Notification Center

Turn on/off sound

Show/Hide Coins Ticker

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 10 Gwei | 10 Gwei | 12 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 10 Gwei | 10 Gwei | 12 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

P.S. The report is free. I think halving event is crypto public service.

So far it is predictable as we are heading into halving the price shows some green. It's a hook more than likely. S&P500 is continuing in its correction, and this gap is basically retail money expecting immediate post-halving results. Check the report, and then you'll know whether to expect immediate 100x long or not. Cheers my friend!

Halving is here. Miners rewards cut in half. You have the report here https://t.me/blockchainwhispersbaby/11349 about what to expect in price if history is to be asked. Cheers my friend!

Remember this green drawing? Above = bullish, below = dump. We are retesting it now in a quite bad way. Just fyi.

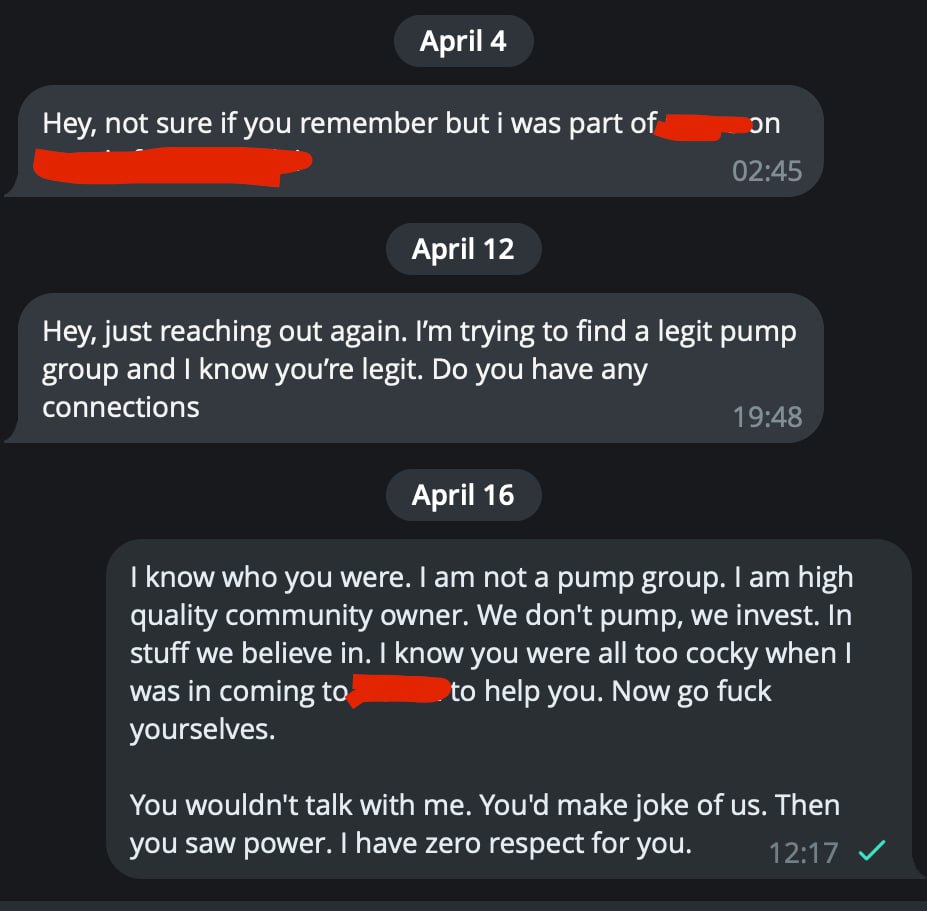

To all project founders who ignore good-intent people, are cocky to them, but once they see the power (like BCW) they get on their knees to suck a dick. FUCK YOU!

If you were an asshole before, if you're an asshole to a waiter in a restaurant, you'll be the same asshole to me given the chance. I want nothing to do with you. You don't deserve BCW.

Many guys like this guy. I remember him, founder of a project, a fork that was good idea. I came anon to give them top notch advice, they were ubercocky. Later, when they saw BCW power, they started to suck dick.

You know that joke: "Jenny would you suck a dick for a million bucks?"

- "for a million, yes"

- "what about for $10?"

She slaps him.

"who do you think I am"

- "we already established that, now we're just negotiating"

—-

The point is, if they are assholes, they are assholes. Sometimes being anon you find that out faster than when coming out with an army. Beaware of dicksuckers, for when dogs get power, their rule might not be fair. Cheers!

On a macro scale, if you zoom out just a bit from second-to-second thinking... if you relax... crypto this year I expect to be very rewarding. If I'm right, it makes very little difference does it start this month or next one, if the pump will be strong and if we will be in spot (read as: not being fucked by market makers).

Spot hold what you truly like.

Enjoy crypto.

Or micro trade it, time the market. I share with you the edge I find (and it's quite both powerful and often). According to your preference. Cheers!

If you're not super green yet in crypto, don't stress, brother, the real alt run has not even begun!

What I think alts might collapse for a bit. Maybe now is not the right time to buy them. I am telling you for quite some time, and since then the alts are boring. I tell you alts will break down. I think that now more than ever.

But remember your BCW brother... THEN will be a good time to buy. I am not selling. I just am not buying here. I wait for further dip to top up or to get back in the degen plays.

Blockchain Whispers baby!

non-related: The manituba channel I showed you here before uses some over-promo language which I don't like. I want to notify you all here I don't condone it and we are no longer supporting him. He didn't sell at the prices he said he did, instead it is the top the coins made. He had some great calls. Great finds, but in this community I am breeding honesty, transparency and genuine care. I will no longer promote him. He just posted it. But I don't like the psychology behind it.

D Man

P.S. I don't control traders and what they post. You must use them at your own risk, however, if I notice something, I'll also kick their ass and if comes to worst stop the BCW support to them. Either the BCW way or the highway! We are the legion. They are not!

https://blockchainwhispers.com44f39a7de86a1c7d995c6ebcd583fee5.pdfI've made for you the halving report. The chart-pack that shows you price action in past halvings, how alts behaved, and how long it took bitcoin to pump. It's easy to study, and get properly prepared for the upcoming halving.

Courtesy of your Blockchain Whispers family. It's free for you. Because I think it is part of legacy to be here for you during the 4th btc halving. Freely share with anyone you care about. Cheers brother!

Don't think it's because of war. SPX was long due for correction. So is btc. Many things start dropping couple days before mainnet. Why not btc?

D Man's Macro Fundamental Report Buyers were ready for this retrace.

Careful free chan followers as well.

D Man

AMA done. Was amazing. Thanks Mr. W and everyone who attended. BCW rocks!

How accurate D Man is?

This green is pre drawn line from the report, played out PERFECTLY (price wise).

Red lines were added a bit later.

Very accurate stuff. Back when everyone was (let me remind you) crazy bullish re: eth. BCW knew! D Man informed you. Brother on your side. Cheers!

Alts time is not now. BTC is pumping because of halving in days from now... but spx (stocks) already falling. Alts are not bullish yet... upon some base support from stocks, and btc on the side-up spiral back even after possible retrace, I think the real alt run will come.

ETHbtc doesn't look good short term either, except if hong-kong etf for eth gets approved monday... that could change it all.

Discussions

top 3 breaking news

A decentralized finance (DeFI) protocol has been hacked to the tune of millions of dollars over the Ethereum (ETH) and Arbitrum (ARB) blockchains. In a new announcement, cybersecurity firm Cyvers says that DeFi platform Hedgey Finance has been breached by bad actors who took at least $1.9 million worth of funds that were converted to […] The post DeFi Platform Hacked for at Least $1,900,000 and Possibly More on Ethereum and Arbitrum Blockchains appeared first on The Daily Hodl.

a

a

a

a

a

a

The highly anticipated Bitcoin Halving event is close, bringing with it heightened expectations regarding the long-term impact on the Bitcoin price. There are concerns, however, that this quadrennial event may already be priced in, as Bitcoin recently reached an unprecedented all-time high of $73,700 on March 14. This surge broke the pattern of previous Halvings, where Bitcoin had never surpassed its previous ATH before the event. However, historical data reveals significant price increases in the year following previous Halvings. Experts Predict Delayed Bitcoin Halving Price Impact Analysts argue that the compounding impact of reduced issuance takes several months to materialize, suggesting that the Halving itself may not prompt a significant rally before or immediately after the event. Deutsche Bank analysts share this sentiment, highlighting that substantial price increases have typically occurred in the run-up to previous Halvings rather than immediately after them. Related Reading: Analyst Forecast: Litecoin Poised For $250-$300, But Can It Hold? Another factor to consider is the increased production costs for Bitcoin miners resulting from the Halving. As the mining reward decreases, participating in the mining process becomes less profitable. This has historically led to a decline in the hashrate, the total computational power used for Bitcoin mining. JPMorgan analysts predict that production costs could rise to an average of $42,000 after the Halving. One JPMorgan analyst wrote, “This estimate is also the level we envisage Bitcoin prices drifting towards once Bitcoin-Halving-induced euphoria subsides after April.” While these factors may influence short-term price movement, historical data reveals that the price of Bitcoin has experienced significant increases in the year following previous Halvings. The respective price gains for the three previous halvings were 8,760%, 2,570%, and 594%. However, it’s important to note that each successive halving has a diminishing impact on the new supply of Bitcoin. Mining Industry Shake-Up In the mining sector, Halving could lead to significant revenue losses, estimated to be around $10 billion annually. According to Fortune, publicly traded miners have taken measures to increase their resilience, diversify their offerings, and optimize their operations. However, mining stocks have faced challenges, with some experiencing significant declines. While larger miners may undergo a period of adjustment, smaller miners and pools may be pushed offline. This could result in a wider market share for the surviving miners. Experts at private asset management firm Bernstein expect the mining industry to consolidate, with “smaller and less efficient players” potentially selling assets to raise capital and shore up their balance sheets. The increased market dominance of the surviving miners is expected to be profitable over the long term, especially with the continued structural demand for Bitcoin from ETFs. Timing The Bitcoin Bull Market Peak Cryptocurrency analyst Rekt Capital has provided insights into the potential timing of Bitcoin’s bull market peak based on historical Halving cycles and the current acceleration seen in the market. According to Rekt Capital, Bitcoin has traditionally reached its peak in the bull market approximately 518-546 days after the Halving event. However, the current cycle has shown signs of unprecedented acceleration, with Bitcoin surpassing previous all-time highs roughly 260 days ahead of historical norms. Nonetheless, the recent “pre-Halving retrace” has slowed down the cycle by around 30 days and counting. Related Reading: The Next Dogecoin? Top Trader Points To This Memecoin Taking into account this accelerated perspective, if Bitcoin’s bull market peak is measured from the moment it breaks its old all-time high, it may occur 266-315 days later. As Bitcoin achieved new all-time highs in March, this suggests a potential bull market peak in December 2024 or February 2025, according to Rekt’s analysis. Both perspectives carry significance throughout the cycle, especially if the acceleration trend persists. However, prolonged retracements or consolidation periods can slow down the cycle, potentially pushing the anticipated bull market peak further into the future. At the time of writing, BTC was trading at $64,300, up from the $59,000 mark reached in the early hours of Friday. Featured image from Shutterstock, chart from TradingView.com

a

a

a

a

a

a

Ethereum (ETH), the second largest cryptocurrency by market capitalization, is poised for a significant upward trajectory, capturing the attention and interest of market analysts and investors alike. The recent performance of Ethereum underscores its resilience and potential for growth. Following a brief downturn, during which it dipped by approximately 10% to the $2,868 level, ETH swiftly rebounded, […]

a

a

a

a

a

a

Bitcoin miners get a fixed reward when they successfully validate a new block on the bitcoin blockchain. That reward is currently 6.25 bitcoin, worth ...

a

a

a

a

a

a

The U.S.-based spot bitcoin (BTC) exchange-traded funds (ETFs) registered cumulative outflows of $4.3 million on Thursday, extending the four-day run ...

a

a

a

a

a

a

Bitcoin's price whipsaws align with global conflict and macroeconomic concerns, but data shows investors' halving expectations positively ...

a

a

a

a

a

a

Bloomberg Crypto · @crypto. Bitcoin's propensity to rally ahead of much-touted industry milestones is raising the risk of another “sell-the-news” ...

a

a

a

a

a

a

Yuga Labs' decision to transfer gaming intellectual property rights to Faraway is in line with its larger goal to "unshackle" its team.

a

a

a

a

a

a

Upcoming Bitcoin halving may lead to mining power centralization and innovation as miners adapt to new profitability challenges. The post This Bitcoin halving could lead to greater mining power centralization: Bitfinex analyst appeared first on Crypto Briefing.

a

a

a

a

a

a

Matthew Hougan, chief investment officer at Bitwise Asset Management, joins BNN Bloomberg as we await the Bitcoin halving.

a

a

a

a

a

a

... crypto payments, Tether CEO Paolo Ardoino told Bloomberg in a report posted Friday (April 19). The TON Foundation, in conjunction with Telegram ...

a

a

a

a

a

a

The Texas Comptroller's office is recommending over $61 million in property tax breaks for a sustainable aviation fuel facility through the ...

a

a

a

a

a

a

As the adoption of Web3 applications continues to increase, the need for blockchain networks capable of scaling to sustain mainstream adoption has ...

a

a

a

a

a

a

Bitcoin markets received a boost today, with BTC rising to $63.8K ahead of its highly anticipated halving event in just over 36 hours. Santiment’s data indicates a persistent bearish sentiment among investors towards leading cryptocurrencies like BTC, ETH, BNB, and SOL, further supporting the case for potential growth. Santiment’s weighted sentiment metric is determined by […]

a

a

a

a

a

a

Crypto exchange HashKey said it would end support for Binance-related transactions next month. In an April 19 statement, the Hong Kong-based crypto trading platform stated that it would restrict deposits from Binance starting May 10 and end support for virtual asset withdrawals to Binance-hosted wallet addresses by May 17. However, transactions involving virtual assets to […] The post Hong Kong-based HashKey to cease Binance-related transactions amid policy change appeared first on CryptoSlate.

a

a

a

a

a

a

MicroStrategy's Saylor nets $370 million selling company shares: report The Block

a

a

a

a

a

a

The Binance executive's legal counsel criticized the prosecution for the delay in the bail application hearing.

a

a

a

a

a

a

The post From 2012 to 2024: Analyzing market conditions before each Bitcoin halving appeared first on CryptoSlate.

a

a

a

a

a

a

Bitcoin holders have again reaffirmed their faith in the flagship crypto despite its recent price declines. This follows recent data showing that Bitcoin accumulation addresses recorded a new all-time high (ATH) amidst the current market downward trend. Accumulation Addresses Record New All-Time High Of Bitcoin Inflows Data from the on-chain analytics platform CryptoQuant shows that over 27,700 BTC was transferred into accumulation addresses between April 16 and 17. This is a new all-time high (ATH) for these addresses in terms of their daily Bitcoin inflows. Related Reading: Crypto Analyst Predicts Cardano Rally To $3 As Price Reaches ‘Ultimate Support Test’ Before now, the highest amount of BTC sent to these addresses in a day stood at 25,500, recorded on March 23 earlier this year. Interestingly, the March 23 record came just about a month after Bitcoin inflows into accumulation addresses hit an all-time high (ATH) of 25,300 BTC on February 21. Accumulation addresses are wallets with no outgoing transactions and have a balance of over 10 BTC. Accounts belonging to centralized exchanges and Bitcoin Miners are excluded from this category. Meanwhile, these addresses must have received two incoming transactions, with the most recent occurring within the last seven years. These addresses can be considered the most bullish on Bitcoin, and the growing accumulation trend from these wallets shows how much faith these long-term holders have in the flagship crypto. Furthermore, they are also believed to be positioning themselves ahead of the bull run, as BTC may never drop to these price levels once it comes into full force. Meanwhile, CryptoQuant’s CEO, Ki Young Ju, also highlighted the significance of this development, noting that on-chain accumulation has remained “very active” even as the demand for Spot Bitcoin ETFs has stagnated for four weeks. This suggests that Bitcoin bulls could help shore up the demand gap left open by these ETFs. BTC Price Shows Strength Bitcoin dropped below the $60,000 support level following reports about Israel’s retaliatory attack on Iran. However, the flagship crypto showed strength as it quickly rebounded above the $60,000 price mark. This is significant considering how much Bitcoin and the broader crypto market declined rapidly following Iran’s attack against Israel on April 13. Related Reading: XRP Whales Are On The Move Again, But Are They Bullish Or Bearish? Furthermore, the quick price recovery also suggests that Bitcoin has established strong support around the $60,000 price range and could be set for a parabolic move to the upside once this period of consolidation is over. Crypto analyst Crypto Rover also recently commented on Bitcoin’s future trajectory, stating that the crypto token will come out with a “banger” soon enough. At the time of writing, Bitcoin is trading at around $62,000, up in the last 24 hours according to data from CoinMarketCap. BTC price recovers above $64,000 | Source: BTCUSD on Tradingview.com Featured image from Crypto News, chart from Tradingview.com

a

a

a

a

a

a

Trader analysis suggests the current bull market could be shorter, with the first peak scenario set for December 2024. The post Bitcoin price could peak in December 2024, highlights trader appeared first on Crypto Briefing.

a

a

a

a

a

a

The bank's analysis of bitcoin futures shows that the cryptocurrency is in overbought territory. Mining companies will feel the pinch post-halving, ...

a

a

a

a

a

a

Was Ripple CEO's $5 trillion market prediction for the end of 2024 misleading or conservative?

a

a

a

a

a

a

Mexico's Claudia Sheinbaum Would Examine Role of Military in Companies Bloomberg

a

a

a

a

a

a

Top 100 Coins By Market Cap

NEXT BTC MOVE:

I think Bitcoin goes UP because

| Name | Price | Marketcap | 24h | ||

|---|---|---|---|---|---|

Bitcoin (BTC)

Bitcoin (BTC)

|

$64,347.54 | $1.27 T | 1.35% | ||

Ethereum (ETH)

Ethereum (ETH)

|

$3,099.34 | $372.15 B | 0.93% | ||

Tether USDt (USDT)

Tether USDt (USDT)

|

$1.00 | $109.52 B | 0.00% | ||

BNB (BNB)

BNB (BNB)

|

$560.27 | $83.78 B | 1.54% | ||

Solana (SOL)

Solana (SOL)

|

$144.34 | $64.49 B | 2.26% | ||

USDC (USDC)

USDC (USDC)

|

$1.00 | $33.50 B | 0.00% | ||

XRP (XRP)

XRP (XRP)

|

$0.50776756 | $27.99 B | 1.02% | ||

Dogecoin (DOGE)

Dogecoin (DOGE)

|

$0.15463378 | $22.26 B | 1.01% | ||

Toncoin (TON)

Toncoin (TON)

|

$6.14 | $21.32 B | -6.12% | ||

Cardano (ADA)

Cardano (ADA)

|

$0.47251965 | $16.83 B | 3.34% | ||

Shiba Inu (SHIB)

Shiba Inu (SHIB)

|

$0.00002292 | $13.51 B | 0.23% | ||

Avalanche (AVAX)

Avalanche (AVAX)

|

$35.20 | $13.31 B | 0.37% | ||

Polkadot (DOT)

Polkadot (DOT)

|

$6.76 | $9.71 B | -0.28% | ||

TRON (TRX)

TRON (TRX)

|

$0.11047000 | $9.68 B | 1.30% | ||

Bitcoin Cash (BCH)

Bitcoin Cash (BCH)

|

$484.10 | $9.55 B | -0.22% | ||

Chainlink (LINK)

Chainlink (LINK)

|

$14.02 | $8.23 B | 1.48% | ||

Polygon (MATIC)

Polygon (MATIC)

|

$0.67880000 | $6.70 B | -0.14% | ||

Internet Computer (ICP)

Internet Computer (ICP)

|

$14.35 | $6.67 B | 12.79% | ||

Litecoin (LTC)

Litecoin (LTC)

|

$81.40 | $6.06 B | 0.20% | ||

NEAR Protocol (NEAR)

NEAR Protocol (NEAR)

|

$5.63 | $6.01 B | -0.55% | ||

UNUS SED LEO (LEO)

UNUS SED LEO (LEO)

|

$5.80 | $5.38 B | -0.96% | ||

Dai (DAI)

Dai (DAI)

|

$1.00 | $5.35 B | 0.03% | ||

Uniswap (UNI)

Uniswap (UNI)

|

$7.58 | $4.54 B | 3.91% | ||

Aptos (APT)

Aptos (APT)

|

$9.55 | $4.06 B | 0.61% | ||

Ethereum Classic (ETC)

Ethereum Classic (ETC)

|

$26.44 | $3.88 B | 0.59% | ||

Mantle (MNT)

Mantle (MNT)

|

$1.15 | $3.75 B | -1.11% | ||

Stacks (STX)

Stacks (STX)

|

$2.48 | $3.61 B | 0.46% | ||

First Digital USD (FDUSD)

First Digital USD (FDUSD)

|

$0.99940000 | $3.59 B | 0.02% | ||

Filecoin (FIL)

Filecoin (FIL)

|

$6.24 | $3.37 B | 3.82% | ||

OKB (OKB)

OKB (OKB)

|

$55.73 | $3.34 B | 0.40% | ||

Cronos (CRO)

Cronos (CRO)

|

$0.12487727 | $3.32 B | 1.23% | ||

Stellar (XLM)

Stellar (XLM)

|

$0.11230000 | $3.25 B | 1.54% | ||

Cosmos (ATOM)

Cosmos (ATOM)

|

$8.24 | $3.22 B | -0.13% | ||

Render (RNDR)

Render (RNDR)

|

$8.04 | $3.09 B | 1.38% | ||

Arbitrum (ARB)

Arbitrum (ARB)

|

$1.14 | $3.03 B | -0.46% | ||

Hedera Hashgraph (HBAR)

Hedera Hashgraph (HBAR)

|

$0.08176700 | $2.92 B | -0.97% | ||

Immutable (IMX)

Immutable (IMX)

|

$2.06 | $3.00 B | 2.55% | ||

VeChain (VET)

VeChain (VET)

|

$0.04107000 | $2.99 B | 3.13% | ||

dogwifhat (WIF)

dogwifhat (WIF)

|

$2.99 | $2.99 B | 15.93% | ||

Bittensor (TAO)

Bittensor (TAO)

|

$447.86 | $2.97 B | -3.78% | ||

Hedera (HBAR)

Hedera (HBAR)

|

$0.08170000 | $2.92 B | -0.96% | ||

Maker (MKR)

Maker (MKR)

|

$2,969.00 | $2.74 B | -3.28% | ||

Kaspa (KAS)

Kaspa (KAS)

|

$0.11345746 | $2.65 B | -5.29% | ||

Injective (INJ)

Injective (INJ)

|

$28.29 | $2.64 B | 0.79% | ||

The Graph (GRT)

The Graph (GRT)

|

$0.26213131 | $2.49 B | 2.08% | ||

Optimism (OP)

Optimism (OP)

|

$2.27 | $2.37 B | 1.49% | ||

Monero (XMR)

Monero (XMR)

|

$118.33 | $2.18 B | 1.06% | ||

Pepe (PEPE)

Pepe (PEPE)

|

$0.00000518 | $2.18 B | 0.95% | ||

Theta Network (THETA)

Theta Network (THETA)

|

$2.09 | $2.09 B | 0.12% | ||

Fantom (FTM)

Fantom (FTM)

|

$0.69833578 | $1.96 B | 1.21% | ||

Celestia (TIA)

Celestia (TIA)

|

$10.81 | $1.93 B | 7.80% | ||

THORChain (RUNE)

THORChain (RUNE)

|

$5.45 | $1.83 B | 11.13% | ||

Arweave (AR)

Arweave (AR)

|

$27.79 | $1.82 B | 9.74% | ||

Fetch.ai (FET)

Fetch.ai (FET)

|

$2.14 | $1.82 B | 4.10% | ||

Lido DAO (LDO)

Lido DAO (LDO)

|

$2.01 | $1.79 B | 0.57% | ||

Core (CORE)

Core (CORE)

|

$2.02 | $1.78 B | -3.14% | ||

Sui (SUI)

Sui (SUI)

|

$1.36 | $1.76 B | 8.88% | ||

Bitget Token (BGB)

Bitget Token (BGB)

|

$1.24 | $1.74 B | -0.75% | ||

Sei (SEI)

Sei (SEI)

|

$0.56170000 | $1.57 B | 5.69% | ||

Beam (BEAM)

Beam (BEAM)

|

$0.02739160 | $1.45 B | 3.89% | ||

Algorand (ALGO)

Algorand (ALGO)

|

$0.17700000 | $1.44 B | 1.06% | ||

Jupiter (JUP)

Jupiter (JUP)

|

$1.07 | $1.44 B | 4.42% | ||

Render Token (RNDR)

Render Token (RNDR)

|

$8.04 | $3.09 B | 1.24% | ||

Ethena (ENA)

Ethena (ENA)

|

$0.98300000 | $1.40 B | 6.45% | ||

Pendle (PENDLE)

Pendle (PENDLE)

|

$5.79 | $1.38 B | -2.53% | ||

Gala (GALA)

Gala (GALA)

|

$0.04476000 | $1.36 B | 1.70% | ||

FLOKI (FLOKI)

FLOKI (FLOKI)

|

$0.00014102 | $1.35 B | 1.46% | ||

Flow (FLOW)

Flow (FLOW)

|

$0.88800000 | $1.33 B | 0.92% | ||

Bitcoin SV (BSV)

Bitcoin SV (BSV)

|

$66.66 | $1.31 B | -1.04% | ||

Neo (NEO)

Neo (NEO)

|

$18.45 | $1.30 B | -0.46% | ||

Quant (QNT)

Quant (QNT)

|

$106.20 | $1.28 B | -2.02% | ||

Aave (AAVE)

Aave (AAVE)

|

$86.49 | $1.28 B | 1.03% | ||

Flare (FLR)

Flare (FLR)

|

$0.03191373 | $1.23 B | -1.86% | ||

BitTorrent (New) (BTT)

BitTorrent (New) (BTT)

|

$0.00000126 | $1.22 B | -1.16% | ||

SingularityNET (AGIX)

SingularityNET (AGIX)

|

$0.87880000 | $1.13 B | 3.62% | ||

MultiversX (EGLD)

MultiversX (EGLD)

|

$41.34 | $1.11 B | 1.30% | ||

Wormhole (W)

Wormhole (W)

|

$0.60067907 | $1.08 B | 1.34% | ||

dYdX (Native) (DYDX)

dYdX (Native) (DYDX)

|

$2.31 | $1.07 B | 4.12% | ||

Huobi Token (HT)

Huobi Token (HT)

|

$0.57513700 | $91.68 M | -6.43% | ||

eCash (XEC)

eCash (XEC)

|

$0.00005143 | $1.01 B | -0.35% | ||

Ronin (RON)

Ronin (RON)

|

$3.20 | $1.01 B | 2.43% | ||

Axie Infinity (AXS)

Axie Infinity (AXS)

|

$7.02 | $1.01 B | -0.86% | ||

The Sandbox (SAND)

The Sandbox (SAND)

|

$0.44740000 | $1.01 B | 1.41% | ||

Synthetix (SNX)

Synthetix (SNX)

|

$3.01 | $985.80 M | 5.31% | ||

Bonk (BONK)

Bonk (BONK)

|

$0.00001504 | $980.20 M | 1.75% | ||

Chiliz (CHZ)

Chiliz (CHZ)

|

$0.10971000 | $974.45 M | 0.74% | ||

dYdX (DYDX)

dYdX (DYDX)

|

$2.30 | $717.28 M | 3.73% | ||

Tezos (XTZ)

Tezos (XTZ)

|

$0.99500000 | $973.13 M | 1.82% | ||

ORDI (ORDI)

ORDI (ORDI)

|

$45.74 | $960.55 M | 5.47% | ||

Worldcoin (WLD)

Worldcoin (WLD)

|

$5.01 | $955.72 M | -0.90% | ||

Conflux (CFX)

Conflux (CFX)

|

$0.23470000 | $926.00 M | 1.05% | ||

Akash Network (AKT)

Akash Network (AKT)

|

$3.92 | $917.13 M | -1.36% | ||

JasmyCoin (JASMY)

JasmyCoin (JASMY)

|

$0.01855000 | $915.42 M | 0.13% | ||

Pyth Network (PYTH)

Pyth Network (PYTH)

|

$0.61020000 | $915.19 M | -0.33% | ||

Gnosis (GNO)

Gnosis (GNO)

|

$347.90 | $901.78 M | 2.95% | ||

Starknet (STRK)

Starknet (STRK)

|

$1.23 | $897.69 M | -1.23% | ||

EOS (EOS)

EOS (EOS)

|

$0.78500000 | $881.64 M | 3.00% | ||

Nervos Network (CKB)

Nervos Network (CKB)

|

$0.02002200 | $879.09 M | -0.17% | ||

Mina (MINA)

Mina (MINA)

|

$0.80686169 | $878.75 M | 1.98% | ||

KuCoin Token (KCS)

KuCoin Token (KCS)

|

$8.90 | $855.28 M | 4.00% |

Try to search another coin

ch80 Yes