Notification Center

Turn on/off sound

Show/Hide Coins Ticker

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 14 Gwei | 14 Gwei | 18 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 14 Gwei | 14 Gwei | 18 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

I might have something good to really good for you soon (days)... It is good for small wallets, a bit trouble for medium, a skip for whales this time due to liquidity.

It's a narrative change caught by so few. I love the opportunity and I think you'll be excited we discovered this timely as well. Cheers!

Halved. Weekend volume. Don't trust it. Have a nice weekend instead. Cheers!

P.S. The report is free. I think halving event is crypto public service.

So far it is predictable as we are heading into halving the price shows some green. It's a hook more than likely. S&P500 is continuing in its correction, and this gap is basically retail money expecting immediate post-halving results. Check the report, and then you'll know whether to expect immediate 100x long or not. Cheers my friend!

Halving is here. Miners rewards cut in half. You have the report here https://t.me/blockchainwhispersbaby/11349 about what to expect in price if history is to be asked. Cheers my friend!

Remember this green drawing? Above = bullish, below = dump. We are retesting it now in a quite bad way. Just fyi.

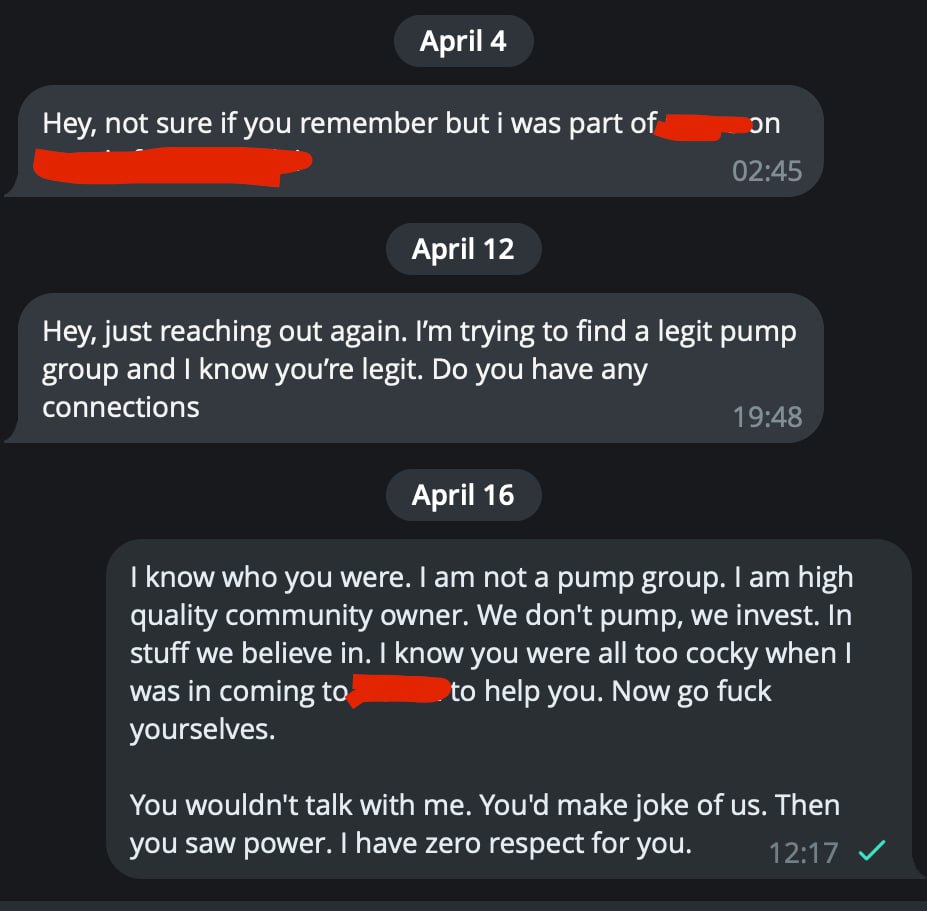

To all project founders who ignore good-intent people, are cocky to them, but once they see the power (like BCW) they get on their knees to suck a dick. FUCK YOU!

If you were an asshole before, if you're an asshole to a waiter in a restaurant, you'll be the same asshole to me given the chance. I want nothing to do with you. You don't deserve BCW.

Many guys like this guy. I remember him, founder of a project, a fork that was good idea. I came anon to give them top notch advice, they were ubercocky. Later, when they saw BCW power, they started to suck dick.

You know that joke: "Jenny would you suck a dick for a million bucks?"

- "for a million, yes"

- "what about for $10?"

She slaps him.

"who do you think I am"

- "we already established that, now we're just negotiating"

—-

The point is, if they are assholes, they are assholes. Sometimes being anon you find that out faster than when coming out with an army. Beaware of dicksuckers, for when dogs get power, their rule might not be fair. Cheers!

On a macro scale, if you zoom out just a bit from second-to-second thinking... if you relax... crypto this year I expect to be very rewarding. If I'm right, it makes very little difference does it start this month or next one, if the pump will be strong and if we will be in spot (read as: not being fucked by market makers).

Spot hold what you truly like.

Enjoy crypto.

Or micro trade it, time the market. I share with you the edge I find (and it's quite both powerful and often). According to your preference. Cheers!

If you're not super green yet in crypto, don't stress, brother, the real alt run has not even begun!

What I think alts might collapse for a bit. Maybe now is not the right time to buy them. I am telling you for quite some time, and since then the alts are boring. I tell you alts will break down. I think that now more than ever.

But remember your BCW brother... THEN will be a good time to buy. I am not selling. I just am not buying here. I wait for further dip to top up or to get back in the degen plays.

Blockchain Whispers baby!

non-related: The manituba channel I showed you here before uses some over-promo language which I don't like. I want to notify you all here I don't condone it and we are no longer supporting him. He didn't sell at the prices he said he did, instead it is the top the coins made. He had some great calls. Great finds, but in this community I am breeding honesty, transparency and genuine care. I will no longer promote him. He just posted it. But I don't like the psychology behind it.

D Man

P.S. I don't control traders and what they post. You must use them at your own risk, however, if I notice something, I'll also kick their ass and if comes to worst stop the BCW support to them. Either the BCW way or the highway! We are the legion. They are not!

https://blockchainwhispers.com44f39a7de86a1c7d995c6ebcd583fee5.pdfI've made for you the halving report. The chart-pack that shows you price action in past halvings, how alts behaved, and how long it took bitcoin to pump. It's easy to study, and get properly prepared for the upcoming halving.

Courtesy of your Blockchain Whispers family. It's free for you. Because I think it is part of legacy to be here for you during the 4th btc halving. Freely share with anyone you care about. Cheers brother!

Don't think it's because of war. SPX was long due for correction. So is btc. Many things start dropping couple days before mainnet. Why not btc?

D Man's Macro Fundamental Report Buyers were ready for this retrace.

Careful free chan followers as well.

D Man

AMA done. Was amazing. Thanks Mr. W and everyone who attended. BCW rocks!

How accurate D Man is?

This green is pre drawn line from the report, played out PERFECTLY (price wise).

Red lines were added a bit later.

Very accurate stuff. Back when everyone was (let me remind you) crazy bullish re: eth. BCW knew! D Man informed you. Brother on your side. Cheers!

Discussions

top 3 breaking news

Geoff Kendrick, head of digital assets research at Standard Chartered, recently reiterated the bank’s ambitious Bitcoin price target of $150,000 by the end of this year, despite current market volatility and geopolitical tensions. In a comprehensive interview with BNN Bloomberg, Kendrick highlighted the significant role of ETF inflows and upcoming halving events in driving Bitcoin’s price. Why Bitcoin Is Set For A Rally To $150,000 By Year-End One of the principal drivers identified by Kendrick is the remarkable influx of capital into Bitcoin ETFs within the United States. Since the inception of these ETFs in early 2024, they have witnessed approximately $12 billion in net inflows. Kendrick highlighted the significance of these developments, stating, “The ETF inflows in the US have dominated really the demand supply metrics in 2024 so far. This is huge in terms of how the ETFs have gone so far.” He drew parallels between the current trends in Bitcoin and the historical performance of gold following the introduction of gold ETFs. Kendrick elaborated on the potential scale of this trend by projecting, “From the start of this year to when the ETF market in the US is mature, we’ll get between $50 and $100 billion of inflow.” Related Reading: Conservative Projection Places Bitcoin At $245,000 In 5 Years In addition to the ETF inflows, the Bitcoin halving event was identified as another pivotal factor. This event, which reduces the reward for mining new blocks thereby halving the rate of new Bitcoin entering circulation, is set to reduce the daily production from 900 BTC to 450 BTC. Although Kendrick mentioned that this halving might be “less important than previous ones,” he still considers it significant in the short-term supply dynamics. He stated, “Obviously, once we have the halving […], you have only half as many new coins, so that helps at the margin.” Responding to questions about market skepticism, particularly criticism from figures such as JPMorgan CEO Jamie Dimon, who described Bitcoin as a “Ponzi scheme,” Kendrick offered a defense of Bitcoin’s underlying technology. He argued, “There’s a lot of people out there that don’t understand the basic methodology behind Bitcoin. And it’s really that blockchain technology, which is where the value is medium term.” Looking Further Ahead Kendrick continued, explaining the transformative potential of blockchain technology not just for financial services but across various industries, “Bitcoin is the first in on that. It’s the largest asset at the moment, makes up for more than 50% of the crypto market, but that opens up the Ethereum and other use cases, which quite frankly, over the next five to 10 years, you can easily see a lot of traditional finance go on chain.” Related Reading: Market Expert Predicts New Paradigm For Bitcoin: ‘Days Under $100,000 Numbered’ Furthermore, he addressed the recent market volatility, noting that Bitcoin had experienced a significant sell-off just prior to the halving, with $260 million in Bitcoin leverage positions being liquidated. The Standard Chartered exec interpreted this as a market correction that might set the stage for a healthier build-up post-halving, saying, “We’ve had a large move lower in Bitcoin. Specifically, on Saturday last weekend, there were $260 million Bitcoin leverage positions that were liquidated. So the market is now looking much more square going into the halving, if you like, in terms of leverage.” Summarizing his perspective on the future trajectory of Bitcoin, Kendrick expressed a confident outlook, projecting not only recovery but a robust increase in Bitcoin’s price, driven by both the maturation of the ETF market and ongoing technological advancements. His vision for Bitcoin by the end of 2025 reaches even beyond the current year’s target, predicting a potential value of $200,000 per coin. At press time, BTC traded at $66,556. Featured image created with DALL·E, chart from TradingView.com

a

a

a

a

a

a

Amid a volatile crypto market, DeeStream's presale accelerates as Tether expands supply and Tezos holders search for robust investment opportunities. #partnercontent

a

a

a

a

a

a

At least two lawyers from the US SEC have resigned in response to the agency being sanctioned by a federal judge for "gross abuse of power" in a case against a crypto company.

a

a

a

a

a

a

San Francisco-based company Ripple argues that the civil penalty should not exceed $10 million

a

a

a

a

a

a

Amid fluctuating markets, Milei Moneda gains traction in its presale, while Solana and Binance Coin seek recovery from recent downturns. #partnercontent

a

a

a

a

a

a

Crypto analyst Crypto Gains reviews 5th Scape (5SCAPE), a project aiming to become the “world’s first AR & VR ecosystem connecting the smartest minds.” This [...]

a

a

a

a

a

a

The world’s largest asset manager, BlackRock, has registered 70 straight days of inflows for its spot Bitcoin exchange-traded fund, IBIT.

a

a

a

a

a

a

Analysts are pondering the effects of the approval of the Rebuilding Economic Prosperity and Opportunity (REPO) Act by the U.S. House. The execution of seizures for over $6 billion of Russian assets held in U.S. institutions would “supercharge” the de-dollarization efforts of several nations. This is due to the possibility of having their assets seized […]

a

a

a

a

a

a

Bitcoin (BTC) price is trading with a bullish bias following a successful halving event that has since renewed optimism in the market.

a

a

a

a

a

a

BNB price is attempting a fresh increase from the $550 zone. The price cleared the $600 resistance and might extend its increase above $630. BNB price started a fresh increase after it cleared the $550 resistance zone. The price is now trading above $580 and the 100 simple moving average (4 hours). There is a key bullish trend line forming with support at $592 on the 4-hour chart of the BNB/USD pair (data source from Binance). The pair could gain bullish momentum if it clears the $608-$610 resistance zone. BNB Price Gains Strength After forming a base above the $520 level, BNB price started a fresh increase. There was a steady increase above the $550 and $565 resistance levels, like Ethereum and Bitcoin. The bulls pushed the price above the $580 pivot level and the 61.8% Fib retracement level of the downward wave from the $630 swing high to the $512 low. More importantly, the price is now trading above $580 and the 100 simple moving average (4 hours). It is consolidating just above the 76.4% Fib retracement level of the downward wave from the $630 swing high to the $512 low. There is also a key bullish trend line forming with support at $592 on the 4-hour chart of the BNB/USD pair. Source: BNBUSD on TradingView.com Immediate resistance is near the $608 level. The next resistance sits near the $630 level. A clear move above the $630 zone could send the price further higher. In the stated case, BNB price could test $650. A close above the $650 resistance might set the pace for a larger increase toward the $680 resistance. Any more gains might call for a test of the $720 level in the coming days. Are Dips Supported? If BNB fails to clear the $608 resistance, it could start a downside correction. Initial support on the downside is near the $592 level and the trend line. The next major support is near the $585 level. The main support sits at $570. If there is a downside break below the $570 support, the price could drop toward the $550 support. Any more losses could initiate a larger decline toward the $532 level. Technical Indicators 4-Hours MACD – The MACD for BNB/USD is gaining pace in the bullish zone. 4-Hours RSI (Relative Strength Index) – The RSI for BNB/USD is currently above the 50 level. Major Support Levels – $592, $585, and $570. Major Resistance Levels – $608, $630, and $650.

a

a

a

a

a

a

The following is a guest post by Brendan Cochrane, Partner at YK Law LLP. Artificial Intelligence tools could revolutionize anti-money laundering efforts in cryptocurrency transactions. These tools can analyze far more transactions quickly than any human, helping banks and law enforcement keep up with the volume of transactions, of which there are millions per day. […] The post Decoding the Black Box: How AI is unveiling the secrets of crypto money laundering appeared first on CryptoSlate.

a

a

a

a

a

a

Top 100 Coins By Market Cap

NEXT BTC MOVE:

I think Bitcoin goes UP because

| Name | Price | Marketcap | 24h | ||

|---|---|---|---|---|---|

Bitcoin (BTC)

Bitcoin (BTC)

|

$66,543.07 | $1.31 T | 0.45% | ||

Ethereum (ETH)

Ethereum (ETH)

|

$3,184.80 | $388.69 B | -1.31% | ||

Tether USDt (USDT)

Tether USDt (USDT)

|

$1.00 | $109.93 B | 0.02% | ||

BNB (BNB)

BNB (BNB)

|

$602.00 | $90.02 B | -0.66% | ||

Solana (SOL)

Solana (SOL)

|

$155.11 | $69.32 B | -0.13% | ||

USDC (USDC)

USDC (USDC)

|

$1.00 | $33.87 B | 0.01% | ||

XRP (XRP)

XRP (XRP)

|

$0.54996211 | $30.32 B | 2.54% | ||

Dogecoin (DOGE)

Dogecoin (DOGE)

|

$0.15882061 | $22.87 B | -2.24% | ||

Toncoin (TON)

Toncoin (TON)

|

$5.60 | $19.44 B | -9.71% | ||

Cardano (ADA)

Cardano (ADA)

|

$0.51457327 | $18.33 B | 0.46% | ||

Shiba Inu (SHIB)

Shiba Inu (SHIB)

|

$0.00002676 | $15.77 B | -1.66% | ||

Avalanche (AVAX)

Avalanche (AVAX)

|

$38.73 | $14.65 B | -0.70% | ||

Polkadot (DOT)

Polkadot (DOT)

|

$7.43 | $10.68 B | -1.00% | ||

Bitcoin Cash (BCH)

Bitcoin Cash (BCH)

|

$512.90 | $10.10 B | -0.29% | ||

TRON (TRX)

TRON (TRX)

|

$0.11230000 | $9.84 B | 0.41% | ||

Chainlink (LINK)

Chainlink (LINK)

|

$15.47 | $9.08 B | -2.47% | ||

NEAR Protocol (NEAR)

NEAR Protocol (NEAR)

|

$7.00 | $7.50 B | 1.65% | ||

Polygon (MATIC)

Polygon (MATIC)

|

$0.73310000 | $7.26 B | -0.82% | ||

Internet Computer (ICP)

Internet Computer (ICP)

|

$14.91 | $6.90 B | -2.64% | ||

Litecoin (LTC)

Litecoin (LTC)

|

$84.75 | $6.32 B | -1.03% | ||

Dai (DAI)

Dai (DAI)

|

$1.00 | $5.35 B | -0.02% | ||

UNUS SED LEO (LEO)

UNUS SED LEO (LEO)

|

$5.77 | $5.34 B | 0.04% | ||

Uniswap (UNI)

Uniswap (UNI)

|

$8.16 | $4.88 B | 1.60% | ||

Stacks (STX)

Stacks (STX)

|

$3.13 | $4.54 B | 7.80% | ||

Aptos (APT)

Aptos (APT)

|

$9.95 | $4.24 B | -3.96% | ||

Ethereum Classic (ETC)

Ethereum Classic (ETC)

|

$28.07 | $4.13 B | -0.72% | ||

Mantle (MNT)

Mantle (MNT)

|

$1.21 | $3.94 B | -1.52% | ||

First Digital USD (FDUSD)

First Digital USD (FDUSD)

|

$1.00 | $3.76 B | -0.01% | ||

Filecoin (FIL)

Filecoin (FIL)

|

$6.55 | $3.55 B | -2.18% | ||

Render (RNDR)

Render (RNDR)

|

$9.23 | $3.55 B | -0.66% | ||

Immutable (IMX)

Immutable (IMX)

|

$2.40 | $3.50 B | 6.58% | ||

Cronos (CRO)

Cronos (CRO)

|

$0.13120429 | $3.49 B | -0.19% | ||

Cosmos (ATOM)

Cosmos (ATOM)

|

$8.88 | $3.47 B | -0.23% | ||

Bittensor (TAO)

Bittensor (TAO)

|

$515.65 | $3.42 B | 4.83% | ||

Stellar (XLM)

Stellar (XLM)

|

$0.11710000 | $3.39 B | 0.70% | ||

Hedera Hashgraph (HBAR)

Hedera Hashgraph (HBAR)

|

$0.08912500 | $3.21 B | -3.65% | ||

OKB (OKB)

OKB (OKB)

|

$54.88 | $3.29 B | -1.48% | ||

Hedera (HBAR)

Hedera (HBAR)

|

$0.08890000 | $3.18 B | -3.79% | ||

Arbitrum (ARB)

Arbitrum (ARB)

|

$1.19 | $3.16 B | -3.47% | ||

VeChain (VET)

VeChain (VET)

|

$0.04207000 | $3.06 B | -0.59% | ||

Kaspa (KAS)

Kaspa (KAS)

|

$0.12807411 | $3.00 B | 6.32% | ||

Pepe (PEPE)

Pepe (PEPE)

|

$0.00000684 | $2.88 B | 4.83% | ||

The Graph (GRT)

The Graph (GRT)

|

$0.29986556 | $2.84 B | 0.72% | ||

dogwifhat (WIF)

dogwifhat (WIF)

|

$2.79 | $2.79 B | -8.41% | ||

Maker (MKR)

Maker (MKR)

|

$2,848.00 | $2.63 B | -5.35% | ||

Optimism (OP)

Optimism (OP)

|

$2.52 | $2.63 B | -2.38% | ||

Injective (INJ)

Injective (INJ)

|

$28.18 | $2.63 B | -3.80% | ||

Theta Network (THETA)

Theta Network (THETA)

|

$2.39 | $2.39 B | 1.71% | ||

Core (CORE)

Core (CORE)

|

$2.59 | $2.28 B | 5.96% | ||

Arweave (AR)

Arweave (AR)

|

$34.74 | $2.27 B | 3.40% | ||

Monero (XMR)

Monero (XMR)

|

$122.81 | $2.26 B | 2.06% | ||

Fantom (FTM)

Fantom (FTM)

|

$0.74645434 | $2.09 B | -5.36% | ||

Fetch.ai (FET)

Fetch.ai (FET)

|

$2.44 | $2.08 B | -2.81% | ||

Celestia (TIA)

Celestia (TIA)

|

$11.11 | $1.99 B | -4.05% | ||

Lido DAO (LDO)

Lido DAO (LDO)

|

$2.13 | $1.90 B | -0.89% | ||

THORChain (RUNE)

THORChain (RUNE)

|

$5.62 | $1.88 B | -5.83% | ||

Sei (SEI)

Sei (SEI)

|

$0.66590000 | $1.86 B | 4.80% | ||

Bitget Token (BGB)

Bitget Token (BGB)

|

$1.27 | $1.78 B | -0.95% | ||

Sui (SUI)

Sui (SUI)

|

$1.37 | $1.78 B | -3.26% | ||

FLOKI (FLOKI)

FLOKI (FLOKI)

|

$0.00017275 | $1.65 B | -3.79% | ||

Beam (BEAM)

Beam (BEAM)

|

$0.03115109 | $1.65 B | 0.38% | ||

Jupiter (JUP)

Jupiter (JUP)

|

$1.17 | $1.58 B | -3.48% | ||

Render Token (RNDR)

Render Token (RNDR)

|

$9.21 | $3.57 B | -0.45% | ||

Algorand (ALGO)

Algorand (ALGO)

|

$0.19350000 | $1.58 B | 0.18% | ||

Pendle (PENDLE)

Pendle (PENDLE)

|

$6.48 | $1.55 B | 6.36% | ||

Gala (GALA)

Gala (GALA)

|

$0.04891000 | $1.48 B | -2.53% | ||

Flow (FLOW)

Flow (FLOW)

|

$0.95000000 | $1.43 B | -1.11% | ||

Bitcoin SV (BSV)

Bitcoin SV (BSV)

|

$72.05 | $1.42 B | -0.29% | ||

Ethena (ENA)

Ethena (ENA)

|

$0.99500000 | $1.42 B | -8.38% | ||

Aave (AAVE)

Aave (AAVE)

|

$95.49 | $1.42 B | 0.75% | ||

Akash Network (AKT)

Akash Network (AKT)

|

$6.03 | $1.41 B | 46.52% | ||

Neo (NEO)

Neo (NEO)

|

$19.64 | $1.39 B | -1.71% | ||

Bonk (BONK)

Bonk (BONK)

|

$0.00002045 | $1.33 B | -3.77% | ||

Quant (QNT)

Quant (QNT)

|

$107.10 | $1.29 B | -2.87% | ||

BitTorrent (New) (BTT)

BitTorrent (New) (BTT)

|

$0.00000133 | $1.28 B | -0.99% | ||

SingularityNET (AGIX)

SingularityNET (AGIX)

|

$0.99606000 | $1.28 B | -1.84% | ||

Flare (FLR)

Flare (FLR)

|

$0.03238179 | $1.25 B | -3.76% | ||

MultiversX (EGLD)

MultiversX (EGLD)

|

$44.71 | $1.20 B | -0.66% | ||

Huobi Token (HT)

Huobi Token (HT)

|

$0.59487200 | $95.44 M | -0.57% | ||

Worldcoin (WLD)

Worldcoin (WLD)

|

$5.81 | $1.12 B | 3.29% | ||

dYdX (Native) (DYDX)

dYdX (Native) (DYDX)

|

$2.38 | $1.11 B | -0.78% | ||

Axie Infinity (AXS)

Axie Infinity (AXS)

|

$7.69 | $1.10 B | -1.60% | ||

Wormhole (W)

Wormhole (W)

|

$0.61162657 | $1.10 B | -5.25% | ||

The Sandbox (SAND)

The Sandbox (SAND)

|

$0.48600000 | $1.09 B | -1.28% | ||

eCash (XEC)

eCash (XEC)

|

$0.00005528 | $1.09 B | -0.26% | ||

Ronin (RON)

Ronin (RON)

|

$3.38 | $1.07 B | -3.43% | ||

Tezos (XTZ)

Tezos (XTZ)

|

$1.06 | $1.04 B | -1.08% | ||

dYdX (DYDX)

dYdX (DYDX)

|

$2.38 | $741.96 M | -1.07% | ||

Chiliz (CHZ)

Chiliz (CHZ)

|

$0.11628000 | $1.03 B | -2.56% | ||

Gnosis (GNO)

Gnosis (GNO)

|

$392.00 | $1.02 B | 6.70% | ||

Pyth Network (PYTH)

Pyth Network (PYTH)

|

$0.67710000 | $1.02 B | -2.30% | ||

Synthetix (SNX)

Synthetix (SNX)

|

$3.09 | $1.01 B | -2.31% | ||

ORDI (ORDI)

ORDI (ORDI)

|

$48.20 | $1.01 B | -4.51% | ||

JasmyCoin (JASMY)

JasmyCoin (JASMY)

|

$0.02038100 | $1.01 B | -2.72% | ||

Conflux (CFX)

Conflux (CFX)

|

$0.25130000 | $991.85 M | -2.01% | ||

Mina (MINA)

Mina (MINA)

|

$0.88021107 | $960.43 M | -0.72% | ||

Starknet (STRK)

Starknet (STRK)

|

$1.31 | $957.15 M | -4.04% | ||

EOS (EOS)

EOS (EOS)

|

$0.84940000 | $954.28 M | 1.80% | ||

KuCoin Token (KCS)

KuCoin Token (KCS)

|

$9.69 | $931.15 M | -0.06% | ||

Decentraland (MANA)

Decentraland (MANA)

|

$0.47950575 | $915.05 M | -0.53% |

Try to search another coin

clc7 Bitcoin