Notification Center

Turn on/off sound

Show/Hide Coins Ticker

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 10 Gwei | 11 Gwei | 13 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 10 Gwei | 11 Gwei | 13 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

P.S. The report is free. I think halving event is crypto public service.

So far it is predictable as we are heading into halving the price shows some green. It's a hook more than likely. S&P500 is continuing in its correction, and this gap is basically retail money expecting immediate post-halving results. Check the report, and then you'll know whether to expect immediate 100x long or not. Cheers my friend!

Halving is here. Miners rewards cut in half. You have the report here https://t.me/blockchainwhispersbaby/11349 about what to expect in price if history is to be asked. Cheers my friend!

Remember this green drawing? Above = bullish, below = dump. We are retesting it now in a quite bad way. Just fyi.

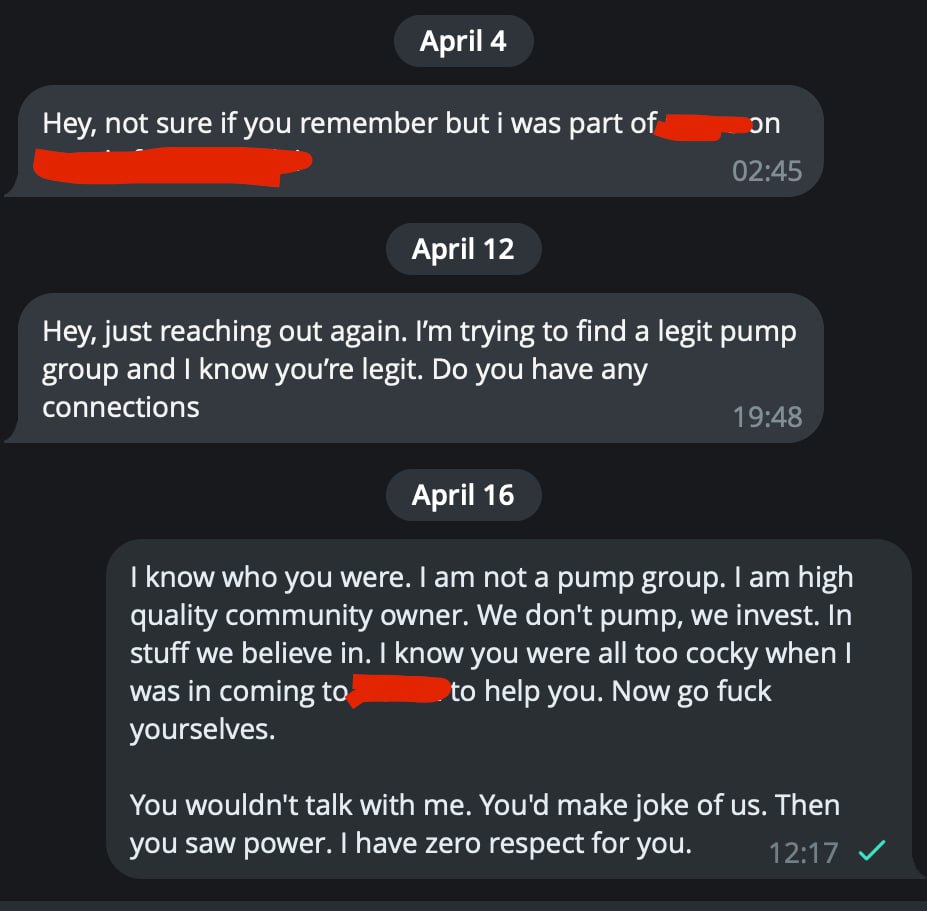

To all project founders who ignore good-intent people, are cocky to them, but once they see the power (like BCW) they get on their knees to suck a dick. FUCK YOU!

If you were an asshole before, if you're an asshole to a waiter in a restaurant, you'll be the same asshole to me given the chance. I want nothing to do with you. You don't deserve BCW.

Many guys like this guy. I remember him, founder of a project, a fork that was good idea. I came anon to give them top notch advice, they were ubercocky. Later, when they saw BCW power, they started to suck dick.

You know that joke: "Jenny would you suck a dick for a million bucks?"

- "for a million, yes"

- "what about for $10?"

She slaps him.

"who do you think I am"

- "we already established that, now we're just negotiating"

—-

The point is, if they are assholes, they are assholes. Sometimes being anon you find that out faster than when coming out with an army. Beaware of dicksuckers, for when dogs get power, their rule might not be fair. Cheers!

On a macro scale, if you zoom out just a bit from second-to-second thinking... if you relax... crypto this year I expect to be very rewarding. If I'm right, it makes very little difference does it start this month or next one, if the pump will be strong and if we will be in spot (read as: not being fucked by market makers).

Spot hold what you truly like.

Enjoy crypto.

Or micro trade it, time the market. I share with you the edge I find (and it's quite both powerful and often). According to your preference. Cheers!

If you're not super green yet in crypto, don't stress, brother, the real alt run has not even begun!

What I think alts might collapse for a bit. Maybe now is not the right time to buy them. I am telling you for quite some time, and since then the alts are boring. I tell you alts will break down. I think that now more than ever.

But remember your BCW brother... THEN will be a good time to buy. I am not selling. I just am not buying here. I wait for further dip to top up or to get back in the degen plays.

Blockchain Whispers baby!

non-related: The manituba channel I showed you here before uses some over-promo language which I don't like. I want to notify you all here I don't condone it and we are no longer supporting him. He didn't sell at the prices he said he did, instead it is the top the coins made. He had some great calls. Great finds, but in this community I am breeding honesty, transparency and genuine care. I will no longer promote him. He just posted it. But I don't like the psychology behind it.

D Man

P.S. I don't control traders and what they post. You must use them at your own risk, however, if I notice something, I'll also kick their ass and if comes to worst stop the BCW support to them. Either the BCW way or the highway! We are the legion. They are not!

https://blockchainwhispers.com44f39a7de86a1c7d995c6ebcd583fee5.pdfI've made for you the halving report. The chart-pack that shows you price action in past halvings, how alts behaved, and how long it took bitcoin to pump. It's easy to study, and get properly prepared for the upcoming halving.

Courtesy of your Blockchain Whispers family. It's free for you. Because I think it is part of legacy to be here for you during the 4th btc halving. Freely share with anyone you care about. Cheers brother!

Don't think it's because of war. SPX was long due for correction. So is btc. Many things start dropping couple days before mainnet. Why not btc?

D Man's Macro Fundamental Report Buyers were ready for this retrace.

Careful free chan followers as well.

D Man

AMA done. Was amazing. Thanks Mr. W and everyone who attended. BCW rocks!

How accurate D Man is?

This green is pre drawn line from the report, played out PERFECTLY (price wise).

Red lines were added a bit later.

Very accurate stuff. Back when everyone was (let me remind you) crazy bullish re: eth. BCW knew! D Man informed you. Brother on your side. Cheers!

Alts time is not now. BTC is pumping because of halving in days from now... but spx (stocks) already falling. Alts are not bullish yet... upon some base support from stocks, and btc on the side-up spiral back even after possible retrace, I think the real alt run will come.

ETHbtc doesn't look good short term either, except if hong-kong etf for eth gets approved monday... that could change it all.

Discussions

top 3 breaking news

Quick Take As we approach the Bitcoin halving and bid farewell to the current epoch, it is crucial to reflect on the events that have transpired since the previous halving in May 2020. The world has witnessed a series of significant events that have shaped the economic landscape and influenced the adoption of Bitcoin. The […] The post Bitcoin’s resilience tested: Price up 577% amid pandemics, war and corporate embrace appeared first on CryptoSlate.

a

a

a

a

a

a

Mercuryo, a global payments company, has partnered with TON to introduce fiat-to-crypto conversion services for USDT.

a

a

a

a

a

a

Closely followed quant analyst PlanB is predicting that the cycle top for Bitcoin (BTC) will be more than 4x the current value. The pseudonymous analyst tells his 1.9 million followers on the social media platform X that Bitcoin could put up massive gains after the April 19th halving event based on historic precedence. He believes […] The post Quant Analyst PlanB Predicts Bitcoin To Skyrocket by Over 4x – Here’s the Timeline appeared first on The Daily Hodl.

a

a

a

a

a

a

April 19, 2024 (Investorideas.com Newswire) Rick Mills: Good morning Rob. I'd like us to do a bird's eye, a fly-over macro view of Dolly Varden Silver's (TSXV:DV, OTC:DOLLF) Kitsault Valley project.

a

a

a

a

a

a

The Chief Executive Officer (CEO) of Ripple, Brad Garlinghouse, has revised his earlier ambitious prediction on the crypto industry’s future market capitalization, acknowledging that he had underestimated the market’s potential surge. Ripple CEO Underpredicts Crypto Market Cap Appearing in a recent interview with Fox Business, Garlinghouse shed light on the growth potential of the cryptocurrency market as well as its performance since the beginning of the year. The Ripple CEO was questioned about his previous optimistic forecast for the crypto industry’s market capitalization, in which he projected that the market cap would double to approximately $5 trillion by the end of the year. According to CoinMarketCap, the current global cryptocurrency market capitalization stands at roughly around $2.25 trillion. Related Reading: Here’s What Would Happen If The Bitcoin Price Fell Below $58,000 In response to the inquiry, Garlinghouse expressed his belief that his previous predictions were not overly ambitious, emphasizing the market’s potential for further growth. He admitted to underpredicting the industry’s potential market capitalization by the end of 2024, citing factors such as the current supply and demand dynamics driving additional increases. Garlinghouse noted that the current market conditions are characterized by increased demand and reduced supply, with these dynamics playing a significant role in the performance of cryptocurrencies. He disclosed that the Spot Bitcoin ETF market and the overall sentiment regarding Bitcoin’s value have significantly boosted demand for the cryptocurrency. Meanwhile, Bitcoin’s supply is diminishing due to the increasing number of large-scale investors purchasing the cryptocurrency rapidly. Additionally, the impending Bitcoin halving event is expected to further decrease the cryptocurrency’s supply. Assessing the current state of the crypto market, Garlinghouse stated that since the last six months, Bitcoin has been up by more than 250%, with further increases anticipated. He also asserted that this overperformance was largely driven by the approval and launch of Spot Bitcoin ETFs as well as the upcoming Bitcoin halving. Regulations Are Vital For Market Development Garlinghouse has disclosed that establishing proper regulatory frameworks for the cryptocurrency market would yield positive outcomes for the market in the future. He explained that one of the primary factors hindering the growth of this evolving market was the United State’s prevailing anti-crypto stance, suggesting that the country’s enforcement actions on the developing industry were “problematic.” Related Reading: Goldman Sachs On Bitcoin Halving: ‘It doesn’t Matter If It’s A Buy The Rumor, Sell The News Event’ The Ripple CEO highlighted several countries, including Dubai, Singapore and the United Kingdom, which have been proactively embracing cryptocurrencies and implementing proper regulatory systems to foster further growth in the market. Garlinghouse has asserted that the US has significantly lagged in recognizing the transformative and innovative impact of the cryptocurrency market, attributing this setback to the United States Securities and Exchange Commission (SEC) and its current Chair, Gary Gensler. Total market cap at $2.2 trillion | Source: Crypto Total Market Cap on Tradingview.com Featured image from Bitcoinist, chart from Tradingview.com

a

a

a

a

a

a

Jane Street Strategy in Millennium Suit Involved India Trading, Hearing Reveals Bloomberg

a

a

a

a

a

a

... bitcoin miners validating transactions on the network. Chapters: 0:00 - Bitcoin halving 0:36 - Market impact 4:45 - Mining impact Hosted by ...

a

a

a

a

a

a

The long-awaited day of the 4th phase of Bitcoin's halving is looming in the cryptocurrency sector. The countdown to this event shows that it could happen around the final hours of Friday evening if you are located in the Americas or Saturday morning if you are in Asia or Europe.According to the market metrics, the event is much anticipated and should be discounted well in advance of its actual occurrence. In contrast to unpredictable overnight barrages of rockets in the heat of the Middle East, the halving event has a clear outcome—the amount of BTC rewards that miners get for completing a block will be reduced in half to 3.125 BTC from the current 6.25.This will inevitably lead to less supply from miners, but does it change the liquidity of the overall market? We will attempt to answer that question in the coming paragraphs, and while at it, we will also highlight some challenges related to the current geopolitical landscape and the resulting jittery market conditions we have recently observed.Are Previous Halvings Linked to Liquidity Squeezes?Every time 210,000 blocks are mined, the Bitcoin network's protocol cuts in half the amount of new rewards. As highlighted by the institutional research team at Coinbase, this means that the newly minted supply will drop from 900 Bitcoins per day to 450 Bitcoins per day. At current market prices ($65,000 per BTC), this equates to roughly $30,000,000 worth of new supply per day or $900,000,000 per month.These figures are rather low compared to the average daily trading volumes across crypto exchanges, especially since the launch of BTC ETF trading, which triggered increased interest in the asset class.The amount of tradable Bitcoin has also been on the rise during the recent bull run that accelerated since early Q4 2023. According to the team at Coinbase Institutional Research, active BTC supply, defined as Bitcoin moved in the past three months, rose to 1.3 million. This figure is in comparison to 150,000, which was mined during that time.In a statement shared with Finance Magnates, Coinbase's Research Analyst, David Han, mentioned that the decline in BTC mining issuance could create new supply-side dynamics that are constructive in the longer term.Han expressed his doubts as to whether that can result in an imminent supply crunch: “We find that the largest contributors to increased BTC supply during bull markets come from long-term wallets beginning to activate instead of from newly mined BTC.”Crypto and Fiat Liquidity Cycles – the Signal and the NoiseA widely held belief in the cryptocurrency community is that halving events are usually followed by a significant rally in the value of their digital assets. While there is some historical correlation to corroborate this notion, science has long established - correlation does not imply causation.The logical fallacy where two events that occur at a similar time have a cause-effect relationship is at the center of spurious relationships - two events can be correlated, but that connection may not be causal.With only three halving events behind us and a fourth one brewing, one can observe correlations, but not necessarily cause-effect relationships. Halving events don’t perfectly coincide with central bank liquifying cycles, but as the chart below shows, there is some food for thought for risk-management teams and traders alike.Around the first halving in 2012, the Fed launched the third chapter of its post-financial crisis quantitative easing program (QE3), shortly followed by the first US debt ceiling crisis and the loss of the reserve currency issuer’s AAA rating.The second one, in 2016, was followed by the Bank of England’s post-Brexit ramp-up of bond buying in tandem with the ECB’s asset purchase program. Fast-forward to 2020, and we all remember the central bank and fiscal policy bazookas firing left and right with fiat liquidity so ample that it ultimately caused the sharpest spike in inflationary pressures globally since the 1970s. Geopolitical BlocksIt was an early morning in the Middle East, as a well-telegraphed attack by Iran had been unleashed upon Israel. With all other financial markets closed, it was up to crypto to reflect the current state of mind (or compute).The old Wall Street saying, “up the stairs, down the elevator,” came to mind as BTC and ETH dropped in tandem in rapidly dwindling liquidity conditions. That night, Coinbase registered about $2 billion worth of liquidations, the company’s institutional research team highlighted in a recent weekly market call.In contrast to the rather gradual price action that unfolded in the aftermath of the October 7th attack on Israel by Hamas, the Iranian attack, despite being well-telegraphed before the weekend, did result in material price action across the crypto market.At one point, Pax Gold, a crypto token supposed to be fully backed by gold, spiked about $1000 at a time when the physical gold market, which is underpinning the coin's value, wasn’t open. The magnitude of the attack certainly surprised market participants, while some automatic “stop trading” commands must have been unleashed across algorithmic trading strategies.Events centered around geopolitical stress have certainly caused some leveraged players to rethink, not only in the crypto market. Fed chair Powell’s higher rates for a longer period re-pivot raise questions about a widely expected easing of monetary policy.To Bid, or Not to BidAs the halving cycles come and go, the impact of these events could lessen in time. Since most bitcoins have already been mined, the current market liquidity state is much more about the existing supply of BTC on the market than newly mined coins.A supply crunch overnight is the least likely event, and if very recent history is any guide, geopolitical tensions can create more volatility or liquidity waves on cryptocurrency and traditional financial markets.Guided by risk-on and risk-off flows, cryptocurrencies have been defying the trend occasionally, but at their core they remain a high-risk asset with a digital store of value component behind it. Only time will tell whether or not that narrative has become a well-established characteristic, but so far, so good.As the halving event comes and passes us by, it is the central banks that will have the ball in their court - ready to do whatever it takes to address inflationary challenges or supply more fiat liquidity to the monetary system.With Bitcoin ETFs breaking new ground, the liquidity situation for the king of crypto has significantly improved. As David Han outlines: “Net US spot ETFs inflows to date approximately offset the BTC that was mined in the previous six months.” This article was written by Victor Golovtchenko at www.financemagnates.com.

a

a

a

a

a

a

[PRESS RELEASE – Seychelles, Mahe, April 19th, 2024] ScapesMania, a new project in the blockchain space, is set to engage with the burgeoning casual gaming market, which is projected to reach $19.12 billion by 2027 according to industry forecasts. Overview of ScapesMania Inspired by successful blockchain gaming projects during previous bullish market cycles, ScapesMania combines […]

a

a

a

a

a

a

MicroStrategy World and the Bitcoin for Corporations conference is set to gather leaders of Fortune 1000 companies to educate on trends in AI and analytics, and the strategic advantages of integrating Bitcoin into business operations.

a

a

a

a

a

a

The bullish divergence between SOL’s price and a key technical indicator may be hinting at a reversal.

a

a

a

a

a

a

Around 60 entities account for a “tiny” 0.4% of the fund's total shares outstanding, Bloomberg Intelligence analyst Eric Balchunas wrote in a post on ...

a

a

a

a

a

a

The IRS released a draft form for digital assets and cryptocurrency brokers to report information about their clients and transactions on their ...

a

a

a

a

a

a

Boxing legend Mike Tyson has partnered with the blockchain project for boxers Ready To Fight.

a

a

a

a

a

a

Netflix (NFLX) to Stop Reporting Subscriber Data in Move Similar to Apple, Meta Bloomberg

a

a

a

a

a

a

April 19, 2024 (Investorideas.com Newswire) Who would have thought that those markets are connected? They are.

a

a

a

a

a

a

Top 100 Coins By Market Cap

NEXT BTC MOVE:

I think Bitcoin goes UP because

| Name | Price | Marketcap | 24h | ||

|---|---|---|---|---|---|

Bitcoin (BTC)

Bitcoin (BTC)

|

$64,449.01 | $1.27 T | 2.87% | ||

Ethereum (ETH)

Ethereum (ETH)

|

$3,078.76 | $369.68 B | 1.62% | ||

Tether USDt (USDT)

Tether USDt (USDT)

|

$1.00 | $109.52 B | 0.00% | ||

BNB (BNB)

BNB (BNB)

|

$559.36 | $83.64 B | 2.13% | ||

Solana (SOL)

Solana (SOL)

|

$145.83 | $65.16 B | 7.21% | ||

USDC (USDC)

USDC (USDC)

|

$0.99994403 | $33.21 B | 0.00% | ||

XRP (XRP)

XRP (XRP)

|

$0.50367094 | $27.77 B | 1.57% | ||

Dogecoin (DOGE)

Dogecoin (DOGE)

|

$0.15320963 | $22.05 B | 3.87% | ||

Toncoin (TON)

Toncoin (TON)

|

$6.08 | $21.09 B | -2.14% | ||

Cardano (ADA)

Cardano (ADA)

|

$0.47044906 | $16.76 B | 5.64% | ||

Shiba Inu (SHIB)

Shiba Inu (SHIB)

|

$0.00002280 | $13.44 B | 2.02% | ||

Avalanche (AVAX)

Avalanche (AVAX)

|

$35.19 | $13.30 B | 2.92% | ||

Polkadot (DOT)

Polkadot (DOT)

|

$6.78 | $9.72 B | 2.04% | ||

TRON (TRX)

TRON (TRX)

|

$0.11039000 | $9.67 B | 2.12% | ||

Bitcoin Cash (BCH)

Bitcoin Cash (BCH)

|

$478.60 | $9.42 B | 0.63% | ||

Chainlink (LINK)

Chainlink (LINK)

|

$13.93 | $8.18 B | 3.66% | ||

Polygon (MATIC)

Polygon (MATIC)

|

$0.67540000 | $6.69 B | 1.88% | ||

Internet Computer (ICP)

Internet Computer (ICP)

|

$13.65 | $6.33 B | 11.47% | ||

Litecoin (LTC)

Litecoin (LTC)

|

$81.55 | $6.08 B | 2.07% | ||

NEAR Protocol (NEAR)

NEAR Protocol (NEAR)

|

$5.58 | $5.93 B | -0.30% | ||

UNUS SED LEO (LEO)

UNUS SED LEO (LEO)

|

$5.84 | $5.41 B | -0.40% | ||

Dai (DAI)

Dai (DAI)

|

$1.00 | $5.35 B | 0.01% | ||

Uniswap (UNI)

Uniswap (UNI)

|

$7.53 | $4.52 B | 6.68% | ||

Aptos (APT)

Aptos (APT)

|

$9.51 | $4.04 B | 2.94% | ||

Ethereum Classic (ETC)

Ethereum Classic (ETC)

|

$26.19 | $3.84 B | 2.18% | ||

Mantle (MNT)

Mantle (MNT)

|

$1.14 | $3.72 B | 0.15% | ||

Stacks (STX)

Stacks (STX)

|

$2.50 | $3.64 B | 5.58% | ||

First Digital USD (FDUSD)

First Digital USD (FDUSD)

|

$0.99950000 | $3.59 B | -0.04% | ||

Filecoin (FIL)

Filecoin (FIL)

|

$6.19 | $3.34 B | 5.50% | ||

OKB (OKB)

OKB (OKB)

|

$55.66 | $3.34 B | 1.87% | ||

Cronos (CRO)

Cronos (CRO)

|

$0.12526568 | $3.33 B | 4.06% | ||

Stellar (XLM)

Stellar (XLM)

|

$0.11200000 | $3.23 B | 3.67% | ||

Cosmos (ATOM)

Cosmos (ATOM)

|

$8.26 | $3.23 B | 1.52% | ||

Render (RNDR)

Render (RNDR)

|

$8.10 | $3.12 B | 4.77% | ||

Bittensor (TAO)

Bittensor (TAO)

|

$461.20 | $3.05 B | 0.90% | ||

Hedera Hashgraph (HBAR)

Hedera Hashgraph (HBAR)

|

$0.08278900 | $2.98 B | 3.33% | ||

Immutable (IMX)

Immutable (IMX)

|

$2.08 | $3.02 B | 6.37% | ||

dogwifhat (WIF)

dogwifhat (WIF)

|

$3.02 | $3.01 B | 21.48% | ||

Arbitrum (ARB)

Arbitrum (ARB)

|

$1.13 | $3.01 B | 0.77% | ||

Hedera (HBAR)

Hedera (HBAR)

|

$0.08280000 | $2.96 B | 3.13% | ||

VeChain (VET)

VeChain (VET)

|

$0.04067000 | $2.95 B | 4.66% | ||

Maker (MKR)

Maker (MKR)

|

$2,968.00 | $2.75 B | -3.05% | ||

Kaspa (KAS)

Kaspa (KAS)

|

$0.11484488 | $2.69 B | -0.86% | ||

Injective (INJ)

Injective (INJ)

|

$27.85 | $2.60 B | 2.12% | ||

The Graph (GRT)

The Graph (GRT)

|

$0.26281892 | $2.49 B | 6.39% | ||

Optimism (OP)

Optimism (OP)

|

$2.27 | $2.37 B | 3.65% | ||

Monero (XMR)

Monero (XMR)

|

$121.02 | $2.23 B | 4.01% | ||

Pepe (PEPE)

Pepe (PEPE)

|

$0.00000516 | $2.17 B | 4.01% | ||

Theta Network (THETA)

Theta Network (THETA)

|

$2.08 | $2.08 B | 2.60% | ||

Fantom (FTM)

Fantom (FTM)

|

$0.70457844 | $1.98 B | 4.14% | ||

Celestia (TIA)

Celestia (TIA)

|

$10.96 | $1.96 B | 11.04% | ||

Fetch.ai (FET)

Fetch.ai (FET)

|

$2.16 | $1.83 B | 7.60% | ||

THORChain (RUNE)

THORChain (RUNE)

|

$5.43 | $1.82 B | 15.32% | ||

Lido DAO (LDO)

Lido DAO (LDO)

|

$2.01 | $1.79 B | 3.12% | ||

Arweave (AR)

Arweave (AR)

|

$27.19 | $1.78 B | 12.00% | ||

Sui (SUI)

Sui (SUI)

|

$1.37 | $1.78 B | 13.97% | ||

Bitget Token (BGB)

Bitget Token (BGB)

|

$1.24 | $1.74 B | -0.85% | ||

Core (CORE)

Core (CORE)

|

$1.94 | $1.71 B | -2.23% | ||

Sei (SEI)

Sei (SEI)

|

$0.55800000 | $1.56 B | 6.90% | ||

Jupiter (JUP)

Jupiter (JUP)

|

$1.08 | $1.46 B | 10.43% | ||

Beam (BEAM)

Beam (BEAM)

|

$0.02751263 | $1.46 B | 6.00% | ||

Algorand (ALGO)

Algorand (ALGO)

|

$0.17750000 | $1.44 B | 4.11% | ||

Render Token (RNDR)

Render Token (RNDR)

|

$8.11 | $3.16 B | 5.09% | ||

Ethena (ENA)

Ethena (ENA)

|

$1.01 | $1.44 B | 13.59% | ||

Pendle (PENDLE)

Pendle (PENDLE)

|

$5.79 | $1.38 B | -2.18% | ||

Gala (GALA)

Gala (GALA)

|

$0.04481000 | $1.36 B | 5.51% | ||

FLOKI (FLOKI)

FLOKI (FLOKI)

|

$0.00014165 | $1.36 B | 4.55% | ||

Flow (FLOW)

Flow (FLOW)

|

$0.89100000 | $1.34 B | 3.71% | ||

Bitcoin SV (BSV)

Bitcoin SV (BSV)

|

$66.09 | $1.30 B | 0.59% | ||

Neo (NEO)

Neo (NEO)

|

$18.22 | $1.29 B | 4.06% | ||

Quant (QNT)

Quant (QNT)

|

$106.30 | $1.28 B | 1.79% | ||

Aave (AAVE)

Aave (AAVE)

|

$86.69 | $1.28 B | 3.12% | ||

Flare (FLR)

Flare (FLR)

|

$0.03194114 | $1.23 B | 0.62% | ||

BitTorrent (New) (BTT)

BitTorrent (New) (BTT)

|

$0.00000126 | $1.22 B | 0.40% | ||

SingularityNET (AGIX)

SingularityNET (AGIX)

|

$0.87745000 | $1.12 B | 5.97% | ||

MultiversX (EGLD)

MultiversX (EGLD)

|

$41.31 | $1.11 B | 3.34% | ||

Wormhole (W)

Wormhole (W)

|

$0.59851960 | $1.08 B | 4.81% | ||

Huobi Token (HT)

Huobi Token (HT)

|

$0.59266700 | $94.21 M | -5.34% | ||

dYdX (Native) (DYDX)

dYdX (Native) (DYDX)

|

$2.30 | $1.07 B | 5.69% | ||

eCash (XEC)

eCash (XEC)

|

$0.00005137 | $1.01 B | 2.87% | ||

The Sandbox (SAND)

The Sandbox (SAND)

|

$0.44810000 | $1.01 B | 4.32% | ||

Axie Infinity (AXS)

Axie Infinity (AXS)

|

$7.01 | $1.01 B | 1.57% | ||

Ronin (RON)

Ronin (RON)

|

$3.19 | $1.01 B | 3.64% | ||

Bonk (BONK)

Bonk (BONK)

|

$0.00001508 | $983.30 M | 5.28% | ||

Worldcoin (WLD)

Worldcoin (WLD)

|

$5.14 | $978.38 M | 6.03% | ||

Synthetix (SNX)

Synthetix (SNX)

|

$2.97 | $973.80 M | 6.79% | ||

dYdX (DYDX)

dYdX (DYDX)

|

$2.30 | $719.14 M | 5.34% | ||

Chiliz (CHZ)

Chiliz (CHZ)

|

$0.10926000 | $970.77 M | 3.24% | ||

Tezos (XTZ)

Tezos (XTZ)

|

$0.99200000 | $970.50 M | 4.78% | ||

ORDI (ORDI)

ORDI (ORDI)

|

$45.91 | $964.10 M | 8.39% | ||

Akash Network (AKT)

Akash Network (AKT)

|

$4.02 | $940.57 M | 2.47% | ||

Conflux (CFX)

Conflux (CFX)

|

$0.23590000 | $927.98 M | 2.96% | ||

JasmyCoin (JASMY)

JasmyCoin (JASMY)

|

$0.01870100 | $922.17 M | 4.02% | ||

Pyth Network (PYTH)

Pyth Network (PYTH)

|

$0.61440000 | $921.10 M | 3.28% | ||

Starknet (STRK)

Starknet (STRK)

|

$1.24 | $904.89 M | 1.66% | ||

Gnosis (GNO)

Gnosis (GNO)

|

$347.90 | $897.82 M | 4.22% | ||

EOS (EOS)

EOS (EOS)

|

$0.78520000 | $880.95 M | 6.18% | ||

Mina (MINA)

Mina (MINA)

|

$0.80709686 | $878.95 M | 4.64% | ||

Nervos Network (CKB)

Nervos Network (CKB)

|

$0.01993200 | $876.69 M | 2.61% | ||

KuCoin Token (KCS)

KuCoin Token (KCS)

|

$8.82 | $848.19 M | 5.10% |

Try to search another coin

ch80 Yes