Notification Center

Turn on/off sound

Show/Hide Coins Ticker

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 8 Gwei | 9 Gwei | 11 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 8 Gwei | 9 Gwei | 11 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

P.S. The report is free. I think halving event is crypto public service.

So far it is predictable as we are heading into halving the price shows some green. It's a hook more than likely. S&P500 is continuing in its correction, and this gap is basically retail money expecting immediate post-halving results. Check the report, and then you'll know whether to expect immediate 100x long or not. Cheers my friend!

Halving is here. Miners rewards cut in half. You have the report here https://t.me/blockchainwhispersbaby/11349 about what to expect in price if history is to be asked. Cheers my friend!

Remember this green drawing? Above = bullish, below = dump. We are retesting it now in a quite bad way. Just fyi.

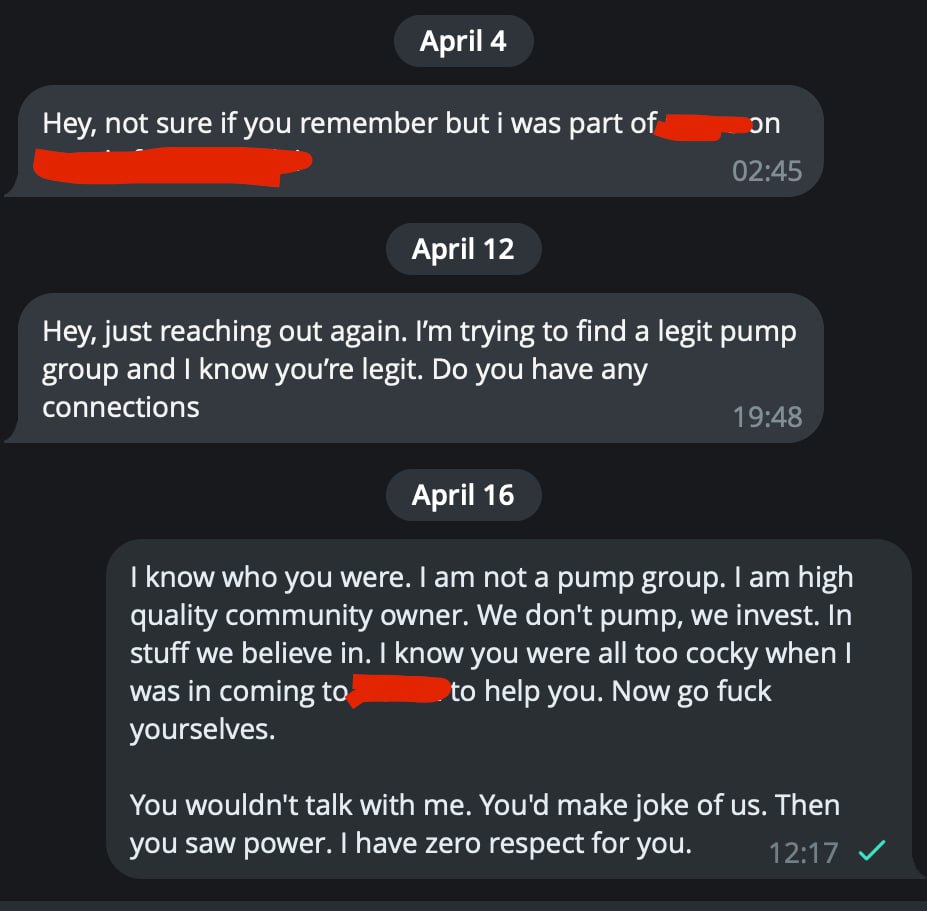

To all project founders who ignore good-intent people, are cocky to them, but once they see the power (like BCW) they get on their knees to suck a dick. FUCK YOU!

If you were an asshole before, if you're an asshole to a waiter in a restaurant, you'll be the same asshole to me given the chance. I want nothing to do with you. You don't deserve BCW.

Many guys like this guy. I remember him, founder of a project, a fork that was good idea. I came anon to give them top notch advice, they were ubercocky. Later, when they saw BCW power, they started to suck dick.

You know that joke: "Jenny would you suck a dick for a million bucks?"

- "for a million, yes"

- "what about for $10?"

She slaps him.

"who do you think I am"

- "we already established that, now we're just negotiating"

—-

The point is, if they are assholes, they are assholes. Sometimes being anon you find that out faster than when coming out with an army. Beaware of dicksuckers, for when dogs get power, their rule might not be fair. Cheers!

On a macro scale, if you zoom out just a bit from second-to-second thinking... if you relax... crypto this year I expect to be very rewarding. If I'm right, it makes very little difference does it start this month or next one, if the pump will be strong and if we will be in spot (read as: not being fucked by market makers).

Spot hold what you truly like.

Enjoy crypto.

Or micro trade it, time the market. I share with you the edge I find (and it's quite both powerful and often). According to your preference. Cheers!

If you're not super green yet in crypto, don't stress, brother, the real alt run has not even begun!

What I think alts might collapse for a bit. Maybe now is not the right time to buy them. I am telling you for quite some time, and since then the alts are boring. I tell you alts will break down. I think that now more than ever.

But remember your BCW brother... THEN will be a good time to buy. I am not selling. I just am not buying here. I wait for further dip to top up or to get back in the degen plays.

Blockchain Whispers baby!

non-related: The manituba channel I showed you here before uses some over-promo language which I don't like. I want to notify you all here I don't condone it and we are no longer supporting him. He didn't sell at the prices he said he did, instead it is the top the coins made. He had some great calls. Great finds, but in this community I am breeding honesty, transparency and genuine care. I will no longer promote him. He just posted it. But I don't like the psychology behind it.

D Man

P.S. I don't control traders and what they post. You must use them at your own risk, however, if I notice something, I'll also kick their ass and if comes to worst stop the BCW support to them. Either the BCW way or the highway! We are the legion. They are not!

https://blockchainwhispers.com44f39a7de86a1c7d995c6ebcd583fee5.pdfI've made for you the halving report. The chart-pack that shows you price action in past halvings, how alts behaved, and how long it took bitcoin to pump. It's easy to study, and get properly prepared for the upcoming halving.

Courtesy of your Blockchain Whispers family. It's free for you. Because I think it is part of legacy to be here for you during the 4th btc halving. Freely share with anyone you care about. Cheers brother!

Don't think it's because of war. SPX was long due for correction. So is btc. Many things start dropping couple days before mainnet. Why not btc?

D Man's Macro Fundamental Report Buyers were ready for this retrace.

Careful free chan followers as well.

D Man

AMA done. Was amazing. Thanks Mr. W and everyone who attended. BCW rocks!

How accurate D Man is?

This green is pre drawn line from the report, played out PERFECTLY (price wise).

Red lines were added a bit later.

Very accurate stuff. Back when everyone was (let me remind you) crazy bullish re: eth. BCW knew! D Man informed you. Brother on your side. Cheers!

Alts time is not now. BTC is pumping because of halving in days from now... but spx (stocks) already falling. Alts are not bullish yet... upon some base support from stocks, and btc on the side-up spiral back even after possible retrace, I think the real alt run will come.

ETHbtc doesn't look good short term either, except if hong-kong etf for eth gets approved monday... that could change it all.

Discussions

top 3 breaking news

The Human Rights Foundation (HRF) unveiled the Finney Freedom Prize on Bitcoin’s fourth halving day to celebrate the flagship crypto for enabling greater financial freedom for the world. The award is designed to honor significant global achievements in Bitcoin and human rights, reflecting Finney’s vision of using technology as a tool for liberation. The inaugural […] The post Human Rights Foundation launches Finney Freedom Prize to reward contributions to Bitcoin for 110 years appeared first on CryptoSlate.

a

a

a

a

a

a

At 8:12 p.m. ET on Friday., April 19, 2024, the Bitcoin network marked its fourth block reward halving at block height 840,000. Block 840,000 was mined by Viabtc, securing the notable ‘epic satoshi’ for the fortunate mining pool and a 3.125 BTC reward. The Halving Is Now Complete Bitcoin’s latest halving event occurred at block […]

a

a

a

a

a

a

The Bitcoin halving just took place at block number 840,000. This event today reduced the mining reward for each block to 3.125 Bitcoins from 6.25 Bitcoins. New Bitcoins are introduced into circulation through these mining rewards.Another Bitcoin HalvingHalving is one of the most significant events in the cryptocurrency world and occurs approximately every four years, specifically after every 210,000 blocks. It greatly reduces the supply of Bitcoin, thus helping to control inflation by maintaining scarcity.Bitcoin was created on 3 January 2009. Initially, the reward for mining each block was 50 Bitcoins. The mining reward was first halved on 28 November 2012 in the first halving event. The next halving event took place on 9 July 2016, reducing the mining reward to 12.5 Bitcoins per block, while the third halving on 11 May 2020 reduced it further to 6.25 Bitcoins.Now, the reward for mining each Bitcoin block is 3.125 Bitcoins.The Cap of 21 Million BitcoinsBitcoin operates on a proof-of-work consensus mechanism, and according to the algorithm, a halving must occur every 210,000 blocks until all 21 million Bitcoins are mined. It is estimated that the last Bitcoin halving will happen around 2140.To alter this pre-set algorithm, a majority of Bitcoin miners, more than 50 percent, must agree, which is nearly impossible given Bitcoin's decentralized and extensive network.Currently, around 19 million Bitcoins have already been mined, leaving only 2 million more to be mined.The halving of Bitcoin supply has a significant impact on the cryptocurrency's price. Historically, it has been one of the major price drivers, with Bitcoin prices surging around the event. The event affects Bitcoin miners' operations, as a reduction in the reward by half without a corresponding significant price increase, affects the cash flow of the mining operations. This article was written by Arnab Shome at www.financemagnates.com.

a

a

a

a

a

a

Bitcoin has officially executed a systematic, hard-coded and highly anticipated event known as the halving. The event, which happens roughly every four years, essentially cuts the Bitcoin reward that miners receive for powering the network in half, reducing the new supply of BTC entering the market. The reward for mining a block has reduced from […] The post Bitcoin Halving Executes, Defying Era of Money Printing and Currency Debasement With ‘Quantitative Tightening’ appeared first on The Daily Hodl.

a

a

a

a

a

a

The bitcoin halving event (BTC-USD) is approaching, likely to occur over this weekend and decrease the reward for bitcoin mining operators.

a

a

a

a

a

a

The countdown to Bitcoin's 4th halving has begun. Tune in to the Bitcoin Halving Livestream powered by Kraken.

a

a

a

a

a

a

Solana’s price declined and broke below the bottom of its upward trend channel, which means its upward momentum has slowed down over the medium to long term. Right now, SOL is near an important support level at $118. This could be a chance for the price to go back up. But if the price goes […]

a

a

a

a

a

a

A popular crypto trader says the decentralized oracle network Chainlink (LINK) is flashing a short-term bullish signal. Ali Martinez tells his 59,300 followers on the social media platform X that the Tom DeMark (TD) Sequential indicator recently presented a buy signal for LINK on the daily chart, which he says suggests “a potential one to […] The post Trader Says Chainlink (LINK) Flashing Short-Term Bullish Signal As Crypto Market Tracks Sideways appeared first on The Daily Hodl.

a

a

a

a

a

a

The Shiba Inu burn rate has seen another daily increase, which is a welcome development for the community. However, the figures being burned paint another picture, especially when it comes to participation from Shiba Inu holders in the SHIB burning initiative. Shiba Inu Burn Rate Rises 81% The Shiba Inu daily burn rate saw a significant uptick, rising an impressive 81% in a single day. While this surge is a positive for the meme coin, the number of tokens burned to cause this surge are far from impressive. Related Reading: Goldman Sachs On Bitcoin Halving: ‘It doesn’t Matter If It’s A Buy The Rumor, Sell The News Event’ According to data from the Shiba Inu burn tracking website Shibburn, a total of 4.64 million SHIB tokens were burned in the last day. To put this in perspective, the total value of the tokens burned for the day is around $105. Additionally, given that this constitutes an 81% increase, it means an even smaller amount of tokens were burned the prior day. Shibburn’s records show that the previous day saw a total of 1.9 million tokens burned, which is around $45 worth of coins. This drastic decline in the number of coins being burned on a daily basis suggests muted participation from investors. This could be directly tied to Shiba Inu’s price struggle over the last few weeks, which has seen investors take a more conservative stance to protect their positions. SHIB Price Crashes 21% The Shiba Inu burn rate is not the only thing that has been seeing a decline in the last week, its price has also taken a hit. According to data from the token tracking platform Coinmarketcap, the Shiba Inu price is down 15% in the last week alone. Related Reading: Here’s What Would Happen If The Bitcoin Price Fell Below $58,000 As a result of this 15% decline, the SHIB price has now dropped to $0.000023, which also represents a 50% drop from its March peak of $0.000044. However, its daily trading volume has seen a bullish reversal, rising 12% in the last day to $645 million. A rise in volume can often signal a return in interest to a cryptocurrency. If this is the case, then the Shiba Inu price may be headed for a reversal as investors start to place their bets once more. At the time of writing, the SHIB price is still trending at $0.0000228, showing small daily gains of 4%. However, despite the negative headwinds the meme coin has experienced, it continues to maintain a market cap above $13.5 billion, which makes it the 11th-largest cryptocurrency in the market, ahead of the likes of Avalanche and Polkadot. SHIB price at $0.0000228 | Source: SHIBUSDT on Tradingview.com Featured image from Bitcoin News, chart from Tradingview.com

a

a

a

a

a

a

Bloomberg Television New 3.6K views · 10:51 · Go to channel · Crypto World: The Bitcoin Halving Is Set To Shake Up The Crypto's Price And The ...

a

a

a

a

a

a

Since its ascent to dominance in the stablecoin market, Tether has faced persistent inquiries regarding the lack of audits for its reserves. The absence of these audits has left investors grappling with uncertainty, despite Tether’s pivotal role as the world’s leading stablecoin with a staggering $108 billion market value. In a recent interview with DL […]

a

a

a

a

a

a

... blockchain adjacent to messaging app Telegram. Tether's transparency page earlier today showed that there's $10 million worth of USDT authorized ...

a

a

a

a

a

a

Chanalysis submitted a Polkadot governance proposal on April 18 that could lead to a $10 million partnership. The services provided by Chainalysis will include monitoring and tracing the DOT token activities on the Relay Chain, ensuring visibility of any potentially risky on-chain actions to regulators and institutional entities. This approach is aimed at maintaining a […] The post Chainalysis proposes $10 million Polkadot partnership to provide analytics solutions appeared first on CryptoSlate.

a

a

a

a

a

a

PRESS RELEASE. WorkML.ai is developing a revolutionary platform that will harness the potential of hundreds of thousands of annotators from around the globe. Through comprehensive training programs, WorkML.ai aims to qualify annotators to produce high-quality Metadata, essential for enhancing AI models. Annotators will be compensated in WML tokens for their contributions, creating a dynamic ecosystem. […]

a

a

a

a

a

a

The head of research at the on-chain analytics firm CryptoQuant has explained why selling pressure from Bitcoin traders may be declining. Bitcoin Short-Term Holder Realized Price Has Risen To $60,000 In a new post on X, CryptoQuant head of research Julio Moreno has discussed why the short-term holder selling pressure may be declining for BTC. The “short-term holders” (STHs) refer to the Bitcoin investors who have been holding onto their coins since less than 155 days ago. Related Reading: Bitcoin Miners Always Sell Into Halvings, Is This Time Any Different? The STHs include the “traders” of the market who make many moves within short periods and don’t tend to HODL their coins. This group can be quite reactive to market movements, easily panic selling whenever a crash or rally takes place. Generally, investors in profits are more likely to sell their coins, so one way to gauge whether the STHs would be likely to take part in a selloff is through their profit/loss margin. Here, Moreno has cited the profit/loss margin of this cohort based on its realized price. The realized price of the group appears to have been going up in recent weeks | Source: @jjcmoreno on X The STH realized price (highlighted in pink) here refers to the average cost basis or acquisition price of the investors part of this cohort calculated using blockchain transaction history. When the spot value of the cryptocurrency is above this level, it means that these holders as a whole are sitting on some net profits right now. On the other hand, the price being below the metric implies the dominance of losses. From the above chart, it’s visible that Bitcoin has been above the STH realized price for the last few months, meaning that these traders have been enjoying profits. This is typical during bull markets as the price keeps pushing up, letting these investors make profits. While STHs tend to stay in the green in these periods, tops do become probable to take place if these profits get extreme. As is apparent in the graph, the profit/loss margin spiked to significant levels just as BTC set its latest all-time high, which continues to be the top thus far. Related Reading: Chainlink (LINK) Forms Bullish Pattern That Led To 50% Rally On Average Recently, as Bitcoin has consolidated between the $60,000 to $70,000 range, the STH realized price has rapidly risen, now attaining a value of around $60,000. This occurs because as STHs have traded in this range, their acquisition prices have been repriced at these higher levels, thus pushing up the average. BTC has been quite close to this level recently so that the STHs wouldn’t be holding that much profit now. “Bitcoin selling pressure from traders may be declining as unrealized profit margins are basically zero now,” notes the CryptoQuant head. BTC Price Bitcoin has continued to show action contained within its recent range as its price is still trading around $65,200. Looks like the price of the asset has rebounded in the past day | Source: BTCUSD on TradingView Featured image from Kanchanara on Unsplash.com, CryptoQuant.com, chart from TradingView.com

a

a

a

a

a

a

Analysts are buzzing about what they see as potential missteps by the bears in the Bitcoin market in the ever-volatile world of cryptocurrency. According to some experts, such as Analyst Mags, a curious inverse correlation between USDT dominance and Bitcoin may be signalling a bullish turn for the leading cryptocurrency. Examining the dominance chart, which tracks the percentage of the total cryptocurrency […]

a

a

a

a

a

a

IntoTheBlock data shows that the largest bitcoin investors added nearly 20000 BTC to their holdings as the top crypto briefly buckled below $60000 ...

a

a

a

a

a

a

The bitcoin halving event will also mark the launch of Runes, a new standard for fungible tokens issued directly on Bitcoin.

a

a

a

a

a

a

Top 100 Coins By Market Cap

NEXT BTC MOVE:

I think Bitcoin goes UP because

| Name | Price | Marketcap | 24h | ||

|---|---|---|---|---|---|

Bitcoin (BTC)

Bitcoin (BTC)

|

$63,926.00 | $1.26 T | 1.42% | ||

Ethereum (ETH)

Ethereum (ETH)

|

$3,062.47 | $367.72 B | 0.31% | ||

Tether USDt (USDT)

Tether USDt (USDT)

|

$1.00 | $109.52 B | -0.03% | ||

BNB (BNB)

BNB (BNB)

|

$556.41 | $83.20 B | 1.42% | ||

Solana (SOL)

Solana (SOL)

|

$142.87 | $63.84 B | 2.49% | ||

USDC (USDC)

USDC (USDC)

|

$1.00 | $33.90 B | -0.03% | ||

XRP (XRP)

XRP (XRP)

|

$0.50359470 | $27.76 B | 1.04% | ||

Dogecoin (DOGE)

Dogecoin (DOGE)

|

$0.15727338 | $22.64 B | 5.34% | ||

Toncoin (TON)

Toncoin (TON)

|

$6.02 | $20.89 B | -7.52% | ||

Cardano (ADA)

Cardano (ADA)

|

$0.47262215 | $16.84 B | 3.65% | ||

Shiba Inu (SHIB)

Shiba Inu (SHIB)

|

$0.00002303 | $13.57 B | 2.27% | ||

Avalanche (AVAX)

Avalanche (AVAX)

|

$34.62 | $13.16 B | 0.69% | ||

Polkadot (DOT)

Polkadot (DOT)

|

$6.69 | $9.64 B | -0.30% | ||

TRON (TRX)

TRON (TRX)

|

$0.11013000 | $9.64 B | 1.04% | ||

Bitcoin Cash (BCH)

Bitcoin Cash (BCH)

|

$477.60 | $9.43 B | -0.34% | ||

Chainlink (LINK)

Chainlink (LINK)

|

$13.94 | $8.21 B | 1.48% | ||

Polygon (MATIC)

Polygon (MATIC)

|

$0.67220000 | $6.69 B | 0.72% | ||

Internet Computer (ICP)

Internet Computer (ICP)

|

$14.10 | $6.56 B | 11.65% | ||

Litecoin (LTC)

Litecoin (LTC)

|

$81.16 | $6.05 B | 1.06% | ||

NEAR Protocol (NEAR)

NEAR Protocol (NEAR)

|

$5.61 | $5.98 B | -0.57% | ||

UNUS SED LEO (LEO)

UNUS SED LEO (LEO)

|

$5.84 | $5.41 B | -0.35% | ||

Dai (DAI)

Dai (DAI)

|

$1.00 | $5.35 B | 0.00% | ||

Uniswap (UNI)

Uniswap (UNI)

|

$7.50 | $4.50 B | 3.97% | ||

Aptos (APT)

Aptos (APT)

|

$9.46 | $4.02 B | 0.45% | ||

Ethereum Classic (ETC)

Ethereum Classic (ETC)

|

$26.10 | $3.84 B | 0.94% | ||

Mantle (MNT)

Mantle (MNT)

|

$1.14 | $3.72 B | -1.62% | ||

First Digital USD (FDUSD)

First Digital USD (FDUSD)

|

$0.99950000 | $3.59 B | -0.03% | ||

Stacks (STX)

Stacks (STX)

|

$2.46 | $3.57 B | 1.74% | ||

Filecoin (FIL)

Filecoin (FIL)

|

$6.15 | $3.33 B | 3.87% | ||

OKB (OKB)

OKB (OKB)

|

$55.20 | $3.31 B | 0.31% | ||

Cronos (CRO)

Cronos (CRO)

|

$0.12319809 | $3.27 B | 0.76% | ||

Stellar (XLM)

Stellar (XLM)

|

$0.11200000 | $3.25 B | 2.10% | ||

Cosmos (ATOM)

Cosmos (ATOM)

|

$8.19 | $3.20 B | 0.55% | ||

Render (RNDR)

Render (RNDR)

|

$7.95 | $3.06 B | 1.88% | ||

Arbitrum (ARB)

Arbitrum (ARB)

|

$1.13 | $2.99 B | -0.41% | ||

Hedera Hashgraph (HBAR)

Hedera Hashgraph (HBAR)

|

$0.08073900 | $2.86 B | -1.23% | ||

Immutable (IMX)

Immutable (IMX)

|

$2.04 | $2.98 B | 1.74% | ||

VeChain (VET)

VeChain (VET)

|

$0.04050000 | $2.96 B | 0.58% | ||

dogwifhat (WIF)

dogwifhat (WIF)

|

$2.94 | $2.93 B | 16.98% | ||

Bittensor (TAO)

Bittensor (TAO)

|

$440.83 | $2.92 B | -4.84% | ||

Hedera (HBAR)

Hedera (HBAR)

|

$0.08040000 | $2.89 B | -1.18% | ||

Maker (MKR)

Maker (MKR)

|

$2,964.00 | $2.74 B | -0.97% | ||

Kaspa (KAS)

Kaspa (KAS)

|

$0.11355669 | $2.66 B | -4.44% | ||

Injective (INJ)

Injective (INJ)

|

$28.39 | $2.65 B | 3.62% | ||

The Graph (GRT)

The Graph (GRT)

|

$0.25785037 | $2.45 B | 1.73% | ||

Optimism (OP)

Optimism (OP)

|

$2.24 | $2.34 B | 1.29% | ||

Pepe (PEPE)

Pepe (PEPE)

|

$0.00000517 | $2.17 B | 2.94% | ||

Monero (XMR)

Monero (XMR)

|

$117.35 | $2.16 B | 1.90% | ||

Theta Network (THETA)

Theta Network (THETA)

|

$2.06 | $2.07 B | 0.93% | ||

Fantom (FTM)

Fantom (FTM)

|

$0.69157750 | $1.94 B | 1.55% | ||

Celestia (TIA)

Celestia (TIA)

|

$10.80 | $1.93 B | 6.57% | ||

THORChain (RUNE)

THORChain (RUNE)

|

$5.42 | $1.82 B | 11.91% | ||

Core (CORE)

Core (CORE)

|

$2.05 | $1.81 B | 0.96% | ||

Arweave (AR)

Arweave (AR)

|

$27.63 | $1.81 B | 11.23% | ||

Fetch.ai (FET)

Fetch.ai (FET)

|

$2.11 | $1.80 B | 4.49% | ||

Lido DAO (LDO)

Lido DAO (LDO)

|

$1.98 | $1.78 B | 0.85% | ||

Bitget Token (BGB)

Bitget Token (BGB)

|

$1.25 | $1.75 B | -0.82% | ||

Sui (SUI)

Sui (SUI)

|

$1.34 | $1.73 B | 8.02% | ||

Sei (SEI)

Sei (SEI)

|

$0.55600000 | $1.56 B | 8.75% | ||

Beam (BEAM)

Beam (BEAM)

|

$0.02735647 | $1.45 B | 5.54% | ||

Algorand (ALGO)

Algorand (ALGO)

|

$0.17480000 | $1.43 B | 1.50% | ||

Render Token (RNDR)

Render Token (RNDR)

|

$7.90 | $3.04 B | 1.98% | ||

Jupiter (JUP)

Jupiter (JUP)

|

$1.05 | $1.42 B | 4.16% | ||

Ethena (ENA)

Ethena (ENA)

|

$0.97300000 | $1.40 B | 9.15% | ||

Pendle (PENDLE)

Pendle (PENDLE)

|

$5.72 | $1.37 B | -1.93% | ||

Gala (GALA)

Gala (GALA)

|

$0.04437000 | $1.35 B | 0.72% | ||

FLOKI (FLOKI)

FLOKI (FLOKI)

|

$0.00013917 | $1.33 B | 2.17% | ||

Flow (FLOW)

Flow (FLOW)

|

$0.87900000 | $1.33 B | 1.60% | ||

Bitcoin SV (BSV)

Bitcoin SV (BSV)

|

$65.87 | $1.30 B | -0.95% | ||

Neo (NEO)

Neo (NEO)

|

$18.18 | $1.28 B | -4.36% | ||

Aave (AAVE)

Aave (AAVE)

|

$85.93 | $1.28 B | 1.61% | ||

Quant (QNT)

Quant (QNT)

|

$104.10 | $1.26 B | -2.64% | ||

Flare (FLR)

Flare (FLR)

|

$0.03234124 | $1.25 B | 0.96% | ||

BitTorrent (New) (BTT)

BitTorrent (New) (BTT)

|

$0.00000125 | $1.21 B | -1.37% | ||

SingularityNET (AGIX)

SingularityNET (AGIX)

|

$0.86291000 | $1.11 B | 4.48% | ||

MultiversX (EGLD)

MultiversX (EGLD)

|

$40.89 | $1.10 B | 1.64% | ||

dYdX (Native) (DYDX)

dYdX (Native) (DYDX)

|

$2.29 | $1.06 B | 3.68% | ||

Wormhole (W)

Wormhole (W)

|

$0.58958523 | $1.06 B | 0.60% | ||

Huobi Token (HT)

Huobi Token (HT)

|

$0.57638200 | $91.55 M | -7.22% | ||

Ronin (RON)

Ronin (RON)

|

$3.18 | $1.00 B | 2.42% | ||

eCash (XEC)

eCash (XEC)

|

$0.00005175 | $1.00 B | 0.34% | ||

Axie Infinity (AXS)

Axie Infinity (AXS)

|

$6.94 | $999.26 M | -0.62% | ||

The Sandbox (SAND)

The Sandbox (SAND)

|

$0.44120000 | $997.35 M | 1.59% | ||

Synthetix (SNX)

Synthetix (SNX)

|

$2.96 | $970.82 M | 4.47% | ||

Chiliz (CHZ)

Chiliz (CHZ)

|

$0.10838000 | $969.19 M | 1.90% | ||

Tezos (XTZ)

Tezos (XTZ)

|

$0.98400000 | $966.53 M | 2.03% | ||

dYdX (DYDX)

dYdX (DYDX)

|

$2.27 | $703.44 M | 3.97% | ||

Bonk (BONK)

Bonk (BONK)

|

$0.00001480 | $965.16 M | 2.00% | ||

ORDI (ORDI)

ORDI (ORDI)

|

$45.71 | $959.82 M | 7.00% | ||

Worldcoin (WLD)

Worldcoin (WLD)

|

$4.91 | $944.16 M | 0.34% | ||

Conflux (CFX)

Conflux (CFX)

|

$0.23200000 | $920.84 M | 3.30% | ||

JasmyCoin (JASMY)

JasmyCoin (JASMY)

|

$0.01827800 | $905.80 M | 0.38% | ||

Pyth Network (PYTH)

Pyth Network (PYTH)

|

$0.60090000 | $903.67 M | 0.44% | ||

Akash Network (AKT)

Akash Network (AKT)

|

$3.83 | $897.01 M | -1.61% | ||

Gnosis (GNO)

Gnosis (GNO)

|

$346.10 | $894.69 M | 1.83% | ||

Starknet (STRK)

Starknet (STRK)

|

$1.21 | $880.53 M | -3.00% | ||

EOS (EOS)

EOS (EOS)

|

$0.78120000 | $880.27 M | 3.31% | ||

Mina (MINA)

Mina (MINA)

|

$0.79975281 | $871.06 M | 2.66% | ||

Nervos Network (CKB)

Nervos Network (CKB)

|

$0.01948700 | $864.24 M | -1.67% | ||

KuCoin Token (KCS)

KuCoin Token (KCS)

|

$8.90 | $855.44 M | 4.44% |

Try to search another coin

ch80 Yes