Notification Center

Turn on/off sound

Show/Hide Coins Ticker

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 11 Gwei | 11 Gwei | 12 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 11 Gwei | 11 Gwei | 12 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

Remember this green drawing? Above = bullish, below = dump. We are retesting it now in a quite bad way. Just fyi.

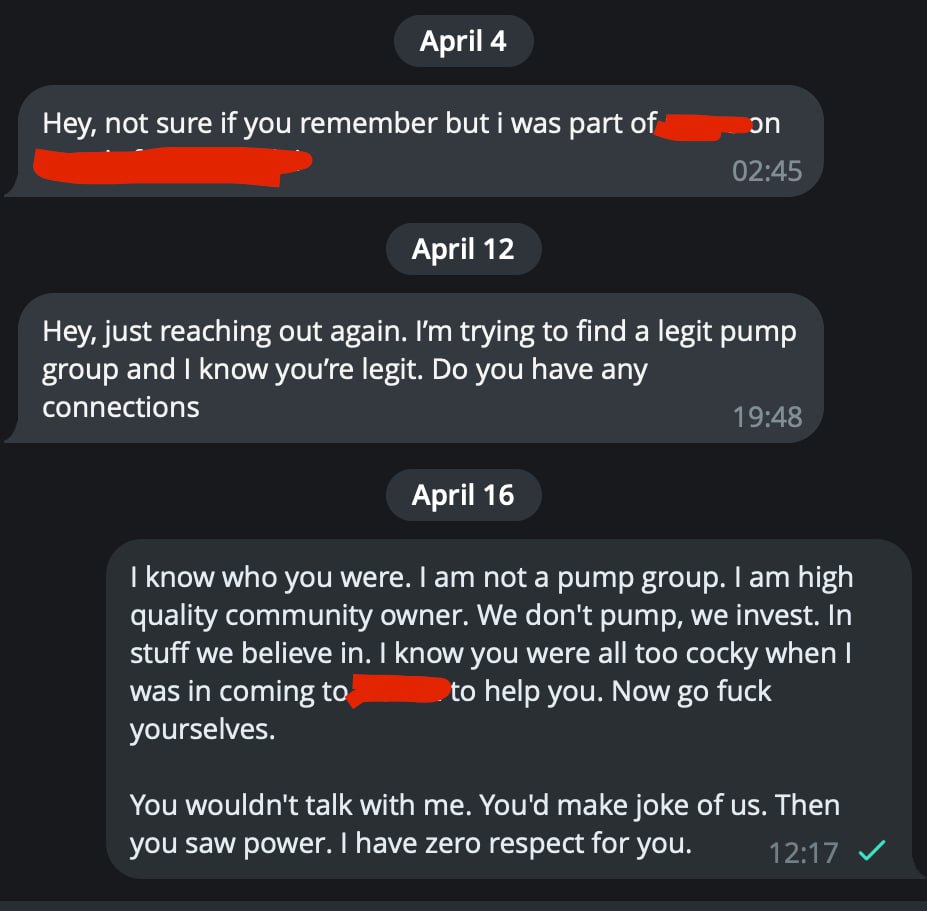

To all project founders who ignore good-intent people, are cocky to them, but once they see the power (like BCW) they get on their knees to suck a dick. FUCK YOU!

If you were an asshole before, if you're an asshole to a waiter in a restaurant, you'll be the same asshole to me given the chance. I want nothing to do with you. You don't deserve BCW.

Many guys like this guy. I remember him, founder of a project, a fork that was good idea. I came anon to give them top notch advice, they were ubercocky. Later, when they saw BCW power, they started to suck dick.

You know that joke: "Jenny would you suck a dick for a million bucks?"

- "for a million, yes"

- "what about for $10?"

She slaps him.

"who do you think I am"

- "we already established that, now we're just negotiating"

—-

The point is, if they are assholes, they are assholes. Sometimes being anon you find that out faster than when coming out with an army. Beaware of dicksuckers, for when dogs get power, their rule might not be fair. Cheers!

On a macro scale, if you zoom out just a bit from second-to-second thinking... if you relax... crypto this year I expect to be very rewarding. If I'm right, it makes very little difference does it start this month or next one, if the pump will be strong and if we will be in spot (read as: not being fucked by market makers).

Spot hold what you truly like.

Enjoy crypto.

Or micro trade it, time the market. I share with you the edge I find (and it's quite both powerful and often). According to your preference. Cheers!

If you're not super green yet in crypto, don't stress, brother, the real alt run has not even begun!

What I think alts might collapse for a bit. Maybe now is not the right time to buy them. I am telling you for quite some time, and since then the alts are boring. I tell you alts will break down. I think that now more than ever.

But remember your BCW brother... THEN will be a good time to buy. I am not selling. I just am not buying here. I wait for further dip to top up or to get back in the degen plays.

Blockchain Whispers baby!

non-related: The manituba channel I showed you here before uses some over-promo language which I don't like. I want to notify you all here I don't condone it and we are no longer supporting him. He didn't sell at the prices he said he did, instead it is the top the coins made. He had some great calls. Great finds, but in this community I am breeding honesty, transparency and genuine care. I will no longer promote him. He just posted it. But I don't like the psychology behind it.

D Man

P.S. I don't control traders and what they post. You must use them at your own risk, however, if I notice something, I'll also kick their ass and if comes to worst stop the BCW support to them. Either the BCW way or the highway! We are the legion. They are not!

https://blockchainwhispers.com44f39a7de86a1c7d995c6ebcd583fee5.pdfI've made for you the halving report. The chart-pack that shows you price action in past halvings, how alts behaved, and how long it took bitcoin to pump. It's easy to study, and get properly prepared for the upcoming halving.

Courtesy of your Blockchain Whispers family. It's free for you. Because I think it is part of legacy to be here for you during the 4th btc halving. Freely share with anyone you care about. Cheers brother!

Don't think it's because of war. SPX was long due for correction. So is btc. Many things start dropping couple days before mainnet. Why not btc?

D Man's Macro Fundamental Report Buyers were ready for this retrace.

Careful free chan followers as well.

D Man

AMA done. Was amazing. Thanks Mr. W and everyone who attended. BCW rocks!

How accurate D Man is?

This green is pre drawn line from the report, played out PERFECTLY (price wise).

Red lines were added a bit later.

Very accurate stuff. Back when everyone was (let me remind you) crazy bullish re: eth. BCW knew! D Man informed you. Brother on your side. Cheers!

Alts time is not now. BTC is pumping because of halving in days from now... but spx (stocks) already falling. Alts are not bullish yet... upon some base support from stocks, and btc on the side-up spiral back even after possible retrace, I think the real alt run will come.

ETHbtc doesn't look good short term either, except if hong-kong etf for eth gets approved monday... that could change it all.

Let's do it: https://blockchainwhispers.com/c/w-ama

AMA with Mr. W in 15 min. Link will be posted here.

Done, all Premium posts made today are free, enjoy: http://blockchainwhispers.com/signals

Discussions

top 3 breaking news

As the US economy grapples with rising inflation expectations and scaled-back forecasts for Federal Reserve rate cuts, the Bitcoin market remains buoyant, according to a detailed analysis by Reflexivity Research. With the US CPI headline inflation projected to accelerate to 4.8% by the November 2024 elections, according to Bank of America, conditions are seemingly unfavorable for a loosening of monetary policy. Despite this, the cryptocurrency sector, particularly Bitcoin, appears insulated and optimistic. Bitcoin Unfazed By Delayed Rate Cuts? The bond market now anticipates only three Federal Reserve rate cuts this year, a significant reduction from the earlier forecast of six. The CME FedWatch tool indicates that the majority of market participants do not expect a rate cut to occur before the mid-September FOMC meeting. This adjustment reflects a recalibration of expectations regarding the Fed’s capacity to manage persistent inflation pressures. Amidst these macroeconomic shifts, Ritik Goyal, in a guest post for Reflexivity Research, presents a compelling analysis in his report titled “The Fed is Unable to Cause a Recession. Risk Assets are Yet to Realize This.” Related Reading: Pre-Halving Jitters: Bitcoin Price Briefly Slips Below $60,000 The report argues that, contrary to conventional wisdom, the Federal Reserve’s rate hikes have had unintended stimulative effects on the economy. Goyal elucidates three specific mechanisms through which this phenomenon operates: 1. Increased Government Interest Payments: “Rate hikes raised interest payments by the government to the private sector,” Goyal notes. As the Fed raises rates, it increases the interest burden on the government, which has borrowed extensively during the post-COVID period. With the federal debt-to-GDP ratio exceeding 120%, the doubled interest payments now effectively act as a stimulus, channeling approximately $1 trillion annually to the private sector 2. Direct Subsidy to Banking System: The Fed’s policy adjustments have also led to a redistribution of wealth within the financial system. “Rate hikes raised the Fed’s direct subsidy to the banking system,” states Goyal. This has occurred as the yield curve inversion resulted in the Fed incurring losses on its balance sheet, losses that directly benefit the banking sector, translating to an estimated $150 billion annual subsidy. Related Reading: Bitcoin Displays Bullish Adam And Eve Double Bottom: What It Means 3. Induced Housing Construction Boom: The rate hikes have paradoxically stimulated the housing market. “Rate hikes induced a housing construction boom,” according to Goyal. As higher rates discourage existing homeowners from selling, the only viable option to meet housing demand is new construction, a sector with one of the highest GDP multipliers. Goyal’s insights underline a critical misalignment in the Fed’s current approach against the backdrop of substantial fiscal interventions since the pandemic. “The traditional monetary policy framework is breaking down under the weight of fiscal dominance,” Goyal concludes, suggesting an environment that could favor non-traditional assets like Bitcoin. Echoing Goyal’s findings, crypto expert Will Clemente highlighted the broader implications for cryptocurrencies on X (formerly Twitter), stating, “With debt/GDP as high as it is, we’re in a backwards world where high rates mean interest payments on debt are stimmy checks for people that buy assets—~$1T will be paid out in 2024. Big picture is very constructive for the internet coins.” At press time, BTC traded at $61,173. Featured image from Shutterstock, chart from TradingView.com

a

a

a

a

a

a

Ethena (ENA), the synthetic U.S. dollar protocol built on the Ethereum network, recorded a notable plunge as the market witnessed bearish sentiment. ENA is down by 17% in the past 24 hours and is trading at $0.84 at the time…

a

a

a

a

a

a

The exchange could return as a FIU-registered firm after paying the fine, the report added.

a

a

a

a

a

a

BTC dominance is creeping upwards as Layer-1s and Artificial Intelligence tokens had a rough week, while Google search interest in the halving skyrockets.

a

a

a

a

a

a

Crypto exchange Binance has made a notable reorganizational move for its billion-dollar SAFU insurance fund, with all the assets in it converting into the USDC stablecoin. Binance has announced a sudden update for its emergency insurance fund called SAFU, converting…

a

a

a

a

a

a

ULTIMA Tokens’ hyperdeflationary strategy aims to increase value and ensure long-term sustainability by reducing token supply and enhancing scarcity. #partnercontent

a

a

a

a

a

a

Former Coinbase Executive Nana Murugesan Joins Matter Labs as President Bloomberg

a

a

a

a

a

a

Cryptocurrency analyst Kevin Svenson believes Bitcoin (BTC) remains in an upward trajectory despite the recent pullback. In a new video, Svenson tells his 76,100 YouTube subscribers that as long as Bitcoin holds the mid to high $50,000 range as support a broader parabolic trend remains intact. “According to the textbook diagram, there’s no reason for […] The post Bitcoin Still on an Exponential Upward Trajectory, According to Analyst Kevin Svenson – But There’s a Catch appeared first on The Daily Hodl.

a

a

a

a

a

a

Singapore-based crypto trading firm QCP Capital has signed a strategic partnership agreement with Further Ventures to double down on the Middle Eastern markets. Asia’s crypto trading firm QCP Capital revealed a partnership agreement with Further Ventures, an investment firm backed…

a

a

a

a

a

a

In the volatile landscape of cryptocurrency markets, Shiba Inu, the popular meme coin, has once again captured the attention of investors with a notable surge in value, despite losing 4% of its value in the last day. The memecoin reached a high of $0.00002296 after experiencing a temporary dip to $0.00002092 just the day before. Source: CoinMarketCap Related Reading: Whale Alert: MATIC Poised For Epic Surge – Time To Dive In? Open Interest Surge Signals Market Activity A key indicator of this newfound interest in Shiba Inu lies in the surge of open interest observed across major exchanges. Leading the charge are exchanges like Huobi and OKX, where Shiba Inu’s open interest soared to nearly $16 million and $15 million, respectively. Source: Coinalyze This surge in open interest reflects heightened market activity and suggests a growing number of investors are actively engaging with Shiba Inu futures contracts. Mixed Sentiment Persists Among Traders Despite the surge in open interest and the subsequent price rally, sentiment among traders remains mixed. While there is evident optimism driving the market, reflected in the increase in open interest, the Long/Short Ratio paints a nuanced picture. SHIB market cap currently at $12.8 billion. Chart: TradingView.com Currently standing at 0.94, the Long/Short Ratio indicates that more traders are betting on a potential price drop for Shiba Inu. This divergence in sentiment adds a layer of complexity to the market dynamics surrounding Shiba Inu. Leveraged Trading Statistics And On-Chain Indicators Examining the market, statistics on leveraged trading offer additional insights into the current state of SHIB. Across exchanges like Bitget, CoinEx, BingX, Huobi, OKX, Kraken, and BitMex, open interest for Shiba Inu futures contracts stands at a staggering 2.40 trillion SHIB tokens. While exchanges like Bitget lead the pack with significant gains in open interest, others like BingX and CoinEx also show notable increases. Related Reading: Elon Musk Latest Tweet: How Much Did Dogecoin Gain From It Today? Furthermore, on-chain indicators present a bullish outlook for Shiba Inu, despite the fluctuations in price and market sentiment. A consistent decline in SHIB tokens held on exchanges since the onset of the bull market in October 2023 suggests that long-term investors maintain confidence in Shiba Inu’s potential. This trend persists even amidst recent market dips in March and April, highlighting the resilience of Shiba Inu’s investor base. Navigating Shiba Inu’s Market Dynamics While the recent surge in price and open interest signals renewed interest and activity, the divergence in trader sentiment underscores the inherent uncertainty of the market. Nevertheless, with on-chain indicators pointing towards long-term confidence, Shiba Inu remains a cryptocurrency to watch closely in the days to come. Featured image from Pexels, chart from TradingView

a

a

a

a

a

a

Top 100 Coins By Market Cap

NEXT BTC MOVE:

I think Bitcoin goes UP because

| Name | Price | Marketcap | 24h | ||

|---|---|---|---|---|---|

Bitcoin (BTC)

Bitcoin (BTC)

|

$61,266.21 | $1.20 T | -3.92% | ||

Ethereum (ETH)

Ethereum (ETH)

|

$2,976.23 | $357.36 B | -3.53% | ||

Tether USDt (USDT)

Tether USDt (USDT)

|

$1.00 | $109.09 B | 0.04% | ||

BNB (BNB)

BNB (BNB)

|

$543.37 | $81.25 B | -0.11% | ||

Solana (SOL)

Solana (SOL)

|

$130.05 | $58.09 B | -7.23% | ||

USDC (USDC)

USDC (USDC)

|

$1.00 | $32.67 B | 0.04% | ||

XRP (XRP)

XRP (XRP)

|

$0.49052537 | $27.04 B | -3.13% | ||

Dogecoin (DOGE)

Dogecoin (DOGE)

|

$0.14313184 | $20.60 B | -7.89% | ||

Toncoin (TON)

Toncoin (TON)

|

$5.89 | $20.43 B | -7.38% | ||

Cardano (ADA)

Cardano (ADA)

|

$0.44000113 | $15.67 B | -3.93% | ||

Shiba Inu (SHIB)

Shiba Inu (SHIB)

|

$0.00002163 | $12.75 B | -3.56% | ||

Avalanche (AVAX)

Avalanche (AVAX)

|

$33.44 | $12.58 B | -5.23% | ||

TRON (TRX)

TRON (TRX)

|

$0.10933000 | $9.58 B | -2.81% | ||

Polkadot (DOT)

Polkadot (DOT)

|

$6.53 | $9.35 B | -2.30% | ||

Bitcoin Cash (BCH)

Bitcoin Cash (BCH)

|

$472.60 | $9.24 B | -1.31% | ||

Chainlink (LINK)

Chainlink (LINK)

|

$13.00 | $7.58 B | -4.13% | ||

Polygon (MATIC)

Polygon (MATIC)

|

$0.65810000 | $6.49 B | -6.66% | ||

Litecoin (LTC)

Litecoin (LTC)

|

$79.36 | $5.89 B | 0.27% | ||

NEAR Protocol (NEAR)

NEAR Protocol (NEAR)

|

$5.41 | $5.76 B | -0.89% | ||

Internet Computer (ICP)

Internet Computer (ICP)

|

$11.87 | $5.47 B | -3.97% | ||

UNUS SED LEO (LEO)

UNUS SED LEO (LEO)

|

$5.87 | $5.44 B | 0.06% | ||

Dai (DAI)

Dai (DAI)

|

$1.00 | $5.35 B | 0.00% | ||

Uniswap (UNI)

Uniswap (UNI)

|

$6.90 | $4.11 B | -3.26% | ||

Aptos (APT)

Aptos (APT)

|

$8.99 | $3.82 B | -3.59% | ||

First Digital USD (FDUSD)

First Digital USD (FDUSD)

|

$0.99940000 | $3.75 B | -0.02% | ||

Ethereum Classic (ETC)

Ethereum Classic (ETC)

|

$25.32 | $3.70 B | -3.93% | ||

Mantle (MNT)

Mantle (MNT)

|

$1.11 | $3.63 B | -3.94% | ||

Stacks (STX)

Stacks (STX)

|

$2.27 | $3.29 B | -2.86% | ||

OKB (OKB)

OKB (OKB)

|

$54.21 | $3.25 B | -6.60% | ||

Cronos (CRO)

Cronos (CRO)

|

$0.11973522 | $3.18 B | -5.82% | ||

Filecoin (FIL)

Filecoin (FIL)

|

$5.81 | $3.12 B | -3.82% | ||

Cosmos (ATOM)

Cosmos (ATOM)

|

$7.97 | $3.12 B | -2.13% | ||

Stellar (XLM)

Stellar (XLM)

|

$0.10710000 | $3.08 B | -2.97% | ||

Arbitrum (ARB)

Arbitrum (ARB)

|

$1.11 | $2.96 B | -2.99% | ||

Bittensor (TAO)

Bittensor (TAO)

|

$442.09 | $2.92 B | -10.51% | ||

Hedera Hashgraph (HBAR)

Hedera Hashgraph (HBAR)

|

$0.07784100 | $2.81 B | -2.67% | ||

Render (RNDR)

Render (RNDR)

|

$7.51 | $2.89 B | -6.10% | ||

Maker (MKR)

Maker (MKR)

|

$3,116.00 | $2.87 B | -4.16% | ||

Hedera (HBAR)

Hedera (HBAR)

|

$0.07820000 | $2.79 B | -2.56% | ||

VeChain (VET)

VeChain (VET)

|

$0.03740000 | $2.71 B | -7.84% | ||

Kaspa (KAS)

Kaspa (KAS)

|

$0.11502288 | $2.69 B | -3.40% | ||

Immutable (IMX)

Immutable (IMX)

|

$1.87 | $2.67 B | -2.46% | ||

Injective (INJ)

Injective (INJ)

|

$25.06 | $2.34 B | -2.37% | ||

dogwifhat (WIF)

dogwifhat (WIF)

|

$2.29 | $2.27 B | -14.10% | ||

Optimism (OP)

Optimism (OP)

|

$2.15 | $2.25 B | -3.38% | ||

The Graph (GRT)

The Graph (GRT)

|

$0.23679509 | $2.25 B | -7.10% | ||

Monero (XMR)

Monero (XMR)

|

$113.03 | $2.08 B | -9.48% | ||

Pepe (PEPE)

Pepe (PEPE)

|

$0.00000472 | $1.99 B | -10.86% | ||

Theta Network (THETA)

Theta Network (THETA)

|

$1.97 | $1.96 B | -3.37% | ||

Bitget Token (BGB)

Bitget Token (BGB)

|

$1.31 | $1.83 B | 9.91% | ||

Fantom (FTM)

Fantom (FTM)

|

$0.64772990 | $1.82 B | -3.57% | ||

Core (CORE)

Core (CORE)

|

$1.98 | $1.75 B | -14.24% | ||

Lido DAO (LDO)

Lido DAO (LDO)

|

$1.90 | $1.69 B | -5.15% | ||

Celestia (TIA)

Celestia (TIA)

|

$9.48 | $1.69 B | -10.53% | ||

Fetch.ai (FET)

Fetch.ai (FET)

|

$1.91 | $1.62 B | -6.95% | ||

Sui (SUI)

Sui (SUI)

|

$1.22 | $1.58 B | -0.82% | ||

Arweave (AR)

Arweave (AR)

|

$23.91 | $1.55 B | -3.49% | ||

THORChain (RUNE)

THORChain (RUNE)

|

$4.40 | $1.47 B | -13.89% | ||

Pendle (PENDLE)

Pendle (PENDLE)

|

$5.93 | $1.42 B | -3.23% | ||

Sei (SEI)

Sei (SEI)

|

$0.48630000 | $1.36 B | -6.85% | ||

Beam (BEAM)

Beam (BEAM)

|

$0.02532329 | $1.34 B | -8.13% | ||

Algorand (ALGO)

Algorand (ALGO)

|

$0.16500000 | $1.34 B | -5.19% | ||

Render Token (RNDR)

Render Token (RNDR)

|

$7.55 | $2.91 B | -5.99% | ||

Bitcoin SV (BSV)

Bitcoin SV (BSV)

|

$64.28 | $1.27 B | -4.11% | ||

Flow (FLOW)

Flow (FLOW)

|

$0.84100000 | $1.26 B | -5.75% | ||

Jupiter (JUP)

Jupiter (JUP)

|

$0.91907464 | $1.24 B | -7.46% | ||

FLOKI (FLOKI)

FLOKI (FLOKI)

|

$0.00012982 | $1.24 B | -8.04% | ||

Aave (AAVE)

Aave (AAVE)

|

$83.40 | $1.23 B | -3.46% | ||

Gala (GALA)

Gala (GALA)

|

$0.04007000 | $1.22 B | -4.11% | ||

Quant (QNT)

Quant (QNT)

|

$100.70 | $1.21 B | -3.15% | ||

Flare (FLR)

Flare (FLR)

|

$0.03120403 | $1.20 B | -2.82% | ||

BitTorrent (New) (BTT)

BitTorrent (New) (BTT)

|

$0.00000122 | $1.19 B | -5.71% | ||

Ethena (ENA)

Ethena (ENA)

|

$0.84000000 | $1.18 B | -17.99% | ||

Neo (NEO)

Neo (NEO)

|

$16.47 | $1.16 B | -10.64% | ||

MultiversX (EGLD)

MultiversX (EGLD)

|

$39.53 | $1.06 B | -2.48% | ||

SingularityNET (AGIX)

SingularityNET (AGIX)

|

$0.79636000 | $1.01 B | -6.04% | ||

dYdX (Native) (DYDX)

dYdX (Native) (DYDX)

|

$2.11 | $978.36 M | -0.88% | ||

Axie Infinity (AXS)

Axie Infinity (AXS)

|

$6.85 | $980.27 M | -2.32% | ||

Huobi Token (HT)

Huobi Token (HT)

|

$0.62202800 | $99.19 M | -1.60% | ||

Wormhole (W)

Wormhole (W)

|

$0.54210956 | $975.80 M | -10.02% | ||

Chiliz (CHZ)

Chiliz (CHZ)

|

$0.10852000 | $960.04 M | -1.03% | ||

eCash (XEC)

eCash (XEC)

|

$0.00004863 | $955.26 M | -6.65% | ||

Ronin (RON)

Ronin (RON)

|

$3.04 | $952.44 M | -4.15% | ||

The Sandbox (SAND)

The Sandbox (SAND)

|

$0.42280000 | $948.70 M | -3.54% | ||

Tezos (XTZ)

Tezos (XTZ)

|

$0.93400000 | $909.48 M | -6.59% | ||

Bonk (BONK)

Bonk (BONK)

|

$0.00001371 | $893.93 M | -6.47% | ||

dYdX (DYDX)

dYdX (DYDX)

|

$2.11 | $650.43 M | -1.17% | ||

Worldcoin (WLD)

Worldcoin (WLD)

|

$4.71 | $892.33 M | -6.04% | ||

Synthetix (SNX)

Synthetix (SNX)

|

$2.73 | $893.61 M | -5.94% | ||

Conflux (CFX)

Conflux (CFX)

|

$0.22490000 | $882.07 M | -5.19% | ||

Akash Network (AKT)

Akash Network (AKT)

|

$3.75 | $877.21 M | -4.06% | ||

Nervos Network (CKB)

Nervos Network (CKB)

|

$0.02000900 | $876.53 M | -10.82% | ||

Starknet (STRK)

Starknet (STRK)

|

$1.20 | $872.55 M | -6.47% | ||

JasmyCoin (JASMY)

JasmyCoin (JASMY)

|

$0.01760400 | $868.14 M | -4.54% | ||

ORDI (ORDI)

ORDI (ORDI)

|

$41.22 | $865.67 M | -2.56% | ||

Gnosis (GNO)

Gnosis (GNO)

|

$324.80 | $840.13 M | -3.60% | ||

Pyth Network (PYTH)

Pyth Network (PYTH)

|

$0.56220000 | $839.36 M | -5.44% | ||

Mina (MINA)

Mina (MINA)

|

$0.75468492 | $821.32 M | -3.46% | ||

EOS (EOS)

EOS (EOS)

|

$0.72320000 | $810.01 M | -3.88% | ||

Decentraland (MANA)

Decentraland (MANA)

|

$0.41746885 | $796.66 M | -3.63% |

Try to search another coin

ch80 Yes