Notification Center

Turn on/off sound

Show/Hide Coins Ticker

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 12 Gwei | 12 Gwei | 15 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 12 Gwei | 12 Gwei | 15 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

Brother, our patience can be tested. It was and is tested. However, if we are determined, we can remain patient. And then, when our time does come, it will be like: "oh, already!" :)

I fully expect alt run this year. Relax now... because when the time comes, you will have plenty of excitement to look forward to.

I informed you of this top. Of bear phase, D Man's Macro fundamental report readers went into further details.. the point is, you my friend are once again at the right side of trade and expectation. There is currently not much to be made for regular spot traders, so patience is the right move.

Cheers my friend!

D Man

Mr. S just published a curious report about TIME.

Every chart consists of price and TIME. This one found an ancient method by stocks trader from seventies, adjusted by Mr. S for Bitcoin shows you when this bull cycle will reach bottom and when top according to this theory.

Very valuable report for strategising, I hope you find it useful. Unlock it here: https://blockchainwhispers.com/signals?signal_anchor=8364

I made this post (spot positions update) from Mr. M free for all now: https://blockchainwhispers.com/signals?signal_anchor=8359 Enjoy

Here's banana.

I know you're hungry. I know you want something different in life. Better. However, impatience is enemy of achievement.

How did it work for you before?

It's easy for me to write "1000x". But you know I'm ethics, trust and loyalty above and before anything. I try to write as conservative and as close to real as I can predict.

Maybe this banana will not satisfy your everpresent hunger, but 3x in slow times, might be better than 0x. Maybe that 3x will be foundation to next 10x becoming 30x. Maybe you'll skip it but will give you ideas of good ways to approach token-selection for your portfolio. Maybe it doesn't make even 3x... and only after I said all this I can say, but maybe, it also pleasantly surprises us!

While I'm waiting on the team, your BCW analysts are now checking projects with similar market category, similar development level where we have close confidence this will get and their marketcaps vs the expected marketcap at launch of this (implemented hard caps with the team in place)...

To understand, look, I don't want noobs, idiots etc. I know in most bullish days I'm not noob's favorite person as I'm telling them about caution education etc. However, I'm the only one followed in bear and bull markets, because I tell as transparently as educated as I am able.

My friend, the truth is at the end of the crypto bull run, there will not be all winners.

Yes, at some point many people might be in green, but due to their lack of proper perspective, they will fail. They will not book, chase the top, be stubborn at chart, having ego, having too much greed, whatever.

This particular opportunity, I know you'd like to see "gazillion X" — but really, of those screaming gazillion X on twitter, how many actually in this period achieved that gazillion X.

This find, at marketcap I assume, vs what the industry average on this developed project without much marketing, so basically taking every bit of figure conservatively, presents an easy and natural 3x opportunity vs the market.

If the market will fly, this will fly with it. Not as some AI coins, etc... but risk vs reward... is in our favor because we have one non-public advantage and that is we know the narrative change while most ignored that news. And plus now we have a slippage free entry.

So, let's say in this bull run avg of this category at this stage will be +10x, this one will be 3x first to category and 10x with the category it's 30x.

If the category or alts will not move, it is still 3x.

If it will drop the entire market 50% instead of pumping 10x, this thing is still +1.5x with some time delay as bear markets make.

Of course, no guarantees, but THIS is why I like such opportunity. Eventually, chart gaps are filled, liquidity voids cleared, and price-to-category equalized.

I know, I know, too advanced shit for avg noob. Wen Lambo? Wen moon?

For that, you have other channels. I'm very happy about this find, and I will invite you to check it when the time comes. I'll invite you not to put all your eggs in this basket, I'll structure it so that you must read and inform yourself before entering... so that at the end of the day, only the real holders get true BCW opportunity.

And even with this, yup, completely non-noob-friendly - we might still fail, project might end up being shit.

But we the real BCW know, given many such opportunities, edge by edge, where we are vs where the rest of the market is.

Remember all those dumps and pumps we predicted. Not all, but more than Twitter did, more than many if not most gurus did, many than sometimes even HUGE trading desks did (remember when I told you Microstrategy bought at the wrong timing, and it proved correct) - and they have a team of top pros...

Brother, we are united into something really powerful. Crypto awarded us with real people having almost the same opportunity as top pros. And we are staying sharp on top of it. This is why I didn't abandon crypto in bear times. Why I traded... so for this next bull run, I am more capable, more educated, more experienced to guide you with maximum edge.

Again, noobs I am sorry but, NO GUARANTEES!

Can you live with that?

Good, then join me and fellow BCW elite-hand brothers on the amazing crypto journey ahead!

D Man

Good news is yes, this year, I do expect to finally us, we all here in crypto to have a 2017-like alt run. Probably the last of its kind. This year, not this day or week. If you can live with it, you might get finally rewarded for years of being in crypto while others abandoned it after long and exhausting red periods. Cheers my loyal bro!

Imagine a guy developing something for years and the village already starts talking "he is nuts, never gonna deliver it" and one day he does, long after everyone stopped checking on him...

Similar find we have here. Not as strong though. They didn't invent anything breakthrough, but they reached that community-dulling moment because they were chasing something else for 2 years, now changed the direction and practically nobody noticed! They are very close to achieving it. And we, BCW, are among the very first to cash-in on the info.

Making a zero-slippage deal with the team, helped them restructure to buy out all previous investors since they got too small, and make even better, healthier (supertight) tokenomics that the market will appreciate.

Stay tuned, will tell more when I can/know.

My biggest concern, slippage at low marketcap is now solved (thanks to BCW reputation that makes teams listen). And tokenomics got even better (no airdrops, team got less, no coins for exchanges,... instead huge percentage for public and liquidity).

Will tell you more, this is just a small teaser why I'm happy about it. Not a gem of the year, but if it works out, it is easy and simple coin due to undervalue to market and category average due to info we know and others don't. It's not a privileged info, it's just something that most, professional market scanners, hobbyists etc overlooked because they assumed the team continued in the old direction, the news of the new direction didn't reach the community.

Sharing more in the following days.

Again, not a gem, but a really good, simple-to-understand opportunity imo.

Think of it this way: it's not a Lamborghini. It's a Prius, but a Prius offered at $1 starting auction and other people not knowing it's a real car, they think it's a toy. You know it's real. That's why I'm hot for this.

You might not reach valuation of Lambo, but if you reach even half the valuation of Prius and you paid $100, or $1000 for the $10,000 car, you did a great job, no?

Stay tuned.. (days, not hours, be relaxed)

Cheers!

I am very excited about this find. It is an undergem. It is not a gem only because it misses some technological breakthrough. Everything else: under the radar; price-to-opportunity; narrative... heck even chain is on the massive-gains train so to speak. I'll tell you about it soon. I made a nice progress with the team to do the crazy thing, to buy out the old investors so you have slippage--free entry. All this, thanks to BCW stellar reputation. Stay tuned. Likely early next week.

Cheers!

D Man

P.S. They asked me when. I said now. I want us actually to do this in red times. It will remain under the radar, and you'll be the lowest buyer possible. No one will be able to dump on you in profit. This is the strong position I like for BCW.

I might have something good to really good for you soon (days)... It is good for small wallets, a bit trouble for medium, a skip for whales this time due to liquidity.

It's a narrative change caught by so few. I love the opportunity and I think you'll be excited we discovered this timely as well. Cheers!

Halved. Weekend volume. Don't trust it. Have a nice weekend instead. Cheers!

P.S. The report is free. I think halving event is crypto public service.

So far it is predictable as we are heading into halving the price shows some green. It's a hook more than likely. S&P500 is continuing in its correction, and this gap is basically retail money expecting immediate post-halving results. Check the report, and then you'll know whether to expect immediate 100x long or not. Cheers my friend!

Halving is here. Miners rewards cut in half. You have the report here https://t.me/blockchainwhispersbaby/11349 about what to expect in price if history is to be asked. Cheers my friend!

Remember this green drawing? Above = bullish, below = dump. We are retesting it now in a quite bad way. Just fyi.

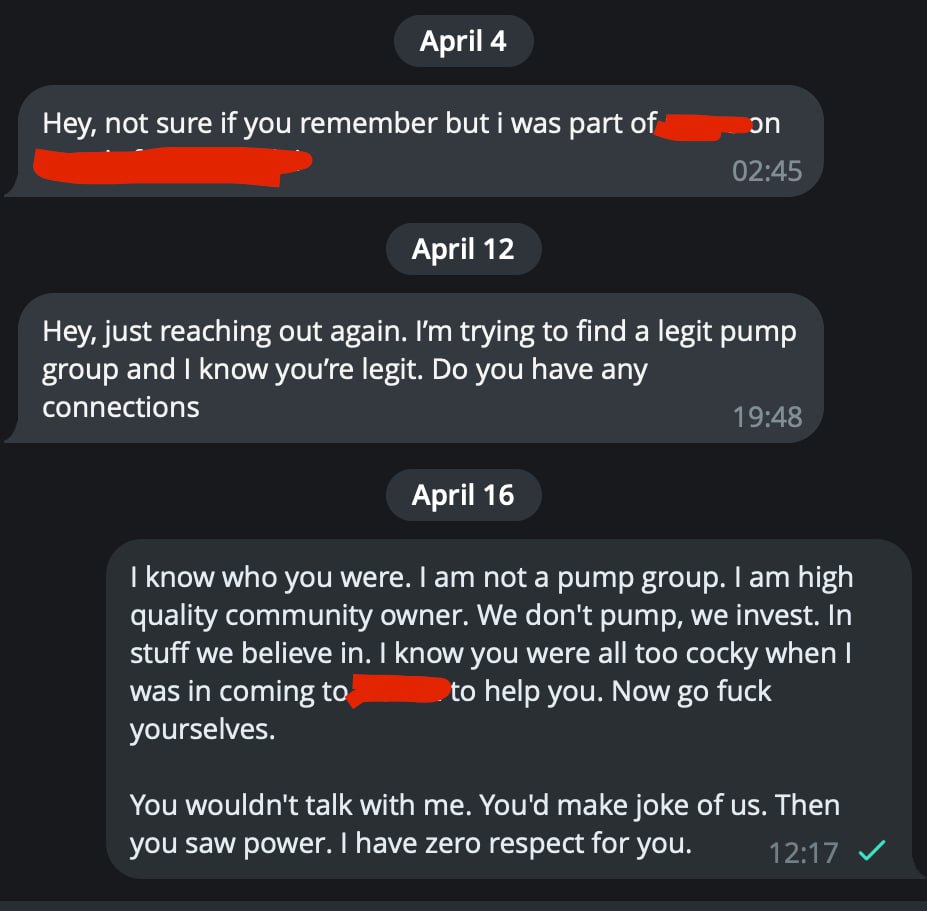

To all project founders who ignore good-intent people, are cocky to them, but once they see the power (like BCW) they get on their knees to suck a dick. FUCK YOU!

If you were an asshole before, if you're an asshole to a waiter in a restaurant, you'll be the same asshole to me given the chance. I want nothing to do with you. You don't deserve BCW.

Many guys like this guy. I remember him, founder of a project, a fork that was good idea. I came anon to give them top notch advice, they were ubercocky. Later, when they saw BCW power, they started to suck dick.

You know that joke: "Jenny would you suck a dick for a million bucks?"

- "for a million, yes"

- "what about for $10?"

She slaps him.

"who do you think I am"

- "we already established that, now we're just negotiating"

—-

The point is, if they are assholes, they are assholes. Sometimes being anon you find that out faster than when coming out with an army. Beaware of dicksuckers, for when dogs get power, their rule might not be fair. Cheers!

On a macro scale, if you zoom out just a bit from second-to-second thinking... if you relax... crypto this year I expect to be very rewarding. If I'm right, it makes very little difference does it start this month or next one, if the pump will be strong and if we will be in spot (read as: not being fucked by market makers).

Spot hold what you truly like.

Enjoy crypto.

Or micro trade it, time the market. I share with you the edge I find (and it's quite both powerful and often). According to your preference. Cheers!

Discussions

top 3 breaking news

Recently, regulatory agencies in Spain and Portugal accused Worldcoin of allowing minors to undergo eye scans and obtain blockchain-based identity ...

a

a

a

a

a

a

Bullish Bitcoin traders appear to have scaled back their bets on the world's largest cryptocurrency as its two major tailwinds subside ...

a

a

a

a

a

a

Hong Kong’s securities regulatory body, SFC, has approved the launch of Bitcoin and Ethereum ETFs, offering investors a regulated and secure investment option starting April 30th.

a

a

a

a

a

a

Chivo wallet, the official cryptocurrency wallet of El Salvador, has dismissed an alleged hack of the source code of its software and the data of over 5 million users linked to the wallet’s KYC procedures. According to Chivo, the data of Salvadorans is protected, and the security of its data has never been breached. Chivo […]

a

a

a

a

a

a

Dispelling all rumors, the Shiba Inu team has confirmed that one of its upcoming ecosystem tokens, Treat, has not been launched. Amidst upcoming developments, deceptive campaigns circulate, falsely announcing the “stealth launch” of the TREAT tokens. These misleading tactics not only generate unwarranted excitement but also spread scams and misinformation about the tokens. It is […]

a

a

a

a

a

a

The crypto market is in the red today, with a majority of the top-100 cryptocurrencies reflecting losses over the last 24 hours. Notably, only six altcoins, including two stablecoins, have managed to maintain a positive performance amidst a broader market sell-off. Several complex and intertwined factors have contributed to the day’s negative market sentiment, affecting major cryptocurrencies. Over the last 24 hours, the price of Bitcoin has decreased by 4.2%, Ethereum has fallen by 5.0%, Solana has dropped by 8.7%, XRP has declined by 4.7%, and Dogecoin has decreased by 8.3%. #1 Persistent Macroeconomic Uncertainty A primary factor influencing today’s market movements is the evolving macroeconomic landscape, particularly concerning US interest rates and inflation expectations. At the beginning of the year, the market anticipated aggressive monetary easing by the Federal Reserve. However, the sentiment has shifted considerably based on recent data and Federal Reserve signals. “Markets are pricing in fewer rate cuts for this year compared to the Fed’s dot plot projection of 3 rate cuts by year end. The implied fed funds rate for December has risen to 5.0%, indicating that the futures market is pricing in only 1 to 2 rate cuts,” Cetera Investment Management stated via X (formerly Twitter). This week, all eyes are on the release of the Personal Consumption Expenditures (PCE) price index for March—the Fed’s favored inflation measure on Friday, April 26 at 8:30 am EDT. Until then, the market could be in a derisk mode. Related Reading: How To Outperform In Crypto: Arthur Hayes’ ‘Left Curve’ Strategy The PCE is anticipated to present a varied view of inflation trends, which could strengthen the Federal Reserve’s inclination to delay any increases in interest rates. Analysts predict a slight increase in the overall PCE Price Index, rising to 2.6% year-over-year from 2.5% in February. Additionally, they expect a decrease in the index’s month-over-month change, dropping to 0.30% from 0.33%. #2 Crypto Market In Shock Over Legal Action Against Samourai Wallet The crypto market has also been rocked by yesterday’s legal developments involving the Samourai Wallet. The US Federal prosecutors’ decision to charge the founders Keonne Rodriguez and William Lonergan Hill with money laundering and operating an unlicensed money transmitting business has sent ripples through the crypto community. This action underscores the ongoing regulatory scrutiny within the crypto space. The prosecution of Samourai Wallet’s founders not only raises questions about the future of cryptographic privacy but also significantly impacts market sentiment as it underscores the legal risks inherent in the crypto sector. The implications of this case extend beyond the immediate legal concerns, influencing broader market perceptions and investor confidence. #3 Bitcoin And Crypto Are “Just Ranging” Further insights into market dynamics come from prominent crypto analysts who have commented on the state of market liquidity and trader behavior. “The market has gifted us with a beautiful reset in trader positioning for Bitcoin. OI weighted funding turned negative for the first time since October 2023. That was before Bitcoin ran from 27k to 46k without any meaningful dip,” said Ted, a crypto analyst on X. This reset refers to a reduction in the overheated futures market, which could allow the market to consolidate and potentially build a base for future upward movements. Related Reading: Akash Network (AKT) Leads Crypto Top 100 With 46% Rise Today: Here’s Why Emperor, another crypto analyst, described the current market state through a series of tweets, highlighting the ongoing consolidation phase post-highs: “Too much panic still on the timeline but we’ve been ranging since the ATH, that’s all.” He added, “The bear/bull line is an important resistance + Point of Control (PoC) of our range. Expecting VaL (Value Area Low) to hold on pullbacks and VaH (Value area High) to be the next target on longs if we reclaim level 1.” Bitcoin Price Update Too much panic still on the timeline but We've been ranging since the ATH, that's all 1. The bear/bull line is a important resistance + Point of Control (PoC) of our range. Expecting VaL (Value Area Low) to hold on pullbacks and VaH(Value area High ) to… pic.twitter.com/4UTExqQv0n — Emperor👑 (@EmperorBTC) April 24, 2024 #4 Bitcoin ETFs Remain Muted Yesterday’s ETF flows were negative again. Only Fidelity’s FBTC and Ark Invest’s ARKB had minimal inflows. GBTC sold more again at -$130.4m and BlackRock had zero inflows for the first time ever since inception on January 11. Thus, BlackRock’s (IBIT) inflow streak ended at 70 days. Prior to this, IBIT entered into the top 10 all time after passing the ETFs like JETS, BND and VEA. Yesterday's ETF flows by @FarsideUK.We are back to outflows and of course it's Barry.We had $120.6 million in outflows yesterday.$GBTC did $130.4 million of outflows. Blackrock had 0. Which means that after 70 days for the first time they didn't have any inflows. Price… pic.twitter.com/Akh1agezb6 — WhalePanda (@WhalePanda) April 25, 2024 Notably, the momentum for spot Bitcoin ETFs has waned significantly in the past two weeks. The last notable day of inflows was on March 26, when they surpassed $400 million—nearly a month ago. On the bright side, despite this slowdown, there have been no outflows from either BlackRock or Fidelity. Grayscale’s GBTC remains the primary negative factor driving outflows. Furthermore, there seems to be a decrease in investment willingness among traditional sector investors; the total inflows through ETFs have been stagnant for more than 30 days, coinciding with a flat trend in Bitcoin prices. At press time, BTC traded at $64,034. Featured image from Shutterstock, chart from TradingView.com

a

a

a

a

a

a

Insiders expect the SEC to deny spot Ethereum ETF applications, citing unproductive meetings and a lack of engagement on the agency's part. The post SEC likely to reject Ethereum spot ETF applications, insiders say appeared first on Crypto Briefing.

a

a

a

a

a

a

The chief technology officer of VC firm a16z said that memecoins are like risky casinos that deter real builders from the crypto ecosystem.

a

a

a

a

a

a

US DoJ charges Samourai Wallet founders, an action that sparked a debate on Bitcoin's privacy.

a

a

a

a

a

a

PANDA and MEW see price rally but face resistance resulting in pullbacks. Investors shift focus to Altgotech amid cooling off of PANDA and MEW momentum. Altgotech aims to revolutionize trading and its native token ALGT is currently in the presale stage. In the volatile world of cryptocurrency, investors are always on the lookout for the […] The post PANDA and MEW bullish momentum cool off: investors shift to new altcoin appeared first on CoinJournal.

a

a

a

a

a

a

OKX Jumpstart has listed Meson Network, a DePIN project working to create and scale a streamlined bandwidth marketplace. The post OKX Jumpstart lists Meson Network for BTC and ETH staking event appeared first on Crypto Briefing.

a

a

a

a

a

a

Bitcoin's impending 'death cross' signals potential price turbulence, with risk to fall below $60,000 per BTC

a

a

a

a

a

a

Brian Rose also aims to implement a new London cryptocurrency to promote financial education in the Greater London area.

a

a

a

a

a

a

London Stock Exchange's David Schwimmer to Be One of FTSE 100's Top Paid CEOs Bloomberg

a

a

a

a

a

a

BNP-Anglo American Deal: UK Stock Market May Have Found Its Catalyst Bloomberg

a

a

a

a

a

a

Learn how to earn Bitcoin (BTC) through mining, trading, freelancing, airdrops, and incentivized social media. Following the SEC’s approval of spot Bitcoin exchange-traded funds (ETFs) in the U.S. in January, the world’s largest cryptocurrency by market cap has increasingly become…

a

a

a

a

a

a

(Bloomberg) -- Bullish Bitcoin traders appear to have scaled back their bets on the world's largest cryptocurrency as its two major tailwinds ...

a

a

a

a

a

a

Memecoins Becoming Hedge Funds Ultimate Risk-on Asset Could Spell Disaster for Institutional Trust in Crypto ... ICYMI: BLOOMBERG REPORTS THAT "HEDGE ...

a

a

a

a

a

a

... Bitcoin Spot ETF, and Harvest Ether Spot ETF. It's a digital smorgasbord within the comforting confines of regulation. Image. (Bloomberg Media). Can ...

a

a

a

a

a

a

Top 100 Coins By Market Cap

NEXT BTC MOVE:

I think Bitcoin goes UP because

| Name | Price | Marketcap | 24h | ||

|---|---|---|---|---|---|

Bitcoin (BTC)

Bitcoin (BTC)

|

$63,412.01 | $1.25 T | -4.57% | ||

Ethereum (ETH)

Ethereum (ETH)

|

$3,099.05 | $378.23 B | -5.36% | ||

Tether USDt (USDT)

Tether USDt (USDT)

|

$0.99958156 | $110.42 B | -0.04% | ||

BNB (BNB)

BNB (BNB)

|

$604.75 | $89.25 B | -0.91% | ||

Solana (SOL)

Solana (SOL)

|

$143.24 | $64.04 B | -9.87% | ||

USDC (USDC)

USDC (USDC)

|

$0.99995752 | $33.43 B | -0.01% | ||

XRP (XRP)

XRP (XRP)

|

$0.51424987 | $28.35 B | -5.28% | ||

Dogecoin (DOGE)

Dogecoin (DOGE)

|

$0.14863641 | $21.41 B | -8.05% | ||

Toncoin (TON)

Toncoin (TON)

|

$5.22 | $18.13 B | -9.02% | ||

Cardano (ADA)

Cardano (ADA)

|

$0.46605537 | $16.61 B | -6.33% | ||

Shiba Inu (SHIB)

Shiba Inu (SHIB)

|

$0.00002479 | $14.61 B | -8.79% | ||

Avalanche (AVAX)

Avalanche (AVAX)

|

$34.95 | $13.16 B | -10.41% | ||

TRON (TRX)

TRON (TRX)

|

$0.11542000 | $10.10 B | 1.31% | ||

Polkadot (DOT)

Polkadot (DOT)

|

$6.76 | $9.69 B | -8.58% | ||

Bitcoin Cash (BCH)

Bitcoin Cash (BCH)

|

$474.10 | $9.32 B | -5.98% | ||

Chainlink (LINK)

Chainlink (LINK)

|

$14.52 | $8.50 B | -6.18% | ||

NEAR Protocol (NEAR)

NEAR Protocol (NEAR)

|

$6.75 | $7.17 B | -4.37% | ||

Polygon (MATIC)

Polygon (MATIC)

|

$0.70220000 | $6.93 B | -7.19% | ||

Litecoin (LTC)

Litecoin (LTC)

|

$83.88 | $6.23 B | -3.33% | ||

Internet Computer (ICP)

Internet Computer (ICP)

|

$13.44 | $6.22 B | -9.05% | ||

Dai (DAI)

Dai (DAI)

|

$0.99990049 | $5.35 B | -0.01% | ||

UNUS SED LEO (LEO)

UNUS SED LEO (LEO)

|

$5.76 | $5.34 B | -0.02% | ||

Uniswap (UNI)

Uniswap (UNI)

|

$7.65 | $4.57 B | -6.05% | ||

First Digital USD (FDUSD)

First Digital USD (FDUSD)

|

$1.00 | $4.41 B | -0.10% | ||

Hedera (HBAR)

Hedera (HBAR)

|

$0.11219386 | $4.01 B | -17.65% | ||

Stacks (STX)

Stacks (STX)

|

$2.65 | $3.86 B | -7.25% | ||

Ethereum Classic (ETC)

Ethereum Classic (ETC)

|

$26.06 | $3.81 B | -6.99% | ||

Aptos (APT)

Aptos (APT)

|

$8.82 | $3.76 B | -10.04% | ||

Mantle (MNT)

Mantle (MNT)

|

$1.10 | $3.60 B | -3.87% | ||

Cronos (CRO)

Cronos (CRO)

|

$0.12555126 | $3.34 B | -4.35% | ||

Stellar (XLM)

Stellar (XLM)

|

$0.11250000 | $3.24 B | -5.65% | ||

Cosmos (ATOM)

Cosmos (ATOM)

|

$8.24 | $3.22 B | -6.48% | ||

Render (RNDR)

Render (RNDR)

|

$8.32 | $3.20 B | -9.39% | ||

Filecoin (FIL)

Filecoin (FIL)

|

$5.89 | $3.19 B | -9.28% | ||

OKB (OKB)

OKB (OKB)

|

$52.67 | $3.16 B | -5.42% | ||

Pepe (PEPE)

Pepe (PEPE)

|

$0.00000738 | $3.11 B | -7.17% | ||

Hedera Hashgraph (HBAR)

Hedera Hashgraph (HBAR)

|

$0.11260000 | $4.02 B | -17.82% | ||

Immutable (IMX)

Immutable (IMX)

|

$2.09 | $3.03 B | -12.80% | ||

Bittensor (TAO)

Bittensor (TAO)

|

$451.66 | $3.00 B | -9.89% | ||

dogwifhat (WIF)

dogwifhat (WIF)

|

$2.90 | $2.89 B | -17.98% | ||

Arbitrum (ARB)

Arbitrum (ARB)

|

$1.07 | $2.85 B | -9.35% | ||

VeChain (VET)

VeChain (VET)

|

$0.03895000 | $2.81 B | -9.23% | ||

Kaspa (KAS)

Kaspa (KAS)

|

$0.11675310 | $2.74 B | -10.06% | ||

Maker (MKR)

Maker (MKR)

|

$2,829.00 | $2.62 B | -6.00% | ||

The Graph (GRT)

The Graph (GRT)

|

$0.26196858 | $2.48 B | -10.49% | ||

Optimism (OP)

Optimism (OP)

|

$2.36 | $2.47 B | -8.74% | ||

Injective (INJ)

Injective (INJ)

|

$25.75 | $2.40 B | -11.07% | ||

Theta Network (THETA)

Theta Network (THETA)

|

$2.40 | $2.40 B | -3.33% | ||

Monero (XMR)

Monero (XMR)

|

$117.26 | $2.16 B | -3.50% | ||

Arweave (AR)

Arweave (AR)

|

$32.86 | $2.14 B | -1.90% | ||

Fantom (FTM)

Fantom (FTM)

|

$0.72442671 | $2.03 B | -4.32% | ||

Core (CORE)

Core (CORE)

|

$2.29 | $2.02 B | -8.80% | ||

Celestia (TIA)

Celestia (TIA)

|

$10.60 | $1.90 B | -9.15% | ||

Fetch.ai (FET)

Fetch.ai (FET)

|

$2.24 | $1.89 B | -14.00% | ||

THORChain (RUNE)

THORChain (RUNE)

|

$5.32 | $1.78 B | -8.46% | ||

FLOKI (FLOKI)

FLOKI (FLOKI)

|

$0.00018437 | $1.76 B | -8.36% | ||

Lido DAO (LDO)

Lido DAO (LDO)

|

$1.97 | $1.75 B | -8.81% | ||

Sei (SEI)

Sei (SEI)

|

$0.60000000 | $1.68 B | -6.11% | ||

Bitget Token (BGB)

Bitget Token (BGB)

|

$1.19 | $1.66 B | -3.94% | ||

Bonk (BONK)

Bonk (BONK)

|

$0.00002474 | $1.61 B | -12.15% | ||

Algorand (ALGO)

Algorand (ALGO)

|

$0.19780000 | $1.61 B | -11.31% | ||

Render Token (RNDR)

Render Token (RNDR)

|

$8.34 | $3.20 B | -9.34% | ||

Sui (SUI)

Sui (SUI)

|

$1.20 | $1.55 B | -10.63% | ||

Beam (BEAM)

Beam (BEAM)

|

$0.02687258 | $1.42 B | -7.61% | ||

Pendle (PENDLE)

Pendle (PENDLE)

|

$5.93 | $1.42 B | -6.56% | ||

Gala (GALA)

Gala (GALA)

|

$0.04610000 | $1.39 B | -10.61% | ||

Jupiter (JUP)

Jupiter (JUP)

|

$1.01 | $1.37 B | -15.78% | ||

Flow (FLOW)

Flow (FLOW)

|

$0.90500000 | $1.36 B | -10.71% | ||

Aave (AAVE)

Aave (AAVE)

|

$89.23 | $1.32 B | -7.45% | ||

Bitcoin SV (BSV)

Bitcoin SV (BSV)

|

$65.85 | $1.30 B | -8.77% | ||

Quant (QNT)

Quant (QNT)

|

$106.70 | $1.29 B | -4.81% | ||

Neo (NEO)

Neo (NEO)

|

$17.52 | $1.24 B | -6.27% | ||

BitTorrent (New) (BTT)

BitTorrent (New) (BTT)

|

$0.00000125 | $1.21 B | -5.34% | ||

Ethena (ENA)

Ethena (ENA)

|

$0.84900000 | $1.20 B | -12.21% | ||

SingularityNET (AGIX)

SingularityNET (AGIX)

|

$0.92341000 | $1.18 B | -13.03% | ||

Flare (FLR)

Flare (FLR)

|

$0.03034787 | $1.17 B | -6.31% | ||

Akash Network (AKT)

Akash Network (AKT)

|

$4.73 | $1.11 B | -8.66% | ||

MultiversX (EGLD)

MultiversX (EGLD)

|

$41.33 | $1.11 B | -8.67% | ||

Huobi Token (HT)

Huobi Token (HT)

|

$0.59151400 | $93.63 M | -1.24% | ||

Axie Infinity (AXS)

Axie Infinity (AXS)

|

$7.22 | $1.03 B | -12.23% | ||

Chiliz (CHZ)

Chiliz (CHZ)

|

$0.11457000 | $1.02 B | -7.35% | ||

The Sandbox (SAND)

The Sandbox (SAND)

|

$0.45070000 | $1.01 B | -10.34% | ||

Wormhole (W)

Wormhole (W)

|

$0.56275975 | $1.01 B | -5.41% | ||

dYdX (Native) (DYDX)

dYdX (Native) (DYDX)

|

$2.17 | $1.01 B | -9.98% | ||

eCash (XEC)

eCash (XEC)

|

$0.00005026 | $987.34 M | -9.02% | ||

Tezos (XTZ)

Tezos (XTZ)

|

$1.01 | $982.76 M | -5.32% | ||

Ronin (RON)

Ronin (RON)

|

$3.05 | $963.43 M | -11.15% | ||

dYdX (DYDX)

dYdX (DYDX)

|

$2.18 | $676.00 M | -10.28% | ||

KuCoin Token (KCS)

KuCoin Token (KCS)

|

$9.94 | $956.02 M | -2.71% | ||

Conflux (CFX)

Conflux (CFX)

|

$0.24300000 | $953.91 M | -7.48% | ||

EOS (EOS)

EOS (EOS)

|

$0.84160000 | $944.47 M | -3.35% | ||

Worldcoin (WLD)

Worldcoin (WLD)

|

$4.76 | $924.65 M | -12.95% | ||

Synthetix (SNX)

Synthetix (SNX)

|

$2.82 | $923.82 M | -9.05% | ||

Mina (MINA)

Mina (MINA)

|

$0.83226359 | $909.09 M | -11.29% | ||

JasmyCoin (JASMY)

JasmyCoin (JASMY)

|

$0.01841700 | $904.34 M | -11.08% | ||

Pyth Network (PYTH)

Pyth Network (PYTH)

|

$0.59890000 | $895.97 M | -10.71% | ||

ORDI (ORDI)

ORDI (ORDI)

|

$42.23 | $886.79 M | -11.85% | ||

Decentraland (MANA)

Decentraland (MANA)

|

$0.44842945 | $855.75 M | -9.03% | ||

Gnosis (GNO)

Gnosis (GNO)

|

$327.40 | $852.37 M | -10.42% | ||

Starknet (STRK)

Starknet (STRK)

|

$1.15 | $838.31 M | -13.96% |

Try to search another coin

clc7 Bitcoin