Notification Center

Turn on/off sound

Show/Hide Coins Ticker

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 10 Gwei | 10 Gwei | 11 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 10 Gwei | 10 Gwei | 11 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

I am very excited about this find. It is an undergem. It is not a gem only because it misses some technological breakthrough. Everything else: under the radar; price-to-opportunity; narrative... heck even chain is on the massive-gains train so to speak. I'll tell you about it soon. I made a nice progress with the team to do the crazy thing, to buy out the old investors so you have slippage--free entry. All this, thanks to BCW stellar reputation. Stay tuned. Likely early next week.

Cheers!

D Man

P.S. They asked me when. I said now. I want us actually to do this in red times. It will remain under the radar, and you'll be the lowest buyer possible. No one will be able to dump on you in profit. This is the strong position I like for BCW.

I might have something good to really good for you soon (days)... It is good for small wallets, a bit trouble for medium, a skip for whales this time due to liquidity.

It's a narrative change caught by so few. I love the opportunity and I think you'll be excited we discovered this timely as well. Cheers!

Halved. Weekend volume. Don't trust it. Have a nice weekend instead. Cheers!

P.S. The report is free. I think halving event is crypto public service.

So far it is predictable as we are heading into halving the price shows some green. It's a hook more than likely. S&P500 is continuing in its correction, and this gap is basically retail money expecting immediate post-halving results. Check the report, and then you'll know whether to expect immediate 100x long or not. Cheers my friend!

Halving is here. Miners rewards cut in half. You have the report here https://t.me/blockchainwhispersbaby/11349 about what to expect in price if history is to be asked. Cheers my friend!

Remember this green drawing? Above = bullish, below = dump. We are retesting it now in a quite bad way. Just fyi.

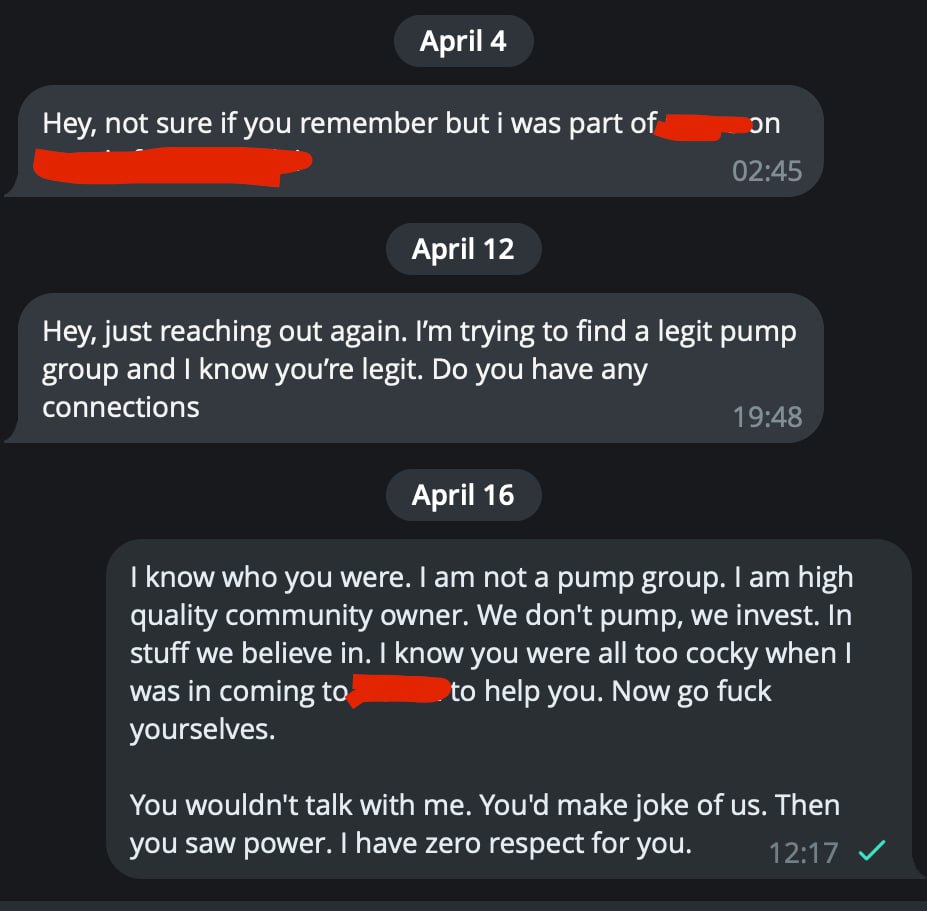

To all project founders who ignore good-intent people, are cocky to them, but once they see the power (like BCW) they get on their knees to suck a dick. FUCK YOU!

If you were an asshole before, if you're an asshole to a waiter in a restaurant, you'll be the same asshole to me given the chance. I want nothing to do with you. You don't deserve BCW.

Many guys like this guy. I remember him, founder of a project, a fork that was good idea. I came anon to give them top notch advice, they were ubercocky. Later, when they saw BCW power, they started to suck dick.

You know that joke: "Jenny would you suck a dick for a million bucks?"

- "for a million, yes"

- "what about for $10?"

She slaps him.

"who do you think I am"

- "we already established that, now we're just negotiating"

—-

The point is, if they are assholes, they are assholes. Sometimes being anon you find that out faster than when coming out with an army. Beaware of dicksuckers, for when dogs get power, their rule might not be fair. Cheers!

On a macro scale, if you zoom out just a bit from second-to-second thinking... if you relax... crypto this year I expect to be very rewarding. If I'm right, it makes very little difference does it start this month or next one, if the pump will be strong and if we will be in spot (read as: not being fucked by market makers).

Spot hold what you truly like.

Enjoy crypto.

Or micro trade it, time the market. I share with you the edge I find (and it's quite both powerful and often). According to your preference. Cheers!

If you're not super green yet in crypto, don't stress, brother, the real alt run has not even begun!

What I think alts might collapse for a bit. Maybe now is not the right time to buy them. I am telling you for quite some time, and since then the alts are boring. I tell you alts will break down. I think that now more than ever.

But remember your BCW brother... THEN will be a good time to buy. I am not selling. I just am not buying here. I wait for further dip to top up or to get back in the degen plays.

Blockchain Whispers baby!

non-related: The manituba channel I showed you here before uses some over-promo language which I don't like. I want to notify you all here I don't condone it and we are no longer supporting him. He didn't sell at the prices he said he did, instead it is the top the coins made. He had some great calls. Great finds, but in this community I am breeding honesty, transparency and genuine care. I will no longer promote him. He just posted it. But I don't like the psychology behind it.

D Man

P.S. I don't control traders and what they post. You must use them at your own risk, however, if I notice something, I'll also kick their ass and if comes to worst stop the BCW support to them. Either the BCW way or the highway! We are the legion. They are not!

https://blockchainwhispers.com44f39a7de86a1c7d995c6ebcd583fee5.pdfI've made for you the halving report. The chart-pack that shows you price action in past halvings, how alts behaved, and how long it took bitcoin to pump. It's easy to study, and get properly prepared for the upcoming halving.

Courtesy of your Blockchain Whispers family. It's free for you. Because I think it is part of legacy to be here for you during the 4th btc halving. Freely share with anyone you care about. Cheers brother!

Don't think it's because of war. SPX was long due for correction. So is btc. Many things start dropping couple days before mainnet. Why not btc?

D Man's Macro Fundamental Report Buyers were ready for this retrace.

Careful free chan followers as well.

D Man

AMA done. Was amazing. Thanks Mr. W and everyone who attended. BCW rocks!

Discussions

top 3 breaking news

Tesla Shares Soar Amid Plans for Cheaper Cars | Daybreak: Europe 04/24/2024 Bloomberg

a

a

a

a

a

a

In a remarkable turn of events for the cryptocurrency market, Hedera Hashgraph’s native digital asset, HBAR, experienced a meteoric rise on April 13th. The catalyst for this surge was the announcement by financial giant BlackRock that it would leverage the Hedera blockchain to tokenize one of its money market funds. TLDR Hedera (HBAR) experienced a [...] The post Hedera (HBAR) Price Surges 100% Following BlackRock Tokenization Announcement appeared first on Blockonomi.

a

a

a

a

a

a

Numerous meme coins have also posted double-digit price increases in the past 24 hours.

a

a

a

a

a

a

Fezoo's Stage 1 presale attracts Kusama and TRON investors amid their ongoing market challenges and uncertainties. #partnercontent

a

a

a

a

a

a

The company behind the world’s largest stablecoin, USDT Tether, pledges to freeze assets made to the entities sanctioned by the Office of Foreign Assets Control (OFAC) following claims that Venezuela’s state-owned oil company looks to crypto for payments. Tether vows it will bar payments to the OFAC-sanctioned entities using USDT to facilitate trade payments. The … The post Tether Pledges to Block Payments After Venezuela Looks to USDT to Bypass Oil Sanctions first appeared on Tokenhell.

a

a

a

a

a

a

India’s general election in 2024 is not expected to immediately affect crypto policy, and its current – restrictive – rules are expected to continue on through the upcoming Parliamentary term.

a

a

a

a

a

a

Hedera's native HBAR token surged by more than 107% on Tuesday as investors believed that BlackRock was involved in a fund tokenization project on the Hedera blockchain, the token then slumped by more than 25% as BlackRock turned out to have no involvement in the launch.

a

a

a

a

a

a

Mexico is poised to have its biggest election ever in a few weeks, with 100 million voters choosing 628 elected officials, thousands of local officials and the president. And crypto issues will remain on the sidelines during the campaign.

a

a

a

a

a

a

Use of Tether has increased in Venezuela after the U.S. reimposed sanctions on oil exports.

a

a

a

a

a

a

Pepe (PEPE) has recorded an impressive price surge over the past day amid inflated whale activity. PEPE is up by 18.5% in the past 24 hours and is trading at $0.0000080 at the time of writing. The meme coin’s market…

a

a

a

a

a

a

U.S. prosecutors are seeking 36 months of imprisonment for Changpeng Zhao, the founder of Binance, citing the “magnitude of Zhao’s willful violation of U.S. law and its consequences.” Binance founder and former CEO Changpeng Zhao might be facing 36 months…

a

a

a

a

a

a

BONK is one of the sector's best performers, with its price spiking by almost 30% daily.

a

a

a

a

a

a

Tokyo-based financial services company Monex Group has completed its acquisition of a majority stake in 3iQ Digital Holdings, a Canadian crypto asset manager. The acquisition, initially announced in December 2023, has resulted in 3iQ and its subsidiaries becoming part of the Monex Group. Monex Group Acquires Majority Stake in Canadian Crypto Asset Manager 3iQTo support 3iQ's rapid business expansion, Monex Group has also invested $7.5 million in 3iQ's Managed Account Platform (QMAP). QMAP offers institutional investors access to a diverse range of crypto hedge funds, featuring alpha-oriented strategies tailored to meet the complex demands of global institutions. This investment significantly strengthens 3iQ's institutional digital asset management position.The company was the first to launch a Bitcoin fund on the Toronto Stock Exchange in Canada. It also assisted CoinShares in creating a cryptocurrency ETF. Now, it will expand its crypto services under the Monex umbrella.QMAP employs a stringent due diligence process to select fund managers with proven track records of generating alpha and effectively managing risks across various market cycles. These managers bring institutional backgrounds, specialized expertise, and operational excellence to the table."I have high hope that QMAP will quickly become the leading platform for sophisticated investors to invest in a diversified suite of crypto hedge funds,” Yuko Seimei, the CEO of Monex Group, stated.The platform's managed account structure allows 3iQ direct control over assets, enhancing transparency and risk management capabilities. This approach eliminates the extra layer of fees typically found in traditional fund-of-funds structures, enabling investors to customize their allocations or choose from pre-designed model portfolios at no additional cost.“Together with Monex, we aim to create a superior investor experience that sets new standards globally,” added Pascal St. Jean, the President of 3iQ. "With a seasoned team, we remain committed to upholding our firm's decade-long tradition of developing cutting-edge investment solutions for institutional investors.”The acquisition of 3iQ and investment in QMAP align with Monex Group's goal of strengthening its asset management business. The company has also recently expanded its operations in the APAC region, planning to increase employment in the sales department by 80%. This article was written by Damian Chmiel at www.financemagnates.com.

a

a

a

a

a

a

Massive amount of Dogecoin has been transferred to a popular trading venue by an unknown wallet

a

a

a

a

a

a

Cardano’s DeFi and NFT verticals declined last month as the network experienced a fall in demand.

a

a

a

a

a

a

Arthur Hayes is bullish on crypto amid the macro setup that he says could present a golden opportnity He says altcoins as well as presale tokens may be worth a look at as crypto exits latest window of weakness KangaMoon (KANG) is one of the new projects attracting huge attention as its presale noves towards […] The post Arthur Hayes says macro setup favours Bitcoin bulls as KangaMoon attracts investors appeared first on CoinJournal.

a

a

a

a

a

a

RoboHero, the first turn-based multiplayer WEB3 mobile game available on Google Play and the App Store, faced significant challenges when hackers targeted its Twitter account on April 2, 2024. In recent years, the social media platform X (formerly Twitter) has evolved into a vital networking hub within the Web3 sector. Prominent figures like CEO Elon [...] The post RoboHero: Cybersecurity Vulnerabilities Threaten Web3 Project Owners as Twitter Account Compromised appeared first on Blockonomi.

a

a

a

a

a

a

In his latest essay, Arthur Hayes, the former CEO of crypto exchange BitMEX, introduced a bold investment philosophy he calls the “Left Curve.” This strategy diverges sharply from traditional investment approaches typically adopted during bull markets in the crypto world. Hayes’ essay serves not only as an investment manifesto but also as a critique of conventional financial wisdom, encouraging investors to maximize their returns by embracing more aggressive tactics. Crypto Bull Run Just Got Started Hayes begins by criticizing the common investor mentality that prevails during bull markets, particularly the tendency to revert to conservative strategies after initial gains. He argues that many investors, despite having made profitable decisions, fail to capitalize fully on bull markets by selling their holdings too soon—particularly when they convert high-performing cryptocurrencies into fiat currencies. “Some of you think you are masters of the universe right now because you bought Solana sub $10 and sold it at $200,” he states, challenging the notion that such actions demonstrate market mastery. Instead, Hayes promotes a strategy of sustained investment and accumulation, particularly in Bitcoin, which he refers to as “the hardest money ever created.” Related Reading: Akash Network (AKT) Leads Crypto Top 100 With 46% Rise Today: Here’s Why A central thesis of Hayes’ argument is the critique of fiat currency as a safe haven for profits taken from cryptocurrency investments. “If you sold shitcoins for fiat that you don’t immediately need for living expenses, you are fucking up,” Hayes bluntly asserts. He discusses the inherent weaknesses of fiat money, primarily its susceptibility to inflation and devaluation through endless cycles of printing by central banks. “Fiat will continue to be printed ad infinitum until the system resets,” he predicts, suggesting that fiat currencies are inherently unstable storage of value compared to cryptocurrencies. Hayes extends his analysis to the macroeconomic factors influencing cryptocurrency markets. He describes how major economies like the US, China, the European Union, and Japan are debasing their currencies to manage national debt levels. This macroeconomic maneuvering, according to Hayes, is inadvertently setting the stage for cryptocurrencies to rise. He points out the increasing adoption of Bitcoin ETFs in the US, UK, and Hong Kong markets as a tool for institutional and retail investors to hedge against fiat depreciation. Related Reading: ‘More Upside Is Coming’: Crypto Market Set For 350% Growth, Predicts Glassnode Cofounders This part of his analysis underscores a broader acceptance of cryptocurrency as a legitimate asset class in traditional investment circles, powered by the realization that traditional financial systems are struggling under the weight of unsustainable fiscal policies. Hayes also delves into the strategic aspects of market timing, particularly around events known to influence market dynamics, such as US tax payment deadlines and Bitcoin halving. He notes: As we exit the window of weakness that I forecasted would occur due to April 15th US tax payments and the Bitcoin halving, I want to remind readers why the bull market will continue and prices will get sillier on the upside. This observation suggests that understanding these cyclic events can provide strategic entry and exit points for maximizing investment returns. Emphasizing psychological resilience, Hayes encourages investors to adopt a mindset that resists the conventional impulse to cash out during brief market rallies. “At this moment, I will resist the urge to take chips off the table. I will encourage myself to add more to the winners,” he advises, promoting a long-term view of investment in cryptocurrencies. This approach, according to Hayes, is essential for realizing the full potential of crypto investments, particularly in a market characterized by high volatility and rapid gains. In conclusion, Hayes’ “Left Curve” philosophy is more than just an investment strategy; it is a comprehensive approach that encompasses understanding macroeconomic trends, psychological resilience, and strategic market timing. His essay serves as a guide for investors looking to navigate the complexities of crypto markets with a bold, assertive strategy that challenges traditional financial doctrines. At press time, BTC traded at $66,789. Featured image created with Bloomberg, chart from TradingView.com

a

a

a

a

a

a

Pushd emerges as a formidable e-commerce platform, capturing the attention of Ripple and Monero investors, amid fluctuating crypto markets. #partnercontent

a

a

a

a

a

a

Top 100 Coins By Market Cap

NEXT BTC MOVE:

I think Bitcoin goes UP because

| Name | Price | Marketcap | 24h | ||

|---|---|---|---|---|---|

Bitcoin (BTC)

Bitcoin (BTC)

|

$66,702.29 | $1.31 T | 0.76% | ||

Ethereum (ETH)

Ethereum (ETH)

|

$3,251.26 | $396.81 B | 2.73% | ||

Tether USDt (USDT)

Tether USDt (USDT)

|

$0.99992154 | $110.45 B | -0.04% | ||

BNB (BNB)

BNB (BNB)

|

$608.19 | $89.76 B | 0.91% | ||

Solana (SOL)

Solana (SOL)

|

$157.26 | $70.30 B | 2.14% | ||

USDC (USDC)

USDC (USDC)

|

$0.99990524 | $33.69 B | -0.01% | ||

XRP (XRP)

XRP (XRP)

|

$0.55143287 | $30.40 B | 0.58% | ||

Dogecoin (DOGE)

Dogecoin (DOGE)

|

$0.16229606 | $23.37 B | 2.85% | ||

Toncoin (TON)

Toncoin (TON)

|

$5.85 | $20.31 B | 6.27% | ||

Cardano (ADA)

Cardano (ADA)

|

$0.50103920 | $17.85 B | -2.59% | ||

Shiba Inu (SHIB)

Shiba Inu (SHIB)

|

$0.00002709 | $15.96 B | 1.78% | ||

Avalanche (AVAX)

Avalanche (AVAX)

|

$39.24 | $14.80 B | 2.15% | ||

Polkadot (DOT)

Polkadot (DOT)

|

$7.47 | $10.72 B | 0.51% | ||

Bitcoin Cash (BCH)

Bitcoin Cash (BCH)

|

$507.70 | $9.99 B | -0.50% | ||

TRON (TRX)

TRON (TRX)

|

$0.11349000 | $9.94 B | 1.05% | ||

Chainlink (LINK)

Chainlink (LINK)

|

$15.48 | $9.06 B | 0.22% | ||

Polygon (MATIC)

Polygon (MATIC)

|

$0.75370000 | $7.44 B | 3.43% | ||

NEAR Protocol (NEAR)

NEAR Protocol (NEAR)

|

$6.91 | $7.36 B | -0.11% | ||

Internet Computer (ICP)

Internet Computer (ICP)

|

$14.80 | $6.84 B | 1.20% | ||

Litecoin (LTC)

Litecoin (LTC)

|

$87.15 | $6.50 B | 3.38% | ||

Dai (DAI)

Dai (DAI)

|

$1.00 | $5.35 B | -0.01% | ||

UNUS SED LEO (LEO)

UNUS SED LEO (LEO)

|

$5.75 | $5.33 B | -0.26% | ||

Uniswap (UNI)

Uniswap (UNI)

|

$8.14 | $4.86 B | 0.63% | ||

Hedera (HBAR)

Hedera (HBAR)

|

$0.13605968 | $4.86 B | 54.48% | ||

Stacks (STX)

Stacks (STX)

|

$2.91 | $4.23 B | -5.21% | ||

Aptos (APT)

Aptos (APT)

|

$9.88 | $4.21 B | -0.05% | ||

First Digital USD (FDUSD)

First Digital USD (FDUSD)

|

$1.00 | $4.20 B | 0.07% | ||

Ethereum Classic (ETC)

Ethereum Classic (ETC)

|

$28.11 | $4.11 B | 0.24% | ||

Mantle (MNT)

Mantle (MNT)

|

$1.15 | $3.77 B | -3.61% | ||

Cronos (CRO)

Cronos (CRO)

|

$0.13247324 | $3.52 B | 1.51% | ||

Immutable (IMX)

Immutable (IMX)

|

$2.42 | $3.52 B | 1.22% | ||

Filecoin (FIL)

Filecoin (FIL)

|

$6.49 | $3.52 B | -0.03% | ||

Render (RNDR)

Render (RNDR)

|

$9.09 | $3.49 B | 0.22% | ||

Stellar (XLM)

Stellar (XLM)

|

$0.11980000 | $3.46 B | 2.78% | ||

Cosmos (ATOM)

Cosmos (ATOM)

|

$8.83 | $3.45 B | 0.99% | ||

dogwifhat (WIF)

dogwifhat (WIF)

|

$3.42 | $3.41 B | 22.71% | ||

Hedera Hashgraph (HBAR)

Hedera Hashgraph (HBAR)

|

$0.13480000 | $4.87 B | 50.42% | ||

OKB (OKB)

OKB (OKB)

|

$55.66 | $3.34 B | 1.77% | ||

Pepe (PEPE)

Pepe (PEPE)

|

$0.00000781 | $3.29 B | 16.05% | ||

Bittensor (TAO)

Bittensor (TAO)

|

$494.27 | $3.28 B | -0.99% | ||

Arbitrum (ARB)

Arbitrum (ARB)

|

$1.19 | $3.15 B | 0.66% | ||

VeChain (VET)

VeChain (VET)

|

$0.04270000 | $3.10 B | 1.99% | ||

Kaspa (KAS)

Kaspa (KAS)

|

$0.12888959 | $3.02 B | -0.04% | ||

The Graph (GRT)

The Graph (GRT)

|

$0.29379221 | $2.79 B | -0.22% | ||

Maker (MKR)

Maker (MKR)

|

$2,992.00 | $2.76 B | 5.60% | ||

Injective (INJ)

Injective (INJ)

|

$28.87 | $2.70 B | 3.84% | ||

Optimism (OP)

Optimism (OP)

|

$2.57 | $2.68 B | 3.37% | ||

Theta Network (THETA)

Theta Network (THETA)

|

$2.52 | $2.51 B | 6.59% | ||

Monero (XMR)

Monero (XMR)

|

$121.12 | $2.23 B | -0.60% | ||

Core (CORE)

Core (CORE)

|

$2.52 | $2.22 B | -2.61% | ||

Arweave (AR)

Arweave (AR)

|

$33.52 | $2.20 B | -3.69% | ||

Fetch.ai (FET)

Fetch.ai (FET)

|

$2.52 | $2.12 B | 3.64% | ||

Celestia (TIA)

Celestia (TIA)

|

$11.84 | $2.12 B | 8.17% | ||

Fantom (FTM)

Fantom (FTM)

|

$0.75150778 | $2.11 B | 1.92% | ||

THORChain (RUNE)

THORChain (RUNE)

|

$5.82 | $1.95 B | 5.30% | ||

Lido DAO (LDO)

Lido DAO (LDO)

|

$2.15 | $1.91 B | 1.10% | ||

Algorand (ALGO)

Algorand (ALGO)

|

$0.23280000 | $1.91 B | 22.33% | ||

FLOKI (FLOKI)

FLOKI (FLOKI)

|

$0.00019723 | $1.89 B | 15.97% | ||

Sei (SEI)

Sei (SEI)

|

$0.64440000 | $1.80 B | -2.30% | ||

Bonk (BONK)

Bonk (BONK)

|

$0.00002663 | $1.74 B | 30.18% | ||

Bitget Token (BGB)

Bitget Token (BGB)

|

$1.23 | $1.72 B | -2.64% | ||

Render Token (RNDR)

Render Token (RNDR)

|

$9.14 | $3.50 B | 0.15% | ||

Sui (SUI)

Sui (SUI)

|

$1.32 | $1.71 B | -2.12% | ||

Jupiter (JUP)

Jupiter (JUP)

|

$1.19 | $1.61 B | 3.72% | ||

Beam (BEAM)

Beam (BEAM)

|

$0.02933677 | $1.55 B | -0.05% | ||

Gala (GALA)

Gala (GALA)

|

$0.05089000 | $1.54 B | 4.80% | ||

Flow (FLOW)

Flow (FLOW)

|

$1.01 | $1.51 B | 6.94% | ||

Pendle (PENDLE)

Pendle (PENDLE)

|

$6.26 | $1.49 B | -2.39% | ||

Aave (AAVE)

Aave (AAVE)

|

$96.14 | $1.42 B | 1.56% | ||

Bitcoin SV (BSV)

Bitcoin SV (BSV)

|

$72.00 | $1.42 B | 0.91% | ||

Quant (QNT)

Quant (QNT)

|

$114.50 | $1.38 B | 7.20% | ||

Ethena (ENA)

Ethena (ENA)

|

$0.95700000 | $1.36 B | -3.48% | ||

SingularityNET (AGIX)

SingularityNET (AGIX)

|

$1.03 | $1.31 B | 3.67% | ||

Neo (NEO)

Neo (NEO)

|

$18.51 | $1.31 B | -5.00% | ||

BitTorrent (New) (BTT)

BitTorrent (New) (BTT)

|

$0.00000133 | $1.28 B | 1.18% | ||

Flare (FLR)

Flare (FLR)

|

$0.03215019 | $1.24 B | 0.23% | ||

MultiversX (EGLD)

MultiversX (EGLD)

|

$44.98 | $1.21 B | 1.25% | ||

Huobi Token (HT)

Huobi Token (HT)

|

$0.57958500 | $92.22 M | -0.88% | ||

Akash Network (AKT)

Akash Network (AKT)

|

$5.06 | $1.19 B | -14.93% | ||

Axie Infinity (AXS)

Axie Infinity (AXS)

|

$8.03 | $1.15 B | 5.42% | ||

The Sandbox (SAND)

The Sandbox (SAND)

|

$0.50050000 | $1.13 B | 3.57% | ||

dYdX (Native) (DYDX)

dYdX (Native) (DYDX)

|

$2.41 | $1.12 B | 2.16% | ||

Chiliz (CHZ)

Chiliz (CHZ)

|

$0.12503000 | $1.11 B | 7.45% | ||

eCash (XEC)

eCash (XEC)

|

$0.00005517 | $1.09 B | 0.45% | ||

Ronin (RON)

Ronin (RON)

|

$3.41 | $1.08 B | 1.97% | ||

Wormhole (W)

Wormhole (W)

|

$0.59341225 | $1.07 B | -1.14% | ||

Worldcoin (WLD)

Worldcoin (WLD)

|

$5.49 | $1.06 B | -2.14% | ||

dYdX (DYDX)

dYdX (DYDX)

|

$2.42 | $753.43 M | 2.84% | ||

Tezos (XTZ)

Tezos (XTZ)

|

$1.08 | $1.05 B | 2.12% | ||

Conflux (CFX)

Conflux (CFX)

|

$0.26170000 | $1.03 B | 5.09% | ||

Mina (MINA)

Mina (MINA)

|

$0.94119609 | $1.03 B | 8.10% | ||

Synthetix (SNX)

Synthetix (SNX)

|

$3.10 | $1.02 B | 2.18% | ||

JasmyCoin (JASMY)

JasmyCoin (JASMY)

|

$0.02050100 | $1.01 B | -1.90% | ||

Pyth Network (PYTH)

Pyth Network (PYTH)

|

$0.67500000 | $1.01 B | 0.16% | ||

ORDI (ORDI)

ORDI (ORDI)

|

$47.98 | $1.01 B | 0.80% | ||

KuCoin Token (KCS)

KuCoin Token (KCS)

|

$10.20 | $980.22 M | 6.40% | ||

Starknet (STRK)

Starknet (STRK)

|

$1.34 | $978.81 M | 3.24% | ||

EOS (EOS)

EOS (EOS)

|

$0.86590000 | $969.56 M | 2.89% | ||

Gnosis (GNO)

Gnosis (GNO)

|

$368.39 | $953.97 M | -5.74% | ||

Decentraland (MANA)

Decentraland (MANA)

|

$0.49304314 | $940.88 M | 3.36% |

Try to search another coin

clc7 Bitcoin