Notification Center

Turn on/off sound

Show/Hide Coins Ticker

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 8 Gwei | 8 Gwei | 9 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

| 🐌 Slow | 👌 Standard | ⚡️ Fast |

|---|---|---|

| 8 Gwei | 8 Gwei | 9 Gwei |

| ~120 secs | ~60 secs | ~15 secs |

Remember this green drawing? Above = bullish, below = dump. We are retesting it now in a quite bad way. Just fyi.

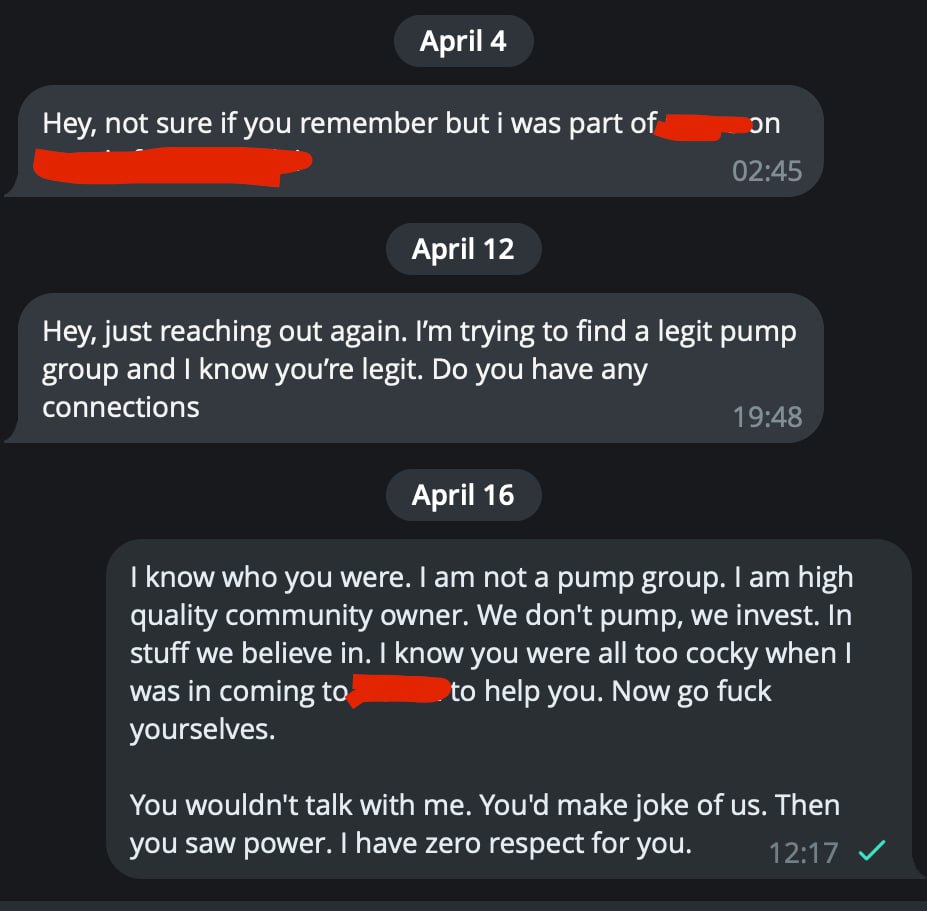

To all project founders who ignore good-intent people, are cocky to them, but once they see the power (like BCW) they get on their knees to suck a dick. FUCK YOU!

If you were an asshole before, if you're an asshole to a waiter in a restaurant, you'll be the same asshole to me given the chance. I want nothing to do with you. You don't deserve BCW.

Many guys like this guy. I remember him, founder of a project, a fork that was good idea. I came anon to give them top notch advice, they were ubercocky. Later, when they saw BCW power, they started to suck dick.

You know that joke: "Jenny would you suck a dick for a million bucks?"

- "for a million, yes"

- "what about for $10?"

She slaps him.

"who do you think I am"

- "we already established that, now we're just negotiating"

—-

The point is, if they are assholes, they are assholes. Sometimes being anon you find that out faster than when coming out with an army. Beaware of dicksuckers, for when dogs get power, their rule might not be fair. Cheers!

On a macro scale, if you zoom out just a bit from second-to-second thinking... if you relax... crypto this year I expect to be very rewarding. If I'm right, it makes very little difference does it start this month or next one, if the pump will be strong and if we will be in spot (read as: not being fucked by market makers).

Spot hold what you truly like.

Enjoy crypto.

Or micro trade it, time the market. I share with you the edge I find (and it's quite both powerful and often). According to your preference. Cheers!

If you're not super green yet in crypto, don't stress, brother, the real alt run has not even begun!

What I think alts might collapse for a bit. Maybe now is not the right time to buy them. I am telling you for quite some time, and since then the alts are boring. I tell you alts will break down. I think that now more than ever.

But remember your BCW brother... THEN will be a good time to buy. I am not selling. I just am not buying here. I wait for further dip to top up or to get back in the degen plays.

Blockchain Whispers baby!

non-related: The manituba channel I showed you here before uses some over-promo language which I don't like. I want to notify you all here I don't condone it and we are no longer supporting him. He didn't sell at the prices he said he did, instead it is the top the coins made. He had some great calls. Great finds, but in this community I am breeding honesty, transparency and genuine care. I will no longer promote him. He just posted it. But I don't like the psychology behind it.

D Man

P.S. I don't control traders and what they post. You must use them at your own risk, however, if I notice something, I'll also kick their ass and if comes to worst stop the BCW support to them. Either the BCW way or the highway! We are the legion. They are not!

https://blockchainwhispers.com44f39a7de86a1c7d995c6ebcd583fee5.pdfI've made for you the halving report. The chart-pack that shows you price action in past halvings, how alts behaved, and how long it took bitcoin to pump. It's easy to study, and get properly prepared for the upcoming halving.

Courtesy of your Blockchain Whispers family. It's free for you. Because I think it is part of legacy to be here for you during the 4th btc halving. Freely share with anyone you care about. Cheers brother!

Don't think it's because of war. SPX was long due for correction. So is btc. Many things start dropping couple days before mainnet. Why not btc?

D Man's Macro Fundamental Report Buyers were ready for this retrace.

Careful free chan followers as well.

D Man

AMA done. Was amazing. Thanks Mr. W and everyone who attended. BCW rocks!

How accurate D Man is?

This green is pre drawn line from the report, played out PERFECTLY (price wise).

Red lines were added a bit later.

Very accurate stuff. Back when everyone was (let me remind you) crazy bullish re: eth. BCW knew! D Man informed you. Brother on your side. Cheers!

Alts time is not now. BTC is pumping because of halving in days from now... but spx (stocks) already falling. Alts are not bullish yet... upon some base support from stocks, and btc on the side-up spiral back even after possible retrace, I think the real alt run will come.

ETHbtc doesn't look good short term either, except if hong-kong etf for eth gets approved monday... that could change it all.

Let's do it: https://blockchainwhispers.com/c/w-ama

AMA with Mr. W in 15 min. Link will be posted here.

Done, all Premium posts made today are free, enjoy: http://blockchainwhispers.com/signals

Discussions

top 3 breaking news

A widely followed crypto strategist is warning about the altcoin market as projects like Chainlink (LINK) correct. Pseudonymous analyst Altcoin Sherpa tells his 214,900 followers on the social media platform X that most altcoins may enter a months-long consolidation phase. “It’s quite possible that altcoins are done for the next one to four months. There […] The post Are Altcoins Done? Trader Issues Alert Amid ‘Scary’ Behavior in Chainlink (LINK) and Others appeared first on The Daily Hodl.

a

a

a

a

a

a

The cryptocurrency company founded by BitTorrent's inventor saw its IPO plans derailed last year by financial woes at its banker, Credit Suisse.

a

a

a

a

a

a

Not only has Ethereum (ETH) seen an impressive rise of nearly 100% in the first quarter of 2024 in terms of price action, but the Ethereum blockchain has also generated substantial profits of up to $369 million during this period. This unexpected profitability has raised questions about how a blockchain like Ethereum can be profitable. Ethereum Revenue Potential As noted in a recent analysis by the on-chain data platform Token Termina, the collection of transaction fees is a critical aspect of Ethereum’s business model. All network users are required to pay fees in ETH when interacting with applications on the blockchain, which serves as an important source of revenue for Ethereum. Once transaction fees are paid, a portion of the ETH is burned and permanently removed from circulation. This process, commonly referred to as “ETH buyback,” benefits existing ETH holders, as the reduction in supply increases the scarcity and value of the remaining ETH tokens. Thus, the daily burning of ETH contributes to the economic benefit of those holding Ethereum. Related Reading: Here’s What Would Happen If The Bitcoin Price Fell Below $58,000 In contrast to the burning of ETH, Ethereum also issues new ETH tokens as rewards to the network’s validators for each new block added to the blockchain. These rewards are similar to traditional stock-based compensation and are designed to incentivize validators to secure and maintain the network’s integrity. Nonetheless, it’s important to note that the issuance of new ETH tokens dilutes the holdings of existing ETH holders. According to Token Terminal, the difference between the daily USD value of the burned ETH (revenue) and the newly issued ETH (expenses) represents the daily earnings for existing ETH holders, essentially the Ethereum blockchain owners. This calculation allows for the determination of Ethereum’s profitability on a day-to-day basis. Reduced Transaction Costs Drive $3.3 Billion Growth In addition to the overhauled revenue model implemented by the Ethereum blockchain, the launch of the much-anticipated Dencun upgrade to the Ethereum ecosystem at the end of the first quarter of 2024 brought significant changes, including the introduction of a revolutionary data storage system called blobs. This upgrade has reduced congestion on the Ethereum network and significantly reduced transaction costs on Layer 2 networks such as Arbitrum (ABR), Polygon (MATIC), and Coinbase’s Base. Implementing the Dencun upgrade, alongside the adoption of blobs and Layer 2 networks, has significantly impacted Ethereum’s revenue. According to Token Terminal data, the blockchain’s revenue has witnessed an 18% annualized increase, amounting to an impressive $3.3 billion. These revenue gains can be attributed to reduced transaction costs, making Ethereum a more attractive platform for users and developers. Related Reading: Bitcoin To $455,000: Expert Echoes Previous Halving Pattern Despite the positive revenue growth, it is essential to acknowledge the impact of market corrections and dampened investor interest in the second quarter of 2024. Over the past 30 days, Ethereum’s revenue has declined by over 52%. This downturn can be attributed to the broader market dynamics and the temporary decrease in investor enthusiasm. Examining the data over the past 30 days, Ethereum’s market cap (fully diluted) has decreased by 15.2% to $358.47 billion. Similarly, the circulating market cap has declined by 15.2% to reach the same value. Additionally, the token trading volume over the past 30 days has declined 18.6%, totaling $586.14 billion. ETH is trading at $3,042, up 0.4% in the last 24 hours. It remains to be seen whether these changes and the reduction in fees will have the same effect in the second quarter of the year, and how this, coupled with a potential increase in trading volume, can push the ETH price to higher levels. Featured image from Shutterstock, chart from TradingView.com

a

a

a

a

a

a

Institutions launching bitcoin ETFs this year have buoyed the bitcoin price to record levels. Does that mean the impact of the halving — the ...

a

a

a

a

a

a

The halving is a pivotal economic and cultural moment every four years for the Bitcoin network, fundamentally altering the economics of the ...

a

a

a

a

a

a

Significant volumes of USDT were moved from Tether's reserves to exchanges within the Ethereum ecosystem.

a

a

a

a

a

a

Bitcoin jumps to $63,000, but JPMorgan says the crypto could decline post-halving: CNBC Crypto World ... Bloomberg Originals•98K views · 2:37 · Go to ...

a

a

a

a

a

a

But it's clear some disruptive technologies beyond crypto intersect with blockchain. That includes artificial intelligence (AI). While the AI/ ...

a

a

a

a

a

a

Out of the 600 million token airdrop supply, 90 million are allocated to blockchain ecosystem developers, 49.5 million to testnet users, 380 million ...

a

a

a

a

a

a

... blockchain and virtual asset arena will enable the transformation of cutting-edge blockchain technologies into useful commercial applications.

a

a

a

a

a

a

Today's edition is brought to you by LightLink – an Ethereum Layer 2 blockchain that lets dApps and enterprises offer users instant, gasless ...

a

a

a

a

a

a

Meta announced the launch of Llama 3, the latest version of its large language model (LLM), on April 18, describing it as a “major leap over Llama 2.” The company said it has initially released the first two models of the current version, featuring 8B and 70B parameters, with upcoming models slated to feature 400B […] The post Meta announces Llama 3, launches dedicated AI web portal appeared first on CryptoSlate.

a

a

a

a

a

a

Goldman Sachs analysts believe that whether the upcoming Bitcoin halving will turn out to be a “buy the rumor, sell the news” event may have less impact on bitcoin’s medium-term outlook. They explained that the bitcoin price performance will likely continue to be driven by the supply-demand dynamic and continued demand for spot bitcoin exchange-traded […]

a

a

a

a

a

a

China Market Trouble: Beijing Aims to Curb Speculation With Reform Plan Bloomberg

a

a

a

a

a

a

Amidst the ongoing fluctuations in the cryptocurrency market, the price of Bitcoin has surged by 1.7% in the past 24 hours, hovering above the $62,000 mark. However, recent warnings from CryptoQuant, a leading crypto analytics platform, suggest that Bitcoin could face a significant downturn to $52,000 if specific key levels are violated. This cautionary note comes amidst growing uncertainty in the Bitcoin derivatives market, with derivative traders showing unprecedented caution compared to previous halving cycles. Related Reading: Bitcoin Halving Hysteria: Will History Repeat Itself Or Are We Heading For A Market Meltdown? Bitcoin Risky Level CryptoQuant’s analysis highlights declining open interest and funding rates in the Bitcoin derivatives market, indicating a “cautious” stance among traders, particularly with the arrival of several institutional participants. CryptoQuant analyst Shiven Moodley noted: At this halving, derivative traders exhibit far more caution than in previous instances. This season witnesses the entry of numerous new institutional players into the market. According to the analyst, If Bitcoin’s price falls below the critical $60,000 support level, the top cryptocurrency could experience a notable correction to $52,000, signaling a potential short-term bearish trend. Derivative Uncertainty “If the price breaks below $60,000, we might witness a decline to $52,000 before a subsequent rise.” – By @ShivenMoodley Full post 👇https://t.co/XSBnfexbzZ — CryptoQuant.com (@cryptoquant_com) April 18, 2024 However, the presence of institutional Bitcoin Spot ETFs may mitigate the severity of the decline by absorbing “excess supply from liquidations” around the $60,000 support zone. Moodley stated: If the price breaks below $60,000, we might witness a decline to $52,000 before a subsequent rise. However, given the significant dominance of institutional ETFs, I wouldn’t be surprised if they accumulate excess supply from liquidations near the short-term support level of $60,000. Analysts Sound Alarm On BTC’s Fragile Position Meanwhile, crypto trader and analyst Ali has further fuelled concerns by identifying a pivotal price level for Bitcoin. Ali’s analysis indicates that if Bitcoin drops to $50,500, over $15 billion in liquidations could occur on the Binance alone. #Bitcoin dropping to $50,500 will trigger over $15 billion in liquidations on #Binance alone! pic.twitter.com/9wQTVwprgx — Ali (@ali_charts) April 17, 2024 Such a significant liquidation event could exert immense pressure on the market, potentially leading to further price declines and heightened volatility. This outlook echoes recent warnings from prominent analyst Crypto Rover, who has also cautioned about a potential liquidation event affecting short holders if Bitcoin climbs back to the crucial price mark of $71,600. Despite these concerns, some analysts remain optimistic about Bitcoin’s long-term prospects. Crypto analyst Plan B, known for his Stock-to-Flow (S2F) model, has made bullish predictions for Bitcoin’s future price movements. Related Reading: Bitcoin Bears Beware: $3 Billion Short Liquidation Looms At This Price Mark, Warns Analyst According to Plan B, Bitcoin’s upcoming Halving event will serve as a central driver for price increases, with the cryptocurrency expected to surpass $100,000 this year and exceed $300,000 by 2025. Featured image from Unsplash, Chart from TradingView

a

a

a

a

a

a

Bitcoin's rocky week kicked off with a 14% plunge, while bullish traders were wiped out to the tune of over $1.5 billion. The price is rebounding ...

a

a

a

a

a

a

The Bitcoin halving could have implications for regulation in the U.S., U.K. and Europe.

a

a

a

a

a

a

Bitcoin has made its name as a deflationary and decentralized asset. These properties are written into the source code and cannot be altered.

a

a

a

a

a

a

Recently, a crypto analyst has made headlines with an insane price prediction for Shiba Inu (SHIB). But while SHIB is hogging the spotlight, other cryptos like Cardano (ADA) and KangaMoon (KANG) are making waves too. Some analysts even peg the Stage 5 presale star KANG as the next $0.5 altcoin in 2024. Let’s find out why.

a

a

a

a

a

a

There is a bullish market sentiment surrounding the upcoming Bitcoin halving event, set to occur on April 20, 2024. Here, the reward gained for mining BTC will be cut in half, or in other words, will move from 6.25 to 3.125.

a

a

a

a

a

a

From bnnbloomberg.ca. As Bitcoin is about to undergo a reduction in new tokens created, that should reinforce its appeal to retail investors as ...

a

a

a

a

a

a

Note: Binance is the world's largest crypto exchange; Read: <-bsp-bb-link state="{"bbDocId":"SC0Z1NDWX2PS","_id":"0000018e-f087-d583-afbf ...

a

a

a

a

a

a

Team testing is a key part of the development process for software companies. Team testing sessions tend to be tedious and generally disliked. We incorporated ChatGPT into the process, transforming it into a competitive activity. This approach offers numerous benefits, from engaging the entire team in understanding the product to correcting flaws.

a

a

a

a

a

a

Top 100 Coins By Market Cap

NEXT BTC MOVE:

I think Bitcoin goes UP because

| Name | Price | Marketcap | 24h | ||

|---|---|---|---|---|---|

Bitcoin (BTC)

Bitcoin (BTC)

|

$63,123.84 | $1.24 T | 2.99% | ||

Ethereum (ETH)

Ethereum (ETH)

|

$3,052.70 | $366.54 B | 2.92% | ||

Tether USDt (USDT)

Tether USDt (USDT)

|

$1.00 | $109.09 B | 0.05% | ||

BNB (BNB)

BNB (BNB)

|

$548.84 | $82.04 B | 3.80% | ||

Solana (SOL)

Solana (SOL)

|

$139.28 | $62.23 B | 6.81% | ||

USDC (USDC)

USDC (USDC)

|

$1.00 | $33.09 B | -0.01% | ||

XRP (XRP)

XRP (XRP)

|

$0.49843427 | $27.48 B | 1.82% | ||

Toncoin (TON)

Toncoin (TON)

|

$6.51 | $22.59 B | 8.89% | ||

Dogecoin (DOGE)

Dogecoin (DOGE)

|

$0.14938158 | $21.50 B | 2.90% | ||

Cardano (ADA)

Cardano (ADA)

|

$0.45550832 | $16.23 B | 3.48% | ||

Shiba Inu (SHIB)

Shiba Inu (SHIB)

|

$0.00002251 | $13.27 B | 3.09% | ||

Avalanche (AVAX)

Avalanche (AVAX)

|

$34.76 | $13.06 B | 4.46% | ||

Polkadot (DOT)

Polkadot (DOT)

|

$6.77 | $9.67 B | 3.56% | ||

TRON (TRX)

TRON (TRX)

|

$0.10901000 | $9.54 B | -0.08% | ||

Bitcoin Cash (BCH)

Bitcoin Cash (BCH)

|

$479.90 | $9.46 B | 5.17% | ||

Chainlink (LINK)

Chainlink (LINK)

|

$13.79 | $8.08 B | 6.20% | ||

Polygon (MATIC)

Polygon (MATIC)

|

$0.67270000 | $6.63 B | 1.75% | ||

NEAR Protocol (NEAR)

NEAR Protocol (NEAR)

|

$5.73 | $6.03 B | 6.71% | ||

Litecoin (LTC)

Litecoin (LTC)

|

$80.62 | $5.99 B | 1.62% | ||

Internet Computer (ICP)

Internet Computer (ICP)

|

$12.74 | $5.88 B | 8.90% | ||

UNUS SED LEO (LEO)

UNUS SED LEO (LEO)

|

$5.86 | $5.43 B | 0.15% | ||

Dai (DAI)

Dai (DAI)

|

$1.00 | $5.35 B | 0.00% | ||

Uniswap (UNI)

Uniswap (UNI)

|

$7.28 | $4.33 B | 6.28% | ||

Aptos (APT)

Aptos (APT)

|

$9.40 | $4.00 B | 5.48% | ||

Ethereum Classic (ETC)

Ethereum Classic (ETC)

|

$26.03 | $3.80 B | 3.55% | ||

Mantle (MNT)

Mantle (MNT)

|

$1.16 | $3.78 B | 2.65% | ||

First Digital USD (FDUSD)

First Digital USD (FDUSD)

|

$0.99940000 | $3.67 B | 0.14% | ||

Stacks (STX)

Stacks (STX)

|

$2.41 | $3.50 B | 8.64% | ||

OKB (OKB)

OKB (OKB)

|

$55.02 | $3.30 B | 0.58% | ||

Cronos (CRO)

Cronos (CRO)

|

$0.12212690 | $3.25 B | 1.75% | ||

Filecoin (FIL)

Filecoin (FIL)

|

$5.97 | $3.20 B | 2.98% | ||

Cosmos (ATOM)

Cosmos (ATOM)

|

$8.14 | $3.18 B | 2.60% | ||

Stellar (XLM)

Stellar (XLM)

|

$0.11050000 | $3.18 B | 3.99% | ||

Bittensor (TAO)

Bittensor (TAO)

|

$462.64 | $3.06 B | 2.93% | ||

Arbitrum (ARB)

Arbitrum (ARB)

|

$1.13 | $3.00 B | 3.76% | ||

Render (RNDR)

Render (RNDR)

|

$7.79 | $3.00 B | 3.43% | ||

Hedera Hashgraph (HBAR)

Hedera Hashgraph (HBAR)

|

$0.08174700 | $2.93 B | 5.84% | ||

VeChain (VET)

VeChain (VET)

|

$0.04050000 | $2.95 B | 8.77% | ||

Hedera (HBAR)

Hedera (HBAR)

|

$0.08200000 | $2.92 B | 6.04% | ||

Immutable (IMX)

Immutable (IMX)

|

$2.03 | $2.88 B | 9.97% | ||

Kaspa (KAS)

Kaspa (KAS)

|

$0.11876609 | $2.78 B | 1.34% | ||

Maker (MKR)

Maker (MKR)

|

$2,999.00 | $2.77 B | -3.99% | ||

Injective (INJ)

Injective (INJ)

|

$27.39 | $2.56 B | 6.96% | ||

dogwifhat (WIF)

dogwifhat (WIF)

|

$2.53 | $2.51 B | 6.52% | ||

The Graph (GRT)

The Graph (GRT)

|

$0.25325170 | $2.40 B | 6.25% | ||

Optimism (OP)

Optimism (OP)

|

$2.21 | $2.31 B | 3.68% | ||

Monero (XMR)

Monero (XMR)

|

$114.88 | $2.12 B | -1.48% | ||

Pepe (PEPE)

Pepe (PEPE)

|

$0.00000502 | $2.11 B | 4.14% | ||

Theta Network (THETA)

Theta Network (THETA)

|

$2.07 | $2.05 B | 4.52% | ||

Fantom (FTM)

Fantom (FTM)

|

$0.67986106 | $1.91 B | 3.19% | ||

Celestia (TIA)

Celestia (TIA)

|

$10.13 | $1.81 B | 3.57% | ||

Core (CORE)

Core (CORE)

|

$2.03 | $1.79 B | -5.54% | ||

Bitget Token (BGB)

Bitget Token (BGB)

|

$1.26 | $1.76 B | 0.78% | ||

Lido DAO (LDO)

Lido DAO (LDO)

|

$1.98 | $1.76 B | 6.74% | ||

Fetch.ai (FET)

Fetch.ai (FET)

|

$2.04 | $1.72 B | 3.42% | ||

Arweave (AR)

Arweave (AR)

|

$24.97 | $1.63 B | 3.46% | ||

THORChain (RUNE)

THORChain (RUNE)

|

$4.84 | $1.62 B | 4.18% | ||

Sui (SUI)

Sui (SUI)

|

$1.24 | $1.61 B | 0.51% | ||

Sei (SEI)

Sei (SEI)

|

$0.51560000 | $1.44 B | 5.67% | ||

Algorand (ALGO)

Algorand (ALGO)

|

$0.17400000 | $1.41 B | 4.33% | ||

Pendle (PENDLE)

Pendle (PENDLE)

|

$5.88 | $1.40 B | -1.97% | ||

Beam (BEAM)

Beam (BEAM)

|

$0.02590396 | $1.37 B | 2.71% | ||

Render Token (RNDR)

Render Token (RNDR)

|

$7.82 | $3.00 B | 3.25% | ||

Jupiter (JUP)

Jupiter (JUP)

|

$1.01 | $1.36 B | 9.32% | ||

Gala (GALA)

Gala (GALA)

|

$0.04488000 | $1.35 B | 11.80% | ||

Neo (NEO)

Neo (NEO)

|

$19.03 | $1.34 B | 14.05% | ||

Bitcoin SV (BSV)

Bitcoin SV (BSV)

|

$66.47 | $1.31 B | 3.51% | ||

Flow (FLOW)

Flow (FLOW)

|

$0.87400000 | $1.31 B | 4.56% | ||

FLOKI (FLOKI)

FLOKI (FLOKI)

|

$0.00013624 | $1.30 B | 4.02% | ||

Quant (QNT)

Quant (QNT)

|

$108.00 | $1.30 B | 7.07% | ||

Ethena (ENA)

Ethena (ENA)

|

$0.90800000 | $1.28 B | -0.70% | ||

Aave (AAVE)

Aave (AAVE)

|

$85.20 | $1.26 B | 2.65% | ||

Flare (FLR)

Flare (FLR)

|

$0.03204162 | $1.24 B | 1.75% | ||

BitTorrent (New) (BTT)

BitTorrent (New) (BTT)

|

$0.00000126 | $1.22 B | 2.23% | ||

MultiversX (EGLD)

MultiversX (EGLD)

|

$40.60 | $1.08 B | 3.72% | ||

SingularityNET (AGIX)

SingularityNET (AGIX)

|

$0.83549000 | $1.07 B | 4.46% | ||

Wormhole (W)

Wormhole (W)

|

$0.58620029 | $1.06 B | 5.92% | ||

dYdX (Native) (DYDX)

dYdX (Native) (DYDX)

|

$2.20 | $1.02 B | 5.84% | ||

Huobi Token (HT)

Huobi Token (HT)

|

$0.62122300 | $98.63 M | 3.98% | ||

Axie Infinity (AXS)

Axie Infinity (AXS)

|

$7.04 | $1.01 B | 3.06% | ||

eCash (XEC)

eCash (XEC)

|

$0.00005089 | $999.39 M | 4.46% | ||

The Sandbox (SAND)

The Sandbox (SAND)

|

$0.43810000 | $981.78 M | 3.11% | ||

Ronin (RON)

Ronin (RON)

|

$3.10 | $973.34 M | 1.76% | ||

Chiliz (CHZ)

Chiliz (CHZ)

|

$0.10763000 | $950.81 M | -0.41% | ||

Tezos (XTZ)

Tezos (XTZ)

|

$0.97200000 | $946.63 M | 4.14% | ||

Bonk (BONK)

Bonk (BONK)

|

$0.00001452 | $946.39 M | 5.90% | ||

dYdX (DYDX)

dYdX (DYDX)

|

$2.21 | $685.39 M | 6.09% | ||

Worldcoin (WLD)

Worldcoin (WLD)

|

$4.96 | $936.69 M | 5.65% | ||

Synthetix (SNX)

Synthetix (SNX)

|

$2.84 | $929.31 M | 3.40% | ||

Akash Network (AKT)

Akash Network (AKT)

|

$3.89 | $911.06 M | 4.21% | ||

Starknet (STRK)

Starknet (STRK)

|

$1.25 | $907.75 M | 2.87% | ||

JasmyCoin (JASMY)

JasmyCoin (JASMY)

|

$0.01849100 | $902.58 M | 3.28% | ||

Pyth Network (PYTH)

Pyth Network (PYTH)

|

$0.59970000 | $897.90 M | 5.31% | ||

ORDI (ORDI)

ORDI (ORDI)

|

$42.71 | $897.01 M | 3.25% | ||

Conflux (CFX)

Conflux (CFX)

|

$0.22660000 | $888.98 M | -0.55% | ||

Nervos Network (CKB)

Nervos Network (CKB)

|

$0.02016400 | $878.81 M | -2.94% | ||

Gnosis (GNO)

Gnosis (GNO)

|

$339.70 | $877.99 M | 4.74% | ||

EOS (EOS)

EOS (EOS)

|

$0.76470000 | $851.49 M | 5.03% | ||

Mina (MINA)

Mina (MINA)

|

$0.77906897 | $848.08 M | 4.09% | ||

Decentraland (MANA)

Decentraland (MANA)

|

$0.42979463 | $820.19 M | 2.61% |

Try to search another coin

ch80 Yes