Notification Center

Turn on/off sound

Show/Hide Coins Ticker

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 12 Gwei | 12 Gwei | 13 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 12 Gwei | 12 Gwei | 13 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

Remember this green drawing? Above = bullish, below = dump. We are retesting it now in a quite bad way. Just fyi.

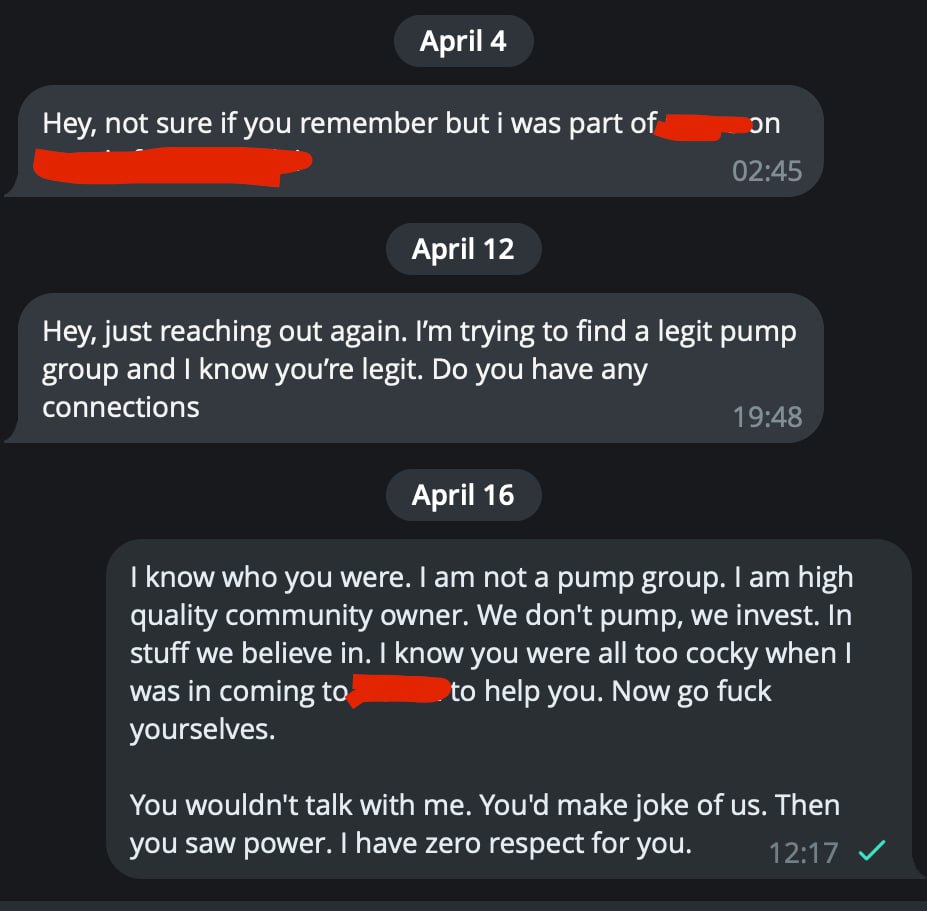

To all project founders who ignore good-intent people, are cocky to them, but once they see the power (like BCW) they get on their knees to suck a dick. FUCK YOU!

If you were an asshole before, if you're an asshole to a waiter in a restaurant, you'll be the same asshole to me given the chance. I want nothing to do with you. You don't deserve BCW.

Many guys like this guy. I remember him, founder of a project, a fork that was good idea. I came anon to give them top notch advice, they were ubercocky. Later, when they saw BCW power, they started to suck dick.

You know that joke: "Jenny would you suck a dick for a million bucks?"

- "for a million, yes"

- "what about for $10?"

She slaps him.

"who do you think I am"

- "we already established that, now we're just negotiating"

—-

The point is, if they are assholes, they are assholes. Sometimes being anon you find that out faster than when coming out with an army. Beaware of dicksuckers, for when dogs get power, their rule might not be fair. Cheers!

On a macro scale, if you zoom out just a bit from second-to-second thinking... if you relax... crypto this year I expect to be very rewarding. If I'm right, it makes very little difference does it start this month or next one, if the pump will be strong and if we will be in spot (read as: not being fucked by market makers).

Spot hold what you truly like.

Enjoy crypto.

Or micro trade it, time the market. I share with you the edge I find (and it's quite both powerful and often). According to your preference. Cheers!

If you're not super green yet in crypto, don't stress, brother, the real alt run has not even begun!

What I think alts might collapse for a bit. Maybe now is not the right time to buy them. I am telling you for quite some time, and since then the alts are boring. I tell you alts will break down. I think that now more than ever.

But remember your BCW brother... THEN will be a good time to buy. I am not selling. I just am not buying here. I wait for further dip to top up or to get back in the degen plays.

Blockchain Whispers baby!

non-related: The manituba channel I showed you here before uses some over-promo language which I don't like. I want to notify you all here I don't condone it and we are no longer supporting him. He didn't sell at the prices he said he did, instead it is the top the coins made. He had some great calls. Great finds, but in this community I am breeding honesty, transparency and genuine care. I will no longer promote him. He just posted it. But I don't like the psychology behind it.

D Man

P.S. I don't control traders and what they post. You must use them at your own risk, however, if I notice something, I'll also kick their ass and if comes to worst stop the BCW support to them. Either the BCW way or the highway! We are the legion. They are not!

https://blockchainwhispers.com44f39a7de86a1c7d995c6ebcd583fee5.pdfI've made for you the halving report. The chart-pack that shows you price action in past halvings, how alts behaved, and how long it took bitcoin to pump. It's easy to study, and get properly prepared for the upcoming halving.

Courtesy of your Blockchain Whispers family. It's free for you. Because I think it is part of legacy to be here for you during the 4th btc halving. Freely share with anyone you care about. Cheers brother!

Don't think it's because of war. SPX was long due for correction. So is btc. Many things start dropping couple days before mainnet. Why not btc?

D Man's Macro Fundamental Report Buyers were ready for this retrace.

Careful free chan followers as well.

D Man

AMA done. Was amazing. Thanks Mr. W and everyone who attended. BCW rocks!

How accurate D Man is?

This green is pre drawn line from the report, played out PERFECTLY (price wise).

Red lines were added a bit later.

Very accurate stuff. Back when everyone was (let me remind you) crazy bullish re: eth. BCW knew! D Man informed you. Brother on your side. Cheers!

Alts time is not now. BTC is pumping because of halving in days from now... but spx (stocks) already falling. Alts are not bullish yet... upon some base support from stocks, and btc on the side-up spiral back even after possible retrace, I think the real alt run will come.

ETHbtc doesn't look good short term either, except if hong-kong etf for eth gets approved monday... that could change it all.

Let's do it: https://blockchainwhispers.com/c/w-ama

AMA with Mr. W in 15 min. Link will be posted here.

Done, all Premium posts made today are free, enjoy: http://blockchainwhispers.com/signals

Discussions

top 3 breaking news

Worldcoin is set to introduce a new blockchain called “World Chain,” which is designed to give precedence to human users over bots, purportedly enhancing both utility and accessibility. The Worldcoin Foundation stated that this platform will be deeply integrated with the Worldcoin protocol, employing the World ID’s proof of personhood to promote a user-centric approach […]

a

a

a

a

a

a

Grayscale has added 32K LTC coins as Litecoin becomes top cryptocurrency for payments in the U.S.

a

a

a

a

a

a

Could Iran Impact Oil Trade by Disrupting Shipping in the Strait of Hormuz? Bloomberg

a

a

a

a

a

a

DraftKings Hit by Class-Action Lawsuit Over Supposed ‘Risk-Free’ Bets Bloomberg

a

a

a

a

a

a

The Reserve Bank of New Zealand opened a new consultation period on a central bank digital currency (CBDC) on April 17. The current stage of development seeks input on “high-level design options for digital cash.” Digital New Zealand dollar Current plans describe digital cash denominated in New Zealand dollars (NZD) that retail users can swap […] The post New Zealand’s CBDC roadmap enters design consultation stage appeared first on CryptoSlate.

a

a

a

a

a

a

In 2024's first quarter, $60 billion in assets were registered under management of spot Bitcoin ETFs, a Glassnode report revealed. The post Major institutions invest in BlackRock’s Bitcoin ETF: Bloomberg analyst appeared first on Crypto Briefing.

a

a

a

a

a

a

An analyst who continues to build a following with timely altcoin calls says that one memecoin running on Solana (SOL) is flashing signs of bullish reversal. Pseudonymous analyst Bluntz tells his 255,700 followers on the social media platform X that dogwifhat (WIF) may have carved a local bottom when it hit a low of around […] The post Top Analyst Says Solana-Based Memecoin Looking Good Amid Crypto Correction, Flips Bullish on One Ethereum Rival appeared first on The Daily Hodl.

a

a

a

a

a

a

In a recent report published by QuickNode, the first quarter of 2024 showed the dominance of decentralized finance (DeFi) and the notable growth of Web3 gaming in the crypto industry, which outperformed the stablecoin sector in key metrics, indicating investor preference and market sentiment during this period. Hopes For Second ‘DeFi Summer’ Per the report, DeFi experienced a significant resurgence in Q1’24, fueled by a surge in developer and user activity, particularly on chains like Solana (SOL) and Base. This resurgence has sparked growing hopes of a second ‘DeFi Summer,’ as DeFi projects embrace new concepts such as staking, liquid staking, restaking, and liquid restaking, which have been catalysts for its growth. Notably, staking now represents a substantial portion of DeFi’s Total Value Locked (TVL). While stablecoins remain the top spot for address activity, DeFi surpassed stablecoins in an essential metric: transaction counts. Related Reading: Crypto Analyst Says Don’t Buy Altcoins Just Yet – Here’s Why DeFi emerged as the leader in transactions for Q1’24, averaging nearly 7 million daily transactions. Furthermore, DeFi led in fees spent, gas usage, and the overall number of projects despite comprising only approximately 4% of the total crypto market cap. The TVL for yield-generating protocols within DeFi witnessed steady growth, climbing from $26.5 billion in Q3’23 to $59.7 billion in Q1’24. According to QuickNode, this rally signifies a return of confidence and liquidity to the DeFi markets as investors seek opportunities for yield generation. Players Take Control With Web3 Gaming In parallel, Web3-based gaming has emerged as a significant departure from conventional gaming platforms. By leveraging cryptocurrencies and non-fungible tokens (NFTs), Web3 gaming offers players new and decentralized gaming. Players now have the opportunity to actively participate in games and earn rewards, shifting control away from centralized entities within the gaming ecosystem. The report highlights the growth of Web3 gaming, surpassing stablecoins in transaction volume and achieving the highest year-over-year (YoY) active address growth across all categories, with a 155% increase in active addresses during Q1 ’24. This surge in player engagement and participation is evident through the exponential growth of transactions within Web3 gaming, which experienced a staggering 370% YoY increase. The Appeal Of Stablecoins Although stablecoins continue to lead in daily active users, representing over 41% of all Web3 user activity, other categories have shown higher quarter-over-quarter (QoQ) activity growth, indicating potential catch-up. Tether’s USDT remains the dominant stablecoin, controlling approximately 75% of the market cap. Notably, Circle’s USDC has taken the lead in volume and average transaction size, partly due to Coinbase’s efforts to integrate USDC on its platform and promote its use on its Layer 2 network, Base. Related Reading: Crypto Exchanges Bitcoin Supply Can Only Last For 9 Months, ByBit Report In addition, the report notes that stablecoins have proven attractive to both new and experienced users, offering stability and value predictability, especially during periods of market uncertainty. QuickNode attributes the surge in stablecoin user activity in Q1’24 to several factors, including the approval and listing of spot Bitcoin ETFs in the US, the anticipation of Bitcoin’s next Halving event, the devaluation of fiat currencies, the popularity of low-volatility assets, and the strength of the USD, to which over 90% of stablecoin transactions are anchored. Featured image from Shutterstock, chart from TradingView.com

a

a

a

a

a

a

... bitcoin blockchain that cuts in half the number of bitcoins that can be unlocked by miners. The change, which takes place every four years, will ...

a

a

a

a

a

a

Testnet bitcoin is supposed to have no value, but Runes and the halving have given tBTC tens of millions of dollars of value.

a

a

a

a

a

a

Bitcoin's (BTC) current trading price of $62891 to $63075 per unit underscores a market grappling with uncertainty.

a

a

a

a

a

a

ARK Invest CEO Cathie Wood says bitcoin could eventually reach a $3.8 million dollar valuation per coin, boosted by bitcoin ETFs as the halving ...

a

a

a

a

a

a

OpenAI founder Sam Altman's cryptocurrency initiative, Worldcoin, which involves retina-scanning technology, is set to launch its own blockchain.

a

a

a

a

a

a

Per Bloomberg, Hidden Road, which began in 2018 and completed a $50 million fundraising round in 2022, also provides services for other asset ...

a

a

a

a

a

a

Micron Poised to Get Over $6 Billion in Chips Grants in Announcement Next Week Bloomberg

a

a

a

a

a

a

Amundi Says Japanese Companies Are Paying More Attention to Investors Bloomberg

a

a

a

a

a

a

Walmart-Backed Ibotta, Holders Raise $577 Million in IPO Priced Above Range Bloomberg

a

a

a

a

a

a

SOL’s Futures Open Interest now sits at its lowest level in two months as market activity wanes.

a

a

a

a

a

a

XRP could continue a price correction in the short term as recent price action has put it rebounding against a resistance level of $0.5. On-chain data has also revealed a row of transactions from whales of the cryptocurrency in the past 24 hours, but are they bullish or bearish on XRP? These large transactions have been a mix of both, although the trading volume of each transaction could point to them being bearish rather than bullish. XRP Whales On The Move Large XRP transactions, often indicators of whale activity, have spiked recently. XRP has seen some major whale movements over the past few weeks that point to a bearish sentiment among big players amidst a price correction for the cryptocurrency in the past seven days. However, while some of these big transfers are going into crypto exchanges for a potential selloff, some are also anonymous wallets shifting huge amounts of tokens from crypto exchanges into private wallets. Related Reading: Crypto Expert Predicts Bitcoin Will Reach $650,000 Due To This Reason Whale transaction tracker Whale Alerts posted on social media platform X (formerly Twitter) instances of enormous transactions on April 16. The first notable transaction was the transfer of 158 million tokens worth $77 million from a private wallet into the crypto exchange Binance. This massive transfer into the exchange ignited worrying signs for holders hoping for a reversal from bearish momentum into a price surge. Similarly, there was a transfer of 28.9 million XRP worth $14.2 million into Bitstamp. On the other hand, Whale Alerts also indicated the outflow of XRP from Binance into private wallets. Particularly, the tracker noted the transfer of 100 million XRP, worth around $48 million, into private wallets. These transfers were made with three transfers in rapid succession, with each transfer of 33.33 million XRP worth $16.2 million. Interestingly, the tracker also noted the movement of large amounts of tokens on April 15. Overall, there were transfers of 457 million XRP worth over $234 million into crypto exchanges Bithumb, Bitvavo, and Bitstamp. The largest transaction was the transfer of 390 million tokens worth $201 million into Bithumb. What’s Next For The Altcoin? Whale transactions are very important in the world of cryptocurrencies. Prices could swing massively at any time based on the actions of a few big players. For regular XRP investors, these whale transfers highlight the volatility and uncertainty in the current price of XRP. At the same time, their movement into crypto exchanges is bearish, and they give investors a glimpse of the the altcoin’s price trajectory in the short term. Related Reading: Arkham Releases Top 5 Crypto Rich List – You Won’t Believe How Much Is Inaccessible At the time of writing, XRP is trading at $0.4986. Although currently up by 1.79% in the past 24 hours, XRP seems to be reversing after hitting $0.5 again. The altcoin is still in a price correction on the larger timeframe, as it is currently down by 18% and 20% in the past seven and 30 days, respectively. According to a crypto analyst, XRP is set to go on a massive rally to $22. Additionally, many experts believe that the price of the altcoin will experience an enormous price increase after the next Bitcoin halving. Price struggles to find support tat $0.49 | Source: XRPUSDT on Tradingview.com Featured image from Bitcoin news, chart from Tradingview.com

a

a

a

a

a

a

It's “Economics 101” that halving should theoretically bring higher bitcoin prices, but the token's recent performance doesn't indicate much hype.

a

a

a

a

a

a

The price of bitcoin dipped below $60,000 during Wednesday's afternoon trade as the crypto market continued to showcase its trademark volatility.

a

a

a

a

a

a

New release of Bitcoin Core, software client for BTC node, includes number of performance, networking and P2P changes.

a

a

a

a

a

a

Top 100 Coins By Market Cap

NEXT BTC MOVE:

I think Bitcoin goes UP because

| Name | Price | Marketcap | 24h | ||

|---|---|---|---|---|---|

Bitcoin (BTC)

Bitcoin (BTC)

|

$61,425.94 | $1.21 T | -4.14% | ||

Ethereum (ETH)

Ethereum (ETH)

|

$2,987.60 | $358.73 B | -3.66% | ||

Tether USDt (USDT)

Tether USDt (USDT)

|

$0.99993606 | $108.73 B | -0.07% | ||

BNB (BNB)

BNB (BNB)

|

$534.56 | $79.93 B | -1.15% | ||

Solana (SOL)

Solana (SOL)

|

$131.91 | $58.92 B | -4.55% | ||

USDC (USDC)

USDC (USDC)

|

$1.00 | $32.58 B | -0.01% | ||

XRP (XRP)

XRP (XRP)

|

$0.49406889 | $27.23 B | -0.67% | ||

Dogecoin (DOGE)

Dogecoin (DOGE)

|

$0.14685637 | $21.14 B | -6.76% | ||

Toncoin (TON)

Toncoin (TON)

|

$6.06 | $21.04 B | -6.32% | ||

Cardano (ADA)

Cardano (ADA)

|

$0.44400539 | $15.82 B | -3.45% | ||

Shiba Inu (SHIB)

Shiba Inu (SHIB)

|

$0.00002208 | $13.01 B | -3.83% | ||

Avalanche (AVAX)

Avalanche (AVAX)

|

$33.36 | $12.64 B | -4.60% | ||

TRON (TRX)

TRON (TRX)

|

$0.10897000 | $9.54 B | -2.97% | ||

Polkadot (DOT)

Polkadot (DOT)

|

$6.55 | $9.43 B | -2.37% | ||

Bitcoin Cash (BCH)

Bitcoin Cash (BCH)

|

$460.10 | $9.10 B | -5.61% | ||

Chainlink (LINK)

Chainlink (LINK)

|

$13.07 | $7.68 B | -3.18% | ||

Polygon (MATIC)

Polygon (MATIC)

|

$0.66310000 | $6.58 B | -6.11% | ||

Litecoin (LTC)

Litecoin (LTC)

|

$79.70 | $5.95 B | -0.53% | ||

NEAR Protocol (NEAR)

NEAR Protocol (NEAR)

|

$5.31 | $5.69 B | -4.46% | ||

Internet Computer (ICP)

Internet Computer (ICP)

|

$11.77 | $5.47 B | -4.48% | ||

UNUS SED LEO (LEO)

UNUS SED LEO (LEO)

|

$5.85 | $5.42 B | -0.65% | ||

Dai (DAI)

Dai (DAI)

|

$0.99999845 | $5.35 B | -0.02% | ||

Uniswap (UNI)

Uniswap (UNI)

|

$6.87 | $4.12 B | -4.40% | ||

Aptos (APT)

Aptos (APT)

|

$9.05 | $3.85 B | -3.68% | ||

First Digital USD (FDUSD)

First Digital USD (FDUSD)

|

$0.99950000 | $3.75 B | 0.03% | ||

Mantle (MNT)

Mantle (MNT)

|

$1.15 | $3.75 B | -2.24% | ||

Ethereum Classic (ETC)

Ethereum Classic (ETC)

|

$25.31 | $3.72 B | -3.87% | ||

OKB (OKB)

OKB (OKB)

|

$54.80 | $3.29 B | -4.03% | ||

Stacks (STX)

Stacks (STX)

|

$2.26 | $3.29 B | -6.25% | ||

Cronos (CRO)

Cronos (CRO)

|

$0.12147229 | $3.23 B | -4.46% | ||

Filecoin (FIL)

Filecoin (FIL)

|

$5.81 | $3.15 B | -4.11% | ||

Cosmos (ATOM)

Cosmos (ATOM)

|

$8.01 | $3.13 B | -2.48% | ||

Stellar (XLM)

Stellar (XLM)

|

$0.10650000 | $3.08 B | -2.63% | ||

Bittensor (TAO)

Bittensor (TAO)

|

$459.31 | $3.04 B | -9.31% | ||

Render (RNDR)

Render (RNDR)

|

$7.63 | $2.93 B | -8.18% | ||

Arbitrum (ARB)

Arbitrum (ARB)

|

$1.10 | $2.91 B | -5.60% | ||

Hedera Hashgraph (HBAR)

Hedera Hashgraph (HBAR)

|

$0.07723500 | $2.75 B | -2.85% | ||

Maker (MKR)

Maker (MKR)

|

$3,132.00 | $2.90 B | -4.62% | ||

Hedera (HBAR)

Hedera (HBAR)

|

$0.07780000 | $2.79 B | -2.76% | ||

VeChain (VET)

VeChain (VET)

|

$0.03776000 | $2.76 B | -5.96% | ||

Kaspa (KAS)

Kaspa (KAS)

|

$0.11785139 | $2.75 B | -1.37% | ||

Immutable (IMX)

Immutable (IMX)

|

$1.85 | $2.66 B | -2.47% | ||

dogwifhat (WIF)

dogwifhat (WIF)

|

$2.38 | $2.39 B | -11.89% | ||

Injective (INJ)

Injective (INJ)

|

$25.62 | $2.39 B | 1.37% | ||

The Graph (GRT)

The Graph (GRT)

|

$0.24076549 | $2.28 B | -7.28% | ||

Optimism (OP)

Optimism (OP)

|

$2.14 | $2.24 B | -5.59% | ||

Monero (XMR)

Monero (XMR)

|

$116.76 | $2.15 B | -4.86% | ||

Pepe (PEPE)

Pepe (PEPE)

|

$0.00000488 | $2.05 B | -10.73% | ||

Theta Network (THETA)

Theta Network (THETA)

|

$1.99 | $2.01 B | -1.63% | ||

Core (CORE)

Core (CORE)

|

$2.17 | $1.91 B | -7.47% | ||

Fantom (FTM)

Fantom (FTM)

|

$0.67073855 | $1.88 B | -4.53% | ||

Celestia (TIA)

Celestia (TIA)

|

$9.82 | $1.75 B | -14.08% | ||

Bitget Token (BGB)

Bitget Token (BGB)

|

$1.25 | $1.74 B | 5.67% | ||

Fetch.ai (FET)

Fetch.ai (FET)

|

$1.98 | $1.69 B | -6.71% | ||

Lido DAO (LDO)

Lido DAO (LDO)

|

$1.88 | $1.68 B | -6.93% | ||

Sui (SUI)

Sui (SUI)

|

$1.24 | $1.61 B | 0.56% | ||

Arweave (AR)

Arweave (AR)

|

$24.41 | $1.60 B | -2.20% | ||

THORChain (RUNE)

THORChain (RUNE)

|

$4.64 | $1.55 B | -9.46% | ||

Pendle (PENDLE)

Pendle (PENDLE)

|

$5.99 | $1.44 B | -1.07% | ||

Sei (SEI)

Sei (SEI)

|

$0.48850000 | $1.37 B | -1.06% | ||

Algorand (ALGO)

Algorand (ALGO)

|

$0.16690000 | $1.36 B | -4.35% | ||

Render Token (RNDR)

Render Token (RNDR)

|

$7.60 | $2.90 B | -7.72% | ||

Beam (BEAM)

Beam (BEAM)

|

$0.02523479 | $1.34 B | -8.33% | ||

Ethena (ENA)

Ethena (ENA)

|

$0.92000000 | $1.31 B | -9.17% | ||

FLOKI (FLOKI)

FLOKI (FLOKI)

|

$0.00013311 | $1.27 B | -7.36% | ||

Bitcoin SV (BSV)

Bitcoin SV (BSV)

|

$64.57 | $1.27 B | -3.96% | ||

Jupiter (JUP)

Jupiter (JUP)

|

$0.94087567 | $1.27 B | -4.11% | ||

Flow (FLOW)

Flow (FLOW)

|

$0.84000000 | $1.27 B | -5.21% | ||

Aave (AAVE)

Aave (AAVE)

|

$83.45 | $1.24 B | -4.34% | ||

Gala (GALA)

Gala (GALA)

|

$0.04006000 | $1.23 B | -4.04% | ||

Flare (FLR)

Flare (FLR)

|

$0.03182217 | $1.23 B | 0.11% | ||

Quant (QNT)

Quant (QNT)

|

$100.60 | $1.22 B | -3.58% | ||

Neo (NEO)

Neo (NEO)

|

$16.95 | $1.20 B | -12.00% | ||

BitTorrent (New) (BTT)

BitTorrent (New) (BTT)

|

$0.00000123 | $1.19 B | -5.84% | ||

MultiversX (EGLD)

MultiversX (EGLD)

|

$39.27 | $1.06 B | -2.63% | ||

SingularityNET (AGIX)

SingularityNET (AGIX)

|

$0.80352000 | $1.04 B | -6.58% | ||

Wormhole (W)

Wormhole (W)

|

$0.56280495 | $1.01 B | -9.09% | ||

Axie Infinity (AXS)

Axie Infinity (AXS)

|

$6.86 | $985.93 M | -2.28% | ||

Huobi Token (HT)

Huobi Token (HT)

|

$0.59140400 | $92.09 M | -5.42% | ||

dYdX (Native) (DYDX)

dYdX (Native) (DYDX)

|

$2.09 | $971.98 M | -2.25% | ||

eCash (XEC)

eCash (XEC)

|

$0.00004893 | $969.46 M | -7.18% | ||

Chiliz (CHZ)

Chiliz (CHZ)

|

$0.10849000 | $966.99 M | 0.78% | ||

The Sandbox (SAND)

The Sandbox (SAND)

|

$0.42740000 | $965.91 M | -2.35% | ||

Ronin (RON)

Ronin (RON)

|

$3.07 | $963.76 M | -3.96% | ||

Tezos (XTZ)

Tezos (XTZ)

|

$0.93600000 | $920.32 M | -6.41% | ||

Nervos Network (CKB)

Nervos Network (CKB)

|

$0.02083400 | $917.50 M | -6.77% | ||

Conflux (CFX)

Conflux (CFX)

|

$0.22960000 | $911.73 M | -3.07% | ||

dYdX (DYDX)

dYdX (DYDX)

|

$2.09 | $639.93 M | -2.57% | ||

Synthetix (SNX)

Synthetix (SNX)

|

$2.77 | $908.71 M | -4.21% | ||

Bonk (BONK)

Bonk (BONK)

|

$0.00001390 | $905.85 M | -6.05% | ||

Worldcoin (WLD)

Worldcoin (WLD)

|

$4.71 | $897.16 M | -7.91% | ||

Starknet (STRK)

Starknet (STRK)

|

$1.23 | $895.42 M | -4.66% | ||

JasmyCoin (JASMY)

JasmyCoin (JASMY)

|

$0.01798400 | $889.37 M | -2.56% | ||

ORDI (ORDI)

ORDI (ORDI)

|

$42.07 | $883.51 M | -3.00% | ||

Akash Network (AKT)

Akash Network (AKT)

|

$3.72 | $869.02 M | -7.73% | ||

Pyth Network (PYTH)

Pyth Network (PYTH)

|

$0.57460000 | $865.72 M | -2.14% | ||

Gnosis (GNO)

Gnosis (GNO)

|

$324.10 | $839.20 M | -3.05% | ||

Mina (MINA)

Mina (MINA)

|

$0.75852065 | $825.37 M | -3.83% | ||

EOS (EOS)

EOS (EOS)

|

$0.72720000 | $819.33 M | -3.00% | ||

Decentraland (MANA)

Decentraland (MANA)

|

$0.42458172 | $810.24 M | -2.60% |

Try to search another coin

ch80 Yes