Notification Center

Turn on/off sound

Show/Hide Coins Ticker

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 6 Gwei | 6 Gwei | 7 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 6 Gwei | 6 Gwei | 7 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

P.S. The report is free. I think halving event is crypto public service.

So far it is predictable as we are heading into halving the price shows some green. It's a hook more than likely. S&P500 is continuing in its correction, and this gap is basically retail money expecting immediate post-halving results. Check the report, and then you'll know whether to expect immediate 100x long or not. Cheers my friend!

Halving is here. Miners rewards cut in half. You have the report here https://t.me/blockchainwhispersbaby/11349 about what to expect in price if history is to be asked. Cheers my friend!

Remember this green drawing? Above = bullish, below = dump. We are retesting it now in a quite bad way. Just fyi.

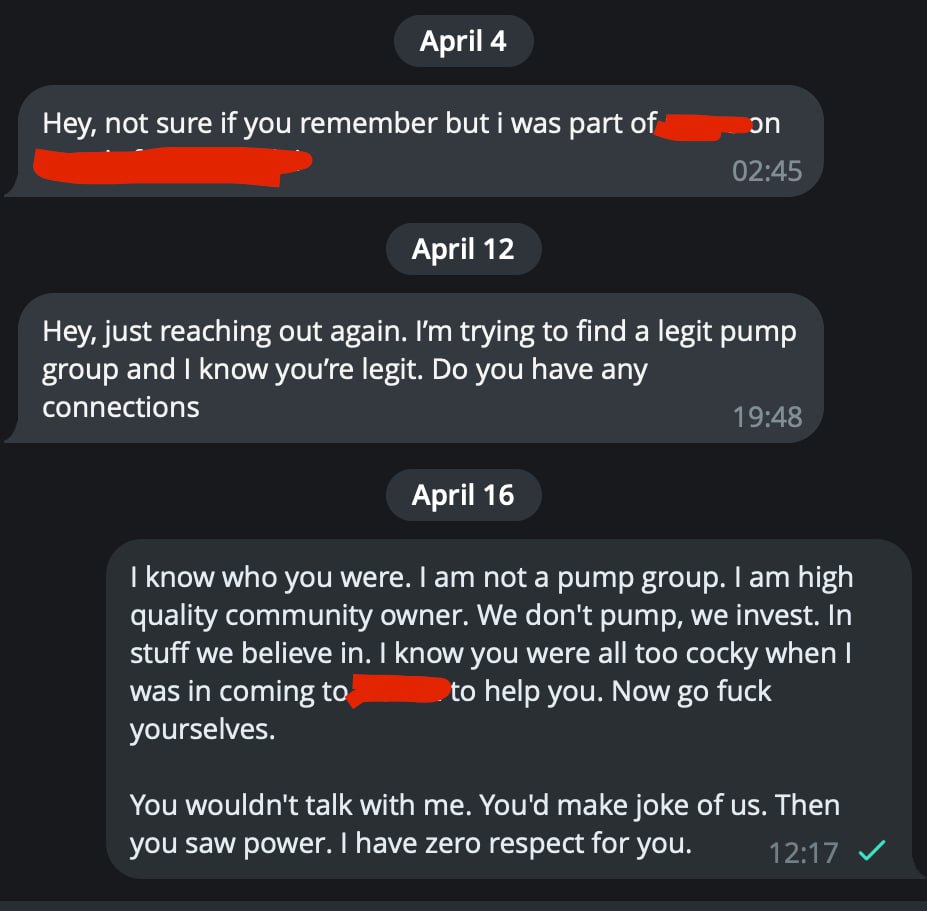

To all project founders who ignore good-intent people, are cocky to them, but once they see the power (like BCW) they get on their knees to suck a dick. FUCK YOU!

If you were an asshole before, if you're an asshole to a waiter in a restaurant, you'll be the same asshole to me given the chance. I want nothing to do with you. You don't deserve BCW.

Many guys like this guy. I remember him, founder of a project, a fork that was good idea. I came anon to give them top notch advice, they were ubercocky. Later, when they saw BCW power, they started to suck dick.

You know that joke: "Jenny would you suck a dick for a million bucks?"

- "for a million, yes"

- "what about for $10?"

She slaps him.

"who do you think I am"

- "we already established that, now we're just negotiating"

—-

The point is, if they are assholes, they are assholes. Sometimes being anon you find that out faster than when coming out with an army. Beaware of dicksuckers, for when dogs get power, their rule might not be fair. Cheers!

On a macro scale, if you zoom out just a bit from second-to-second thinking... if you relax... crypto this year I expect to be very rewarding. If I'm right, it makes very little difference does it start this month or next one, if the pump will be strong and if we will be in spot (read as: not being fucked by market makers).

Spot hold what you truly like.

Enjoy crypto.

Or micro trade it, time the market. I share with you the edge I find (and it's quite both powerful and often). According to your preference. Cheers!

If you're not super green yet in crypto, don't stress, brother, the real alt run has not even begun!

What I think alts might collapse for a bit. Maybe now is not the right time to buy them. I am telling you for quite some time, and since then the alts are boring. I tell you alts will break down. I think that now more than ever.

But remember your BCW brother... THEN will be a good time to buy. I am not selling. I just am not buying here. I wait for further dip to top up or to get back in the degen plays.

Blockchain Whispers baby!

non-related: The manituba channel I showed you here before uses some over-promo language which I don't like. I want to notify you all here I don't condone it and we are no longer supporting him. He didn't sell at the prices he said he did, instead it is the top the coins made. He had some great calls. Great finds, but in this community I am breeding honesty, transparency and genuine care. I will no longer promote him. He just posted it. But I don't like the psychology behind it.

D Man

P.S. I don't control traders and what they post. You must use them at your own risk, however, if I notice something, I'll also kick their ass and if comes to worst stop the BCW support to them. Either the BCW way or the highway! We are the legion. They are not!

https://blockchainwhispers.com44f39a7de86a1c7d995c6ebcd583fee5.pdfI've made for you the halving report. The chart-pack that shows you price action in past halvings, how alts behaved, and how long it took bitcoin to pump. It's easy to study, and get properly prepared for the upcoming halving.

Courtesy of your Blockchain Whispers family. It's free for you. Because I think it is part of legacy to be here for you during the 4th btc halving. Freely share with anyone you care about. Cheers brother!

Don't think it's because of war. SPX was long due for correction. So is btc. Many things start dropping couple days before mainnet. Why not btc?

D Man's Macro Fundamental Report Buyers were ready for this retrace.

Careful free chan followers as well.

D Man

AMA done. Was amazing. Thanks Mr. W and everyone who attended. BCW rocks!

How accurate D Man is?

This green is pre drawn line from the report, played out PERFECTLY (price wise).

Red lines were added a bit later.

Very accurate stuff. Back when everyone was (let me remind you) crazy bullish re: eth. BCW knew! D Man informed you. Brother on your side. Cheers!

Alts time is not now. BTC is pumping because of halving in days from now... but spx (stocks) already falling. Alts are not bullish yet... upon some base support from stocks, and btc on the side-up spiral back even after possible retrace, I think the real alt run will come.

ETHbtc doesn't look good short term either, except if hong-kong etf for eth gets approved monday... that could change it all.

Discussions

top 3 breaking news

In a recent tweet, well-known crypto analyst Rekt Capital delved into the potential timeline for the next Bitcoin market peak, emphasizing the Halving cycle’s significant impact on building BTC’s market path. As the Bitcoin Halving is set to occur between today and tomorrow, April 20, Bitcoin has shown less significant market movement. At the time of writing, the asset has a market price of $64,578. Related Reading: Bitcoin Halving Could Catalyzed $100,000 Price Surge: Bitwise CEO Analyst: ‘When Could Bitcoin Peak In This Bull Market?’ According to Rekt Capital’s analysis, Bitcoin typically reaches its bull market peak between 518 and 546 days following a Halving event. Applying this historical timeline, the next anticipated bull market peak could fall between mid-September and mid-October 2025. However, as disclosed by Rekt Capital, recent market trends suggest a possible acceleration in Bitcoin’s ongoing cycle compared to historical patterns, demonstrated by the cryptocurrency achieving new record levels approximately 260 days ahead of the typical schedule. Despite this apparent acceleration, Rekt Capital noted: Bitcoin has been experiencing a Pre-Halving Retrace for the past month or so As a result, Bitcoin has been slowing down and decelerating the cycle by 30 days thus far and counting So while Bitcoin may have been accelerating by ~260 days last month… Today this acceleration is now more close to ~230 days due to the current Pre-Halving Retrace. Additionally, Rekt Capital introduced an alternative viewpoint termed the “Accelerated Perspective,” which factors in the duration from when Bitcoin exceeds its previous peak to the projected culmination of the bull market. Given Bitcoin’s recent attainment of new all-time highs in March, this perspective implies that the subsequent bull market peak could happen between December 2024 and February 2025. #BTC When Could Bitcoin Peak In This Bull Market? Historically, Bitcoin has peaked in its Bull Market 518-546 days after the Halving (Chart 1) This is how typical Bitcoin Halving Cycles have progressed So if history repeats… Next Bull Market peak may occur 518-546 days… pic.twitter.com/QXZUS7ZyjU — Rekt Capital (@rektcapital) April 19, 2024 BTC Price Dynamics Amidst Market Fluctuations Meanwhile, amidst recent market fluctuations, BTC is undergoing a slight recovery. At the time of writing, it had increased marginally by 1.4%, bringing its market price to above $64,000. This recovery follows a week-long decline during which Bitcoin experienced nearly a 10% downturn. In light of these developments, crypto expert Michaël van de Poppe has shared insights into the potential implications of the impending BTC Halving event. Van de Poppe suggests a shift in focus away from Bitcoin once the halving occurs, speculating on potential changes in market narratives. Related Reading: Crypto Expert Predicts A Narrative Shift Post-Bitcoin Halving While he did not specify the exact narrative shift, Van de Poppe previously outlined expectations for the crypto market, including an anticipated emphasis on Ethereum (ETH) and projects focused on Decentralized Physical Infrastructure Networks (DePIN) and Real World Assets (RWA) post-Halving. Expectance: – #Bitcoin to consolidate. – #Altcoins bouncing in their Bitcoin pairs. – Narrative to shift to ETH and DePIN/RWA. – Altcoin strength from in Q2/Summer. – Corrections in Q3. It’s going to be great, just buy the dip. — Michaël van de Poppe (@CryptoMichNL) April 17, 2024 Featured image from Unsplash, Chart from TradingView

a

a

a

a

a

a

... cryptocurrency's blockchain https://t.co/kABvewn1wj. ... @crypto. The fourth Bitcoin 'halving' has ... From bloomberg.com · 12:28 AM · Apr 20, 2024.

a

a

a

a

a

a

Discover the impacts of the 4th Bitcoin Halving on consumers and merchants. BitPay analyzes economic effects, trends, and offers tips for the crypto market during this pivotal event.

a

a

a

a

a

a

The famous analyst Ali Martinez has provided his insights concerning Bitcoin’s market movements. In a recent X post, Martinez discussed the current speculative theories around Bitcoin’s price behavior, specifically the idea that it is developing a Wyckoff distribution pattern. According to Martinez, much attention has been paid to the discussion about Bitcoin and its possible […]

a

a

a

a

a

a

Boxing legend Mike Tyson has become an ambassador for the blockchain-based social networking app, Ready to Fight. Tyson describes Ready to Fight as a boxing-centric social network that assists boxers and the boxing community with their business needs. RTF Aims to Revolutionize the Boxing Ecosystem Former heavyweight boxing champion Mike Tyson has joined the Web3 […]

a

a

a

a

a

a

AVAX trading volumes are surging and the price is up too. Here's what's next for the token...

a

a

a

a

a

a

“This process, known as mining, rewards miners with newly minted bitcoins. But with each halving, the reward to mining is decreased to maintain ...

a

a

a

a

a

a

Today's Bitcoin halving event means that, on average, miners will now produce around 450 BTC in total per day compared to 900 BTC previously.

a

a

a

a

a

a

Bitcoin is considered to be a risky asset. Mining Bitcoin. The Bitcoin blockchain is maintained by miners. Their job is to add new blocks to the ...

a

a

a

a

a

a

LONDON (Reuters) -Bitcoin, the world's largest cryptocurrency, on Friday completed its "halving," a phenomenon that happens roughly every four ...

a

a

a

a

a

a

Bitcoin halving 2024 — Done and dusted! The landmark occasion sees a reduction in Bitcoin miner rewards, dropping from 6.25 BTC per mined block to ...

a

a

a

a

a

a

The halving, which cuts the reward bitcoin miners receive for adding new blocks by 50%, occurs every 210,000 blocks – in accordance with the original ...

a

a

a

a

a

a

David Ripley, Kraken CEO, joins 'Fast Money' to talk the bitcoin halving and what's ahead for the cryptocurrency.

a

a

a

a

a

a

BlackRock's iShares Bitcoin Trust continues to see daily positive net flows, though its inflow total for a single day hit a new low Wednesday.

a

a

a

a

a

a

Injective Protocol, a blockchain for decentralized finance (DeFi) and derivatives trading, is voting on a proposal to significantly reshape the platform’s tokenomics and introduce a new era dubbed Injective 3.0. According to Injective, through a post on April 19, the proposal is now open for voting via the Injective Hub. For the next four days, stakers and validators are free to participate. Community Voting On Injective 3.0 Over the months since launching in 2023, Injective caught the crypto community’s attention. The team aims to launch a platform for users to launch DeFi-focused protocols in a low-cost, scalable, and yet Ethereum-compatible environment. Though INJ, the native currency of the platform, remains one of the top performers, changes introduced by Injective 3.0 will likely push prices even higher. According to developers, Injective 3.0 aims to make INJ a deflationary asset. A big part of this will be to reduce token minting by controlling the rate of token creation. If the community approves what’s laid out in the proposal, the team will change on-chain parameters to slow down token minting. Related Reading: Crypto Expert Predicts A Narrative Shift Post-Bitcoin Halving At the same time, Injective 3.0 plans to make INJ’s inflation rate more responsive to staking. Under this model, inflation will slow down as more INJ is locked away via staking, making the coin scarcer. Proposers predict the network to be more robust and secure if INJ becomes more deflationary. Usually, token prices of scarce assets tend to be higher. However, it should be noted that changes to tokenomics don’t immediately lead to favorable price repricing. For prices to soar, there must be utility, driven mainly by community interest. Millions Of INJ Burned, Will Prices Break $30? Injective 2.0 is currently live following its activation in August 2023. Under the current regime, there is a token auction burn, where decentralized applications (dapps) running on the platform are free to participate in token burning. According to the Injective Protocol, over 5.9 million INJ have been withdrawn. So far, INJ remains under pressure, sliding down, shedding 50% from March 2024 highs. The coin has been moving horizontally in the past few trading sessions. However, it is under immense selling and within the April 12 bear bar. Related Reading: Bitcoin Halving Could Catalyzed $100,000 Price Surge: Bitwise CEO The level at $30 is a crucial resistance level. Conversely, if INJ prices dip below this week’s lows at $23, the coin will slip towards April 13 lows of around $18. Feature image from Canva, chart from TradingView

a

a

a

a

a

a

Changpeng Zhao (CZ), the founder and former chief executive of Binance, recently took to Twitter to shed light on the looming Bitcoin halving, a pivotal event in the cryptocurrency world. As the countdown to the halving draws nearer, CZ’s insights offer valuable perspectives for crypto enthusiasts and investors alike. In a Twitter post, CZ revisited […]

a

a

a

a

a

a

Super Micro Computer and Nvidia plummeted on Friday, with the two AI favorites leading a broad-based tech selloff: Here's your Evening Briefing ...

a

a

a

a

a

a

FTX investors may drop claims against the company’s co-founder and former CEO, Sam Bankman-Fried, in return for his support. Bloomberg reported on April 19 that, under a proposed settlement, Bankman-Fried would cooperate against celebrity promoters named as defendants in a $1.3 million civil lawsuit. The civil case currently names celebrities as defendants, including former NFL […] The post FTX investors agree to drop civil lawsuit against SBF if he snitches on celebrity promoters appeared first on CryptoSlate.

a

a

a

a

a

a

Mexico Elections: Claudia Sheinbaum Sees Pemex Refinancing Debt in 2025 Bloomberg

a

a

a

a

a

a

Soccer has the World Cup. Athletics and many other sports have the Olympics. Crypto has the halving. The milestone in the blockchain's 15-year history technically means a cut in rewards for crypto miners with each block – a feature designed to minimize inflation.

a

a

a

a

a

a

Upon reaching block height 840,000, when the mining pool Viabtc collected 37.626 bitcoin in fees worth $2.39 million, the expense for onchain transfers climbed, surpassing $240 per transaction. Block 840,003 recorded 16.06 bitcoins in fee payments, and block 840,004 accumulated 24 bitcoins in fees valued at over $1.5 million. Bitcoin Transaction Fees Skyrocket Above $240 […]

a

a

a

a

a

a

Matt Hougan, Bitwise Asset Management CIO, joins 'Squawk Box' to discuss the impact of the expected bitcoin halving this week, whether bitcoin can ...

a

a

a

a

a

a

On-chain data shows that the largest number of investors in the Bitcoin market are finally buying, which could be bullish for the asset’s value. Bitcoin Mega Whales Have Shown Net Inflows In The Past Day In the past few weeks, the Bitcoin price has struggled to mount any significant bullish momentum as it has been stuck consolidating inside a range. Earlier, while this was happening, the largest holders in the space had been sitting quietly, not buying or selling anything notable. According to data from the market intelligence platform IntoTheBlock, however, this appears to have changed in the past day. Related Reading: Bitcoin Trader Selling Pressure Declining, CryptoQuant Head Explains Why Relevant holders here are the “Large Holders,” who, as defined by the analytics firm, are investors carrying at least 0.1% of the entire circulating Bitcoin supply in their wallets. A little under 19.7 million tokens are circulating for the cryptocurrency, 0.1% of which would be 19,700 BTC. This amount is worth more than $1.26 billion at the current exchange rate of BTC. Clearly, these large holders are quite large indeed, and in fact, they are much larger than the usual whale investors, who typically carry between 1,000 and 10,000 BTC. As such, it would perhaps be apt to call these humongous entities “mega whales.” Since an investor’s influence in the market increases the larger their holdings, these mega whales would be the most powerful entities on the Bitcoin network. Therefore, their moves can have some consequences for the wider market. IntoTheBlock has used the netflow on-chain indicator to track the movements of the Large Holders here, which measures the net amount of BTC entering or exiting the wallets of these investors. The below chart shows the trend in this metric over the last few months: The value of the metric seems to have been positive most recently | Source: IntoTheBlock on X As displayed in the above graph, the Bitcoin Large Holders netflow registered a notable positive spike yesterday, meaning these investors have received a net amount of coins into their wallets. The mega whales bought 19,760 BTC during this spike, worth more than $1.27 billion. “Historically, accumulations by these addresses have often preceded rises in Bitcoin’s price,” notes the analytics firm. The chart shows that some extraordinary buys came from this cohort on the way to the new all-time high for the asset. Related Reading: Bitcoin Miners Always Sell Into Halvings, Is This Time Any Different? As such, it’s possible that these latest buys will also help the asset gain some bullish momentum in the near future. However, something to note is that the scale of the latest spike, although large on its own, isn’t quite as prominent as that of some of the large buys seen earlier. BTC Price At the time of writing, Bitcoin is trading at around $64,500, down more than 5% over the past week. Looks like the price of the asset has been trading sideways recently | Source: BTCUSD on TradingView Featured image from Rod Long on Unsplash.com, IntoTheBlock.com, chart from TradingView.com

a

a

a

a

a

a

The IRS published a draft version of its 1099-DA reporting form and controversially included unhosted crypto wallets among its targets on April 19. Ji Kim, Chief Legal and Policy officer at the Crypto Council for Innovation, wrote that the IRS’ approach is “unfortunate” as it does not recognize that unhosted wallet providers lack knowledge about […] The post IRS draft tax form for crypto defines unhosted wallets as brokers appeared first on CryptoSlate.

a

a

a

a

a

a

In an era dominated by digital transformation, KebApp Coin is at the forefront of revolutionizing the food industry through innovative blockchain ...

a

a

a

a

a

a

As blockchain technology continues to evolve and regulatory frameworks adapt to accommodate tokenization, the range of tokenizable RWAs is likely ...

a

a

a

a

a

a

BlockDaemon's Barnaby Hodgkins recently sounded off on the future of the blockchain/cryptocurrency sector at the Token2049 event on April 20 in ...

a

a

a

a

a

a

At the 'After GDC 2024' event, Avalanche Korea General Manager Justin Kim predicted that there would be a blockchain period dedicated solely to ...

a

a

a

a

a

a

Top 100 Coins By Market Cap

NEXT BTC MOVE:

I think Bitcoin goes UP because

| Name | Price | Marketcap | 24h | ||

|---|---|---|---|---|---|

Bitcoin (BTC)

Bitcoin (BTC)

|

$63,900.50 | $1.26 T | 3.72% | ||

Ethereum (ETH)

Ethereum (ETH)

|

$3,052.30 | $366.73 B | 2.91% | ||

Tether USDt (USDT)

Tether USDt (USDT)

|

$1.00 | $109.48 B | 0.00% | ||

BNB (BNB)

BNB (BNB)

|

$557.01 | $83.29 B | 3.33% | ||

Solana (SOL)

Solana (SOL)

|

$142.37 | $63.74 B | 5.81% | ||

USDC (USDC)

USDC (USDC)

|

$1.00 | $33.91 B | -0.15% | ||

XRP (XRP)

XRP (XRP)

|

$0.50671165 | $27.93 B | 5.32% | ||

Dogecoin (DOGE)

Dogecoin (DOGE)

|

$0.15525000 | $22.35 B | 6.82% | ||

Toncoin (TON)

Toncoin (TON)

|

$6.04 | $20.97 B | -8.16% | ||

Cardano (ADA)

Cardano (ADA)

|

$0.47733100 | $16.90 B | 8.42% | ||

Shiba Inu (SHIB)

Shiba Inu (SHIB)

|

$0.00002307 | $13.59 B | 6.42% | ||

Avalanche (AVAX)

Avalanche (AVAX)

|

$34.84 | $13.19 B | 5.18% | ||

TRON (TRX)

TRON (TRX)

|

$0.11018000 | $9.67 B | 3.28% | ||

Polkadot (DOT)

Polkadot (DOT)

|

$6.70 | $9.64 B | 3.87% | ||

Bitcoin Cash (BCH)

Bitcoin Cash (BCH)

|

$474.10 | $9.35 B | 2.73% | ||

Chainlink (LINK)

Chainlink (LINK)

|

$14.00 | $8.22 B | 5.46% | ||

Polygon (MATIC)

Polygon (MATIC)

|

$0.67490000 | $6.69 B | 5.34% | ||

Internet Computer (ICP)

Internet Computer (ICP)

|

$14.20 | $6.57 B | 14.10% | ||

Litecoin (LTC)

Litecoin (LTC)

|

$81.41 | $6.07 B | 3.31% | ||

NEAR Protocol (NEAR)

NEAR Protocol (NEAR)

|

$5.56 | $5.94 B | 2.67% | ||

UNUS SED LEO (LEO)

UNUS SED LEO (LEO)

|

$5.82 | $5.39 B | -0.21% | ||

Dai (DAI)

Dai (DAI)

|

$1.00 | $5.35 B | -0.02% | ||

Uniswap (UNI)

Uniswap (UNI)

|

$7.53 | $5.69 B | 6.82% | ||

Aptos (APT)

Aptos (APT)

|

$9.45 | $4.03 B | 4.75% | ||

Ethereum Classic (ETC)

Ethereum Classic (ETC)

|

$26.19 | $3.85 B | 4.52% | ||

Mantle (MNT)

Mantle (MNT)

|

$1.14 | $3.72 B | 1.97% | ||

First Digital USD (FDUSD)

First Digital USD (FDUSD)

|

$0.99970000 | $3.59 B | -0.41% | ||

Stacks (STX)

Stacks (STX)

|

$2.43 | $3.53 B | 6.45% | ||

Filecoin (FIL)

Filecoin (FIL)

|

$6.19 | $3.34 B | 7.33% | ||

OKB (OKB)

OKB (OKB)

|

$54.81 | $3.29 B | 1.16% | ||

Cronos (CRO)

Cronos (CRO)

|

$0.12356798 | $3.28 B | 4.97% | ||

Stellar (XLM)

Stellar (XLM)

|

$0.11250000 | $3.26 B | 4.82% | ||

Cosmos (ATOM)

Cosmos (ATOM)

|

$8.19 | $3.20 B | 3.81% | ||

Render (RNDR)

Render (RNDR)

|

$7.91 | $3.04 B | 5.89% | ||

Arbitrum (ARB)

Arbitrum (ARB)

|

$1.12 | $2.98 B | 3.33% | ||

Hedera Hashgraph (HBAR)

Hedera Hashgraph (HBAR)

|

$0.08036200 | $2.87 B | 1.19% | ||

VeChain (VET)

VeChain (VET)

|

$0.04039000 | $2.96 B | 5.99% | ||

Immutable (IMX)

Immutable (IMX)

|

$2.01 | $2.94 B | 3.19% | ||

Bittensor (TAO)

Bittensor (TAO)

|

$441.63 | $2.93 B | -0.46% | ||

Hedera (HBAR)

Hedera (HBAR)

|

$0.08030000 | $2.88 B | 1.86% | ||

dogwifhat (WIF)

dogwifhat (WIF)

|

$2.82 | $2.82 B | 17.32% | ||

Maker (MKR)

Maker (MKR)

|

$2,957.00 | $2.74 B | 1.74% | ||

Kaspa (KAS)

Kaspa (KAS)

|

$0.11266200 | $2.60 B | -1.17% | ||

Injective (INJ)

Injective (INJ)

|

$27.52 | $2.57 B | 4.04% | ||

The Graph (GRT)

The Graph (GRT)

|

$0.25872900 | $2.46 B | 5.49% | ||

Optimism (OP)

Optimism (OP)

|

$2.23 | $2.34 B | 5.54% | ||

Monero (XMR)

Monero (XMR)

|

$117.31 | $2.13 B | 3.48% | ||

Pepe (PEPE)

Pepe (PEPE)

|

$0.00000511 | $2.15 B | 6.20% | ||

Theta Network (THETA)

Theta Network (THETA)

|

$2.06 | $2.06 B | 5.21% | ||

Celestia (TIA)

Celestia (TIA)

|

$11.05 | $1.97 B | 11.66% | ||

Fantom (FTM)

Fantom (FTM)

|

$0.68764400 | $1.93 B | 6.97% | ||

Arweave (AR)

Arweave (AR)

|

$27.81 | $1.83 B | 17.13% | ||

Fetch.ai (FET)

Fetch.ai (FET)

|

$2.14 | $1.82 B | 8.26% | ||

THORChain (RUNE)

THORChain (RUNE)

|

$5.32 | $1.78 B | 14.94% | ||

Core (CORE)

Core (CORE)

|

$2.01 | $1.78 B | 4.61% | ||

Lido DAO (LDO)

Lido DAO (LDO)

|

$1.98 | $1.77 B | 2.64% | ||

Bitget Token (BGB)

Bitget Token (BGB)

|

$1.26 | $1.76 B | 3.91% | ||

Sui (SUI)

Sui (SUI)

|

$1.32 | $1.72 B | 8.95% | ||

Sei (SEI)

Sei (SEI)

|

$0.55680000 | $1.56 B | 12.43% | ||

Ethena (ENA)

Ethena (ENA)

|

$1.01 | $1.44 B | 18.78% | ||

Beam (BEAM)

Beam (BEAM)

|

$0.02732999 | $1.45 B | 8.10% | ||

Render Token (RNDR)

Render Token (RNDR)

|

$7.90 | $3.04 B | 5.09% | ||

Algorand (ALGO)

Algorand (ALGO)

|

$0.17570000 | $1.43 B | 6.04% | ||

Jupiter (JUP)

Jupiter (JUP)

|

$1.05 | $1.42 B | 7.12% | ||

Pendle (PENDLE)

Pendle (PENDLE)

|

$5.73 | $557.17 M | 0.99% | ||

Gala (GALA)

Gala (GALA)

|

$0.04478000 | $1.71 B | 4.82% | ||

FLOKI (FLOKI)

FLOKI (FLOKI)

|

$0.00013969 | $1.34 B | 5.73% | ||

Flow (FLOW)

Flow (FLOW)

|

$0.87900000 | $1.32 B | 5.05% | ||

Bitcoin SV (BSV)

Bitcoin SV (BSV)

|

$65.91 | $1.30 B | 4.29% | ||

Neo (NEO)

Neo (NEO)

|

$18.17 | $1.28 B | 0.68% | ||

Aave (AAVE)

Aave (AAVE)

|

$86.16 | $1.28 B | 4.39% | ||

Quant (QNT)

Quant (QNT)

|

$105.20 | $1.27 B | 2.32% | ||

Flare (FLR)

Flare (FLR)

|

$0.03271890 | $1.26 B | 2.40% | ||

BitTorrent (New) (BTT)

BitTorrent (New) (BTT)

|

$0.00000125 | $1.21 B | 3.87% | ||

SingularityNET (AGIX)

SingularityNET (AGIX)

|

$0.87604000 | $1.12 B | 5.40% | ||

MultiversX (EGLD)

MultiversX (EGLD)

|

$41.11 | $1.11 B | 6.53% | ||

dYdX (Native) (DYDX)

dYdX (Native) (DYDX)

|

$2.27 | $1.14 B | 5.70% | ||

Wormhole (W)

Wormhole (W)

|

$0.58809700 | $1.06 B | 5.28% | ||

Huobi Token (HT)

Huobi Token (HT)

|

$0.58903100 | $98.00 M | -4.49% | ||

The Sandbox (SAND)

The Sandbox (SAND)

|

$0.44540000 | $1.01 B | 6.07% | ||

Ronin (RON)

Ronin (RON)

|

$3.18 | $1.00 B | 5.21% | ||

eCash (XEC)

eCash (XEC)

|

$0.00005070 | $999.14 M | 4.27% | ||

Axie Infinity (AXS)

Axie Infinity (AXS)

|

$6.93 | $995.54 M | 2.69% | ||

Synthetix (SNX)

Synthetix (SNX)

|

$2.99 | $981.07 M | 9.61% | ||

Chiliz (CHZ)

Chiliz (CHZ)

|

$0.10978000 | $978.14 M | 6.01% | ||

Tezos (XTZ)

Tezos (XTZ)

|

$0.99000000 | $972.74 M | 5.78% | ||

dYdX (DYDX)

dYdX (DYDX)

|

$2.27 | $707.98 M | 6.24% | ||

ORDI (ORDI)

ORDI (ORDI)

|

$46.18 | $969.88 M | 13.22% | ||

Bonk (BONK)

Bonk (BONK)

|

$0.00001484 | $967.18 M | 4.57% | ||

Worldcoin (WLD)

Worldcoin (WLD)

|

$4.91 | $938.98 M | 4.61% | ||

Conflux (CFX)

Conflux (CFX)

|

$0.23610000 | $934.92 M | 9.94% | ||

Pyth Network (PYTH)

Pyth Network (PYTH)

|

$0.60290000 | $905.22 M | 3.61% | ||

Akash Network (AKT)

Akash Network (AKT)

|

$3.86 | $893.02 M | 3.58% | ||

JasmyCoin (JASMY)

JasmyCoin (JASMY)

|

$0.01828500 | $902.00 M | 4.74% | ||

Gnosis (GNO)

Gnosis (GNO)

|

$344.50 | $894.29 M | 5.66% | ||

Starknet (STRK)

Starknet (STRK)

|

$1.22 | $889.30 M | 2.13% | ||

EOS (EOS)

EOS (EOS)

|

$0.78330000 | $900.72 M | 6.16% | ||

Mina (MINA)

Mina (MINA)

|

$0.80779327 | $879.87 M | 7.19% | ||

KuCoin Token (KCS)

KuCoin Token (KCS)

|

$8.95 | $860.18 M | 8.00% | ||

Nervos Network (CKB)

Nervos Network (CKB)

|

$0.01916900 | $843.67 M | -0.44% |

Try to search another coin

ch80 Yes