Notification Center

Turn on/off sound

Show/Hide Coins Ticker

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 13 Gwei | 14 Gwei | 15 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 13 Gwei | 14 Gwei | 15 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

Remember this green drawing? Above = bullish, below = dump. We are retesting it now in a quite bad way. Just fyi.

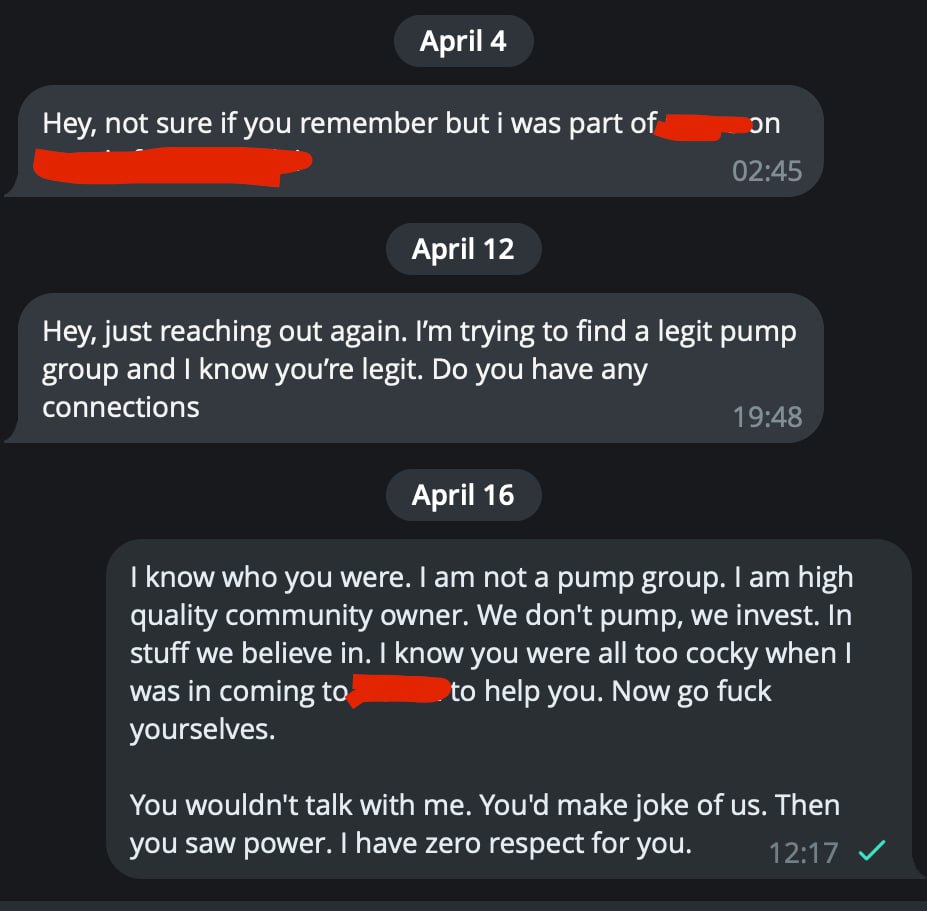

To all project founders who ignore good-intent people, are cocky to them, but once they see the power (like BCW) they get on their knees to suck a dick. FUCK YOU!

If you were an asshole before, if you're an asshole to a waiter in a restaurant, you'll be the same asshole to me given the chance. I want nothing to do with you. You don't deserve BCW.

Many guys like this guy. I remember him, founder of a project, a fork that was good idea. I came anon to give them top notch advice, they were ubercocky. Later, when they saw BCW power, they started to suck dick.

You know that joke: "Jenny would you suck a dick for a million bucks?"

- "for a million, yes"

- "what about for $10?"

She slaps him.

"who do you think I am"

- "we already established that, now we're just negotiating"

—-

The point is, if they are assholes, they are assholes. Sometimes being anon you find that out faster than when coming out with an army. Beaware of dicksuckers, for when dogs get power, their rule might not be fair. Cheers!

On a macro scale, if you zoom out just a bit from second-to-second thinking... if you relax... crypto this year I expect to be very rewarding. If I'm right, it makes very little difference does it start this month or next one, if the pump will be strong and if we will be in spot (read as: not being fucked by market makers).

Spot hold what you truly like.

Enjoy crypto.

Or micro trade it, time the market. I share with you the edge I find (and it's quite both powerful and often). According to your preference. Cheers!

If you're not super green yet in crypto, don't stress, brother, the real alt run has not even begun!

What I think alts might collapse for a bit. Maybe now is not the right time to buy them. I am telling you for quite some time, and since then the alts are boring. I tell you alts will break down. I think that now more than ever.

But remember your BCW brother... THEN will be a good time to buy. I am not selling. I just am not buying here. I wait for further dip to top up or to get back in the degen plays.

Blockchain Whispers baby!

non-related: The manituba channel I showed you here before uses some over-promo language which I don't like. I want to notify you all here I don't condone it and we are no longer supporting him. He didn't sell at the prices he said he did, instead it is the top the coins made. He had some great calls. Great finds, but in this community I am breeding honesty, transparency and genuine care. I will no longer promote him. He just posted it. But I don't like the psychology behind it.

D Man

P.S. I don't control traders and what they post. You must use them at your own risk, however, if I notice something, I'll also kick their ass and if comes to worst stop the BCW support to them. Either the BCW way or the highway! We are the legion. They are not!

https://blockchainwhispers.com44f39a7de86a1c7d995c6ebcd583fee5.pdfI've made for you the halving report. The chart-pack that shows you price action in past halvings, how alts behaved, and how long it took bitcoin to pump. It's easy to study, and get properly prepared for the upcoming halving.

Courtesy of your Blockchain Whispers family. It's free for you. Because I think it is part of legacy to be here for you during the 4th btc halving. Freely share with anyone you care about. Cheers brother!

Don't think it's because of war. SPX was long due for correction. So is btc. Many things start dropping couple days before mainnet. Why not btc?

D Man's Macro Fundamental Report Buyers were ready for this retrace.

Careful free chan followers as well.

D Man

AMA done. Was amazing. Thanks Mr. W and everyone who attended. BCW rocks!

How accurate D Man is?

This green is pre drawn line from the report, played out PERFECTLY (price wise).

Red lines were added a bit later.

Very accurate stuff. Back when everyone was (let me remind you) crazy bullish re: eth. BCW knew! D Man informed you. Brother on your side. Cheers!

Alts time is not now. BTC is pumping because of halving in days from now... but spx (stocks) already falling. Alts are not bullish yet... upon some base support from stocks, and btc on the side-up spiral back even after possible retrace, I think the real alt run will come.

ETHbtc doesn't look good short term either, except if hong-kong etf for eth gets approved monday... that could change it all.

Let's do it: https://blockchainwhispers.com/c/w-ama

AMA with Mr. W in 15 min. Link will be posted here.

Done, all Premium posts made today are free, enjoy: http://blockchainwhispers.com/signals

Discussions

top 3 breaking news

Analytics firm Santiment's social-media metrics suggest the crypto crowd is beginning to lean bearish.

a

a

a

a

a

a

Cryptocurrency data provider CryptoQuant has said that holders of Ethena Labs' USDe stablecoin should monitor the project's reserve fund to avoid risks related to the potential of a negative funding rate.

a

a

a

a

a

a

Binance and nine other foreign crypto exchanges were originally blocked in India due to non-compliance with the country’s Anti-Money Laundering (AML) regulations, but Binance is set to return after a four-month absence by paying a $2-million fine, according to The Economic Times. The Indian Financial Intelligence Unit (FIU) mandated that foreign crypto exchanges, including Binance, […]

a

a

a

a

a

a

Binance is considering re-entering the Indian market after paying a $2 million penalty to local authorities, according to a report from The Economic Times published today (Thursday). The cryptocurrency exchange was ousted from the country last January for failing to comply with local laws.India: A Lucrative Market for Crypto ExchangesThe report emerged just a month after KuCoin, a Seychelles-based cryptocurrency exchange, announced its compliance with Indian regulations. Binance, KuCoin, and seven other global cryptocurrency exchanges were blocked by India’s Financial Intelligence Unit for violating local anti-money laundering laws.Following the order of the Indian authority, the mobile apps of these cryptocurrency exchanges were removed from Google’s Play Store and Apple’s App Store. The domains of their websites were also blocked in the country.Although there is no official confirmation, the local publication cited two anonymous sources regarding the exchange’s planned re-entry into the country.“[It is] unfortunate that it took [Binance] more than two years to realise there is no room for negotiations, and [that] no global powerhouse can command special treatment, especially at the cost of exposing the country’s financial system to vulnerabilities,” one of the anonymous sources told the publication.Binance’s India StrategyBinance is the largest cryptocurrency exchange globally in terms of asset holdings and trading volume. It also dominated the Indian markets when it was operational there. Although there were several local crypto exchanges operating in India, Binance had an advantage due to its vast liquidity pool.India is a massive country with a population of over 1.4 billion. According to a report by the local crypto exchange CoinSwitch, the country has over 19 million cryptocurrency investors, of whom nearly nine percent are women. Further, about 75 percent of cryptocurrency investors in India are between the ages of 18 and 35 years.Despite the popularity of cryptocurrencies, the Indian government’s stance towards digital currencies has remained cautious. Currently, all crypto exchanges are required to deduct a 1 percent tax at source for all executed crypto transactions. OKX which was not named in the Indian authorities' banned list, also exited the country earlier this year, citing harsh local regulations. This article was written by Arnab Shome at www.financemagnates.com.

a

a

a

a

a

a

As Uniswap grapples with SEC scrutiny reminiscent of Ripple's past legal battles, the crypto community's attention shifts to Borroe Finance, a new contender in the blockchain space. #partnercontent

a

a

a

a

a

a

With the growing list of altcoins in the crypto market, it is easy to get lost in the market noise without discovering any real solution to blockchain common challenges. In all of this noise, Bitgert is forging ahead with the introduction of innovative features that are putting it ahead of these other noise makers. But [...] The post The Rise of Bitgert Coin: How It’s Reshaping the Crypto Landscape appeared first on Blockonomi.

a

a

a

a

a

a

The Omni Network (OMNI) token has had a turbulent launch, with its fake copy scamming some gullible users out of $400,000

a

a

a

a

a

a

Polkadot has seen a significant price drop over the past few days, but it has found much-needed support around the $6 mark. The price is currently at $6.54.

a

a

a

a

a

a

ADA was consolidating inside a bullish pattern, which hinted at a price uptick in the coming days.

a

a

a

a

a

a

Recent sell-off by longstanding Ethereum investor prompts fear, uncertainty and doubt amid period of declining ETH price

a

a

a

a

a

a

Blackrock, the world’s largest asset manager, has explained the importance of the Bitcoin halving. “One of the reasons some people find bitcoin valuable is its scarcity,” Blackrock explained, adding that the halving also “underscores Bitcoin’s decentralized, programmatic nature and its resistance to inflationary pressures that traditional currencies often face.” Blackrock on Bitcoin Halving Blackrock, the […]

a

a

a

a

a

a

BlockFills, the provider of digital asset trading technology and liquidity solutions, has announced a strategic integration with Centroid Solutions' institutional-grade connectivity platform, Centroid Bridge. This collaboration aims to provide brokers and institutional clients with a centralized environment for price management, execution, comprehensive reporting, and BlockFills' round-the-clock digital asset liquidity access.BlockFills Partners with Centroid Solutions to Enhance Digital Asset TradingThe integration of BlockFills' liquidity offering with Centroid Bridge addresses the needs of brokerages by directly connecting these services to clients' trading platforms. Their partnership eliminates the requirement for multiple verticals to conduct operations, providing a cost-effective and efficient solution for clients who prefer to connect through a bridge platform."Our clients now have access to a panoramic ecosystem that supports their business evolution swiftly and without restrictions or added processing fees,” Nick Hammer, the CEO of BlockFills, commented. “The integration dispenses universal connectivity and execution, as well as 24/7 access to BlockFills' liquidity."BlockFills is fully integrated with Centroid Bridge to provide 24/7 digital asset liquidityBlockFills announced a full integration with Centroid Solutions' Centroid Bridge, providing 24/7 digital asset liquidity.— DexBot (@dexbot) April 18, 2024BlockFills' liquidity provision benefits a diverse clientele, including OTC desks, exchanges, payments firms, proprietary trading firms, and brokerages. The company's multi-asset technology platform addresses liquidity fragmentation issues in the marketplace, providing solutions for institutions in the digital spot, derivatives, and credit markets.Centroid Solutions' CEO, Cristian Vlasceanu, noted that the collaboration enables their clients to gain access to a wide range of digital assets with deep liquidity, unlocking new opportunities in the digital asset space.“Centroid Solutions takes a leap forward into the crypto market with the integration of BlockFills as a new cryptocurrency liquidity provider,” he added.Over the past few years, BlockFills has raised a considerable amount of capital from institutional investors, including a 2021 round in which CME Group participated. Then, in 2022, the company secured an additional $37 million in a Series A funding round, accumulating a total of $44 million since its inception in 2018.Centroid's Recent Strategic PartnershipsThe collaboration with BlockFills is just one of the latest partnerships announced by Centroid Solutions.Two months ago, Finalto Asia bolstered its presence in the Asia-Pacific region by partnering with Centroid Solutions. By leveraging Centroid's Bridge Connectivity Engine and Finalto's liquidity services, this alliance aims to deliver innovative and client-centric solutions that elevate the trading experience for Finalto Asia's clients.Centroid Solutions further expanded its offerings to multi-asset brokers through a partnership with TransactCloud towards the end of last year. This collaboration provides round-the-clock operational support and system interoperability services, significantly enhancing Centroid Solutions' capabilities.In October, Centroid Solutions announced a partnership with Skale, a CRM provider that comes pre-integrated with leading trading platforms, payment service providers, KYC tools, and business intelligence tools in the FX market. This article was written by Damian Chmiel at www.financemagnates.com.

a

a

a

a

a

a

One of the DOGE creators has made a peculiar statement on the upcoming Bitcoin halving

a

a

a

a

a

a

Despite Filecoin and Injective experiencing steep declines over the past week, expert forecasts suggest a bullish rebound soon, while Rebel Satoshi's RECQ rides a presale surge, gaining significant investor interest. #partnercontent

a

a

a

a

a

a

Jamie Coutts, a former Bloomberg analyst, wrote on the X platform that a conservative estimate is that by 2030, the number of daily active ...

a

a

a

a

a

a

... Bloomberg & CoinDesk guest | Author: "Crypto Titans" | Building the largest Crypto investment firm in the world. 25m. Report this comment; Close menu.

a

a

a

a

a

a

World's Best Airports 2024: Singapore Changi Loses Crown to Qatar's Doha Hamad Bloomberg

a

a

a

a

a

a

As the US economy grapples with rising inflation expectations and scaled-back forecasts for Federal Reserve rate cuts, the Bitcoin market remains buoyant, according to a detailed analysis by Reflexivity Research. With the US CPI headline inflation projected to accelerate to 4.8% by the November 2024 elections, according to Bank of America, conditions are seemingly unfavorable for a loosening of monetary policy. Despite this, the cryptocurrency sector, particularly Bitcoin, appears insulated and optimistic. Bitcoin Unfazed By Delayed Rate Cuts? The bond market now anticipates only three Federal Reserve rate cuts this year, a significant reduction from the earlier forecast of six. The CME FedWatch tool indicates that the majority of market participants do not expect a rate cut to occur before the mid-September FOMC meeting. This adjustment reflects a recalibration of expectations regarding the Fed’s capacity to manage persistent inflation pressures. Amidst these macroeconomic shifts, Ritik Goyal, in a guest post for Reflexivity Research, presents a compelling analysis in his report titled “The Fed is Unable to Cause a Recession. Risk Assets are Yet to Realize This.” Related Reading: Pre-Halving Jitters: Bitcoin Price Briefly Slips Below $60,000 The report argues that, contrary to conventional wisdom, the Federal Reserve’s rate hikes have had unintended stimulative effects on the economy. Goyal elucidates three specific mechanisms through which this phenomenon operates: 1. Increased Government Interest Payments: “Rate hikes raised interest payments by the government to the private sector,” Goyal notes. As the Fed raises rates, it increases the interest burden on the government, which has borrowed extensively during the post-COVID period. With the federal debt-to-GDP ratio exceeding 120%, the doubled interest payments now effectively act as a stimulus, channeling approximately $1 trillion annually to the private sector 2. Direct Subsidy to Banking System: The Fed’s policy adjustments have also led to a redistribution of wealth within the financial system. “Rate hikes raised the Fed’s direct subsidy to the banking system,” states Goyal. This has occurred as the yield curve inversion resulted in the Fed incurring losses on its balance sheet, losses that directly benefit the banking sector, translating to an estimated $150 billion annual subsidy. Related Reading: Bitcoin Displays Bullish Adam And Eve Double Bottom: What It Means 3. Induced Housing Construction Boom: The rate hikes have paradoxically stimulated the housing market. “Rate hikes induced a housing construction boom,” according to Goyal. As higher rates discourage existing homeowners from selling, the only viable option to meet housing demand is new construction, a sector with one of the highest GDP multipliers. Goyal’s insights underline a critical misalignment in the Fed’s current approach against the backdrop of substantial fiscal interventions since the pandemic. “The traditional monetary policy framework is breaking down under the weight of fiscal dominance,” Goyal concludes, suggesting an environment that could favor non-traditional assets like Bitcoin. Echoing Goyal’s findings, crypto expert Will Clemente highlighted the broader implications for cryptocurrencies on X (formerly Twitter), stating, “With debt/GDP as high as it is, we’re in a backwards world where high rates mean interest payments on debt are stimmy checks for people that buy assets—~$1T will be paid out in 2024. Big picture is very constructive for the internet coins.” At press time, BTC traded at $61,173. Featured image from Shutterstock, chart from TradingView.com

a

a

a

a

a

a

Top 100 Coins By Market Cap

NEXT BTC MOVE:

I think Bitcoin goes UP because

| Name | Price | Marketcap | 24h | ||

|---|---|---|---|---|---|

Bitcoin (BTC)

Bitcoin (BTC)

|

$61,463.83 | $1.21 T | -3.19% | ||

Ethereum (ETH)

Ethereum (ETH)

|

$2,985.02 | $358.29 B | -3.04% | ||

Tether USDt (USDT)

Tether USDt (USDT)

|

$1.00 | $109.16 B | 0.11% | ||

BNB (BNB)

BNB (BNB)

|

$549.49 | $82.17 B | 0.88% | ||

Solana (SOL)

Solana (SOL)

|

$130.49 | $57.97 B | -6.17% | ||

USDC (USDC)

USDC (USDC)

|

$1.00 | $32.73 B | 0.19% | ||

XRP (XRP)

XRP (XRP)

|

$0.48957118 | $26.99 B | -1.97% | ||

Toncoin (TON)

Toncoin (TON)

|

$5.99 | $20.79 B | -6.67% | ||

Dogecoin (DOGE)

Dogecoin (DOGE)

|

$0.14357300 | $20.66 B | -8.34% | ||

Cardano (ADA)

Cardano (ADA)

|

$0.44141500 | $15.58 B | -3.34% | ||

Shiba Inu (SHIB)

Shiba Inu (SHIB)

|

$0.00002170 | $12.76 B | -3.43% | ||

Avalanche (AVAX)

Avalanche (AVAX)

|

$33.82 | $12.78 B | -3.62% | ||

TRON (TRX)

TRON (TRX)

|

$0.10938000 | $9.58 B | -2.95% | ||

Polkadot (DOT)

Polkadot (DOT)

|

$6.59 | $9.44 B | -1.19% | ||

Bitcoin Cash (BCH)

Bitcoin Cash (BCH)

|

$479.00 | $9.41 B | 0.44% | ||

Chainlink (LINK)

Chainlink (LINK)

|

$13.08 | $7.66 B | -3.22% | ||

Polygon (MATIC)

Polygon (MATIC)

|

$0.66150000 | $6.54 B | -5.71% | ||

Litecoin (LTC)

Litecoin (LTC)

|

$80.16 | $5.90 B | 1.16% | ||

NEAR Protocol (NEAR)

NEAR Protocol (NEAR)

|

$5.48 | $5.84 B | -0.10% | ||

Internet Computer (ICP)

Internet Computer (ICP)

|

$11.98 | $5.50 B | -2.09% | ||

UNUS SED LEO (LEO)

UNUS SED LEO (LEO)

|

$5.84 | $5.41 B | -0.81% | ||

Dai (DAI)

Dai (DAI)

|

$1.00 | $5.35 B | -0.03% | ||

Uniswap (UNI)

Uniswap (UNI)

|

$6.97 | $5.21 B | -2.13% | ||

Aptos (APT)

Aptos (APT)

|

$9.12 | $3.86 B | -2.14% | ||

First Digital USD (FDUSD)

First Digital USD (FDUSD)

|

$0.99880000 | $3.76 B | 0.42% | ||

Ethereum Classic (ETC)

Ethereum Classic (ETC)

|

$25.44 | $3.72 B | -3.33% | ||

Mantle (MNT)

Mantle (MNT)

|

$1.12 | $3.63 B | -3.35% | ||

Stacks (STX)

Stacks (STX)

|

$2.30 | $3.34 B | -0.86% | ||

OKB (OKB)

OKB (OKB)

|

$54.63 | $3.27 B | -7.09% | ||

Cronos (CRO)

Cronos (CRO)

|

$0.12060074 | $3.20 B | -5.47% | ||

Filecoin (FIL)

Filecoin (FIL)

|

$5.84 | $3.15 B | -2.84% | ||

Cosmos (ATOM)

Cosmos (ATOM)

|

$8.04 | $3.14 B | -1.30% | ||

Stellar (XLM)

Stellar (XLM)

|

$0.10740000 | $3.09 B | -1.98% | ||

Arbitrum (ARB)

Arbitrum (ARB)

|

$1.12 | $2.98 B | -1.81% | ||

Bittensor (TAO)

Bittensor (TAO)

|

$448.58 | $2.95 B | -8.40% | ||

Hedera Hashgraph (HBAR)

Hedera Hashgraph (HBAR)

|

$0.07866400 | $2.79 B | -1.52% | ||

Render (RNDR)

Render (RNDR)

|

$7.64 | $2.94 B | -4.46% | ||

Maker (MKR)

Maker (MKR)

|

$3,114.00 | $2.86 B | -4.61% | ||

Hedera (HBAR)

Hedera (HBAR)

|

$0.07880000 | $2.81 B | -1.58% | ||

VeChain (VET)

VeChain (VET)

|

$0.03804000 | $2.73 B | -6.35% | ||

Immutable (IMX)

Immutable (IMX)

|

$1.90 | $2.67 B | -0.49% | ||

Kaspa (KAS)

Kaspa (KAS)

|

$0.11567600 | $2.65 B | -1.92% | ||

Injective (INJ)

Injective (INJ)

|

$25.41 | $2.37 B | -0.77% | ||

dogwifhat (WIF)

dogwifhat (WIF)

|

$2.32 | $2.31 B | -11.17% | ||

The Graph (GRT)

The Graph (GRT)

|

$0.24022900 | $2.26 B | -5.40% | ||

Optimism (OP)

Optimism (OP)

|

$2.18 | $2.27 B | -2.28% | ||

Monero (XMR)

Monero (XMR)

|

$114.10 | $2.07 B | -7.56% | ||

Pepe (PEPE)

Pepe (PEPE)

|

$0.00000478 | $2.00 B | -9.93% | ||

Theta Network (THETA)

Theta Network (THETA)

|

$2.00 | $1.99 B | -1.83% | ||

Fantom (FTM)

Fantom (FTM)

|

$0.65779200 | $1.84 B | -1.66% | ||

Bitget Token (BGB)

Bitget Token (BGB)

|

$1.30 | $1.82 B | 8.94% | ||

Core (CORE)

Core (CORE)

|

$2.01 | $1.77 B | -11.97% | ||

Lido DAO (LDO)

Lido DAO (LDO)

|

$1.93 | $1.71 B | -2.95% | ||

Celestia (TIA)

Celestia (TIA)

|

$9.55 | $1.70 B | -11.38% | ||

Fetch.ai (FET)

Fetch.ai (FET)

|

$1.94 | $1.64 B | -4.79% | ||

Sui (SUI)

Sui (SUI)

|

$1.23 | $1.58 B | 0.75% | ||

Arweave (AR)

Arweave (AR)

|

$24.18 | $1.58 B | -1.81% | ||

THORChain (RUNE)

THORChain (RUNE)

|

$4.44 | $1.48 B | -12.76% | ||

Pendle (PENDLE)

Pendle (PENDLE)

|

$5.99 | $575.53 M | -2.80% | ||

Sei (SEI)

Sei (SEI)

|

$0.49200000 | $1.37 B | -4.17% | ||

Beam (BEAM)

Beam (BEAM)

|

$0.02578946 | $1.37 B | -7.02% | ||

Render Token (RNDR)

Render Token (RNDR)

|

$7.65 | $2.92 B | -4.38% | ||

Algorand (ALGO)

Algorand (ALGO)

|

$0.16670000 | $1.35 B | -3.83% | ||

Bitcoin SV (BSV)

Bitcoin SV (BSV)

|

$64.73 | $1.27 B | -3.29% | ||

Flow (FLOW)

Flow (FLOW)

|

$0.84600000 | $1.27 B | -4.39% | ||

FLOKI (FLOKI)

FLOKI (FLOKI)

|

$0.00013123 | $1.26 B | -6.91% | ||

Jupiter (JUP)

Jupiter (JUP)

|

$0.92912259 | $1.25 B | -5.62% | ||

Gala (GALA)

Gala (GALA)

|

$0.04077000 | $1.52 B | -1.17% | ||

Aave (AAVE)

Aave (AAVE)

|

$83.93 | $1.24 B | -2.04% | ||

Ethena (ENA)

Ethena (ENA)

|

$0.86800000 | $1.23 B | -13.66% | ||

Flare (FLR)

Flare (FLR)

|

$0.03162901 | $1.22 B | -1.33% | ||

Quant (QNT)

Quant (QNT)

|

$101.00 | $1.22 B | -2.78% | ||

BitTorrent (New) (BTT)

BitTorrent (New) (BTT)

|

$0.00000123 | $1.19 B | -5.44% | ||

Neo (NEO)

Neo (NEO)

|

$16.62 | $1.16 B | -9.50% | ||

MultiversX (EGLD)

MultiversX (EGLD)

|

$39.85 | $1.07 B | -0.82% | ||

SingularityNET (AGIX)

SingularityNET (AGIX)

|

$0.80451000 | $1.02 B | -3.46% | ||

Wormhole (W)

Wormhole (W)

|

$0.55314300 | $986.91 M | -7.61% | ||

Axie Infinity (AXS)

Axie Infinity (AXS)

|

$6.91 | $988.82 M | -1.20% | ||

Huobi Token (HT)

Huobi Token (HT)

|

$0.61090700 | $97.32 M | -1.29% | ||

dYdX (Native) (DYDX)

dYdX (Native) (DYDX)

|

$2.11 | $978.32 M | -0.20% | ||

Chiliz (CHZ)

Chiliz (CHZ)

|

$0.10962000 | $966.91 M | 0.35% | ||

eCash (XEC)

eCash (XEC)

|

$0.00004921 | $967.88 M | -5.22% | ||

The Sandbox (SAND)

The Sandbox (SAND)

|

$0.42630000 | $955.41 M | -2.20% | ||

Ronin (RON)

Ronin (RON)

|

$3.06 | $952.75 M | -2.86% | ||

Tezos (XTZ)

Tezos (XTZ)

|

$0.94200000 | $914.47 M | -5.27% | ||

Worldcoin (WLD)

Worldcoin (WLD)

|

$4.83 | $918.82 M | -3.41% | ||

dYdX (DYDX)

dYdX (DYDX)

|

$2.11 | $654.82 M | -0.19% | ||

Bonk (BONK)

Bonk (BONK)

|

$0.00001389 | $905.29 M | -4.86% | ||

Synthetix (SNX)

Synthetix (SNX)

|

$2.75 | $902.38 M | -4.82% | ||

Conflux (CFX)

Conflux (CFX)

|

$0.22750000 | $896.30 M | -3.20% | ||

Nervos Network (CKB)

Nervos Network (CKB)

|

$0.02038100 | $882.68 M | -6.96% | ||

Starknet (STRK)

Starknet (STRK)

|

$1.21 | $884.16 M | -5.22% | ||

ORDI (ORDI)

ORDI (ORDI)

|

$41.84 | $878.74 M | -0.82% | ||

Akash Network (AKT)

Akash Network (AKT)

|

$3.75 | $865.15 M | -3.14% | ||

JasmyCoin (JASMY)

JasmyCoin (JASMY)

|

$0.01773000 | $871.09 M | -2.95% | ||

Pyth Network (PYTH)

Pyth Network (PYTH)

|

$0.56180000 | $838.87 M | -5.14% | ||

Gnosis (GNO)

Gnosis (GNO)

|

$326.10 | $842.45 M | -3.22% | ||

Mina (MINA)

Mina (MINA)

|

$0.76159125 | $828.83 M | -2.24% | ||

EOS (EOS)

EOS (EOS)

|

$0.72780000 | $832.09 M | -3.26% | ||

Decentraland (MANA)

Decentraland (MANA)

|

$0.42280700 | $788.14 M | -1.93% |

Try to search another coin

ch80 Yes