

$1.26 | $920.48 M | 3.44% | ||

ORDI (ORDI)

ORDI (ORDI)

|

$43.78 | $919.48 M | 7.02% | ||

JasmyCoin (JASMY)

JasmyCoin (JASMY)

|

$0.01832300 | $904.59 M | 3.97% | ||

Pyth Network (PYTH)

Pyth Network (PYTH)

|

$0.60180000 | $895.59 M | 4.80% | ||

Nervos Network (CKB)

Nervos Network (CKB)

|

$0.02017600 | $883.70 M | -2.98% | ||

Gnosis (GNO)

Gnosis (GNO)

|

$340.90 | $876.38 M | 3.03% | ||

Mina (MINA)

Mina (MINA)

|

$0.79777042 | $868.31 M | 5.76% | ||

EOS (EOS)

EOS (EOS)

|

$0.75280000 | $842.84 M | 3.99% | ||

Decentraland (MANA)

Decentraland (MANA)

|

$0.43670734 | $833.38 M | 4.25% |

Try to search another coin

ch80 Yes